Summary:

- Disney’s recent film successes and Disney+ streaming growth have improved its financial outlook, making it a fair buy at current valuations.

- Walt Disney’s valuation metrics, including price-to-book and price-to-sales ratios, remain reasonable compared to the market, supporting its intrinsic value.

- DIS’s balance sheet shows improvement with reduced debt and increased dividends, positioning it as a dividend-growth stock.

- Despite a 29% price rise since my last article, Disney’s growth in EBITDA and book value suggests potential for future outperformance, making DIS stock a worthwhile investment.

ZargonDesign

My Thanksgiving story

For a company that just couldn’t seem to get out of its own way the past few years when producing new films, The Walt Disney Company (NYSE:DIS) seems to have found its footing. This Thanksgiving holiday, several Dads like myself were in a desperate last-minute search to find something to do for their young kid who wanted nothing to do with another NFL football game. I had not seen the movie theaters packed in quite a while, so I thought, “hey, we’ll just get some last-minute Moana 2 tickets today, no problem.” Yeah, right.

Estimated ticket sales for Friday through Sunday at U.S. and Canadian theaters, according to Comscore. Final domestic figures will be released Monday.

1. “Moana 2,” $135 million.

2. “Wicked,” $80 million.

3. “Gladiator II” $30.7 million.

4. “Red One,” $12.9 million.

5. “The Best Christmas Pageant Ever,” $3.3 million.

6. “Bonhoeffer: Pastor. Spy. Assassin,” $2.4 million.

7. “Venom: The Last Dance,” $2.2 million.

8. “Heretic,” $956,797.

9. “The Wild Robot,” $670,000.

10. “A Real Pain,” $665,000.

After endless searching, we literally could not find even two seats together in the whole city or adjoining cities that would have been close enough to drive to. Everything was picked dry. In the end, we went to another hugely successful film, “Wicked”, a Universal Comcast (CMCSA) production. The kids liked the film, but in my opinion, it was like being trapped in a 2-hour-long theme park parade.

So now we have Moana 2 setting global records for an animated movie release. Dead Pool and Wolverine is the Highest grossing-rated R film ever, and Inside Out 2 reached $1 Billion in gross ticket sales in record time. Disney + streaming is now cash flow positive and parks remain solid. The dividend has been reinstated and recently raised to $1/share FWD, a 33% increase over fiscal year 2024. Is all the good news now baked in?

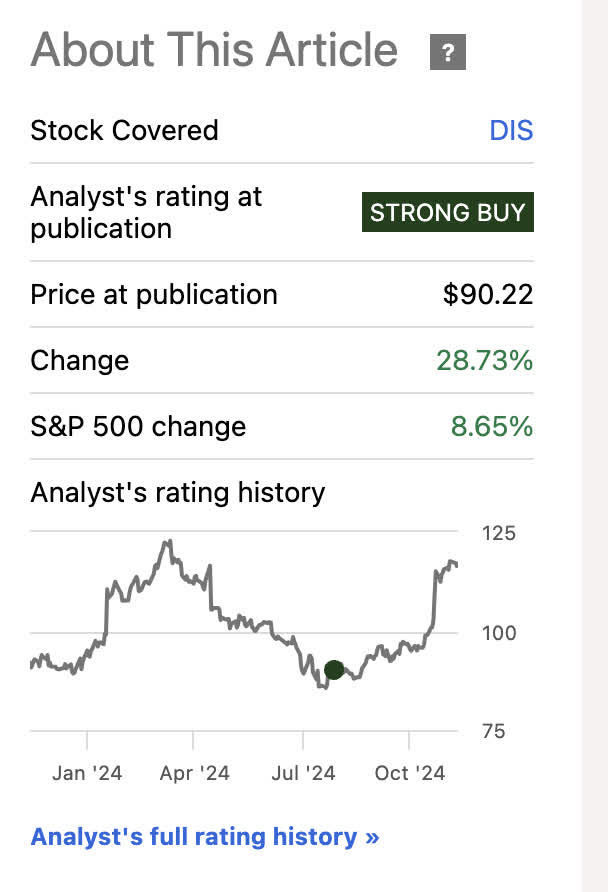

I believe Disney is now trading right at fair value considering next year’s expected growth. I think it is still a fair buy, but I am downgrading this from a “Strong Buy” that my last article opined. There’s really no discount to intrinsic value unless we start to incorporate cash flows reaching out beyond 2026 which I’d rather not do.

My last Disney article

Seeking Alpha

I had been mostly buying the stock in the low to high $90s. This represented a price at the time which was trading at historically low multiples of book value. $90 a share represented 1.6 X book and 1.84 X sales. In addition to my price target model building out a modified Graham Number based on EBITDA per share showing an undervaluation, any stock near a price-to-sales ratio under 2 X should strongly be considered in a current market where most stocks are trading well in excess of that. Revenue is the lifeblood of profit [eventually] and the hardest thing to establish.

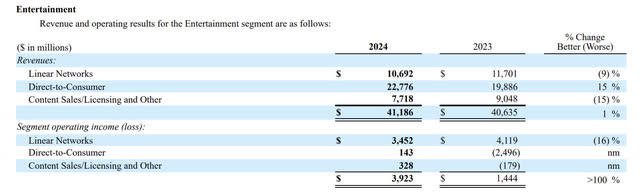

Revenue sources over the last quarter

All data courtesy of Disney 2024 10-K:

| Segment | 2024 amount in millions | Percentage |

| Entertainment | 41186 | 45% |

| Sports | 17619 | 19.28% |

| Experiences | 34151 | 37.3% |

| Eliminations | -1595 | |

| total | 91361 |

The largest revenue exposure is still in both linear and DTC media entertainment content. I will break down the entertainment progress later by sub-segment in the article. Every category grew year over year which is a good sign, especially considering the dying linear segment. Here are the growth rates year over year as per Disney:

- Entertainment +1%

- Sports +3%

- Experiences +5%

- Overall +3%

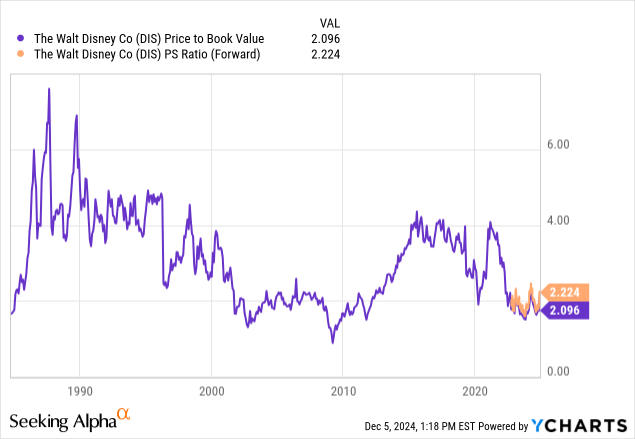

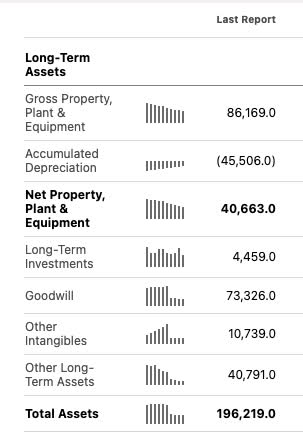

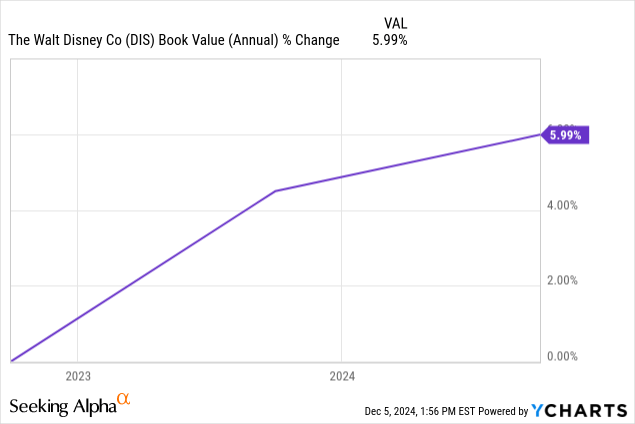

Tracking book value

While price-to-book and price-to-sales have now both crossed over 2 X, they are both still reasonable when compared to the market. I argued before, and will argue again, that the vast real estate this company owns cannot be worth the mere net property of plant and equipment. Land in areas where the parks are built just does not exist anymore.

Seeking Alpha

With over $86 Billion in Gross Property, Plant, and Equipment and a market cap of $211 Billion, I would still say it would be difficult to just recreate the parks & resorts [not the IP or the streaming] for the value of the market cap. This is why Disney has historically traded in the 3-4 X book value rather than the 1.5-2.5 X range. While the market has recently downgraded the value of the intangible IP, the new movie hits might change that opinion sooner rather than later. The movies are getting back to core family values and storytelling rather than “messaging” centric.

Disney+

Breaking out just the entertainment segment as this is the most scrutinized, Direct-to-Consumer grew 15%, outpacing the drop in linear, very positive. As Disney now incorporates ads as a source of revenue as do other popular streamers, this transition from linear to streaming is sure to continue. Pretty soon the DMED segment outside of streaming will be squarely focused on feature films, which are certainly improving.

Sports being broken out now is also interesting. As live sports are going to be a necessary feature of all streamers going forward and with the poor showing by Netflix (NFLX) during the recent Tyson V Paul fight, Disney and ESPN can really market this strength as a reason to subscribe over competition. From my understanding, the original platform Disney + was built on was intended for Major League Baseball [MLB] to stream live sports, this is another great investment thesis in my opinion. Disney’s live-streaming works. With over $17 Billion in revenue and growing for ESPN, Disney’s sports segment is one to watch.

DIS stock valuation

Firstly, I would like to incorporate some 2026 forward predictions when looking at this modified Graham Number model. Book value on a nominal basis has increased by about 6% over the past 3 years. That’s a CAGR of 1.96% per year. Using the current $55.57 / per share TTM book value X 1.0196 would get us a FWD $56.65 2026 Book Value prediction tracking trends.

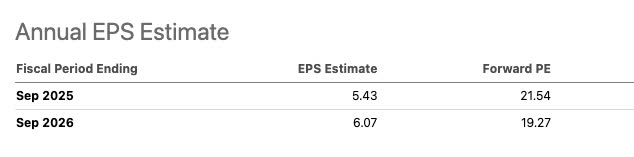

Earnings growth expectations

Seeking Alpha

Average analyst estimates have GAAP earnings growth from FY 2025 to 2026 growing 11.7%. In this model, I am using EBITDA per share, being that this is a media company with a lot of IPs with much higher cash flows than GAAP earnings due to IP amortization and the large amounts of equipment and real estate depreciation expense.

On a per-share basis, I will assume EBITDA growth tracks GAAP EPS growth. Currently, Disney has $9.56/ share in EBITDA TTM. Multiplying this by 1.117 [11.7% growth rate] will get us to a predicted $10.68/ per share in 2026 EBITDA per share.

Now we have a couple of our inputs to run a modified Graham Number model.

The Graham Number is the fair price where the price to book X the price to earnings ratio does not cross a line of 22.5. An example would be P/E 10 * P/B 2.25 would be a 22.5 stock.

In this case, we are substituting EBITDA/share as our profitability measure. To get a price target, we use the formula Square root (22.5*Book value*EBITDA/share).

Thus Square root of (22.5 X $56.65 X $10.68) = $116.67/share

Current price: $116.72 as of 12/5/2024.

Trading right at intrinsic value based on 2026 numbers.

Looking at Wall St.’s numbers, my price falls below the average but still within range. Wall St. seems to be expecting a multiple re-rating by the market. I also assume this will happen eventually for such a high-quality and storied company now returning to growth, but it’s always best to be conservative. Under 20 X GAAP FWD is still better than the risk-free yield of around 4.2% currently.

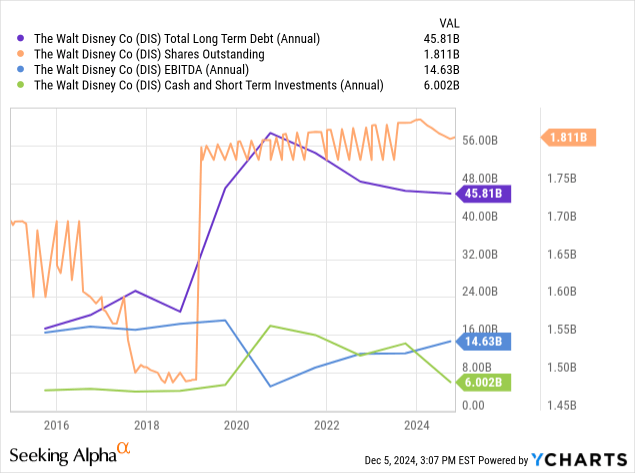

Balance sheet

Some highlights:

- Shares outstanding, down slightly year over year

- LT debt down significantly and now 3.13 X EBITDA, an improved ratio

- Cash and short-term equivalents down as debt is repaid, shares re-purchased and dividends distributed.

This is a mixed bag balance sheet. Debt is high when compared to cash and short-term investments, but much improved when compared to EBITDA. This is a turnaround balance sheet. Not strong, but improving.

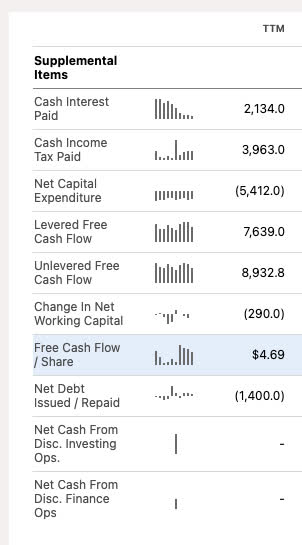

Walt Disney is now a dividend-growth stock

The new $1 per share semi-annual dividend represents a 33% growth rate over the previous year. With this in mind, the forward yield will now stand at .85%. Not quite a percent yet, but moving in the right direction.

Free cash flow per share on a TTM basis now stands at $4.69 a share. This is a payout ratio just based on trailing free cash flow of only 21%. There is a lot of room to grow.

Seeking Alpha

Risks and summary

A lot is baked into the pie at the moment with the 29% rise in price since the last time I visited the thesis in the low $90s. The valuation has improved, however, with growth rates in EBITDA and book value growing faster than anticipated. With everything I know about “average” performance in 2026 looking like a $116 / share value is fair, I would not be surprised for Disney to outperform in the future as well and still make an investment here worthwhile. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS, CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.