Summary:

- The Walt Disney Company’s stock has underperformed this year, down 6% so far, disappointing long-term shareholders.

- As a cyclical business, Disney is likely to feel the heat of macroeconomic challenges.

- Unfortunately, Disney’s struggles extend beyond macroeconomic challenges.

- This massive erosion of the Indian subscriber base is a testament to Disney’s failure to use price hikes as a strategy to boost revenue meaningfully and sustainably amid content challenges.

- The turnaround plan of the company may face new challenges.

Wirestock

The Walt Disney Company (NYSE:DIS) stock has gone nowhere this year – down 6% so far. In a year that has been characterized by significant gains for tech stocks and many other business sectors, DIS stock performance has already disappointed many long-term shareholders, including yours truly. The last time I wrote about Disney, I highlighted why investors need to expect major changes in the foreseeable future. In this analysis, I am focusing on the content challenges faced by Disney, the uncertain monetary policy outlook, and Disney’s valuation.

Macroeconomic Challenges Persist

While there has been a slight improvement in consumer spending, the lingering fear of a recession persists. This concern is underscored by the recent speech delivered by U.S. Federal Reserve Chair Jerome Powell at the Jackson Hole economic summit. In a meeting held in July, the FOMC unanimously decided to raise interest rates to a range of 5.25%-5.5%, marking the highest level in over two decades. The minutes from this meeting, released this month, shed light on central bank officials’ apprehension that inflation might not ease unless there’s a continued cooling down of the labor market and the overall U.S. economy.

In a speech last Friday, Mr. Powell said:

We are attentive to signs that the economy may not be cooling as expected. We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

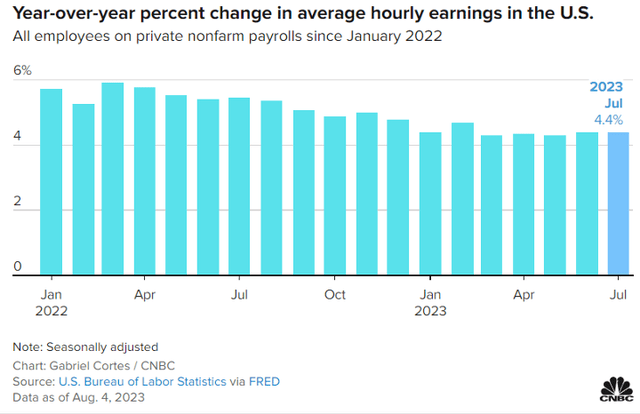

The unexpected economic resilience shown this summer encouraged investors and Federal Reserve policymakers to be optimistic. This optimism was based on the idea that the United States economy could avoid a recession or a major increase in unemployment. However, with the Fed’s recent update, it seems like the way forward remains uncertain. Federal Reserve officials have previously cautioned that the complete impact of the rate increases hasn’t yet been fully realized. July data showed compensation costs escalating at a 4.5% annual rate through the second quarter, which doesn’t align with the Federal Reserve’s inflation target. Further, according to the Bureau of Labour Statistics, job growth in July turned out to be less than anticipated. The unemployment rate stood at 3.5% in comparison to the expected stability at 3.6%. Average hourly earnings, an important metric used in the Fed’s efforts to manage inflation, increased by 0.4% over the previous month, contributing to an annual growth rate of 4.4%. Both these figures surpassed the respective predictions of 0.3% and 4.2%. Further, the labor force participation rate decreased slightly within the 25-to-64 age group.

Exhibit 1: YoY % change in average hourly earnings

CNBC

Mr. Powell acknowledged the decline in inflation, but he added:

Although inflation has moved down from its peak — a welcome development — it remains too high. We will keep at it until the job is done.

In addition, factors such as the resumption of student loan payments in October and the growing load of consumer debt might have an influence on the economy in the future. As a result, consumers continue to grapple with fears of an impending recession within the next year, particularly in fear of continued interest rate hikes in the coming months.

As a cyclical business, Disney will likely feel the heat of macroeconomic challenges in the foreseeable future. In addition, these challenging business conditions will continue to dampen the investor sentiment toward DIS stock as well.

Disney’s Struggles Extend Beyond Macroeconomic Challenges

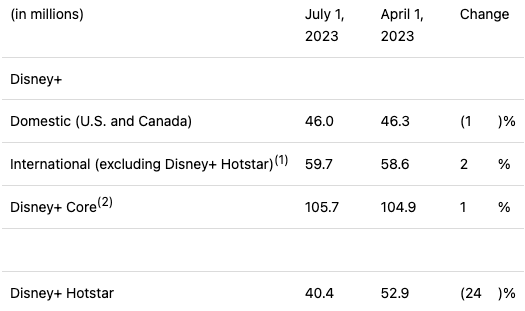

Although consumers are anticipated to increase expenditures on home-based streaming services, Walt Disney’s Disney+ streaming service may encounter challenges. The company has already experienced a decline in subscribers over consecutive quarters. In the company’s fiscal third quarter of 2023, Disney disclosed an 11 million decline in global Disney+ subscribers (including Hotstar) to 146 million.

Exhibit 2: Breakdown of Disney+ paid subscribers

Earnings release

The challenges faced by Walt Disney cannot be blamed on macroeconomic challenges alone, as evidenced by the ongoing success of other streaming platforms such as Netflix (NFLX) in gaining new subscribers. Netflix gained 5.9 million subscribers despite ending password sharing in many countries. While Walt Disney initially emerged as a formidable contender in the streaming sector, the company now grapples with challenges stemming from its strategic approach. The company’s struggles are rooted in its failure to keep costs down along with an underpriced subscription offering for Disney+ aimed at capturing market share.

Disney+ is relatively new to the streaming sector, but it has quickly built a sizable subscriber base thanks to exclusive content from Marvel, Star Wars, and Pixar. However, not all customers are satisfied with Disney+’s offers. One possible source of their dissatisfaction is that they do not believe the rates they pay are reasonable for the available content. Disney+ has raised its subscription prices in India, making it more expensive in the current market environment. The annual plan for Disney+ Hotstar now costs Rs 1,499, up from Rs 999, while the monthly plan is priced at Rs. 299. In a significant setback, Disney+ Hotstar witnessed a substantial decline of 12.5 million paid subscribers in the third quarter.

This massive erosion of the Indian subscriber base is a testament to Disney’s failure to use price hikes as a strategy to boost revenue meaningfully and sustainably. Netflix has successfully executed this strategy in many global markets, which suggests Disney lacks a content advantage. In comparison to the expansive libraries of Netflix and Prime Video spanning various genres and languages, Disney+ offers a more limited selection of titles. For example, the decrease in Disney+ Hotstar subscribers was due in part to the loss of streaming rights to the highly significant IPL cricket tournament in India. Additionally, many of Disney’s recent theatrical releases have been disappointing.

The Turnaround Plan And New Challenges

To overcome the challenges discussed above, Disney plans to raise the price of its ad-free streaming tier starting in October, while also adopting a strategy similar to Netflix’s to curtail password sharing. The cost of the ad-free option for Disney+ is set to increase to $13.99 per month. Additionally, the company has initiated a reduction in non-sports content expenditure by $3 billion. Notably, Disney has achieved a milestone by enrolling 3.3 million subscribers for its ad-supported Disney+ offering as of the end of Q3. Furthermore, there are expansion plans, including the introduction of ad-supported Disney+ subscription options in Canada and certain European markets, starting from November 1. Additionally, a new bundled subscription plan encompassing both Disney+ and Hulu will be available in the United States starting September 6. Disney is also raising the price of Hulu without advertisements to $17.99 per month, a 20% increase, while Hulu with ads will be $7.99 per month.

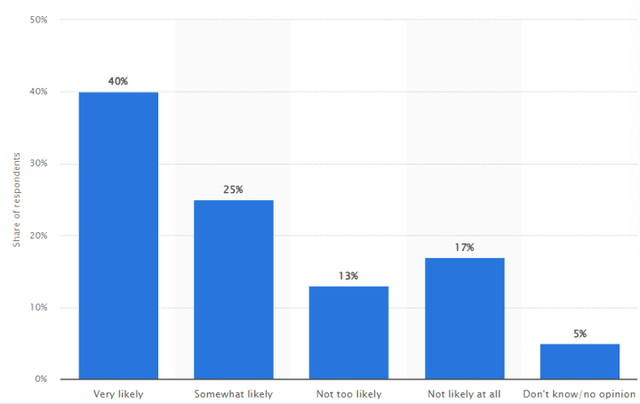

Although these expected price hikes will move ARPUs in the right direction, a major challenge would be to time these price hikes effectively. Given the reported decline in consumer interest in Disney+ content and the strikes of Hollywood writers and actors, price hikes could lead to an accelerated loss of subscribers in the short run. This situation is even more complicated by the prevailing economic challenges, anticipated interest rate hikes in the upcoming months, and the possibility of consumers trimming non-essential expenses. Nevertheless, the upcoming holiday season might present an opportunity for the platform to gain new subscribers, considering the propensity of individuals to seek family-oriented festive content during this time. According to a Statista study from 2018, which gauged the likelihood of adults in the United States consuming holiday movies on streaming services during the holiday season, 40% of Americans have a strong inclination to watch such content via streaming platforms.

Exhibit 3: Holiday movie streaming likelihood among U.S. adults

Statista

When it comes to DTC, ESPN has traditionally been a profitable asset within Walt Disney’s cable business. However, the cable market is shrinking due to the rise of cord-cutting. To adapt, Disney has decided to partner with Penn Entertainment to introduce the ESPN brand to the expanding sports betting market. Notably, ESPN’s main linear channel is experiencing rising viewership, presenting substantial advertising prospects. In Q3, domestic sports advertising revenue for both linear and addressable formats increased by 10% year-over-year. In addition, Amazon.com, Inc. (AMZN) is also said to be in discussions with Walt Disney regarding potential collaboration on the streaming version of ESPN, with a possibility of Amazon acquiring a minority stake in the sports network. The pricing for the new service is yet to be finalized, however, Reuters reports that ESPN is contemplating a monthly charge ranging from $20 to $35 which could create one of the most expensively priced streaming offerings in the United States. Amid market uncertainties, live sports streaming could provide Disney with a competitive advantage and help counterbalance the challenges encountered by Disney+. According to Deloitte Global, streamers are expected to spend more than $6 billion on exclusive major sports rights in the largest global markets in 2023.

Although the parks, experiences, and products division of the company registered a 13% rise in revenue in Q3, domestic parks, especially Walt Disney World in Florida, witnessed a decline in attendance and hotel bookings. Ongoing disputes with Florida Governor Ron DeSantis have led to some consumers boycotting parks. Additionally, DeSantis’ appointees on the governing board of Disney World’s district filed a complaint, alleging the distribution of $2.5 million worth of free passes and discounts to district employees was unethical. Recession fears and shrinking savings are two other possible reasons behind lower visits.

Bullish On Valuation

Disney faces several headwinds today. Some of the main risks facing the company include;

- A potential decline in discretionary spending

- A slowdown in the cord-cutting movement

- A deterioration of consumer and investor sentiment stemming from some of Disney’s controversial casting choices

- Continued pressure on the linear TV business

Out of these major challenges, I believe only the pressure on the linear TV business is permanent in nature. I strongly believe that Disney will eventually regain its brand strength in the coming years and gain some lost ground resulting from recent controversial decisions. For now, I believe Disney’s moat is strong enough to allow the company a strong comeback from these lows. On the other hand, time will most likely solve the content disadvantages faced by Disney+ today, thereby giving the company more room to experiment with price hikes without losing subscribers. The expected strength of the cord-cutting movement will also fuel subscriber growth for the DTC business.

Based on these assumptions, I believe Mr. Market has been too harsh on Disney considering the short-term nature of many of the challenges faced by the company. Today, Disney is valued at a forward P/E of 15.7 compared to the 5-year average of 39.2. Even after normalizing the forward P/E to account for the abnormal valuation in 2020, Disney still seems fairly valued even in the worst-case scenario. This gives me the confidence to add to my long Disney position today with a long-term perspective.

Takeaway

Disney is at a crossroads where the company is forced to rethink its go-to-market strategy while keeping costs low. This is easier said than done, and I believe it will take several quarters before we see any improvement in investor sentiment toward the company. In the absence of a crystal ball to predict when exactly this will happen, I am investing in DIS stock today under the assumption that Disney’s current valuation fails to portray an economically true picture of the company’s prospects.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!