Summary:

- Disney’s shift towards a direct-to-consumer model is risky during an economic downturn, with revenue growth lagging behind competitors like Netflix.

- Concerns over Disney’s overvalued share price, plateauing business growth, and reliance on cost-cutting measures indicate a potential downward trend.

- Despite new content releases and entertainment experiences, competition remains strong and economic conditions may impact Disney’s future success.

RinoCdZ

Investment Thesis

In my last article on the house of mouse I rated Disney (NYSE:DIS) as a hold given what I believe to be as foundational issues with Disney+ streaming strategy. However their recent performance has led me to change my stance. One of my primary concerns is the company’s increasing reliance on their direct-to-consumer (DTC) segments, such Disney+ which I mentioned before, and has not met expectations but also other DTC business lines like their parks division. Despite the initial promise of a vast library of content for their Disney+ division, Disney has shifted towards producing new content, a strategy more aligned with Netflix but also one that eliminates what content edge they had.

Being less dependent on enterprise cable sales and more on their DTC segment is highly risky in my opinion. This avenue for revenue is highly sensitive to economic downturns especially given the premium price point they charge for certain products like their parks and entertainment packages. Business for Disney has seemed to plateau, likely caused by the slowing consumer spending and tightening of budgets. For instance, Disney+ lost 1.6 million international subscribers in the second quarter of 2024. The company’s shares, based on their price to earnings ratio ((P/E)), seem to be overvalued.

Looking at their competitors, the performance of Disney+ significantly lags behind Netflix both in content and now facing new threats in their physical entertainment division. Disney+’s revenue growth does not look promising, with only a 2.84% year-over-year increase projected for fiscal year 2024, compared to Netflix’s projections of 13% to 15%. Downward revisions in revenue estimates further exacerbate this problem, with 19 downward revisions, compared to 4 upward, in the last three months alone. It is clear that Disney seems to be under financial strain, considering the company hopes to implement $7.5 billion in cost cuts to offset declining revenues.

Given these factors, I am personally downgrading Disney’s stock to a strong sell. The increased dependency on the DTC segment during an economic downturn, combined with an overvalued share price and plateauing business growth, leaves me concerned over the company’s future.

Why I Am Doing Followup Coverage

Since my last article on Disney in March, share price has dropped by 16.19%, while the S&P 500 has outperformed the company, jumping by 6.19%.

As I mentioned above, Disney+’s original intent was to serve as a platform that consisted of years of content in one library. However, the company has recently been turning their focus towards investing heavily in new content, running contrary to the original value proposition. Because of this, their business model is fairly similar to Netflix, who has also been focusing on producing a large quantity of new content.

The purpose of this follow up coverage is not to just harp on poor Disney+ performance (even though I warned of this in March). Rather, this is to show that all of the other divisions that were supposed to drive operating profits while the company pivoted away from cable are now slowing as well.

With a weakening consumer base, and concerns over the company’s I think it is important to do follow up coverage.

Performance Is Still Lacking

Disney’s performance, particularly in its streaming services, continues to lag behind their competitors, especially Netflix. As I mentioned above, Disney actually lost about 1.6 million subscribers worldwide in their last quarter. On the other hand, Netflix (NFLX) gained over 9 million in their last quarter.

During the earnings call, there were some quotes that really stood out to me regarding their future performance. For example Hugh Johnston, CFO, mentioned

we are forecasting a loss for Entertainment DTC in the third quarter, the vast majority of which is due to Disney+ Hotstar’s ICC cricket rights. We also do not expect to see core subscriber growth at Disney+ in the third quarter – Q2 2024 earnings call.

Compared to Netflix’s 9.9 million subscriber gain in Q1 this is rough.

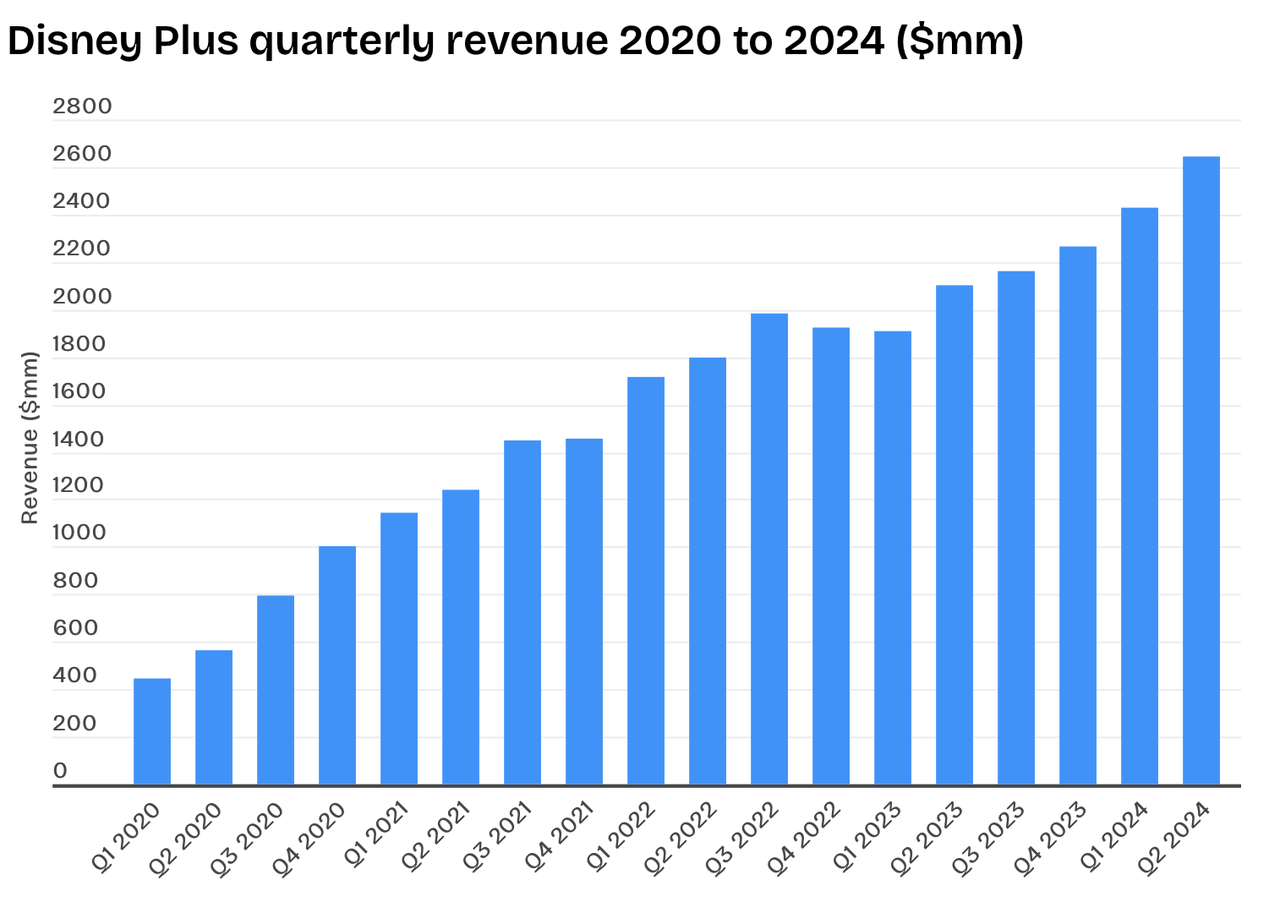

Looking at revenue, below is a chart of Disney+’s revenue.

Disney+ Revenue (Business of Apps)

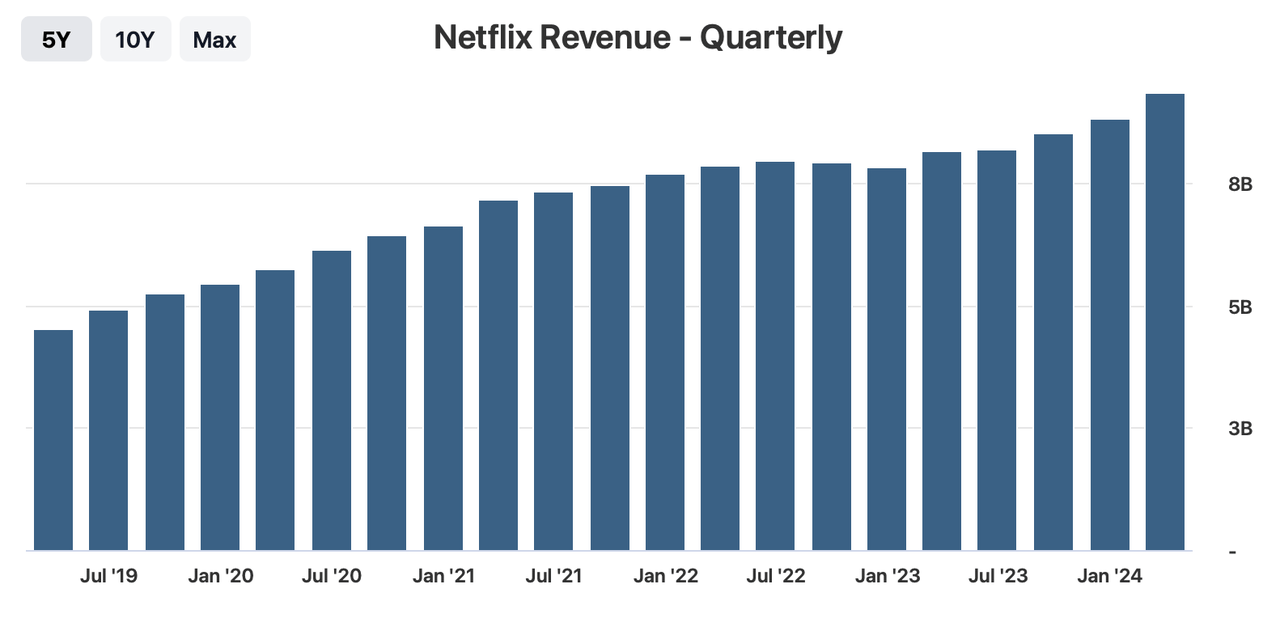

While their revenue has been largely increasing (somewhat driven due to price hikes), their recent quarterly revenue was about $2.643 billion. However looking at Netflix, it is clear Disney is lagging behind.

Netflix Revenue (Stock Analysis)

Although he later went on to say that numbers will likely turn around in the fourth quarter, this still leaves me weary regarding their future. Johnston also mentioned during the call call that:

the third quarter’s results will be impacted by three additional factors, higher wage expenses, pre-opening expenses related to the Disney treasure and adventure cruise ships, as well as Disney Cruise Line’s New Island, Lookout Cay, and some normalization of post-COVID demand – Q2 2024 earnings call.

He further expand on this “normalization” stating:

[we’re] seeing some evidence of a global moderation from peak post-COVID travel – Q2 2024 earnings call.

The quotes above mainly discuss Q3’s expected performance, but Johnston also went on to state that:

pressures from wages, reopening costs and demand impacts are expected to persist in Q4 – Q2 2024 earnings call.

Although he believes operating income growth will rebound in the same quarter, I am still concerned over their future performance.

With rising inflation and economic uncertainty, many families are cutting back on discretionary spending, making it harder for Disney to attract visitors to their parks and cruises. The company acknowledged some of the struggles faced by their parks, as CFO, Hugh Johnston, stated in their Q2 call:

At Disneyland, despite growing attendance and per-capita spend, results declined year-over-year due to cost inflation, including from higher labor expenses – Q2 2024 earnings call.

With this, as I mentioned above, Disney’s theme parks division is very sensitive to economic conditions. For example, an economic assessment completed by Harold L Vogel, a CFA, revealed that a 1% rise in unemployment rate correlates to a 3% drop in U.S Disney park attendance.

Overall, I believe Disney’s performance is very sensitive to any economic downturn. Until Disney can demonstrate significant improvement across their business segments, and make them more robust to consumer spending, the company’s performance will likely continue to lag behind their competitors. I think the company’s P/E multiple does not yet reflect this.

Valuation

Disney’s current valuation appears increasingly unsustainable given the company’s anemic revenue growth and elevated price-to-earnings (P/E) ratio. The company has experienced a notable slowdown in revenue, with projections indicating 2.84% year-over-year growth for fiscal year 2024. I believe this modest growth rate is insufficient to justify Disney’s high P/E ratio, which remains elevated compared to the industry average. Disney’s forward Non- GAAP P/E ratio is 20.60, which is 62.97% higher than the sector median of 12.64. Such a discrepancy suggests that the market may be overly optimistic about Disney’s future earnings potential.

Adding to the concerns, Disney has faced numerous downward revisions in their revenue estimates. Over the past three months, there have been 19 downward revisions, and only 4 upward revisions. This ratio of downward to upward revisions highlights the increasing skepticism among analysts about the company’s ability to meet their financial targets.

In an attempt to maintain performance, Disney has resorted to significant cost-cutting measures, announcing their plan to cut $7.5 billion. While these cuts are necessary to manage short-term financial pressures, they come at a critical time when the company needs to invest heavily in order to compete with their competitors, who as I mentioned above, are already out performing them greatly. These cost cuts are only a one off measure too, meaning that this is a temporary bump in EPS growth, but the company has to be more creative in the long run to get their EPS to compound.

Given these factors, I believe Disney’s valuation should be adjusted downward to reflect the sector median. Based on the company’s P/E ratio, if it was adjusted to the sector median, this would represent 38.6% downside.

Bull Thesis

Despite the numerous challenges and the recent underperformance, I think there could still be some reasons to be optimistic about Disney’s future. The company has an impressive content slate lined up, which could potentially turn the tide. For example, Disney is currently working on new content such as Deadpool & Wolverine, Mufasa: The Lion King, and Moana 2. One of their most recent releases, Inside Out 2, has already proven to be a huge success. This movie, only being in theaters for a few weeks, has passed $1 billion at the global box office.

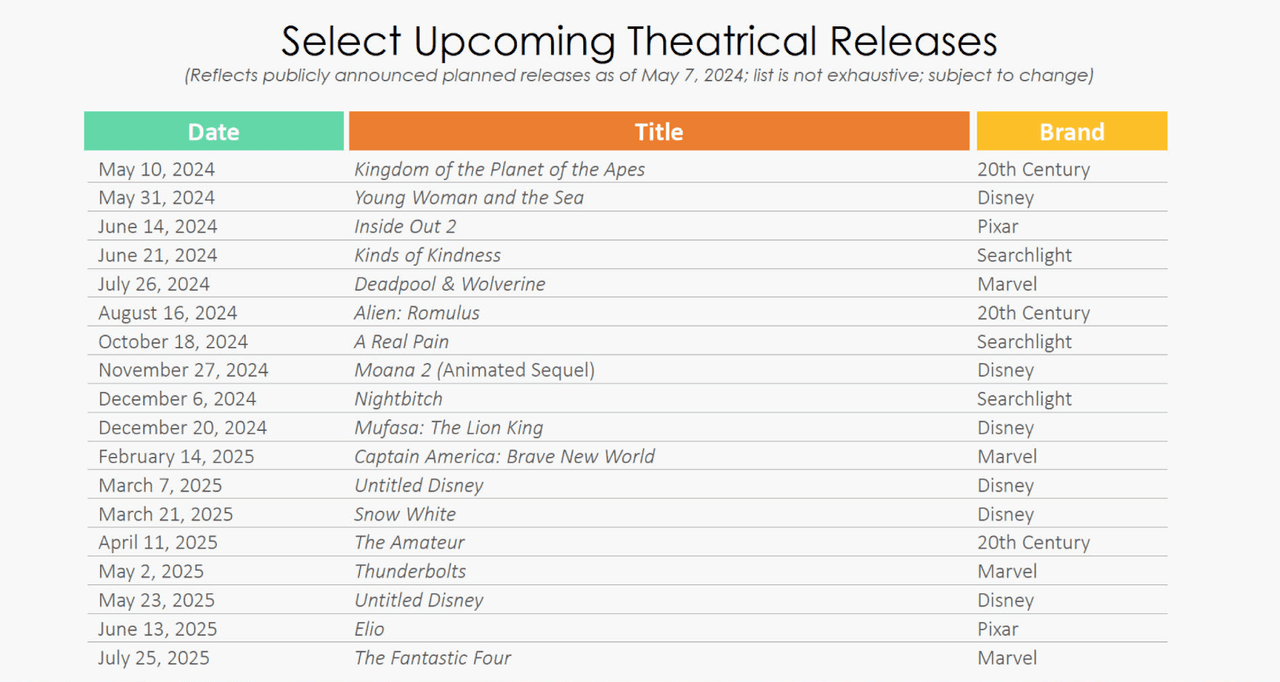

This content slate doesn’t just stop here. Below is an image from the company’s earnings deck.

Disney Content Slate (Disney Investor Relations)

This image presents the vast amount of content Disney will be releasing in the next year. If these movies are as successful as “Inside Out 2”, the company’s revenue could be promising.

However, while this new content may seem promising for Disney, competition is stronger than before. In addition to this, this new movie slate may struggle to live up to the older slates such as the Marvel Series.

The company also continues to build on their current line of entertainment experiences. As shown during the earnings call presentation, Disney plans to open multiple new entertainment experiences. For example, Fantasy Springs, Lookout Cay, Tiana’s Bayou Adventure ((which all opened in June)), and the Disney Treasure cruise. However, as I previously mentioned, these revenue routes are highly sensitive to any downturn in economic conditions. If consumers do not have the money, these business sectors will not be successful for Disney even if they are new and novel.

Takeaway

Unfortunately, despite Disney’s iconic brand and rich history, I now think they are a strong sell. The company’s shift towards a direct-to-consumer model during a potential impending economic downturn, combined with their overvalued share price and plateauing business growth, greatly concerns me. I think, as I mentioned above, Disney’s attempts to cut costs may provide a short-term boost but could lead to long-term consequences. If they reduce investment in improving customer experience, it is likely they will fall even further behind competitors such as Netflix. The house of mouse appears overvalued at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.