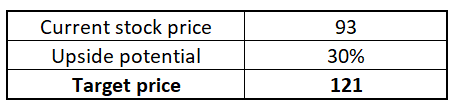

Summary:

- Disney continues executing Bob Iger’s bold strategic turnaround plan, and recent developments suggest that the plan is working.

- The company has a strong positioning in the streaming industry, which will likely be the main revenue growth driver.

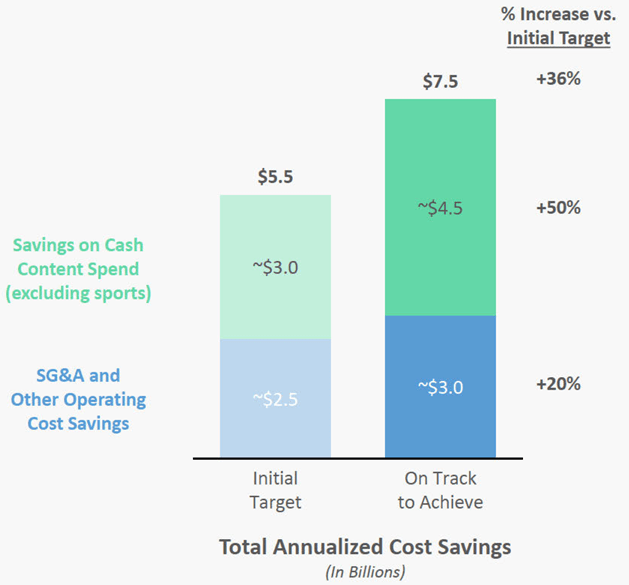

- The management’s strict financial discipline will help improve profitability as the company is already notably ahead of its initial cost-savings targets.

- My valuation analysis suggests that DIS stock is around 30% undervalued.

Justin Sullivan

Investment thesis

My previous bullish thesis about Disney (NYSE:DIS) from September aged well, as the stock outperformed the broader U.S. market by a wide margin over the last quarter. The company’s fundamentals are improving as the management executes Bob Iger’s transformation plan, which has already positively affected financial performance. The near-term outlook is solid as well, and the company’s strong balance sheet makes it well-positioned to balance between investing in growth and keeping shareholders happy. My valuation analysis suggests that the stock is still substantially undervalued even after a recent strong rally. All in all, I reiterate my “Strong Buy” rating for Disney’s stock.

Recent developments

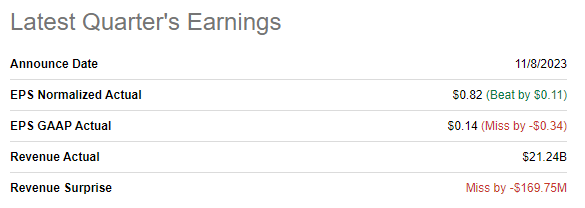

The latest quarterly earnings were released on November 8, when Disney missed consensus revenue and EPS estimates. However, the company delivered a positive adjusted EPS surprise. Revenue grew YoY by 5.4%, and the adjusted EPS more than doubled, from $0.30 to $0.82.

Seeking Alpha

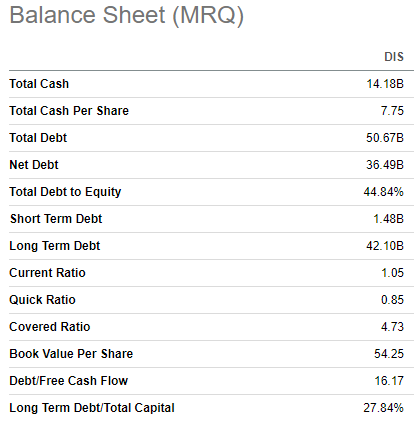

The operating margin expanded YoY by more than three times, from 2.8% to 10.2%. A strong quarter from the profitability perspective allowed Disney to generate almost $2 billion in levered free cash flow [FCF], representing a 9.1% margin. Generating consistently positive and wide FCF margin is crucial for Disney, given the company’s massive $51 billion net debt position. During the latest earnings call, the management shared the expectation that 2024 FCF will return to pre-pandemic levels, which means the company will be able to balance between deleveraging the balance sheet and continuing to invest in growth. Bringing back dividends after a three-year suspension also underscores the management’s confidence in the company’s ability to improve FCF metrics.

Seeking Alpha

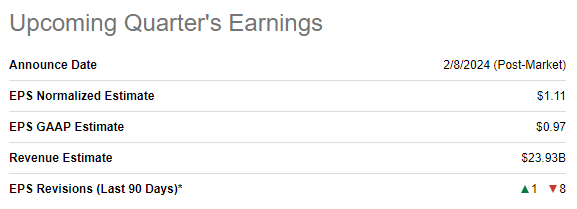

The earnings release for the upcoming quarter is scheduled for February 8, 2024. Consensus estimates forecast quarterly revenue at almost $24 billion, which indicates a 2% YoY growth. The adjusted EPS is expected to expand YoY from $0.99 to $1.11.

Seeking Alpha

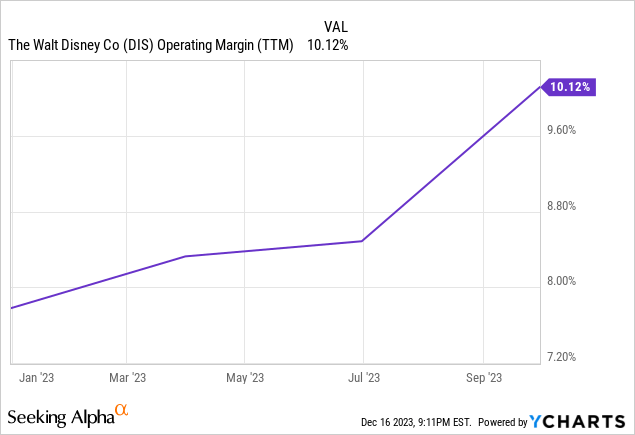

The substantial profitability improvement suggests that the management team is successfully executing Bob Iger’s bold transformation plan, released on February 2023. Mr. Iger returned to Disney 13 months ago, and the operating margin TTM performance says it all. The operating margin returned to double-digits after a massive hit from the pandemic-related crisis, but the company’s financial performance before 2020 suggests there is still vast room for improvement. Disney’s operating margin before the pandemic has been consistently above 20%. That said, I still see a solid upside potential here, especially given the management’s focus on further profitability improvement during the latest earnings call.

The profitability improvement was driven by strict financial discipline, which is one of the key strategic areas the company currently focuses on. The management has significantly raised its cost savings targets and is now $2 billion ahead of the initial $5.5 billion efficiency plan. A clear roadmap for improving operating and content spending is a solid bullish sign for investors because, as I mentioned earlier, there is still a huge room for profitability improvement. This will improve investors’ sentiment around the stock as profitability metrics continue demonstrating positive dynamics.

Disney

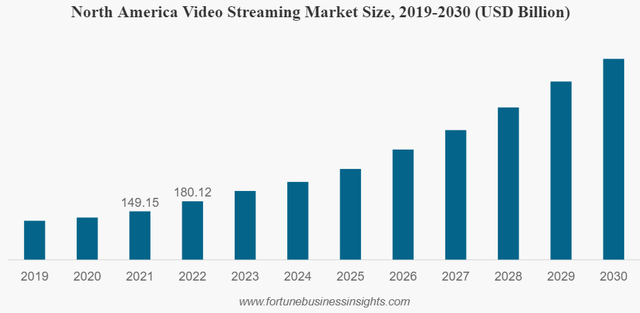

However, it is important to understand that the management’s focus is not merely on profitability from the cost perspective but on delivering profitable growth. The company’s most promising segment is its direct-to-customer [DTC] business, which represents the family of streaming services. The management is not prioritizing its streaming business’s growth at all costs but focuses on profitability instead. The global number of Disney+ subscribers is far from its late 2022 peak because Bob Iger prioritized quality over quantity, and now the management has a clear roadmap for achieving the segment’s operating profitability, which is expected by the end of 2024. Disney has a strong positioning in streaming by capitalizing on the potential to integrate Disney+, ESPN+, and Hulu with a one-app experience. In that light, the recent information regarding the acquisition of full control over Hulu from Comcast (CMCSA) looks sound to streamline this segment’s operations and integrate it with Disney+ to enhance subscribers’ experience. Focusing efforts on building a strong streaming segment is a solid strategic move, given the expected 19.3% CAGR for the industry.

fortunebusinessinsights.com

I consider the company’s new ESPN BET endeavor promising as well. Betting on sports is also an emerging trend in the entertainment industry, and the fact that Disney has a vision beyond its current activities also suggests the ability to add new revenue streams to its portfolio. ESPN+ has an extensive audience of more than 26 million subscribers in the U.S., which is a huge potential customer base for ESPN BET. According to statista.com, the online sports betting industry in the U.S. is expected to compound at a 15.6% CAGR for the next five years, which is a strong tailwind for Disney’s new initiative. According to the survey of hedge fund investors, expectations around ESPN BET are quite positive, which is a bullish sign.

Apart from promising relatively young and new streaming and betting businesses, let us also not forget the company’s legacy businesses. The company has a stellar pipeline of movies for 2024, including sequels of popular franchises like “Deadpool” and “Planet of the Apes“. According to thedirect.com, out of the top ten 2024 movies by earnings potential, there are four expected releases from Disney, which is a solid share. The global cinema industry was hit hard by the pandemic, but PwC expects the industry to recover by 2025 and demonstrate further growth in the years beyond. With multiple iconic franchises in its portfolio, Disney is firmly positioned to capitalize on the global box office recovery.

Last but not least, international tourism is recovering and is expected to achieve 90% of the pre-pandemic levels in 2023. That is a strong recovery pace, given the harsh macroeconomic conditions in the world’s major economies multiplied by the extremely high level of geopolitical uncertainty. Furthermore, there is still an upside potential for the industry to rebound. As Disney operates seven out of the ten most visited theme parks in the world, the company is well-positioned to absorb the ongoing global tourism recovery.

To sum up, Disney is well-positioned to continue delivering profitable growth. I like the management’s strategic moves, which will highly likely positively contribute to both sides of the company’s profitability equation. Strategic positioning in the most promising streaming segment is solid and increases the probability for the company to drive revenue growth. The company’s more mature businesses like movie franchises and theme parks are also well-positioned to absorb the post-pandemic recovery of these industries. At the same time, the ongoing strict cost management ensures that the growth will accumulate value for shareholders, and the recent dividend reinstatement is a clear indication of the management’s confidence in delivering strong cash flows.

Valuation update

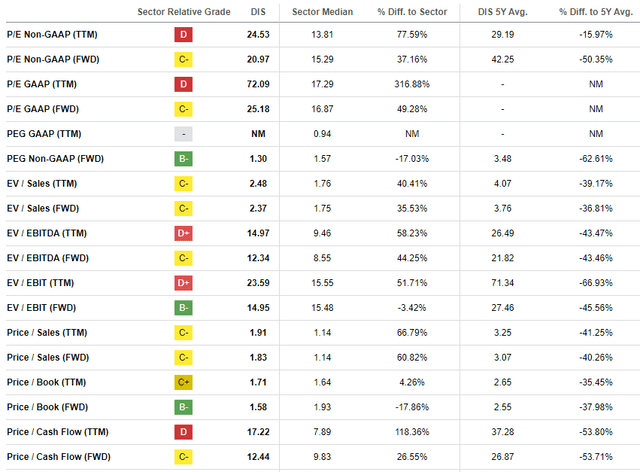

DIS rallied by 5.6% year-to-date, significantly lagging behind the broader U.S. stock market. The company’s valuation ratios are substantially higher than the sector median, but we should not forget Disney’s unmatched brand and massive scale. Therefore, it would be more suitable to compare current valuation ratios to Disney’s historical averages. From that point of view, the stock looks substantially undervalued.

Seeking Alpha

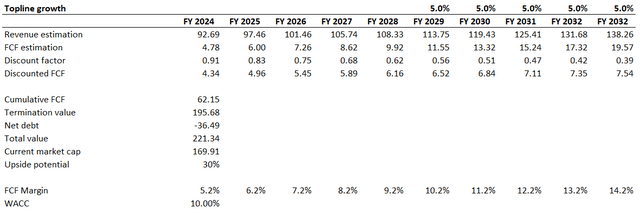

I want to proceed with the discounted cash flow [DCF] simulation to get more conviction. I use a 10% WACC to discount the level suggested by Gurufocus. Consensus revenue estimates are available up to FY 2028, and for the years beyond, I project a conservative 5% CAGR. Such a growth profile is fairly conservative, with an overall 4.4% CAGR for the next decade. To add context, Disney’s revenue has compounded at 7% annually over the last decade. With a promising streaming business in Disney’s portfolio, I believe a 4.4% CAGR for the next decade is doable. I use a 5.2% TTM FCF ex-SBC margin for my base year and expect a one percentage point yearly expansion.

Author’s calculations

According to my DCF simulation, the business’s fair value is $221 billion. This is 30% higher than the current market cap, meaning a strong upside potential for the stock. That said, my target price for DIS is around $121.

Author’s calculations

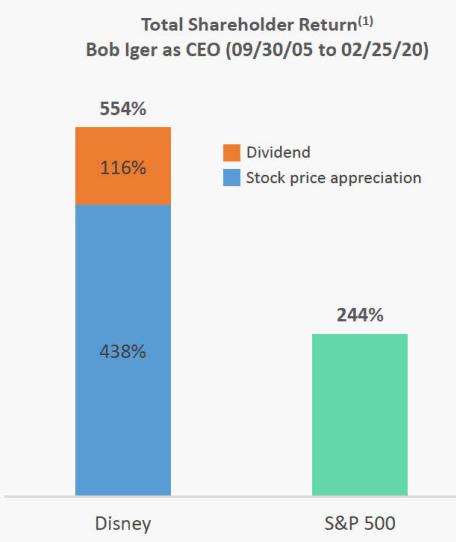

Risks update

Bob Iger is iconic for the company, and most of the recent positive developments happened due to his bold strategic moves to transform the company. During Mr. Iger’s first tenure as the company’s CEO, the stock massively outperformed the broader U.S. market because Disney dominated the entertainment market after numerous stellar acquisitions. To me, it is difficult to overestimate Bob Iger’s role in the company’s success and recent turnaround. However, recently he confirmed that he will step down as the company’s CEO in 2026. Despite three more full years under Iger’s reign, there is a high level of uncertainty about how successful the next CEO will be, especially considering that previous succession failed.

Disney

The public image of any company is crucial to sustaining financial performance, but it is especially important for entertainment companies where competition is high and customer switching costs are low. That said, the content generated by Disney should balance between being buzzworthy and not offending some groups of the population at the same time. There has been a lot of controversy around the company historically, which intensified in 2022. While I do not expect this controversy to undermine Disney’s long-term prospects, big controversial headlines might cause substantial near-term volatility.

Bottom line

To conclude, Disney is still a “Strong Buy”. Fundamentals keep improving, and the company is well-positioned to continue delivering strong results, given the management’s sound strategic turnaround moves. The fact that the company brought back dividends after a three-year suspension suggests that the pandemic-related crisis is in the rearview mirror. Furthermore, my valuation analysis suggests the stock is 30% undervalued, which represents a compelling investing opportunity at the current stock price levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.