Summary:

- Disney’s streaming services, including Disney+, Hulu, and ESPN+, have underperformed in terms of generating profits despite increasing subscriber numbers.

- The company’s stock remains overvalued based on classical valuation multipliers, despite a significant drop in price.

- Disney needs to improve its market share and monetize its growing subscriber base to increase profitability and make the stock more attractive for investors.

Michael M. Santiago

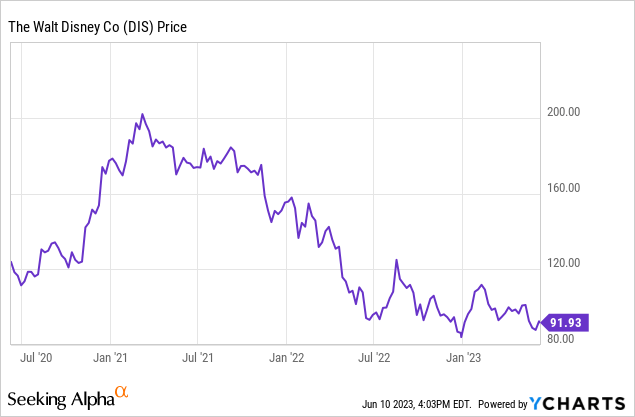

This article is an update of the analysis I published in 2020. At the time, Walt Disney (NYSE:DIS) published not so sound earnings results and its valuations were far too high. I also expressed some skepticism about Disney’s streaming services because of the fast-growing competition in this field. Since that publication, as of the time of writing, the S&P 500 gained 20%, whilst Disney’s stock has lost 37%. And now I am not particularly bullish on Disney’s stock either. But let me share with you my take on the company’s recent news and also Disney’s valuations.

Disney’s recent developments

Earlier on, I predicted The Walt Disney Company’s main challenges would be gaining market share in the streaming space. Although its position was strong at the time, the rivals’ streaming revenues were also growing very well. I was right, it seems. Here are the recent developments since my last publication in November 2020.

The post-COVID recovery helped Disney increase its earnings since then. However, Disney’s stock price went down substantially. This is mostly because of the fact the shares’ valuations were far too high in 2020, whilst investors’ expectations were not met. After all, many analysts predicted an epic recovery thanks to Disney’s streaming services.

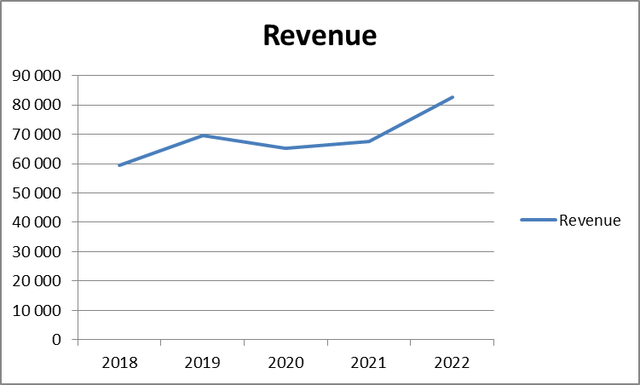

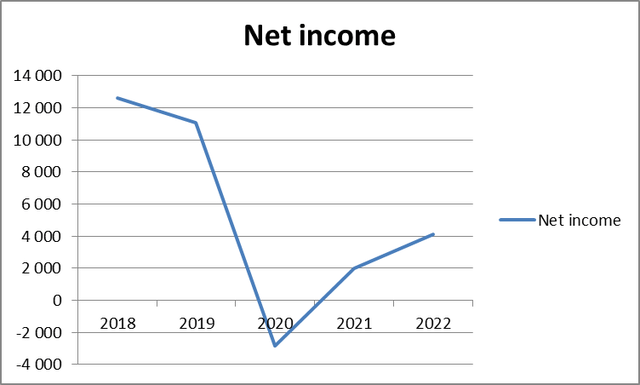

Below is the history of the company’s net earnings and revenues in millions of USD.

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Revenue |

59 434 |

69 607 |

65 338 |

67 418 |

82 722 |

|

Net income |

12 598 |

11 054 |

(2 864) |

1 995 |

4 121 |

Prepared by the author based on Seeking Alpha’s data

On the surface, it looks like Walt Disney’s sales are rising. Still, the revenue growth is not as great as it could have been. It might be alright for a very stable blue chip company, say, producing staples or pharmaceuticals. But it is not good for a corporation that is considered to be a high-growth business.

As concerns Disney’s net earnings, these have hit the bottom in 2020 and seem to be rising. However, the recovery is not as dramatic as many investors have likely hoped. So, the share price drop, in my view, is the result of this disappointment.

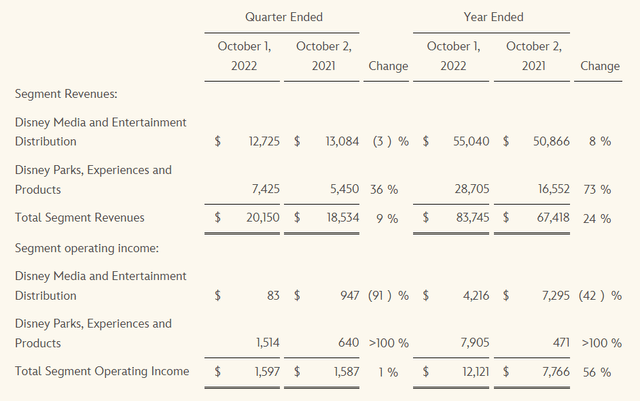

Let us have a look at Walt Disney’s revenue breakdown.

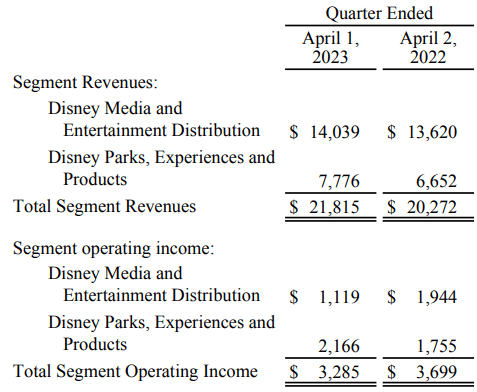

The results above show some sound improvements by the Disney parks, experiences, and products division. This is true both of sales and operating income. As I have mentioned before, thanks to the fact the coronavirus restrictions are not there anymore, Walt Disney’s parks are enjoying many more visitors than they used to in 2020 and 2021. However, the biggest problem for Disney seems to be its subscription services. These are represented by the Disney media and entertainment distribution department. Although the revenue of that division in 2022 increased by 8%, its operating income dropped by 42%.

As the management explained, “The decrease at Disney Media and Entertainment Distribution was due to lower operating results at Direct-to-Consumer and Content Sales/ Licensing… The decrease in Direct-to-Consumer was due to higher losses at Disney+ and, to a lesser extent, lower results at Hulu and higher losses at ESPN+. Lower results at Content Sales/Licensing were due to a decrease in TV/SVOD distribution results, higher film cost impairments, and decreases in home entertainment and theatrical distribution results“. So, as I have mentioned before, Disney+, Hulu, and ESPN+ all led the company and its investors down.

The 2022 data seem to be quite old and out-of-date. But the recent quarterly results also confirm my thesis.

Disney

The operating income recorded in the last quarter declined compared to the same period a year ago. Quite expectedly, the Disney parks, experiences, and products division recorded a sound increase in its operating income, whilst the Disney media and entertainment distribution department’s income declined substantially. However, you could see that the latter added some sales. But as can be seen from the recent press release, “higher subscription revenue was attributable to subscriber growth and increases in retail pricing, partially offset by an unfavorable foreign exchange impact.” That means the demand for streaming services is rising, but Disney is not good at turning these higher sales into rising profits.

You might argue that these streaming platforms were not launched long ago. Disney+ was only launched at the end of 2019, whilst ESPN was introduced in April 2018. High earnings do not indeed come immediately and overnight. A new product, especially content, has to win a new audience, which obviously requires substantial amounts of time. But let us have a look at Disney’s market position in the streaming services market.

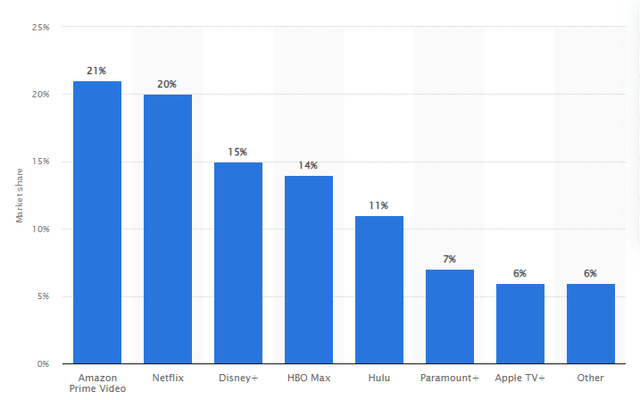

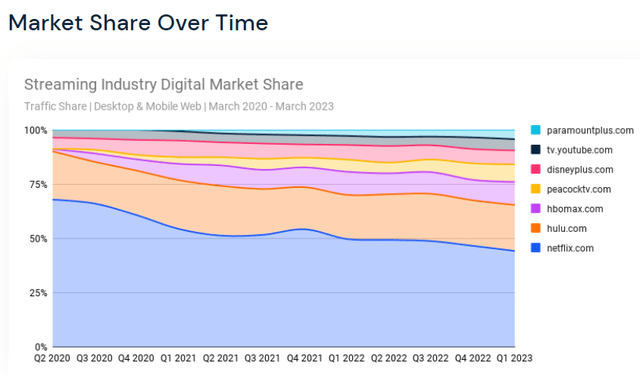

Disney’s market share

To start with, Disney’s market share in the streaming space is strong, but not quite leading. Disney+ is the third-largest platform in the streaming space. The company’s Hulu service, meanwhile, is the fifth largest.

But let us have a look at how the market shares of different streaming platforms differ over the period of the last three years.

Very briefly, Netflix (NFLX), Hulu, and Disney+ experienced a decline in quarterly visits from Q1 2022 to Q1 2023. But the market share of Netflix saw the largest decline, which totaled 29.8%. The best performers were Peacock TV and Paramount Plus. These platforms recorded growth in quarterly visits over the same time period. In other words, the streaming services market is very competitive, and it is still hard to say who will come out on top. But for now, it seems that Disney is not the first company on the list.

As I have mentioned above, the most important issue is to monetize new viewers. Unfortunately, Disney does not seem to be very successful here, given this segment’s operating income. Unfortunately, the Disney media and entertainment distribution department accounts for a substantial part of the company’s revenues. In my opinion, it is much more important for Disney than its theme parks. So, the company really needs to improve on that in my view.

But let me have a look at the company’s stock valuations.

DIS valuations

The Walt Disney Company’s stock price saw a major decline after 2021 as the monetary conditions in the US got tighter.

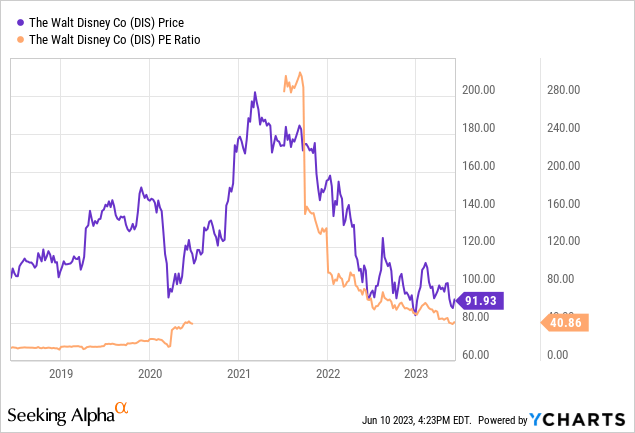

The post-Covid recovery in 2021, however, did Disney’s investors a favor. But it was very short-lived. The earnings growth disappointed. I will compare DIS stock price to its valuation multipliers to get an idea of how overvalued or undervalued the shares are.

As concerns Disney’s P/E ratio of almost 41, it is really high compared to the Dow Jones average of 11.60. But still, it is not as horrible as it used to be in 2021.

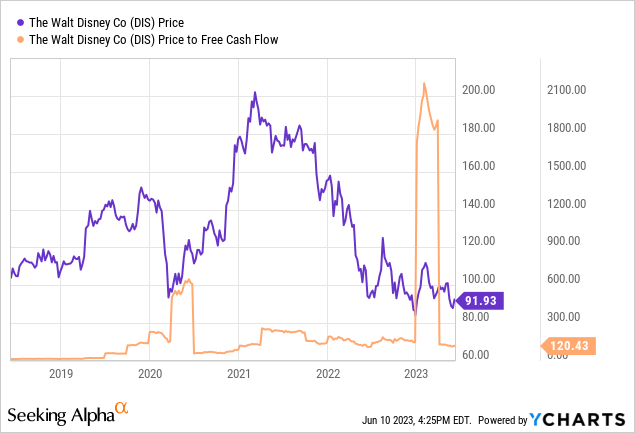

The same can be said about Disney’s price-to-free cash flow (P/FC) ratio.

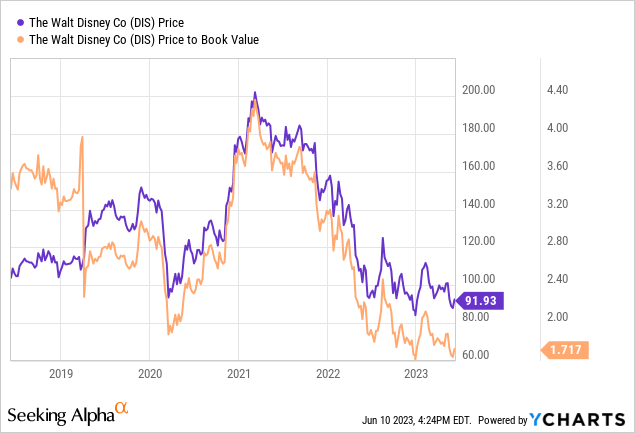

Only the price-to-book (P/B) ratio seems to be reasonable, currently lingering around the 1.7 mark.

Overall, DIS is still not good value for money, in my view. Personally, it would make sense to me to start buying DIS shares if the stock price decreases by 50%. Before the pandemic, DIS stock’s P/E ratio used to be around 20. This means the stock price should be two times lower than the current $92 per share mark for me to see value.

Disney’s risks

The risks are both company-specific and general macroeconomic. To start with, the environment Disney operates in is highly competitive. It is still unclear who will get the most market share in the streaming space. Right now, Disney does not seem to be winning this battle. The company surely has to learn to convert its new subscribers into higher earnings figures.

In spite of the stock price drop, DIS shares still seem to be overvalued as far as the classical multipliers are concerned. But if there is a recession in the near future, the shares will most probably depreciate even further.

Risks to my thesis

Walt Disney has quite a high credit rating of A- assigned by Fitch. This means the company is at “low default risk. The capacity for payment of financial commitments is considered strong. This capacity may, nevertheless, be more vulnerable to adverse business or economic conditions than is the case for higher ratings.” Disney is well within the leverage threshold of 2.5x, which suggests a sound debt position. Not to mention, the company has a very strong brand name recognizable all over the world. Walt Disney might also raise its market share and cut its costs, thus increasing its operating income from subscription services. Moreover, a recession might not come in the next few years.

Conclusion

Overall, Disney’s parks have been performing very well since the post-COVID reopening, but its streaming services do not generate substantial profits. The company has to increase its market share, but most importantly, learn to monetize its growing subscriber base. Although Disney’s stock has depreciated substantially, it is still not cheap enough for me personally, given the valuation multipliers. In spite of my respect of Walt Disney’s brand name, I would not recommend buying its stock right now, especially given the fact I believe a recession is likely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.