Summary:

- The Walt Disney Company has had a 2-year-long streak of significant underperformance when compared to other Dow Jones companies and main indices.

- The company’s financials have deteriorated tremendously. It includes depressed free cash flow, EPS slashed in half compared with 2018, shareholders’ dilution, and rising debt.

- Yet, an investor gets The Walt Disney Company’s old business at a discount and the streaming segment for free.

- From a risk/reward perspective, Disney might be an interesting option for value investors now while trading near its 8-year lows. A recession can push the stock price even lower which could create an attractive opportunity.

Marc Piasecki

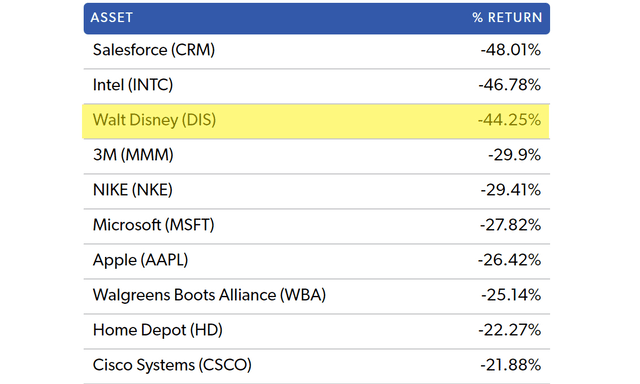

The Walt Disney Company (NYSE:DIS) has had a 2-year-long streak of significant underperformance when compared to other Dow Jones companies and main indices. After being the worst of 30 leading blue chips in 2021 with a -13.9% annual return, Disney managed to place 3rd among the poorest Dow Jones performers with a -44.25% price decline in 2022.

The Worst Performing Dow Components in 2022 (statmuse)

The company posted dissatisfactory earnings for the 2022 fiscal year, its Direct-to-Consumer [DTC] segment is as unprofitable as it has ever been, and the board called the company’s CEO Bob Chapek away in an overnight move that shocked the public. These are just a few factors that has shaken up the sentiment around the company. Global aspects such as high inflation, macro headwinds, or increasing interest rates have only made things worse. The sentiment around Disney has deteriorated with its market cap declining and the stock repeatedly hitting 52-week-lows.

However, these circumstances may create a chance for value investors to acquire Disney at a discount and keep on adding if the price drops further. The business is exceptional, growth is robust, the old/new CEO – Bob Iger has a fabulous track record as a leader and the company is attractive from a risk/reward perspective. Acquiring Disney in the current price range will very likely bring ample returns to investors.

Great investment opportunities come around when excellent companies are surrounded by unusual circumstances that cause the stock to be misappraised.

– Warren Buffett

The aim of the article is to analyze and evaluate The Walt Disney Company by using conservative assumptions and by applying reasonable estimates. The previous article Disney: Fair Value Of The Business With Bad Sentiment Around from 01/11/2021 also focused mainly on valuation specifically on each service being part of the DTC segment. The current analysis reassesses former assumptions and gives a perspective on the business and what investors can expect in the long run.

Fiscal Year 2021 and Beyond

Bob Chapek announced the results for FY 2021 in an upbeat manner. The tone was mismatched with actual numbers that were rather disappointing. Although both revenues and net income saw growth, there have been signs of a slowdown. Linear Networks experienced minuscule revenue growth of 1%, but the decrease in advertising revenue was noticeable. Besides that, the DTC segment posted an operating loss of $1.5 billion in comparison to a $0.8 billion loss in 2021.

The decrease at Direct-to-Consumer was due to higher losses at Disney+ and, to a lesser extent, lower results at Hulu and higher losses at ESPN+. Lower results at Content Sales/Licensing were due to a decrease in TV/SVOD distribution results, higher film cost impairments and decreases in home entertainment and theatrical distribution results, partially offset by an increase at our stage play business, as productions were generally shut down in the prior year due to COVID-19.

On the other hand, Disney Parks, Experiences and Products recorded massive YoY growth in revenue as well as operating income, mostly due to the skewed comparison to 2021 which was impacted by COVID-19 shutdowns. However, this robust growth was partially compressed by cost inflation, higher operations support costs, capacity restrictions or closures, and costs for new guest offerings.

Disney’s disappointing results induced a steep price decline the next day. The stock closed 13.2% lower which was at that time a 52-week-low. Since November 8th there have been two major events directly related to the company.

- Launch of the Disney+ ad-supported tier in the USA which costs $7.99. At the same time subscription fee for its Premium ad-free tier was increased from $7.99 to $10.99. Although it may seem that Disney launched a cheaper tier, subscribers of the ad-supported offering will pay a regular price and the Premium subscribers will be charged more.

- Bob Chapek was fired by the company’s board and replaced with the former chief executive Robert Iger. Dark clouds had been hanging over the former CEO for some time. He was not fit for the job as senior leadership characterized the issue. In the end, he takes responsibility for a $1.5 billion loss in Disney’s streaming service, the turmoil around a pay dispute with the actress Scarlett Johansson, the battle with Florida over parental rights bill, or getting Disney World stripped of its status of the “independent special district”. The board let Bob Chapek go because he wasn’t the leader who believed in Disney magic.

The impact of these events, both financial and strategic, will be certainly seen in the next quarters.

Disney’s Direct-to-Consumer

Disney’s DTC segment has stayed in focus since its launch over three years ago and understandably, it was given a lot of attention at the most recent earnings call. From the valuation perspective, the management shared with investors some important information regarding the current growth and outlook for the streaming platform.

- Streaming services added nearly 57 million subscriptions combined.

- Bob Chapek said that the fourth quarter represented a turning point by reaching peak DTC operating losses.

- The management expects Disney+ to achieve profitability in FY 2024 with losses beginning to decrease in the first quarter of FY 2023.

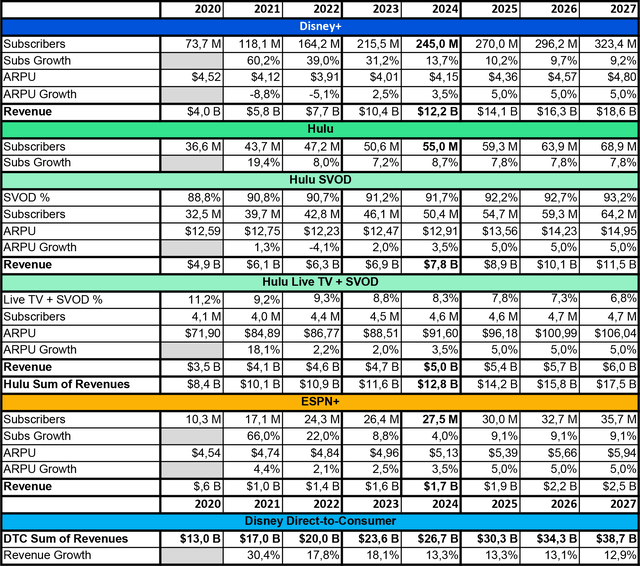

In the valuation model, the DTC segment and the rest of the business are assessed separately. In order to calculate the value of the company’s streaming component following steps were taken:

- The future subscriber numbers are derived from the management projections.

- Average Revenue Per User (ARPU) growth is an estimate taking into account inflation, prior price development, and likely cost increases.

- For each service within the streaming offering i.e. Disney+, Hulu, and ESPN+ there is a resulting revenue for every year from 2023 to 2027.

- The last two lines in the table show the estimated sum of revenues from all streaming services across the suite and revenue growth.

Valuation Model (Input) Disney Direct-to-Consumer (Author)

Based on the projections, Disney is expected to generate $23.6 billion in revenues from its DTC segment in 2023, an 18.1% increase from the year prior.

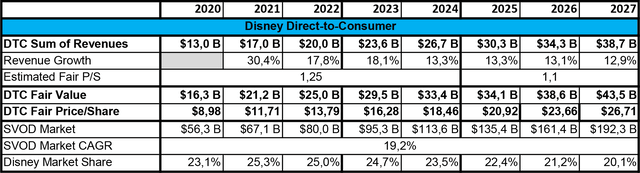

Having revenues for the years ahead, a reasonable P/S ratio was applied. The result delivers the fair value of the DTC business and its per share equivalent. Additionally, an estimated value of the Subscription Video on Demand (SVOD) market was provided with Disney’s share in it over the next years.

Valuation Model Disney Direct-to-Consumer (Author)

By applying a conservative P/S ratio of 1.25 for the next two years and 1.1 for the years beyond, the fair value of Disney’s streaming offering equals $29.5 billion for FY 2023. For comparison, Netflix’s (NFLX) and Warner Bros. Discovery’s (WBD) 5-year average P/S ratios lay at 8.2 and 1.58 respectively. Finally, the total calculated value of the DTC part of the business translates to $16.28 per share.

Disney’s non-Direct-to-Consumer

Before valuing the remaining pieces of the business, it’s worth noting what the management had to say lately about the future of the company’s products and services.

- A robust demand for domestic parks is seen. However, booking trends might be prone to macroeconomic impacts.

- The situation in Shanghai has caused challenges and the park is currently shut down with no reopening in sight. Yet, prior to the closure, a positive momentum was observed.

- Recent results showed YoY growth for Consumer Products due to higher merchandise licensing results.

- Overall, Disney Parks, Experiences and Products (DPEP) segment continues its strong growth.

- Linear Networks increased its operating income by 6% in Q4.

The outlook for the remaining pieces of the business outside DTC is generally positive, as these are well-established and diversified assets with a strong portfolio of successful initiatives and a proven track record. Most importantly, the company’s theme parks and cable networks, which have been major sources of revenue are expected to continue to perform well in the future.

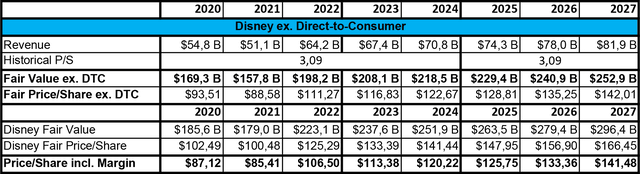

Valuation Model Disney ex. Direct-to-Consumer (Author)

Sales growth was estimated at a conservative 5.0% annually till 2027. By applying a historical 5-year average P/S ratio that Disney was trading at in the years 2015-2019 till the launch of its DTC offerings, one obtains a fair value of the business excluding DTC. It equals $208.1 billion for FY 2023 and corresponds with $116.83 per share. By adding both numbers from the valuation of the DTC segment and the rest of the enterprise respectively, a fair value of $237.6 billion or $133.39 per share is computed.

The valuation model utilizes fairly conservative assumptions. Still, the fair value is over 30.0% above the current price. This would indicate that assuming the fair price of the DTC at $16.28, an investor gets Walt Disney Company’s old business at a discount and also the streaming segment for free.

An additional margin of safety of 15% was also applied. It gives a lower fair price of $113.38 per share and may account for the risks listed below. Yet, it’s still ~15.0% above what Disney stock is currently trading at.

Risks

The Walt Disney Company faces a number of risks that could negatively impact its business and financial performance. Some of the main risks include:

-

Competition in the media and entertainment industry: The media and entertainment industry is highly competitive. Most of all, Disney’s DTC segment faces competition from other large companies such as Netflix, Amazon (AMZN), and Warner Bros. Discovery. Increased challenges could lead to pressure on the company’s revenue from its streaming services and result in a market share loss.

-

Impact of COVID-19 pandemic: Disney’s theme parks, cruises, and other travel-related businesses have been affected by the pandemic. The company has had to temporarily shut down or reduce capacity at its parks. Shanghai Disney Resort remains closed which has had a significant impact on the segment’s revenue and profitability.

-

Dependence on media distribution: Disney’s media networks and distribution channels, including cable and satellite providers, are an essential part of the business. Changes in consumer behavior, such as the shift to streaming, could negatively impact Disney’s traditional distribution channels and revenue.

-

Economic downturns: Disney’s business is sensitive to economic downturns, which could lead to reduced consumer spending on entertainment and travel. According to many market observers, the world is on the brink of a recession. If it materializes Disney will most likely feel the pain.

-

Questionable management: Over the last several years Disney engaged in M&A which hasn’t paid off. It includes $52.0 billion spent on 21st Century Fox and an aggressive bid for Sky. The company’s financials deteriorated tremendously. It includes depressed free cash flow that hasn’t reached the level from 2018, EPS slashed in half compared with 2018, the growing number of shares outstanding, and rising debt. Besides that, exorbitant executive compensation can be observed, a dividend that had been paid for 57 years was eliminated, and what came up recently again, was Disney’s struggle with a succession of Bob Iger.

Disney is one of the most advantaged companies having incredible brand recognition and an edge against the competition in many aspects. The company has the ability and resources to become its better self by getting back on track in terms of finances, decisions, and strategic moves. Currently, it seems like Disney is amid an internal shake-up, additionally challenged by bad press and negative market sentiment. Yet, these may be the best circumstances to acquire the “Kingdom of Magic” for a discounted price.

Conclusion

Bob Iger is back. He has always had a strong vision for the company’s future, particularly in the streaming space, and has been credited for creating Disney+. The service has proven to be a huge success for the company and has helped to offset the decline of traditional media. The company keeps expanding its streaming offerings to international markets, which should further boost its subscriber base. Now, the main points of focus should be to increase the profitability of the DTC services and to improve an overall cost discipline.

Disney’s theme parks, which were impacted by the COVID-19 pandemic, have recovered to some extent with the remaining Shanghai Disney Resort being shut down. In addition, Disney has been able to open new parks, like Star Wars: Galaxy’s Edge at Disneyland and Disney’s Hollywood Studios, which have helped drive attendance. Overall, DPEP’s performance is satisfactory and promises steady robust revenue growth.

From a risk/reward perspective, Disney might be an interesting option for value investors now while trading near its 8-year lows. A recession can push the stock price even lower which could create an opportunity to buy more shares for a lower price. Patient investors will be rewarded. Right now, a combination of the company’s specific as well as macro challenges has to be overcome before the Sun will shine again over the “Kingdom of Magic”.

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.