Summary:

- After the launch of Disney+ in 2019, Disney’s historical trend of profitability collapsed to itself.

- With the return of Bob Iger, it has been made clear that the primary focus for the company is to drive growth in the streaming segment.

- Shifting the distribution of content from traditional channels to streaming platforms has been a powerful test of strength to assure future success.

Wirestock

Investment Thesis

The Walt Disney Company (NYSE:DIS) went through a roller-coaster in the past three years, disrupting itself with the introduction of Disney+, witnessing the complete shutdowns of its parks and movie theatres due to the outbreak of the covid pandemic, ending its twenty-plus year’s relationship with its legendary CEO Bob Iger to then bring it back in late 2022 to help the company survive all of this.

In today’s analysis, we will assess how the decision to shift its content distribution from traditional channels to streaming platforms has impacted Disney’s business model and valuation.

Business Model

After the launch of Disney+ in 2019, Disney’s historical trend of profitability collapsed to itself. Covid impact aside, Disney’s operating margins slumped with the introduction of Disney+, a strategic manoeuvre that can be best described as self-sabotage to prevent the infamous Netflix (NFLX) and Amazon Prime Video from stealing Disney market share.

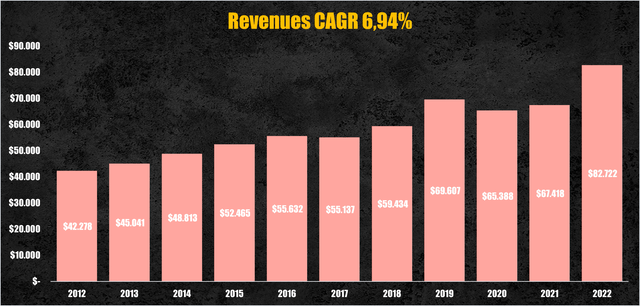

At the expense of profitability, with streaming segment losses going from $1.8 billion in 2019 to $4 billion in 2022, Disney managed to attract 231 million subscribers, combining Disney+, ESPN+ and HULU, in little more than 3 years, boosting its revenues, which despite the forced shutdown of amusement parks due to covid restrictions, kept growing at a sustained rate reaching $82 billion in 2022 after eliminations.

Dividing Disney’s business model into three main segments we have:

- The Linear Networks & Content Licensing segment, comprising the traditional distribution of entertainment content and whose revenues reached $36.4 billion in 2022 and $18.5 billion YTD 2023 growing at a median rate of 5.11% since 2017.

- The Direct-to-Consumer segment, comprising the streaming platforms Disney+, ESPN+, and HULU which totaled $19.5 billion in revenues in 2022 and $10.8 billion YTD 2023 growing at a median rate of 16.36% since 2017.

- The Parks & Experiences segment, which accounts for amusement parks and merchandise products, registering $28.7 billion in revenues in 2022 and $16.5 billion YTD 2023, growing at a median rate of 6.73% since 2017.

Growth Drivers

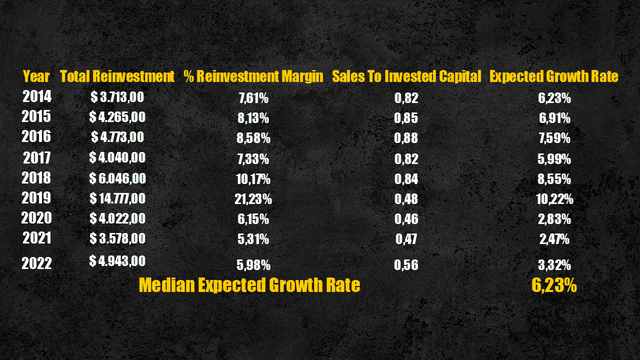

To project Disney’s future revenues, I started by calculating Disney’s expected growth rate, equal to 6.23%, obtained by multiplying Disney’s reinvestment margin, which shows the percentage of revenues that have been reinvested in capital expenditures and acquisitions for future growth, by Disney’s sales-to-invested capital ratio, which indicates how much revenue the company can generate for each dollar invested.

Taking the median value over the years, we obtain the expected growth rate of Disney.

Disney expected growth rate (Personal Data)

Revenues Projections

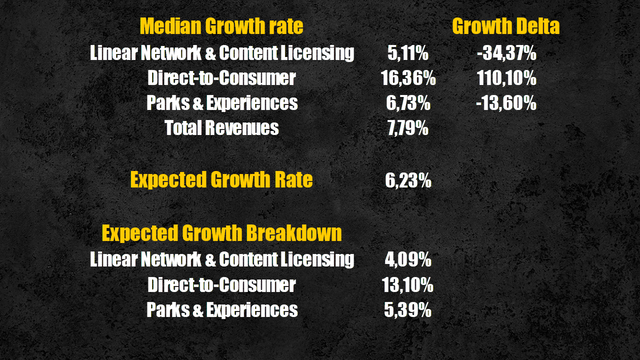

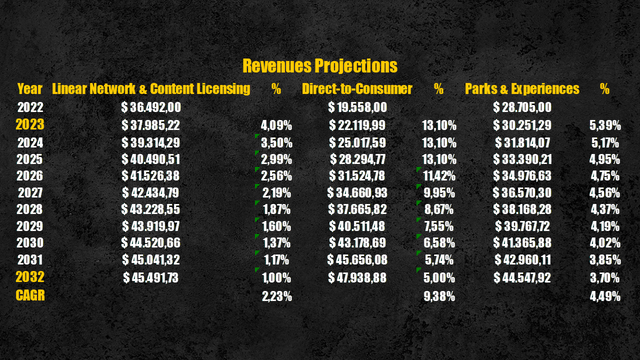

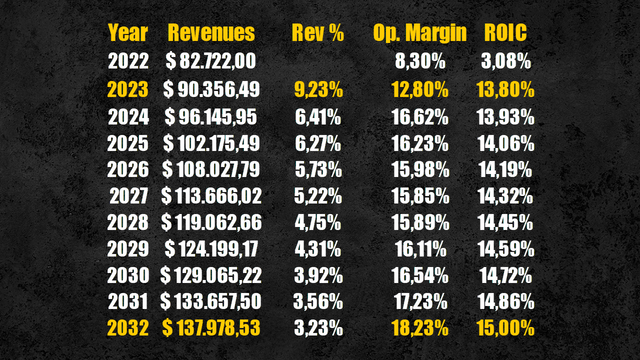

Starting from the value of 6.23% I then adjusted it by each of the three main segments looking at how much the median growth rate of each segment deviated from Disney’s overall median growth rate, equal to 7.79% since 2018.

I obtained that the expected growth rate for the Linear Networks & Content Licensing segment is equal to 4.09%, for the Direct-to-Consumer segment to 13.1%, and for the Parks & Experiences segment to 5.39%.

Disney segment expected growth rate (Personal Data)

With the return of Bob Iger, it has been made clear that the primary focus for the company is to drive growth in the Direct-to-Consumer segment, however, it will happen at the expense of the traditional Linear Networks and Content Licensing segment.

As a growing number of movies, tv-series and sports events will be primarily distributed using streaming platforms rather than traditional methods, the relevance of Linear Networks and Content Licensing, in terms of revenue generation, will decline over time.

With that in mind, I assumed the Linear Networks & Content Licensing revenues to be around $45 billion by 2032, growing at a CAGR of only 2.23% as Disney’s focus shifts to the streaming segment.

Moving to the Direct-to-Consumer segment, here is where growth will play out, expecting it to grow around 13% for the next 2/3 years, as Disney+ and the other streaming platforms scale up, to then slow down as the segment approaches maturity. Revenues are expected to be close to $48 billion by 2032 growing at a CAGR of 9.38%.

In particular, the recently announced project of merging Disney+, ESPN+, and HULU into a single super app to create a better user experience, might unlock greater revenues generation for Disney, especially by attracting more advertisers which will benefit from a larger and more cohesive pool of users to which advertise their products.

Finally, the Parks & Experiences segment is expected to keep expanding at a constant rate, reaching $44.5 billion in revenues by 2032, growing at a CAGR of 4.49%.

Disney future segment revenues breakdown (Personal Data)

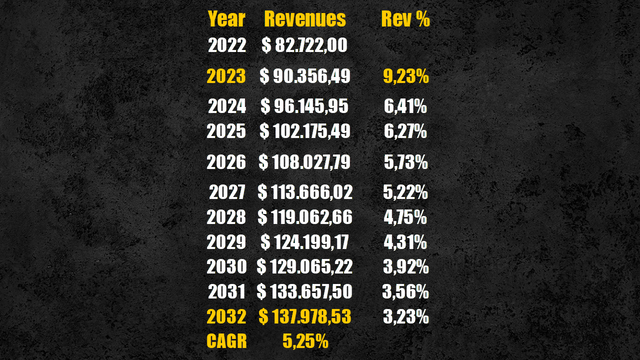

With these assumptions, Disney’s total revenues are expected to be around $140 billion by 2032, growing at a CAGR of 5.25%.

Disney future revenues (Personal Data)

Efficiency & Profitability

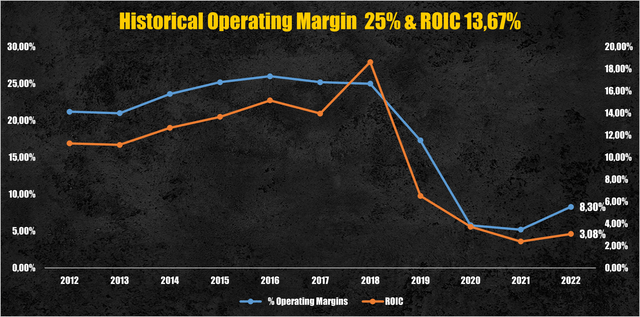

Moving on to Disney’s efficiency and profitability, the combined effect of covid restrictions, which forced amusement parks and movie theatres into prolonged shutdowns, and the launch of Disney+, a big cash-burning machine for the company, made both the operating margin and the return on invested capital (ROIC) to decline considerably from their historical value.

The operating margin declined from a median value of 25% to 8.3% in 2022, while the ROIC declined from a median value of 13.7% to 3.08% in 2022.

Disney operating margin & ROIC (Disney)

Along with a new strategy to drive growth in the Direct-to-Consumer segment, the management also pledged to restate the historical efficiency and profitability of Disney, undertaking a strict capital allocation strategy, particularly regarding marketing budgets and content selection, all this to allocate resources only on projects that actually generate growth for the company.

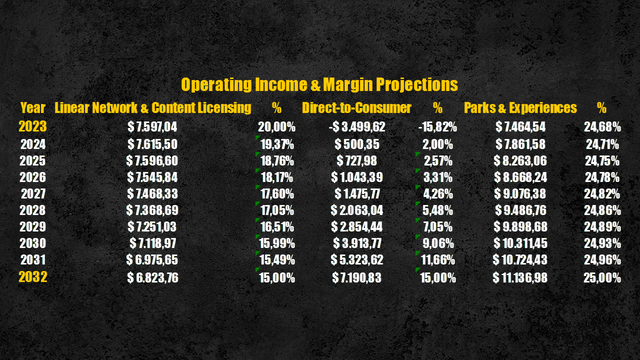

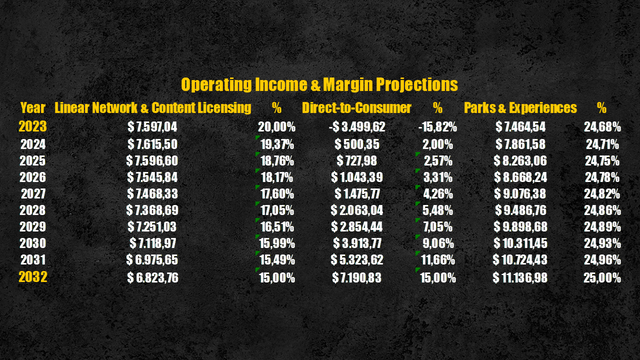

Breaking down Disney’s segments again, I assumed the operating margin for the Linear Networks & Content Licensing segment to keep following a declining trend as it has done in the past years, sitting around 15% by 2032.

That’s due to the prioritization of streaming distribution rather than traditional methods, which will reduce the number of television providers willing to pay for Disney’s proprietary channels and the number of advertisers willing to use traditional media to place their ads.

The Direct-to-Consumer segment on the other hand, as stated by the company is expected to turn profitable by the end of 2024, and I assumed it will improve its operating margin until reaching value close to Netflix’s current ones, equal to 15% by 2032.

Despite the increasing competition in the streaming industry, which will likely drive down margins, I assumed Disney to be able to offset this problem by leveraging on its strong brand and content library to drive numerous advertisers to its ecosystem, which if combined with the creation of a unique streaming platform, will permit the Direct-to-Consumer segment to achieve higher margins than streaming companies which just rely on subscription revenues.

As regards the Parks & Experiences segment, with the end of the covid pandemic, I expect it to recover its pre-pandemic levels, maintaining a solid operating margin of 25%.

Disney future segment operating margin (Personal Data)

Overall, the operating margin for Disney is expected to be around 18% by 2023, lower than its historical value of 25%, however, to stop the rising of streaming companies like Netflix and Prime Video, which were stealing huge market shares of its entertainment industry and potentially could have destroyed the company, Disney had to self-sabotage itself, entering the streaming industry, which at the moment, is less profitable than the traditional industries Disney was used to operating in.

As regards the future ROIC, I expect it to improve to 15% by 2032 as Disney will be able to capitalize on its already huge content library and strong brand, therefore, its capital needs will be lower than its competitors like Netflix and Amazon (AMZN) which still have to build up their libraries.

Disney future operating margin & ROIC (Personal Data)

Cash Flows Projections

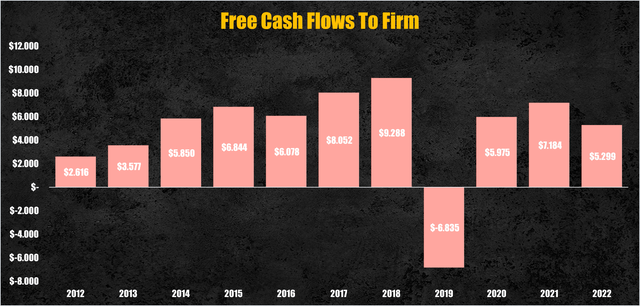

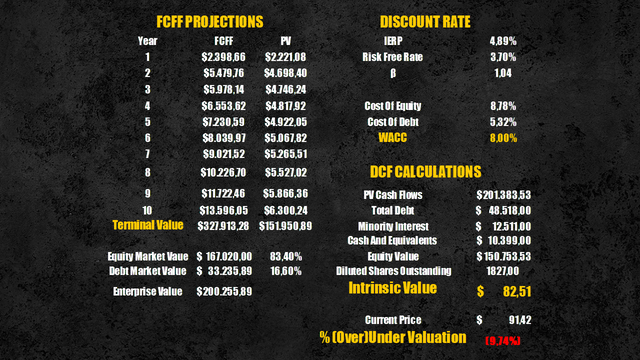

With these assumptions, Disney is expected to return to delivering solid free cash flows to the firm over the years (FCFF). In the past Disney delivered big FCFF, reaching $9.2 billion in 2018, however, the negative impact of Disney+ and the covid pandemic badly affected the capacity of Disney to generate solid cash flows, forcing the company to halt its dividend distribution.

With amusement parks reopening, and the streaming segment expected to reach profitability in the foreseeable future, Disney’s FCFF are expected to reach $13 billion by 2032 assuming Disney will maintain a reinvestment margin, needed to support the growth of its business, around an average value of 5% through the years.

Disney future FCFF (Personal Data)

Valuation

Applying a discount rate of 8%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $150 billion or $82 per share.

Compared to the current prices, Disney’s stocks result slightly overvalued by 9.7%.

Disney intrinsic value (Personal Data)

Conclusion

Despite the surge of the streaming industry has damaged Disney’s business model, I think that the decision to self-sabotage itself, purposely shifting the distribution of its content to streaming platforms rather than traditional channels, has been a powerful test of strength for Disney, which despite having left behind potential short-term gains, is assuring Disney to survive and succeed in the future.

Although my intrinsic value is 10% lower than the current price, Disney can be considered a fairly valued company in view of the many assumptions made in the analysis.

While buying Disney with a better discount is the safest choice, the decision to whether buy or not the company actually depends on how much an investor is willing to bear the risk of further declines in prices derived from negative news which might impact the company during this unstable phase.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.