Summary:

- Walt Disney Company plans to invest $60 billion into its theme parks over the next decade, double the previous decade’s spending.

- Disney faces near-term struggles with its streaming efforts and potential debt increase from the purchase of Hulu.

- Slowing consumer spending and public perception risks also pose challenges for Disney’s short-term prospects.

Wirestock

The Walt Disney Company (NYSE:DIS) announced September 19,2023 a massive investment into its theme parks over the next decade totalling $60B, double the prior decade’s spending. A number of analysts on Seeking Alpha (notably here and here) have broken down the long term benefits of re-investing in Disney’s biggest profit driver. This article is going to take a look at the more short-term prospects for Disney and why despite this investment and the long-term brand strength of the company, it may not be the time to invest in the company with some current headwinds.

Near Term Struggles

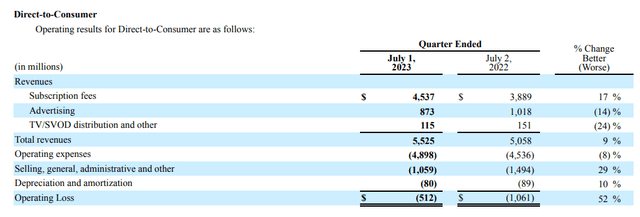

Disney has a number of near term challenges that have been well documented. The company has ramped up its effort to attract streaming users; some may have viewed it as an attempt to garner a better stock multiple like Netflix (NFLX) did, others as a pivot to meet a changing consumer. The company has used low introductory offers and complementary free trials to rapidly boost its user base but this has not led to profitability for the segment:

Q2 2023 Disney 10-Q

As a Disney+ subscriber, I think Disney has wisely not sacrificed the quality of its Disney plus offerings; however, this strategy compares very differently to the “Blumhouse” type model that Netflix uses where it produces more content but at a cheaper price, hoping something will hit and appealing to a broader range of users.

Disney appears set to double-down by buying out Comcast from its share of Hulu as well. Hulu has reached profitability so there is hope that it may have some synergies with Disney+ as CEO Iger has reiterated it is part of Disney’s future. In the near term, it will likely have some hits to the company’s near-term results. The purchase price rumored of about $10B will also likely require more debt to be added to the corporate balance sheet which is nowhere near as cheap now as prior years. Comcast recently issued bonds in the 4.5% interest rate range so this will be another 450 to 500m in annual interest expense added to Disney’s bottom line. All this adds up to some short-term headways.

Debt Levels

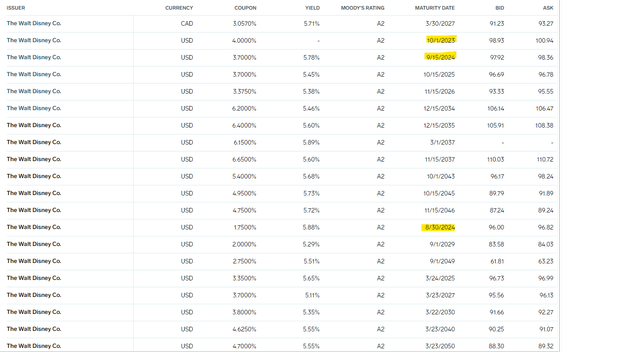

Disney has taken on a massive debt load the last few years as it has need to swallow its purchase of Fox with the total debt load sitting at $47.2B per its latest 10-Q. However, only $2.4B of it comes due in the next year based on this summary of maturities:

Market Insider

This $2.4B will need to be re-financed in a more difficult environment than we have had in a while. Disney will also have to finance a purchase of Hulu in the $10B level range which isn’t ideal either. Disney is a long-term blue chip with profitable business so refinancing will occur, but it is the type of thing that can worry investors in the short run.

Slowing Consumer Spending

The crown jewel of Disney’s business are its parks which are the largest profit drivers; their losses during the COVID period was understandable and these operations have largely rebounded. The earlier announcement of the long-term re-investment in the parks is proof of Disney’s long-term commitment to making.

The consumer is unfortunately going to be facing some headwinds. Inflation continues to be a problem for consumers, most notably in the basics such as food, energy, and shelter. All this is squeezing consumers as evidenced by the sharp drop in airfare prices by 13.3% in the recent CPI report. The sheer cost for families to travel and stay anywhere is going to impact consumers who are also dealing with the rapid increase in interest rates. Disney is a high-cost item for many families, and this can’t help but impact their park business in the near term.

Public Perception

Disney’s former CEO led an ill-fated decision to wade into contentious social issues. In today’s world, any stance is very polarizing and can risk alienating consumers, including fighting with Florida over its preferred tax status. CEO Bob Iger made a statement that they wanted to “quiet the noise” in the culture wars, recognizing that alienating either side will harm its business. As Michael Jordan famously said, “Republicans buy sneakers too”. Iger has clearly learned from this but there is a risk that his reduced status may now inflame the other side along with its employee base. This risk is hard to quantify but with passions on either side still elevated, it will take some time for this less inflammatory stance to take effect.

Technicals

Since the early year rally of its lows, Disney shares have steadily dropped, now having erased all its YTD gains and testing its 2022 Year end low.

Technical (Finviz)

There is a chance it could bounce off this level, but it has been in the $80 to $90 level for several months. Looking out several years, it is trading at lows not seen since the 2015 – 2017 period.

The Takeaway

I personally love Disney as a long-term investment. It has an amazing brand that now spans multiple generations with the Marvel/Star Wars content levels which remains very sticky with fans of its product over the years, and I am a big fan of it.

In the short run, there are a lot of headwinds to Disney’s chance to reverse its recent performance, from increasing debt and interest costs to a tough consumer market with some headwinds for its two major business lines. Combined with a TTM GAAP P/E of 67 and EV/EbiTDA of 15x, Disney does not look like it provides a good risk/reward situation at this point and may in fact make a decent short opportunity.

If I decide to take a short position (which I would do through Put Options), I would like to give it time to play out with some likely headwinds through both the Q3 and Q4 results, a potential market impact from the results of the Hulu negotiations along with the potential risk of a market sell off. At first glance, April 2024 $70s provides a pretty good risk reward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.