Summary:

- The Walt Disney Company surprised the market with strong results and stated clear goals for the future, boosting investor confidence.

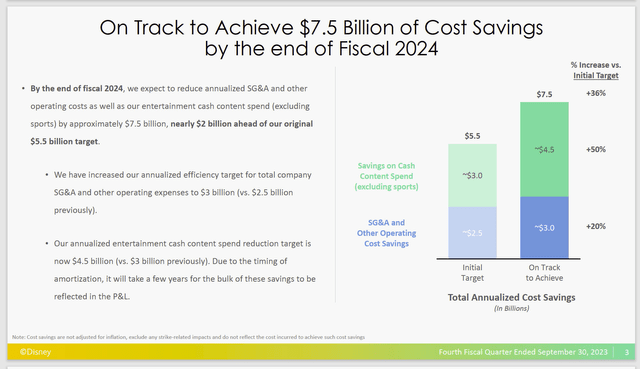

- Disney management aims to achieve $7.5 billion in cost reductions and focuses on profitability in streaming, digital sports, film studios, and parks.

- The DTC transition for both Disney and Warner Bros. Discovery has a focus on cash flow and profitability rather than subscriber growth (temporarily).

- Both Disney and Warner Brothers showed huge cash flow improvement. Netflix began to finally generate significant free cash flow.

- Disney has a long history of successfully exploiting franchises and running the other divisions well to generate a lot of cash. This gives them an advantage over the other two companies.

Wirestock

The Walt Disney Company (NYSE:DIS) surprised the market with superior results to market expectations in fiscal Q4. The stock jumped on the news accordingly. But what is more important is that management has clearly stated a way forward (probably to the extent that they legally can). That same management then “produced.” Good management is not afraid to state the goals and then admit to what worked and what did not. No sugar coating needed. That appears to be the case presently. As long as goals continue to be stated along with realistic evaluations of those goals, then shareholders have little to fear with this investment and probably good expectations going forward.

Those Goals

Here is the summary of management’s plans.

” we’re on track to achieve roughly $7.5 billion in cost reductions”

“As we look forward, there are four key building opportunities that will be central to our success: achieving significant and sustained profitability in our streaming business, building ESPN into the preeminent digital sports platform, improving the output and economics of our film studios, and turbocharging growth in our parks and experiences business”

Source: Disney Fourth Quarter 2023 Earnings Press Release.

Now, this was stated in order of importance to the market. But the key is that it was stated at all. I know a lot of managements that will not state focus areas, let alone going after cost reductions unless the company is financially stressed.

Here, the company is continuing to recover from the pandemic. But management realizes (and has for some time) that post-pandemic conditions have materially changed the competitive atmosphere. The CEO has previously admitted that some things are broken rather than shying away from such a blunt statement. Managements that admit to problems generally fix them. It is the managements that skip important issues that tend to not fix problem while putting the company’s future prospects into considerable danger.

That Streaming Business

It is not unusual for large companies like Disney and Warner Bros. Discovery, Inc. (WBD) to go after market share first (at any cost the way it looks to shareholders). As Michael Porter writes in his book “Competitive Strategies,” large companies often allow “pioneers” to take the risk of developing a niche or new business and then “pounce” by gaining market share quickly. Oftentimes, the pioneer developed the business over a far longer period at considerable cost that was spread out.

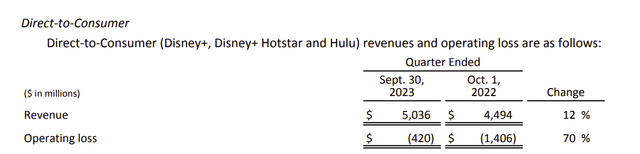

Disney Direct To Consumer Summary Of Financial Results (Disney Fourth Quarter 2023, Earnings Press Release)

Management is showing big gains in profitability even though the latest results are still a loss. This is comparable to the competitive results of Warner Bros Discovery as shown below:

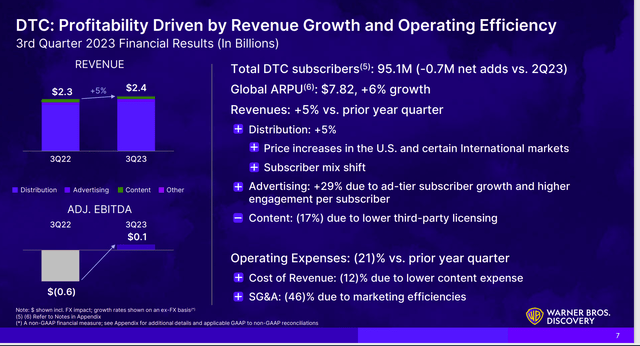

Warner Bros Discovery Fourth Quarter 2023 Direct To Consu (Warner Bros Discovery Fourth Quarter 2023, Earnings Comparison)

What can be concluded in both cases as that the “big boys” are now focusing on profits having established a market presence that the consider satisfactory. Both managements have communicated goals and at least imply that goals met early will be replaced with another rigorous goal. In both cases, these companies have franchises that somewhat protect them from competition in this part of the industry. On the other hand, they do compete with a large possibility of entertainment-type possibilities for the consumer dollar. However, every incremental extra helps.

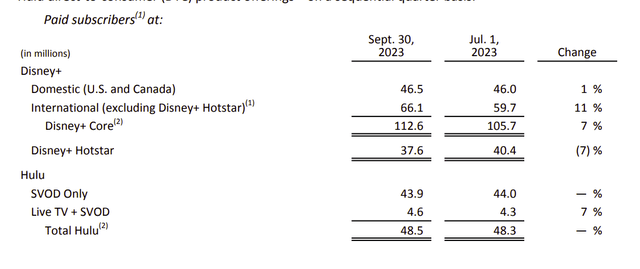

Disney Direct To Consumer Subscriber Comparison (Disney Fourth Quarter 2023, Earnings Press Release)

This market reacts very strongly to any growth. But the fact that Warner Bros. Discovery lost some subscribers ((net)) in the comparison compared to the small growth shown by Disney is likely really to be in the range considered as (materially) the same result.

What the market should have been paying attention to is the material and continuing improvement that points to an industry focus on profitability in the future. Now, whether each can then grow in satisfactory fashion once the appropriate level of profitability is achieved is still an open question that cannot be answered during the drive to turn losses into profits.

Therefore, the market reaction to what is really (right now) an insignificant difference really confirms the old saying that the market “can be irrational longer than you can stay solvent” in possibly a big way.

This is especially true with Warner Bros Discovery, where cash flow is far more important due to the leveraged buyout financing. Therefore, that is where the market focus should be.

Sports Including ESPN

There has been a lot of questions about ESPN, and certainly ESPN is a major profit contributor. Not reflected in the current results just yet is the decision mentioned in a previous article to include the ability to bet on sports teams.

The market is often impatient to see tangible results when a major announcement like that is made. What the market needs to figure out and probably cannot is the probability of success and the materiality to future profitability. Therefore, this venture needs to be done correctly rather than fast. Clearly, the jury is still out on the “correct” part.

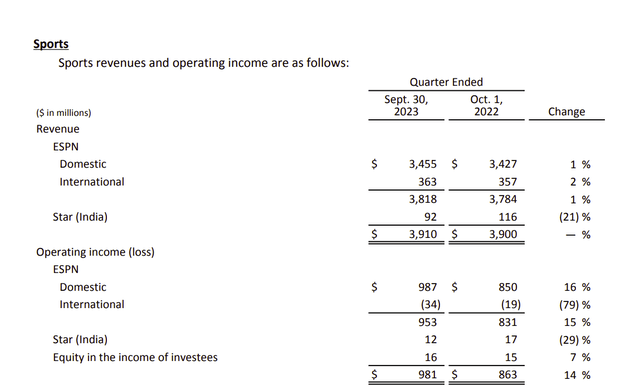

Disney Sports Financial Results Summary Fourth Quarter 2023 (Disney Fourth Quarter 2023, Earnings Press Release)

One of the things not touched upon is that there is a whole world of sports out there. The venture to India has not exactly been a rip-roaring success by most accounts. That happens, and Disney is doing what it can to correct the situation. This points to another key characteristic of superior management. When a course correction is needed, management tackles the issue.

A lot of big companies like Disney take those financial “bumps and bruises” and learn from them. The result is that they often come back with something far better in the future.

Therefore, not only is this a potential growth area from the ESPN angle. It is a growth area in that there is a world out there and Disney really only has a small part of the international market in this area.

Given the “bumps and bruises,” it may take time for any growth strategy to become apparent to shareholders. But there are certainly a lot of possible prospects along with some established profitability thanks to ESPN.

I would put this in the temporarily mature category with gambling and the rest of the world as growth prospects (and potentially more ideas to come). There is also the idea of streaming along the lines of Hulu for classical sports games that may be an idea in the future. It is kind of like television series reruns on streaming.

Film Studios

One of the things about the film industry is that Disney has had such tremendous success that expectations continue to be sky high for management. Right now, things are in a downtrend. But most of the industry has downtrends that make Disney’s current issues a “walk in the part” that several other studios wish they had.

Still with expectations that the exceptional profitability will be back, the market is likely to “ding” every “forgettable” result until the “Disney Normal” is re-established.

That probably makes the past acquisition of assets from Fox extremely important because the market is probably tired of one Marvel film after another. Disney more than made its money from that acquisition but it flooded the market with the same comic book stuff when it should have gone after more diversification.

If storytelling is the advantage Disney has, then it should be all kinds of storytelling. It would appear that management is learning that lesson the hard way. But going forward investors should see a difference as there are a lot of franchises the company owns for new and different stories.

But the other thing is Disney probably needs to break out the filming business both in theaters and as part of the total DTC segment to the extent it can for shareholders. It is highly visible and it would do a lot to generate market understanding of the company.

Disney Content Savings Progress And Other Cost Goals (Disney Fourth Quarter 2023, Earnings Conference Call Slides)

Ironically, both Disney and Warner Bros. Discovery have informed investors that they have a lot of work to do in this area. What is even more interesting is that Disney is known for getting full value of the assets acquired over the years. Yet both Disney and Warner Bros. Discovery admit to having franchises that are not fully exploited for an appropriate level of profits. Both have been cutting costs.

The difference appears to be that Disney has some very profitable franchises in this area whereas Warner Bros Discovery pretty much inherited a relatively dormant asset. Nonetheless, for both companies the film business represents a potentially significant area of growth.

The challenge for both is the transition to streaming and how to accommodate that transition while reining in costs as the transition continues. A lot of the market currently believes that this transition along with traditional television is inherently unfixable. But business often surprises with solutions in the future where the market sees none.

The other thing to consider is that while the business as it is currently constituted has a significant interest in content profitability. That is not nearly the only part of this diversified company. As things change, it is more likely that divisions we know nothing about right now will come into being, while other things fade into history. Businesses like this one with some definite competitive advantages will likely survive even if there are some bumps along the way.

Parks And Experiences

This part of the company depends largely upon successes elsewhere in the company. To a certain extent, this division does not control its future because of that dependence. If the successes fade elsewhere in films (for example) it affects what this division can do to entertain people.

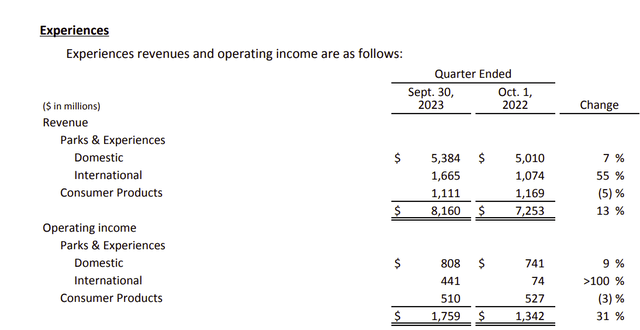

Disney Parks And Experiences Summary Result (Disney Fourth Quarter 2023, Earnings Conference Call Press Release)

The big growth area here was international and it was due to fading covid issues from the year before. Domestic also grew but there were also issues discussed in the press release.

Probably the most obvious area for more growth here would be international parks. That part of the business has a lot more possible penetration in the marketplace.

In the United States, winter is something that limits these kinds of parks in large parts of the country. As a result, there is only so many places a part like this can exist in the Southern part of the country without cannibalizing the business of the existing parks.

Probably the comparable segment at Warner Bros Discovery is video games which appears to be more established than is the case here. Both companies have things like clothing lines and toys licensed.

Cash Flow

Throughout the industry, cash flow growth is essential as this industry is seen as a “cash generating machine” when properly managed (right or wrong).

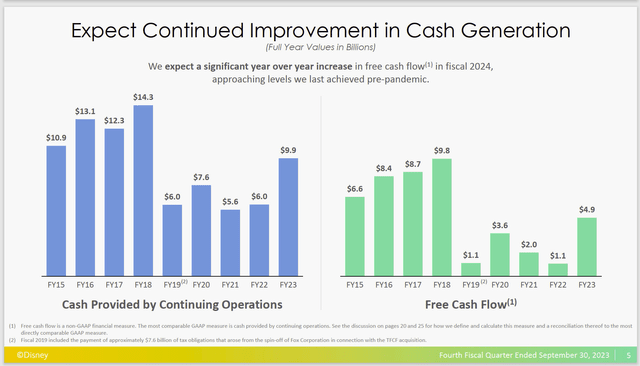

Disney Cash Flow And Free Cash Flow Generation History (Disney Fourth Quarter 2023, Earnings Conference Call Slides)

Disney has a history of generating a lot of cash flow that converted to free cash flow. This is something that the market fully expects to recover and then grow because there was an acquisition (as mentioned several times in past articles) that was not fully exploited. But when those assets and franchises are properly “up and running” then cash flow and earnings per share should reach new highs.

The past few years represented recovery from the coronavirus challenges. That recovery should continue. The coronavirus challenges really were greater for the diversified companies like this one that for a company like Netflix (NFLX) which may have actually benefitted from those same challenges (net).

With a competitor like Warner Bros. Discovery, it is far harder to tell as the company did not come into being until the acquisition was made after the coronavirus challenges were fading into the past. However, Warner Bros. Discovery is focusing on cash flow overall as well because that is normally the focus at this stage of deleveraging a leveraged buyout.

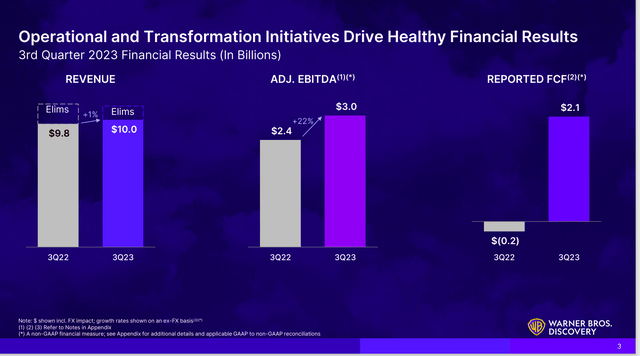

Warner Bros Third Quarter 2023, Summary Results (Warner Bros Discovery Third Quarter 2023, Earnings Conference Call Slides)

Like Disney, Warner Bros. Discovery is pursuing profitability improvement complete with cost reductions. However, the scale here is far larger (comparatively speaking). Warner Bros. Discovery has an advantage in that some accounting issue resolution is generating cash to allow for a smoother transition to more profitability.

The big deal is that significant amounts of debt place cash flow to the top of the list until further notice. Now, that does not mean everything else goes by the wayside as you do need a business to operate once the cash flow and related debt issues are resolved. Still, both companies are leveraged and are therefore driving towards more cash flow.

Even Netflix is joining this cash flow improvement movement.

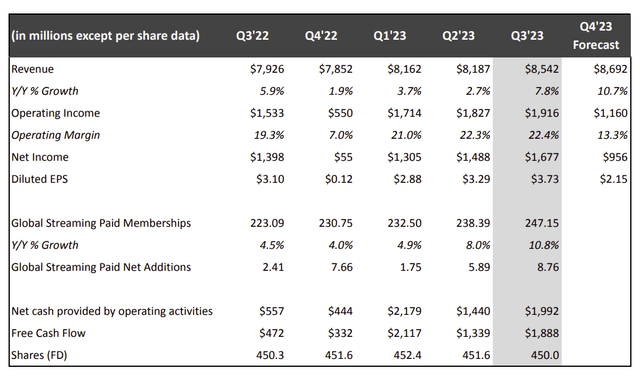

Netflix Summary Of Third Quarter 2023, Operating Results (Netflix Third Quarter 2023, Letter To Shareholders)

Netflix has long reported earnings without the cash flow to back up those earnings. Such a situation normally calls into question the adequacy of the depreciation on the income statement. Investors need to understand that GAAP is not one accounting treatment because there are a lot of discretionary decisions made by management to get to the reported results. Therefore, many different potential results are allowed under GAAP. One of those allowed results is shown above.

What has happened this fiscal year is that cash flow has begun to exceed net income as is traditionally the case for many companies. That may eventually resolve the issue of whether the accounting treatment getting the results above is aggressive but allowed.

The additional risk factor for Netflix compared to the other two companies discussed is that Netflix has no franchises and is not diversified. Franchises appear to take some of the risk out of having a hit movie or a hit television series. So, the risk to investors here has to be considered elevated compared to the other two.

Value Summary

Both Disney and Warner Bros. Discovery are more financially leveraged than Netflix. However, Netflix has no franchises to rely on and is therefore very dependent upon producing hits without the benefit of a franchise. That elevates the investment risk in Netflix considerably.

Both Disney and Warner Brothers have more integration. However, Disney has a history of the most profitability (and far more cash flow and free cash flow) before the pandemic. The known popularity of the “franchises” of both companies is an asset. However, Disney has the best history of making use of those franchises whereas Warner Brothers Discovery is some years behind in that area.

The overall result of this is that Disney is in the best position of the three with Warner Brothers having a good chance at being behind Disney (at least) in the long run. Netflix basically has to establish hits from scratch each season to remain competitive even though some hits stretch over several seasons. In my book any financial risk from leverage of Disney and Warner Bros Discovery is far more offset by the suspected much higher risk that Netflix has of generating hits “from scratch” to keep going. A “bomb” at Netflix could potentially have more material effects.

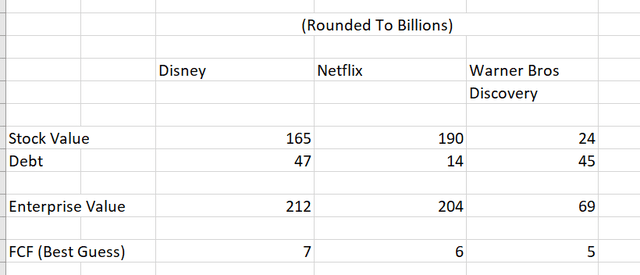

The current comparison of values would look like:

Comparison Of Enterprise Values Of Disney, Netflix And Warner Bros Discovery To Free Cash Flow (Source Seeking Alpha Website November 10, 2023 Arranged By Author)

In doing this, I tried to keep the comparison simple using what I figured were the material values. Others can do all the adjustments if they so desire on their own.

It should be noted that Disney, for example, reported free cash flow as closer to $5 billion, which is lower than the website calculated. The Warner Brothers Discovery and Netflix figures are estimates based upon management guidance and whatever else that is reliable I can read about this. Readers may prefer slightly different numbers.

With that being stated, Warner Bros. Discovery is clearly the cheapest for the free cash flow being guided to. That is likely due to a lack of history, as the company is currently constituted combined with the lack of cash flow of the assets acquired. Warner Brothers Discovery is, therefore, in the position of proving the profitability of the value of the acquired assets. It has the most to demonstrate in the eyes of the market. Warner Bros. Discovery may also have the least downside risk.

The other two are roughly comparable in the eyes of the market without really a significant value difference regardless of the cash flow figure used for Disney.

However, Disney has a history of cash flow generation that is unmatched by the other two until the pandemic arrived. This is in contrast to Netflix which regularly announced profits in history without free cash flow. Disney is still recovery from the coronavirus challenges. But management does predict increasing cash flow next year (so does Netflix).

Disney has the advantage of the profitability of franchises it owns and the market recognized value of those franchises. The market may be getting tired with the time spent on recovering from the pandemic. It also may be focusing on company challenges. But the Disney history of meeting and overcoming challenges largely merits its valuation.

Netflix, on the other hand only recently began to generate free cash flow let alone free cash flow that exceeds income. The company is priced for growth that has really not happened for some time. Even the latest “great quarter” was single digit revenue growth. This stock may have the most downside potential should management not meet market expectations.

Whereas Disney and Warner Bros. can likely use established assets to grow much more, Netflix depends upon relatively risky organic growth for that same effect. Acquisitions frequently use up the cash flow reported which means the company is often left with no free cash after acquisitions. For that reason, Disney probably represents the best value for future prospects, followed by Warner Bros. Discovery (as a turnaround situation), with Netflix probably far overvalued for future prospects.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.