Summary:

- If you are an investor in The Walt Disney Company, you have good reasons to feel disappointed or even despair.

- The DIS stock price went nowhere in the past nine years, while the overall market enjoyed one of the most spectacular bull runs in history.

- However, I will argue this serves as a good indicator that market sentiment has gone too far in the fear extreme and ignored the catalysts for a rebound.

- Many of the issues (like the Hollywood writer strike) are temporary in my view.

- These issues cause short-term pains and its assets, both physical and intellectual, to be underearning, which distorts its long-term potential.

Henrik Sorensen

Can Disney stock rebound?

The Walt Disney Company (NYSE:DIS) has disappointed – to put it mildly – its investors in the past few years. As seen in the chart below, the stock price as of this writing (about $81) is where it had been in 2014 (i.e., about nine years ago). The company has been suffering setback after setback – theme park closures during the pandemic, leadership changes, competition in the streaming space, Hollywood writer strike, et al. And the list can go on.

Source: Seeking Alpha data.

As a result, if you are unfortunately an investor, you must be wondering if the stock can rebound at all. I will argue that it can. The remainder of this article will detail my analysis and thought process. In a nutshell, my key considerations for a bullish view are:

- Temporary issues (like those just mentioned above) have caused its assets to be underearning in recent years. I do not think the poor profitability in the past 2~3 years represents the true earning power of its assets, both physical and intellectual.

- In the meantime, the price correction has created an attractive valuation unseen in about a decade. Thus, I see DIS as one of the most attractive choices to buy into our digital future at a reasonable price.

Hollywood writer strike

Many of the issues mentioned above have been addressed in other SA articles, including several of our own. In particular, we have written about the prospects of its streaming services and its leadership transition in the past. Here, I will focus on a more recent issue that is less discussed on the SA platform so far – the Hollywood writer strike.

The labor dispute between the Writers Guild of America (“WGA”) and the Alliance of Motion Picture and Television Producers (“AMPTP”) began in early May 2023 after the two sides failed to reach an agreement on issues like pay and working conditions. The strike has effectively shut down the production of new film and television projects in Hollywood, and DIS unfortunately is no exception. The strike could negatively impact DIS in several ways.

How might the strike impact Disney?

It could cause (if not already causing) a loss of revenue for DIS. As just mentioned, the strike has effectively shut down production of new content, so Disney would be unable to release them on its streaming services, such as Disney+ and Hulu. Second, a number of films that DIS is undertaking could be delayed or unreleased because of the strike. It’s difficult to establish a definitive causal relationship here and quantify how much delay is caused by the strike. After all, movie projects have a history of delays already, even without any strikes. Nonetheless, as an avid movie fan, my assessment is that at least a few high-profile titles are delayed because of the strike, including Avatar 3 (originally scheduled for release in December 2023 and now delayed to December 2025), Deadpool 3 (whose writers, Rhett Reese and Paul Wernick, are both members of the WGA and have been on strike since May), and also Guardians of the Galaxy (whose director, James Gunn, is a member of the WGA and has been on strike since May).

Hence, just like the other setbacks, I have no doubt that the strike will cause financial headwinds for DIS. My point here is that such headwinds will only be temporary, as argued next.

Under-earning is temporary

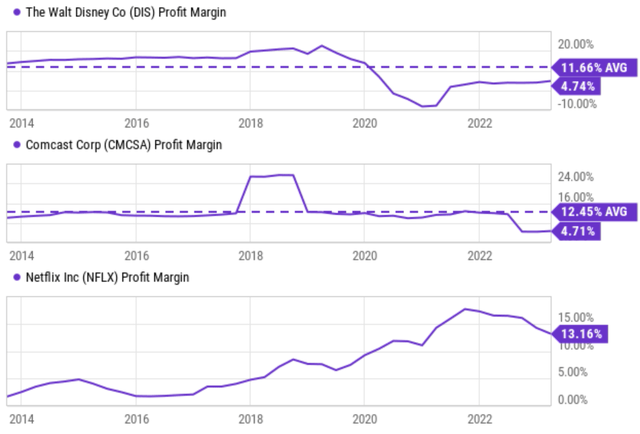

DIS used to be the poster boy for superb profitability. As you can see from the following chart (top panel), its average profit margin has been ~20% until 2020 (i.e., before COVID broke out). Such a margin is very competitive when compared to similar peers such as Comcast (CMCSA) and also pure streaming players such as Netflix (NFLX). However, COVID hit many of its segments really hard. Movie theater audience nosedived, and theme parks were shut during the pandemic. In the meantime, its streaming services have not developed enough to contribute meaningfully. All told, its profit margin fell to negative and currently sits at the miserable level of 4.74% as seen, both far below its own historical average and below its peers.

Source: Seeking Alpha data.

However, I will argue that the issues that are causing the ongoing underearning are temporary. The business moat remains fundamentally sound, and the brand name is strong. To understand its fundamental moat, I will quote what Warren Buffett said about the business. As usual, the man has the insights to cut to the essence of seemingly complex businesses and the ability to communicate in clear (and even entertaining) ways.

- It’s kind of nice to be able to recycle Snow White every seven or eight years. You hit a different crowd. It’s like having an oil field where you pump out all the oil and sell it. And then it all seeps back in over seven or eight years.

- The nice thing about the mouse is that he doesn’t have an agent. He is not in there renegotiating every week or every month… If you own the mouse, you own the mouse.

- If I thought the children of the world were going to want to be entertained 10 or 20 years from now, and I was betting on who is going to have a special place in the minds of those kids and their parents, I would probably bet on Disney.

He made these comments back in 1996~1997, and the essence has remained unchanged since then. DIS still enjoys the perpetuity of its strong intellectual properties, it still can recycle (and is recycling) them every few years and hit a new audience, and it still occupies a magic place in the minds/hearts of kids (based on my first-hand experience as a parent.

And Wall Street analysts seem to be aware of such stability of its moat, as detailed immediately below.

Profitability rebound potential

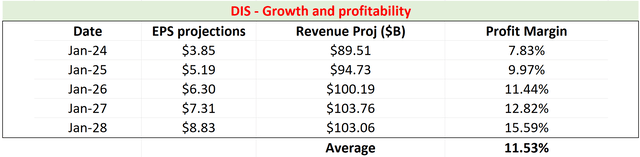

Looking ahead, consensus estimates provide a healthy but non-inspiring forecast of its growth curve. Revenues are projected to grow from $89.5B in 2024 to about $103B in 2028 (see the second column in the table below), translating into an annual growth rate of 2.8%. However, what is of importance to me is the profitability implied by such forecasts. Based on the consensus estimates of its EPS and revenue forecasts, I calculated its projected profit margin for the next five years (the fourth column in the table) by assuming its share count to be constant at the current level of 1.82 billion.

Then, as you can see, the margin implied would improve to 7.8% next year, substantially above its current level of 4.74%. The margin is then projected to keep climbing up to about 15.6% in 2028.

As mentioned, I view such rebound potential to be completely plausible given the arguments above. The gist is that I do not see the earning power of its physical and intellectual assets being permanently damaged by the recent headwinds, either the theme park shutdown or the writers’ strike.

Source: author based on Seeking Alpha data.

Risks, Valuation, and Final Thoughts

To recap, Disney has been facing and is still facing a series of headwinds. Some of these headwinds have almost run their course, such as the impact of the COVID pandemic on its movie and theme park businesses. Some of the headwinds are still ongoing and can keep generating uncertainties, such as the competition in the streaming space and the Hollywood writer’s strike. My bullish thesis here is not to ignore or deny these headwinds. Instead, my bullish view is based on the argument that these issues will only be temporary. These temporary issues are creating and will continue to create earning headwinds, as reflected in its current poor margins.

But for the long term, I see its key moat intact. The business still enjoys some of the most iconic IPs perpetually and still occupies a magic place in a large audience. These temporary issues only serve to distort its profitability in the near term, and I’m optimistic about the rebound potential of its profitability in the near future (and Wall Street seems to share the same view based on the margins implied in their forecasts).

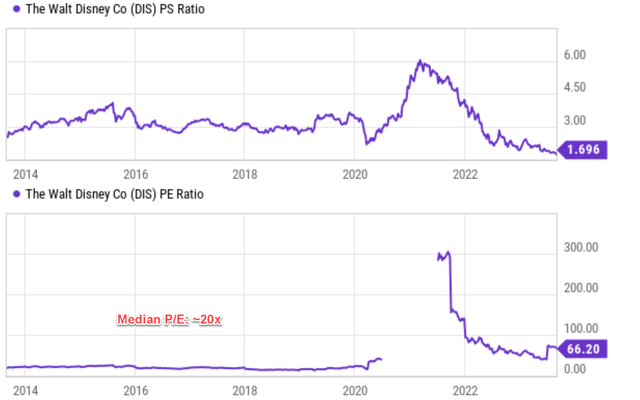

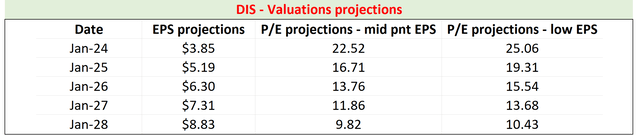

A final word about valuation. The profitability distortion also serves to compress the valuation multiples, as seen in the chart below. In terms of P/S ratio, DIS is trading at 1.7x sales only, the lowest point in more than a decade. In terms of the P/E ratio, the numbers are a bit scattered due to the recent large EPS fluctuations. But if you remove the anomalies, you will see that the stock had been trading at a median P/E of ~20x before the pandemic. But as with the price correction, its FY2 P/E is about 16.7x based on the midpoint of EPS projected by the consensus, a large discount from its historical median. The discounts further expand after that to almost single digits in 4~5 years as seen. The prospect of profitability rebound, combined with the potential of P/E renormalization, creates a highly asymmetric return profile.

Source: Seeking Alpha data.

Source: author based on Seeking Alpha data.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.