Summary:

- Disney unveiled its recast disclosures into its sports business. The segment remains a critical profitability driver, with YTD revenue of $13.2B and an operating profit of $1.48B for FY23.

- Bloomberg Intelligence estimates a valuation of up to $22B for Disney’s sports business, potentially attracting outside investors.

- Disney has made the right move by increasing prices for its theme parks, assuring investors that it can justify increased spending over the next decade.

- Despite the broad market pullback, I argue why DIS’s wash-out price action has shown signs of life over the past month.

- With DIS likely at peak pessimism, high-conviction investors should consider capitalizing on the current levels before the rest return.

Bastiaan Slabbers

The Walt Disney Company (NYSE:DIS) investors have received somewhat of a respite in October, even as the S&P 500 (SPX) (SPY) continues to struggle for traction. Accordingly, since my previous update in August, DIS has slightly outperformed SPX. While the extent of the outperformance isn’t significant, DIS’s price action has shown signs of life in October, as it recovered all its losses from the September hammering. As such, I believe it corroborates my thesis that significant pessimism has been reflected in DIS’s valuation.

Disney updated investors with recast financials yesterday (October 18) through a regulatory filing, providing critical insights into the health of its business segments, particularly its sports business. As such, the timely disclosures have arrived at an opportune time for potential ESPN partners to assess the growth drivers of its sports business as Disney looks to monetize its sports programming further.

As anticipated, ESPN remains a critical profitability driver for the company as it moves toward a streaming-focused future for its content and networks business. Accordingly, Disney’s sports segment posted revenue of $13.2B for the nine months ended 1 July 2023. It recorded an operating profit of $1.48B, resulting in an operating margin of 11.2%. As such, it’s significantly more profitable than its entertainment business segment. The entertainment segment posted an operating profit of $1.21B over the same period for an operating margin of 3.9%. However, investors should expect a much-improved performance for Disney’s entertainment business, as its direct-to-consumer or DTC business tracks toward profitability by the end of FY24.

Bloomberg Intelligence suggested the solid profitability of Disney’s sports business could make it “an attractive option for outside investors.” As such, it estimated a valuation of up to $22B for its sports business. Disney could undoubtedly do with some help as it looks to potentially integrate the one-third stake in Hulu that it doesn’t already own (currently owned by Comcast (CMCSA)). Based on the minimum valuation of $27.5B as part of the 2019 agreement, Disney is expected to pay Comcast at least $9.17B to secure full ownership.

Moreover, with Disney announcing its intention to invest $60B in its theme parks and related attractions over the next decade, the company must assure investors about its ability to sustain its free cash flow or FCF. The market has reacted positively to Disney’s recent price increase in its theme parks, demonstrating its pricing power. Notwithstanding the market optimism, it remains to be seen whether it could price out American families, leading to a loss of goodwill and consumer spending impact. However, given DIS’s battering over the past year, investors seemed confident that consumers might find it hard to obtain world-class substitutes from Disney’s offerings over time.

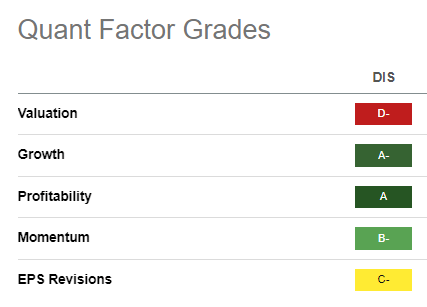

DIS Quant Grades (Seeking Alpha)

DIS is still priced for growth (“A” growth grade). As seen above, investors still expect robust execution from management to justify its “D-” valuation grade. As such, I believe investors should remain focused on the company’s ability to move with more urgency toward profitability in its DTC segment while attracting external partners in its sports business.

Moreover, DIS’s momentum has shown improvement, as indicated by its “B-” valuation grade. Despite that, I must highlight that DIS’s price action has seen substantial damage. As a result, investors must be patient for buyers to return with more aggression. Notwithstanding my near-term caution, high-conviction investors should still find Disney’s wide-moat business model attractive, underscored by its best-in-class “A” profitability grade.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!