Summary:

- In my opinion, it is only a question of time until Disney management finds a business model to leverage its content into the Metaverse.

- Bob Igler’s presentation during Apple’s Vision Pro launch is certainly a notable step in that direction, highlighting the potential of the DIS’ Metaverse thesis.

- While, likelihood, timing, and profitability of Metaverse cash flows are uncertain, I have little doubt that the strategy will eventually unlock a likely handsome payoff for investors.

Michael M. Santiago

Disney (NYSE:DIS) is undoubtedly an iconic brand and company. But lately, the business is struggling somewhat – and bringing former CEO Bob Iger back to lead the strategy did not change the company’s fundamentals, or share price for that matter, much. YTD, DIS shares are down close to 11%, as compared to a gain of almost 7% for the S&P 500 (SPY) …

… And referencing the past 5 years, DIS shares are about 12% under water, versus a gain of 54% for the S&P 500 respectively.

Pointing to the disappointing share price performance, markets are not necessarily pricing DIS equity irrationally. In fact, the share price performance is anchored on depreciating fundamentals.

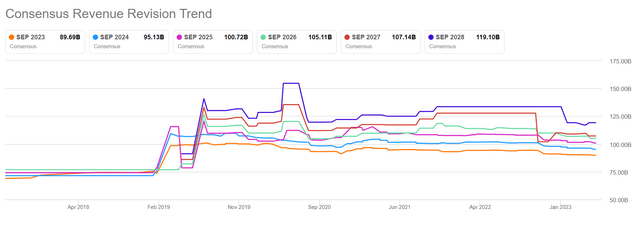

Following the “streaming-push” announcement in early 2019, revenue expectations for Disney have flattened — in fact, slightly deteriorated. Notably, in early 2022 analyst consensus estimated Disney’s FY 2025 revenues at about ~$110 billion; now analysts estimate the same metric to be almost 10% lower, around ~$100 billion.

With that frame of reference, Disney needs a new growth story. And, reflecting on Bob Iger’s presentation in connection to the Apple (AAPL) VR headset launch during the WWDC2023, I believe opportunities connected to the Metaverse may spark the much-needed catalyst to drive shares higher.

A Metaverse Push Together With Apple Makes Perfect Sense

On Friday 9th, Apple unveiled its long-awaited AR/VR platform, and indicated that use cases in gaming and entertainment will likely drive adoption of the new product platform. In that context, Disney CEO Bob Iger joined Tim Cook on stage to share details on a joint effort to bring Disney+ to the Apple Vision Pro.

Iger’s commentary relating to the new technology platform clearly highlighted excitement about the opportunities that VR may bring for Disney, and pointed to strong willingness to leverage these opportunities for business growth (emphasis added):

As the Disney company is celebrating its 100 year anniversary, we are proudly reflecting on our rich history of innovation and storytelling, while also looking to our future with enthusiasm and optimism …

… We are constantly in search of new ways to entertain … by combining extraordinary creativity with groundbreaking technology … [and] we believe Apple Vision Pro is a revolutionary platform that can make our vision a reality.

The first time I tried Apple Vision Pro … the thing that struck me the most was how it will allow us to create deeply personal experiences that will bring our fans close to the characters they love and more deeply immersed in our stories. This platform will allow us to bring Disney to our fans in ways that were previously impossible.

We are so proud to be yet again be partnering the greatest story telling company in the world with the most innovative technology company in the world, to bring you real life magic. And I am excited to announce that Disney+ will be available [on Apple Vision Pro] from day one … We are looking forward to sharing more in the coming months.

Already in the past, Bob Iger has displayed openness and commitment to exploring the economic potential of the metaverse. Notably, he has made personal investments in Genies, a leading startup focused on developing an advanced avatar ecosystem within the metaverse. In a statement, Iger emphasized his dedication to this venture as follow: (emphasis added)

I’ve always been drawn to the intersection between technology and art, and Genies provides unique and compelling opportunities to harness the power of that combination to enable new forms of creativity, expression and communication.

He also added that:

You may have an avatar, but you’ll go all over the place. And I think that it’s likely to be developed into something real as an experience.

A partnership between Apple and Disney makes perfect sense, in my opinion. Reflecting on Meta’s in-house gaming studios for VR/AR related applications, Apple needs Disney’s content to catch up. Meanwhile, Disney needs Apple’s VR/AR platform to find new growth opportunities in what Disney’s former CEO Bob Chapek called ‘the next great storytelling frontier’.

So, how will Disney leverage its IP for the metaverse? In my opinion, the strategy will likely be very similar to the company’s existent approach to parks and gaming.

Metaverse – Parks

The value proposition and idea of Disney’s parks is quite simple: At its core, parks offer an immersive experience of storytelling — creating a world where people can escape the realities of everyday life and enter a world of fantasy and imagination. Now, this is exactly what the Metaverse promises, just in a different format. And as such, it should be easy for Disney to replicate the success with Parks for the Metaverse. The only difference will likely be that Disney’s VR/AR Parks will operate on much lower CAPEX and OPEX, suggesting the potential of a quite rewarding pay-off for shareholders.

As we are already discussing parks, let me give a Metaverse-unrelated commentary to the business segment:

After a challenging period during the pandemic, domestic parks have successfully rebounded and surpassed their pre-pandemic levels. However, international parks are just beginning to recover as pandemic restrictions are being lifted, particularly in China. In that context, both Shanghai Disney Resort and Hong Kong Disney have made swift comebacks following the relaxation of restrictions.

Disney is also set to open a Zootopia land in Shanghai, capitalizing on the immense popularity of the film, being the highest-grossing animated film of all time in China. In Hong Kong, Disney plans to introduce a Frozen-themed area within the park, highlighting ongoing opportunities for expansion.

Disneyland Paris has also witnessed positive trends, attributed not only to improved commercial strategies and reduced discounting compared to the past but also to renovations, including the addition of a new Avengers Campus. These enhancements have resulted in higher ratings, increased attendance, and higher per-capita spending. In addition, Disney has plans to introduce a new Frozen-themed land in Paris, which leaves room for potential future expansion opportunities.

Metaverse – Gaming

Disney’s approach to video games has evolved over the years, shifting from developing and publishing, to licensing its IP to external partners. While Disney is not developing any games in-house since 2016, the company is more relevant for the gaming industry than ever. By embracing licensing, Disney secured deals with notable developers, with EA, Ubisoft, Insomniac/ Sony, Bethesda, and Square Enix to name just a few. For reference, the Star Wars titles produced under the partnership with EA have achieved about $3 billion in revenue. Now, a new open world game is expected to be launched by Ubisoft in FY 2024. In addition, Ubisoft is also working on an open world game for the Avatar franchise. A new Spider Man (by Insomniac, a subsidiary of Sony) game is expected to be released later this year.

Pointing to movies like Ready Player One, I don’t think I need to make an argument for why the potential for gaming in the Metaverse may be huge. However, I would like to highlight that I believe Disney may stand to be a primary benefactor of the (outstanding) gaming boom, as the industry’s demand for Disney IP licensing may pick up aggressively.

The interesting thing is that Disney’s licensing strategy allows the company to capitalize on the gaming boom, without taking any technology or development risk for the success of VR/AR games itself. In other words, the Metaverse gaming opportunity is like a free implied call option embedded in DIS stock.

For reference, here is an overview of titles that Disney could leverage for licensing VR/AR game development: Planet of the Apes, Mickey Mouse Universe, The Incredibles, Toy Story, Pirates of the Caribbean, Avatar, Marvel (think Iron Man, Thor, Captain America, Guardians of The Galaxy, Black Panther, Deadpool, Spider Man, X-Men, etc.), and, of course, Star Wars.

Arguing DIS’ Implied Valuation

Disney is currently trading at a ~x16 EV/EBIT, implying a ~6.3% earnings yield, which is higher than the treasury yield. Moreover, Disney outperforms the treasury investment with regards to value accumulation, or in other words growth. So, a premium would be justified. Personally, given Disney’s strong IP and moat, I would estimate the company’s fair value at around ~x20 EV/EBIT, implying close to ~$50 billion upside for the equity, or ~30%.

Note that the above analysis does not include the embedded Metaverse option. Estimating the options’ implied volatility at 35%, a 900 DTE, financing cost of 3%, and an ATM strike, investors could reasonably add another 20% upside to Disney shares, bringing DIS fair implied value to ~150-$160/share.

Conclusion

In my opinion, it is only a question of time until Disney management finds a business model to leverage its content into the Metaverse. In that context, Bob Iger’s presentation during Apple’s Vision Pro launch is certainly a notable step in that direction, highlighting the validity of my thesis. That said, of course, it is way too early to estimate likelihood, timing, and profitability of cash flows that Disney may extract from the Metaverse; however, I have little doubt that the strategy will eventually unlock a likely handsome payoff for investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.