Summary:

- Disney’s stock is at a 9-year low due to underperformance in its media division, particularly its streaming service Disney+.

- The company’s parks and resorts segment is performing well, but it is not enough to offset the decline in subscribers for Disney+.

- Despite being undervalued, Disney’s stock could remain a value trap until it finds a solution to revive subscriber growth for Disney+.

David Peperkamp

Disney (NYSE:DIS) is currently facing several major headwinds that have already negatively affected its business and resulted in a depreciation of the company’s stock to its 9-year lows. While Disney has been improving the performance of some parts of its business such as the parks division thanks to the improvement of the overall economy, the company’s media division is currently underperforming and dragging the whole company down. As such, until Disney manages to revive the subscriber growth of streaming services such as Disney+, its stock could become a value trap and trade at the current distressed levels despite being undervalued.

Recovery On The Horizon?

Disney’s shares trade around their 9-year lows and there’s a risk that they will remain there for quite some time.

Disney’s Stock Performance (Seeking Alpha)

The earnings results for Q3 that were revealed last month indicate that Disney faces several structural issues that could kill any hopes for a quick recovery. Before outlining those issues, it’s important to note that there are still several growth catalysts that could at least try to create the path to recovery sometime in the future.

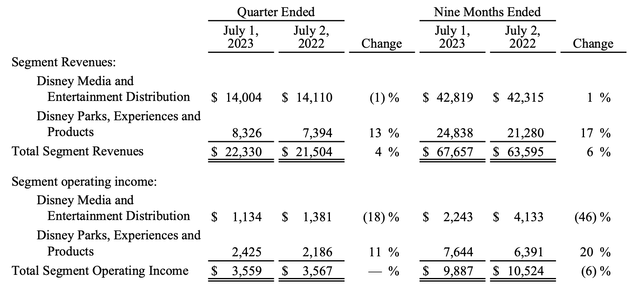

Even though Disney’s revenues were below the street estimates in Q3, they still increased by 3.9% Y/Y in Q3 to $22.33 billion. At the same time, the company managed to grow its parks, experiences, and products segment thanks to the price hikes at home and the increase in international attendance. Thanks to that, the parks, experiences, and products segment has grown at a double-digit rate and despite generating less revenues made the bulk of operating income in Q3.

Considering that the U.S. economy is expected to expand by 4.9% in Q3, there are reasons to believe that the company’s parks and resorts would be able to continue to generate stable returns and help the overall business grow its sales at mid-single-digit rates in the foreseeable future. Add to this the fact that despite the high debt load Disney’s interest coverage ratio is almost 4x and it becomes obvious that even at a subpar performance the company would be able to service its debt without any major issues.

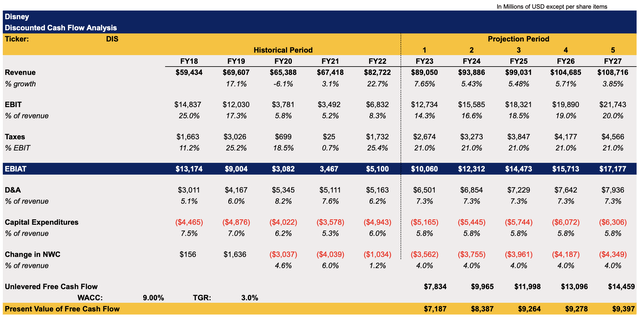

With all of that in mind, it makes sense to create a DCF model to see how big of an upside Disney’s shares represent at the current levels given all of the developments described above. All the assumptions in my model, which can be seen below, mostly align with the street estimates and indicate that Disney would be growing at a single-digit rate in the following years but would also be able to improve its earnings up until the terminal year. The terminal growth rate in the model is 3%, while the weighted average cost of capital is 9%.

Disney’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

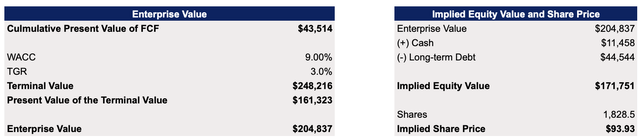

This model shows that Disney’s fair value is $93.93 per share, which represents an upside of over 10% from the current market price.

Disney’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

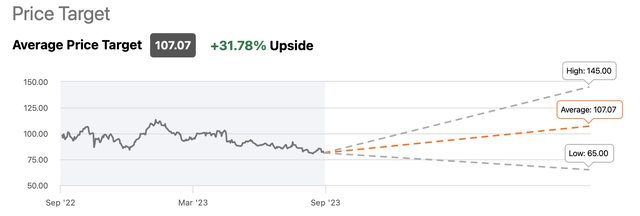

What’s interesting is that Wall Street is even more optimistic and believes that the upside could be as high as ~30%. However, regardless of all the growth catalysts, I’m skeptical about the street’s price target as there are reasons to believe that Disney could be a value trap despite trading close to its 9-year lows and won’t be able to create additional shareholders in the foreseeable future.

Disney’s Consensus Price Target (Seeking Alpha)

Is Disney A Value Trap?

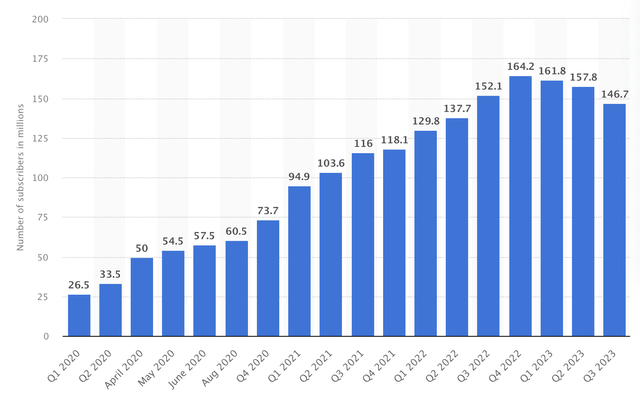

Despite the decent performance of Disney’s parks and resorts, the company’s stock is likely a value trap at this stage due to the underperformance of its media business which generates more sales but less profits. The underperformance itself is caused by the weak growth of the company’s streaming service Disney+. While in Q3, the average revenue per domestic and international subscriber of Disney+ rose and was $7.31 and $6.01, respectively, the increase was possible solely thanks to the price hikes that were implemented to mitigate the decrease of the overall subscriber count.

As is the case with a lot of companies, the decreasing subscriber count indicates the death of the growth narrative that prompts investors to flee such companies and look for better alternatives despite their solid fundamentals. After losing subscribers for the third quarter in a row, it’s safe to say that Disney’s stock is not as attractive as it was before since its growth story is now under threat, especially if it continues to lose more users.

What’s worse is that it seems that Disney has no real solution on how to fix this issue. During the latest earnings call the company’s management hinted at the possibility of more price hikes to improve the profitability, but this seems like a short-sighted strategy that’s unlikely to revive the subscriber growth. At the same time, a couple of weeks ago, Bloomberg reported that Disney will miss its 2024 subscriber target by tens of millions of users as the demand is not returning anytime soon.

Considering this, it seems that there’s no real strategy on how to improve the situation. While we’re likely going to see an increase in revenue per subscriber in the following quarters due to price hikes, such a move is not going to revive subscriber growth in the long run in the already oversaturated streaming market. Therefore, it’s safe to say that as long as the number of subscribers shrinks – the stock would likely continue to trade at distressed levels and be a value trap until the situation improves. Considering the latest moves by the management – it’s unlikely that the improvement is on the horizon.

The Bottom Line

Despite the improvement of the parks business, Disney would likely remain a value trap until it manages to figure out a way to stop the decline of subscribers for its flagship streaming service Disney+. While there are no reasons to believe that the company’s stock is overvalued, as its forward P/E trails behind the S&P 500 average and my DCF model shows that the shares represent an upside, it makes sense to believe that Disney could continue to trade at the current distressed levels until the media business, which generates most sales, starts to attract new subscribers again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!