Summary:

- DIS has pulled back to $105s at the time of writing, offering interested investors with an improved margin of safety, as the market over-reacts to the management’s softer FQ3’24.

- Even so, we believe that its turnaround is already showing great promise, based on the improving balance sheet health and growing D2C/ Experience profitability.

- We expect these to eventually balance the secular decline in DIS’ linear TVs, as the media company ramps up its advertising capabilities through the (eventually) integrated Hulu.

- With it trading at fair valuations compared to its peers, we believe that DIS remains a Buy with a promising upside potential over the next few years.

Klaus Vedfelt

We previously covered Walt Disney Company (NYSE:NYSE:DIS) in February 2024, discussing its bottom line beat in the FQ2’24 earnings, the raised dividends, and the reinstatement of $3B in share repurchases for FY2024, resulting in the improving market sentiments surrounding its long-term prospects.

Combined with its inherent undervaluation compared to historical means and the promising FY2024 guidance, we had rated the stock as an excellent Buy after a moderate retracement to its previous trading range at between $90s and $100s for an improved margin of safety.

Since then, DIS has finally pulled back to $105s at the time of writing, offering interested investors with an improved margin of safety, as the market over-reacts to the management’s soft FQ3’24 commentary.

Even so, we believe that its turnaround is already showing great promise, based on the improving balance sheet health and growing profitability, further aided by the improved upside potential and expanded forward dividend yield from the recent correction.

We maintain Buy for the DIS stock.

The DIS Investment Thesis Is Even More Attractive Here, Thanks To The Recent Pullback

For now, DIS has reported a bottom-line beat in the FQ2’24 earnings call, with overall revenues of $22.08B (-6.2% QoQ/ +1.2% YoY) and adj EPS of $1.21 (-0.8% QoQ/ +30.1% YoY).

Much of the topline headwinds are attributed to the secular decline observed in the linear TV segment at revenues of $2.76B (-1.4% QoQ/ -7.6% YoY) and seasonal weakness in the Content Sales/Licensing and Other revenues of $1.38B (-15.3% QoQ/ -40.5% YoY).

Therefore, while DIS has reported excellent D2C revenues of $5.64B (+1.8% QoQ/ +13.2% YoY), the market cannot help but be concerned indeed.

This is because the linear TV remains the bottom-line driver for the Entertainment segment at operating incomes of $752M (-39.1% QoQ/ -21.5% YoY), despite the sustained migration in advertising dollars to Connected TVs.

On the other hand, readers must also note that the DIS management has finally reported 0.8% in operating margins for the D2C segment (+3.2 points QoQ/ +12.5 YoY) in the latest quarter.

This is mostly attributed by the growth in its global Disney+ subscriber base to 117.6M (+6.3M QoQ/ +12.7M YoY) and ARPU to $7.28 (+6.4% QoQ/ +12.5% YoY), as “Shogun proved to be a global hit with success on both linear and streaming, while driving the second largest number of sign-ups to our streaming services since 2022, behind only Black Panther: Wakanda Forever.”

With the series ending by April 23, 2024 and “the seasonality of its India sports offerings,” we can understand why the DIS management has guided a softer third quarter, implying that we may see some churn in its D2C subscriber base and deterioration in the segment’s profit margins.

This trend is not surprising indeed, seeing that the media company has a relatively soft D2C slate launch in Q2’24, worsened by the fact that Netflix (NFLX) has suddenly opted to do away with its subscriber reporting standard from Q1’25 onwards.

This development suggests that the next growth opportunity for media companies in general, lie in advertising instead of subscriber growth. This is interesting indeed, since the D2C advertising market is increasingly crowded as Amazon (AMZN) similarly launches ads in the Prime Videos.

Then again, we believe that DIS remains well positioned to be a winner in this space, due to its robust IP, potential Hulu integration, and growing Hulu viewing market share at 3% (+0.2 points MoM/ -0.3 YoY) as of March 2024.

This is especially since the global TV & Video Advertising market is expected to reach $337.5B, commanding the lion share of the overall advertising market of $1.08T in 2024.

While the Hulu valuation is still underway with a resolution unlikely in the near-term, we believe that DIS remains well capitalized to pay down this additional obligation, even if Hulu is eventually valued at $40B, implying a raised payout from the original sum of $8.6B to $12.5B instead.

This is based on DIS’ growing FQ2’24 annualized adj EBITDA of $20.32B (-0.5% QoQ/ +10.6% YoY/ +25.5% from FY2019 levels of $16.19B) and moderating net debt levels of $32.88B (compared to $34.31B in FQ1’24, $34.15B in FQ2’23, and $32.71B in FQ4’19).

These numbers imply a moderating net-debt-to-EBITDA ratio of 1.61x in FQ2’24, compared to 1.68x in FQ1’24, 1.88x in FQ2’23, 2.02x in FQ4’19, and the Entertainment sector average of 3.25x.

Lastly, DIS’ Experience segment continues to demonstrate why it is the backbone of the company, with revenues of $8.39B (-8.1% QoQ/ +9.8% YoY) and operating income of $2.28B (-26.4% QoQ/ +12.3% YoY) in the latest quarter, implying robust operating margins of 27.1% (-6.8 points QoQ/ +0.6 YoY/ +1.4 from FY2019 levels of 25.7%).

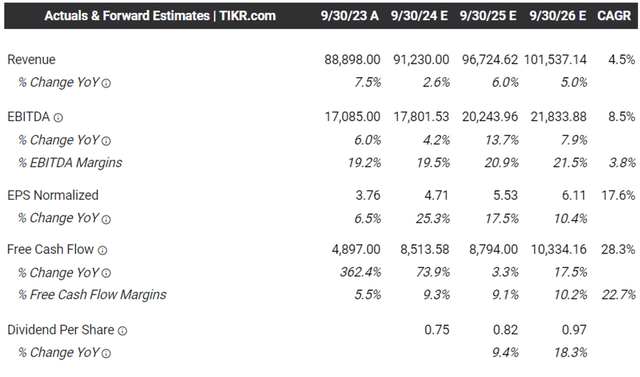

The Consensus Forward Estimates

At the same time, despite the mixed FQ2’23 earnings call, the DIS management has raised their FY2024 adj EPS guidance from the previous number of $4.60 (+22.3% YoY) to $4.70 (+25% YoY).

With the management well on track to exceed its original cost efficiency target of $7.5B, it appears that the FY2024 guidance of $14B cash provided by operations (+41.9% YoY) and over $8B of Free Cash Flow generation (+63.5% YoY) is not overly aggressive indeed.

This is based on the H1’24 generation of $5.84B (+158.4% YoY) and $3.28B (+2,029.4% YoY), respectively.

These numbers further demonstrate why Bob Iger has done well in driving efficiency in DIS’ legacy business, while improving the monetization strategy in the D2C segment.

Perhaps this is why the consensus have moderately raised their forward estimates, with the media company expected to generate an accelerated bottom-line growth at a CAGR of +17.6% through FY2026, compared to the previous estimates of +16.5%.

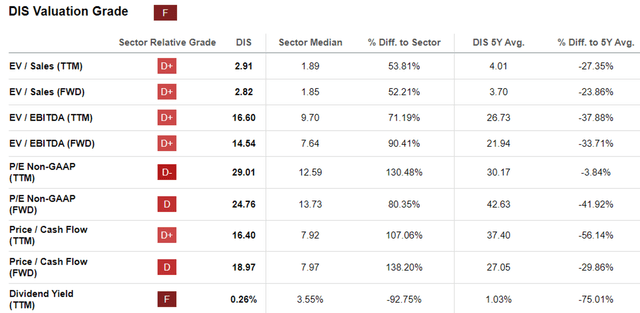

DIS Valuations

As a result of these developments, we believe that DIS is increasingly growing into its premium FWD EV/ EBITDA valuations of 14.54x and FWD P/E valuations of 24.76x, compared to its 1Y mean of 16.60x/ 29.01x and pre-pandemic mean of 14.67x/ 21.50x, respectively.

While DIS still trades at a notable premium compared to its other legacy media peers, including Warner Bros. Discovery (WBD) at 6.46x/ NA, Paramount (PARA) at 7.95x/ 10.70x, and Comcast (CMCSA) at 6.28x/ 9.14x, the former is still inherently cheaper than Netflix (NFLX) at 26.06x/ 32.64x, respectively.

Given the tremendous improvements in DIS’ D2C prospects well balancing the sustained cord cutting thus far and the excellent performance in the Experiences segment, we believe that the stock is trading reasonably here.

So, Is DIS Stock A Buy, Sell, or Hold?

DIS 2Y Stock Price

For now, it is apparent that the market has opted to punish DIS first, with the stock losing -9.5% of its value within a day while trading near its 100 day moving averages.

Then again, we believe that the pullback is a gift indeed, since it brings the stock closer to our fair value estimates of $106, based on the LTM adj EPS of $4.29 and the FWD P/E valuations of 24.73x.

Based on the consensus FY2026 adj EPS estimates of $6.11, there seems to be an improved upside potential of +43.3% to our long-term price target of $151.10 as well.

While minimal, DIS also pays out $0.90 in annual dividends, implying a bonus forward yield of 0.85% for those seeking regular income, raised from the recent bottom of 0.73%.

As a result, we believe that while the sell off may have been overly done, it has also triggered highly attractive entry points for those looking to add.

At the same time, we believe that a further retracement to the next support of $97s is unlikely, with most of the media company earnings already announced and market volatility moderating thus far.

We maintain our Buy rating for the DIS stock here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.