Summary:

- I believe that the recent recovery rally in Disney stock is just the beginning of a larger reversal move.

- Disney’s focus on streaming and cost-cutting measures are expected to improve its financial standing and narrow the discount in its valuation, in my opinion.

- Potential partnerships with the NFL could benefit ESPN and lead to cash flow benefits for Disney, which seems like an ignored upside.

- I am waiting for a re-rating in Disney’s valuation, seeing an upside potential of ~27.54% to the current price of $93.5.

- Despite some serious risks, I rate DIS as a ‘Buy’ today.

IvelinRadkov/iStock via Getty Images

My Thesis

I think that the modest recovery rally in The Walt Disney (NYSE:DIS) stock that we have seen since November 2023 is just the beginning of a massive reversal move in the stock.

As the company recovers its margins thanks to the paradigm shift, the potential improvements in ESPN’s carriage of NFL Network and Red Zone as a new catalyst should help further narrow the discount in the stock’s valuation. In other words: I expect de-risking at DIS and more FCF over the next few years, which should lead to an upside re-rating.

My Reasoning

In the aftermath of the COVID-19 pandemic, Disney strategically pivoted towards fortifying its position in the highly competitive streaming arena, notably with its subscription service, Disney+. Distinguished by a wealth of proprietary releases, such as notable series within the Star Wars universe like The Mandalorian and Boba Fett, Disney leveraged aggressive pricing to boost its subscriber base.

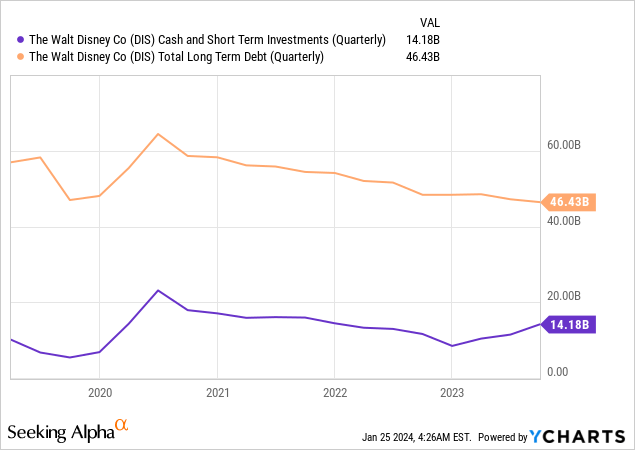

The company revealed plans to acquire NBC Universal’s stake in Hulu for a substantial $8.61 billion, a strategic move laden with financial implications, given Disney’s existing debt of $46.4 billion and cash reserves totaling ~$14.2 billion.

To enhance its financial standing, Disney revised its cost-cutting projections from $5.5 to $7.5 billion, primarily achieved through curtailed investments in the streaming segment, acknowledged for its inherent financial challenges. Concurrently, the company revised its capital expenditure (CAPEX) outlook from $3 to $6 billion, directing increased investments toward its theme park segment, a historically lucrative arm of its business. The resultant FCF projection for FY2024 stands at $8 billion, a notable 20% above industry analysts’ consensus.

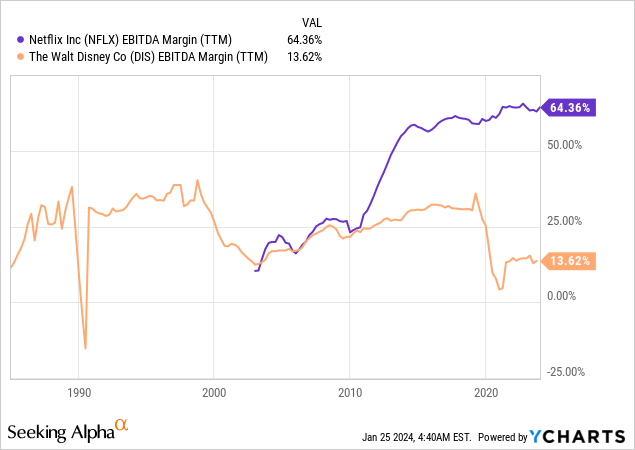

Disney aims to transition its streaming business into profitability this year, adopting a page from Netflix’s (NFLX) playbook by introducing a competitively priced ad-supported subscription model, significantly amplifying its subscriber count. The strategy is further underscored by the premium subscribers with ads, who exhibit a 30% higher engagement level on the platform, rendering them more financially lucrative for Disney. Emphasizing a strategic shift toward creating elite content, particularly blockbuster films, Disney seeks to maximize revenue potential instead of mass-producing television series. I think DIS is definitely making the right move to modernize its business model. I expect the gap between NFLX and DIS in terms of EBITDA margin to narrow somewhat in the next few years.

Also, given the company’s restructuring, I expect DIS’s FCF to improve, though the Hollywood strikes were also a temporary positive for cash flow (this should now reverse with the conclusion of the strikes and the resumption of content production).

The enduring stronghold of Disney’s ESPN in the cable TV domain remains a focal point, continually expanding its audience base and advertising revenues. As Disney finalizes partnerships with major industry players, ESPN is poised for a transition into the realm of streaming, capitalizing on evolving consumer preferences.

Just recently, The NY Post reported advanced talks between ESPN and the NFL for a potential equity stake, marking a significant development for Disney. While the likelihood of a deal remains uncertain, its realization could stabilize ESPN’s outlook, in my view. The talks, reportedly involving ESPN taking over NFL Media, signify strategic importance as the NFL’s transition to streaming gains momentum, with ESPN positioned as a crucial partner.

For DIS investors, the partnership holds value, as the NFL is a key sports league commanding high rights prices. If materialized, the deal could position ESPN favorably in the evolving landscape of sports content consumption. However, potential obstacles include concerns from NFL owners about a perceived conflict of interest.

The deal’s implications include possible improvements in ESPN’s carriage of NFL Network and Red Zone, leading to near-term cash flow benefits, as Wells Fargo analysts wrote in a special note to the bank’s client a few days ago (proprietary source). Investors might not have anticipated such an agreement, presenting upside for DIS and contributing to a more stable sentiment, supported by cost-cutting measures, DTC margin improvements, ESPN DTC launch, and a robust FY24 free cash flow guidance.

In summary, I think Disney is orchestrating a financial realignment, shifting away from leveraging funds from historically lucrative assets towards a self-financing strategy, wherein profits from thriving sectors are reinvested for sustained growth. This strategic shift is coupled with an aggressive cost-cutting approach and revenue augmentation initiatives, encompassing synergies and innovative features such as targeted advertising.

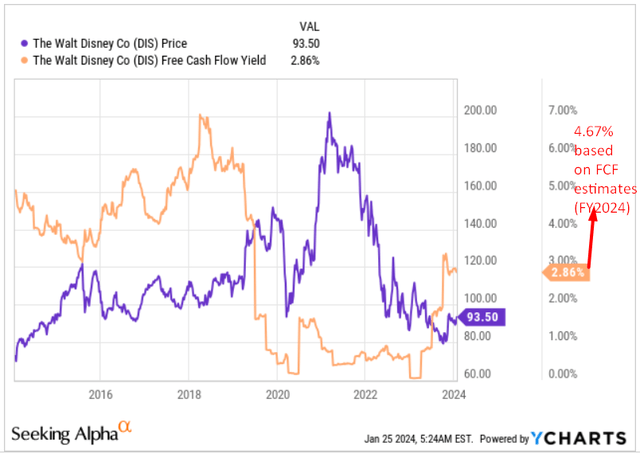

In my opinion, Disney has a fairly significant discount to its fair valuation considering all the above forecasts. The FCF yield for next year (assuming $8bn FCF) is already ~4.67% without any upside scenarios (i.e. it could be higher).

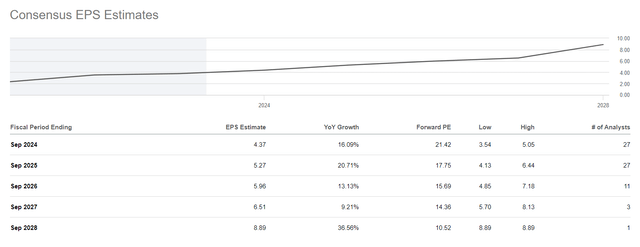

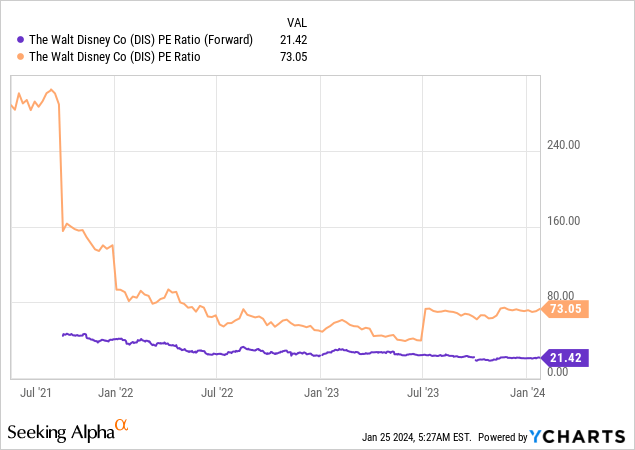

At the same time, we see a strong contraction in the P/E ratio, which implies a strong increase in EPS next year and no reaction in the stock price:

At the same time, analysts’ consensus estimates point to future earnings growth of DIS with a CAGR of 15.26% over the next 5 years. The implied price-to-earnings (P/E) ratio for the 2028 financial year is going to be around 10x, which is hard to believe if you ask me.

I estimate that DIS should trade at 25 times its annual projected earnings of $4.77 by the end of this year (Argus Research, proprietary source). First, I assign the higher multiple due to a likely increase in the company’s growth projections thanks to benefits from the business restructuring. Second, my assumption of higher EPS ($4.77 vs. consensus $4.37) is based on the assumption that systematic earnings beats will continue through 2024. So based on the exit multiple and EPS, my year-end price target for DIS amounts to ~$119.25 per share, which implies a potential upside of 27.54% from the current price.

Risk Factors To Keep In Mind

Investing in Disney stock comes with several risks that should be remembered:

-

Streaming Competition: Risk from intense competition in streaming (Netflix, Amazon), impacting Disney+’s subscriber growth and retention.

-

Economic Sensitivity: Vulnerability to economic downturns affecting consumer spending on entertainment and discretionary areas.

-

Content Production Costs: Substantial investments in content production, with potential profitability impact if returns fall short or face unexpected challenges.

-

Regulatory Environment: Operating in a highly regulated industry; changes in regulations may affect Disney’s operations and profitability.

-

Shift in Consumer Preferences: Adapting to changes in consumer preferences for entertainment content, particularly the shift to streaming services.

-

Debt Levels: Significantly leveraged with long-term debt, making financial health susceptible to interest rates and debt-servicing challenges.

- Valuation: Compared to some close peers in the industry, Disney’s key valuation multiples may seem too high to date, somewhat limiting its upside potential.

Morgan Stanley [January 2024, proprietary source], Oakoff’s notes![Morgan Stanley [January 2024, proprietary source], Oakoff's notes](https://static.seekingalpha.com/uploads/2024/1/26/53838465-17062463988110507.png)

Your Takeaway

According to Seeking Alpha, Disney is expected to release results for the fourth quarter of fiscal 2023 on February 7, 2024. The final quarter of last year should be something of a litmus test for how successfully the management plans are being implemented. Of course, it is still too early to judge the effectiveness, but as a prospective investor, I would focus on the results of the work on the cost-cutting measures and, above all, look at the company’s margins. If the EBITDA margin is increasing (without major “paper adjustments”), then that means DIS is most likely moving in the right direction. Sales growth, which needs to accelerate, will also be important.

Despite the many risks involved, I think Disney investors who have been happily watching the stock rally in recent weeks have seen nothing yet. Thanks to a new, and in my opinion strategically correct, approach to corporate management, Bob Iger should help DIS begin the process of margin expansion again. Hoping for the realization of potential catalysts in the foreseeable future, I am waiting for a re-rating in Disney’s valuation, seeing an upside potential of ~27.54% to the current price of $93.5.

So I rate DIS as a ‘Buy’ today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.