Summary:

- The Walt Disney Company is facing challenges in its traditional cable and broadcasting divisions, with declining viewership and profits.

- Management is actively seeking strategic alternatives for these assets, including a potential partnership or sale to companies like Apple, Amazon, or Verizon.

- The company’s streaming platforms, such as Disney+, ESPN+, and Hulu, have seen growth and are becoming increasingly important for Disney’s future success.

- Investors should be prepared for a big change to occur sometime soon as the company looks to reinvent its struggling operations.

Razvan

As those who follow my work closely know all too well, I am a massive believer in the potential for significant value creation from The Walt Disney Company (NYSE:DIS). Even though shares have dropped quite a bit over the past several months, I maintain a ‘strong buy’ rating on the stock and I continue to have it in my portfolio. In fact, I have not sold a single share. The reason for my optimism centers largely around brand quality and the fact that there are parts of the company that are continuing to grow and will, in the long run, generate significant cash flows for shareholders. But this is not to say that every part of the company is performing at a high level.

At first glance, it may seem as though the more traditional cable and broadcasting parts of the company are doing reasonably well. But when you dig deeper, and focus especially on more recent results, it becomes clear that the company has issues. There have been rumors circulating the market that management is seeking to switch things up. And management has even gone so far as to say that they are exploring strategic alternatives for certain assets. Upon looking deeper into the picture, I would say that this kind of maneuver is definitely warranted. With changes in consumer behavior and with technological innovation, we have seen at least one key part of the business become antiquated. And investors should view the rhetoric engaged in by management, as well as any actions that will likely stem from their initiatives, as bullish in the long run. This is because it shows a management team that is acutely aware of the weakest parts of the company and that is willing to act on this realization before matters get out of hand.

Disney’s pain point

Much of the discussion that has been made online has involved what Disney might do with ESPN. But we need to put the picture in a broader context because their efforts at improving operations don’t include only ESPN. Rather, they encompass the entire Linear Networks division, which is one of the three operating units under the Disney Media and Entertainment Distribution segment. For context, this division includes not only Disney’s 80% ownership over ESPN, but also its full and partial ownership over various other enterprises like ABC Television Network, Disney Channel, National Geographic, Fox, A+E Television Networks, HISTORY, Lifetime, FX, and more.

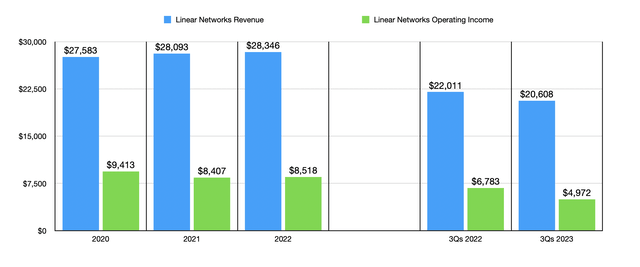

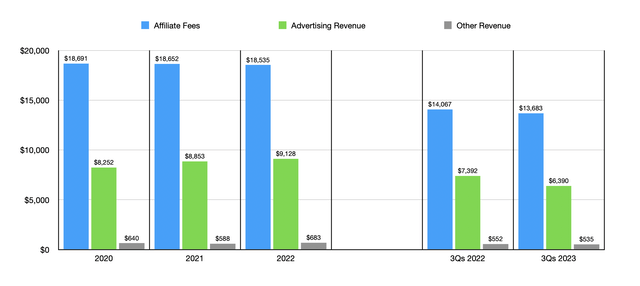

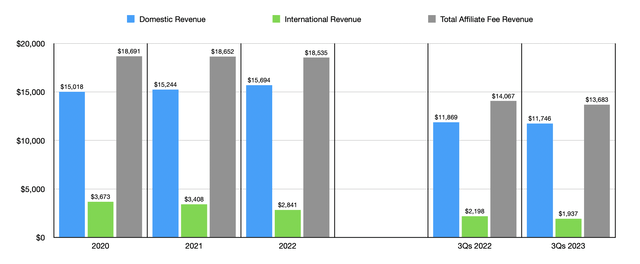

Looking at the financial picture of this division over the past three completed fiscal years, you might get the impression that the picture isn’t great, but that it’s also not bad either. From 2020 through 2022, revenue at the division grew from $27.58 billion to $28.35 billion. Management actually provides multiple ways to break this data up. For instance, we can look at different types of revenue. Affiliate fee revenue, for instance, has decreased modestly from $18.69 billion to $18.54 billion. Even within this, there are ways to segment the data. I don’t think that breaking up each individual part would be necessarily valuable here. However, the short version behind why revenue under this category has dropped centers largely around fewer subscribers, particularly involving the company’s international channels as management has sought to close certain channels. Foreign currency fluctuations have also made some impact from year to year.

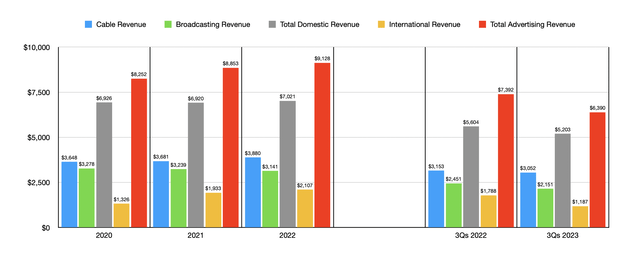

Outside of affiliate fees, the next largest category for the company has been advertising. Revenue has actually grown from $8.25 billion to $9.13 billion. Strength in cable advertising, driven by both higher rates and higher impressions, more than offset weakness under the broadcasting category that was attributable mostly to a drop in impressions for some parts of the company. ABC, for instance, reported a 12% drop in impressions, reflecting lower average viewership, from 2021 to 2022. The revenue picture would have been worse had it not been for a 10% increase in rates charged to its users.

Taking a step back really quick, it is worth touching on the affiliate revenue once more. When you look at the picture for the domestic channels, the revenue picture for the company has been quite positive. From 2020 through 2022, revenue jumped from $15.02 billion to $15.69 billion. But this is where the picture is deceptive. A decrease in the number of subscribers hit domestic affiliate fees by roughly 8% between 2020 and 2022. This was only offset by a 13.4% aggregate increase in rates charged to its clients over that same window of time. Internationally, the picture was far worse. Revenue dropped from $3.67 billion to $2.84 billion over the past three fiscal years. A roughly 16.5% drop in the number of subscribers negatively impacted the company here.

Cable has been something of a bright spot for the company from a revenue perspective, with advertising sales associated with this category growing from $3.65 billion to $3.88 billion. On this front, this situation looks muddled. From 2020 to 2021, for instance, cable advertising revenue was hit negatively to the tune of 6% because of fewer impressions. On the other hand, higher rates helped the company to the tune of 10%. Rates continued to climb in 2022, but only by 2%. However, impressions, driven by higher average viewership, pushed revenue up by 3%. Broadcasting revenue, on the other hand, has experienced a consistent decline. It has dropped from $3.28 billion to $3.14 billion over the past three fiscal years. And that has largely been thanks to the reduction in impressions that I mentioned earlier.

As you can see in the charts interspersed throughout this article, the pain for the company has accelerated into the current fiscal year. Revenue associated with Linear Networks dropped 6.4% for the first nine months of this year compared to the same time last year, declining from $22.01 billion to $20.61 billion. Affiliate fees revenue went from $14.07 billion to $13.68 billion, driven by a 6% reduction in subscribers for the domestic channels and a 7% reduction internationally. On the international side of things, foreign currency fluctuations hit sales by another 10%. But once again, higher pricing helped ease this pain. And when it comes to advertising revenue, the picture was even worse, with sales plummeting from $7.39 billion to $6.39 billion.

Interestingly, ESPN came in strong for the company on the cable side, with higher viewership almost offsetting the decline of non-sports channels. But broadcasting revenue fell 12.2% from $2.45 billion to $2.15 billion thanks largely to a 10% reduction in impressions at ABC and a 1% decrease in rates for ABC. Internationally, the picture is even more painful, with revenue plummeting 33.6% from $1.79 billion to $1.19 billion. An 18% drop in rates failed to boost impressions. In fact, even with the lower pricing, impressions took an 8% hit because of lower average viewership. Although to be fair to the company, this viewership reduction was attributed to fewer IPL (Indian Premier League) matches that aired in this fiscal year compared to the same time last year thanks to the shifting of timing for those matches caused by the COVID-19 pandemic.

While the profit picture looked generally appealing from 2020 through 2022, the profit picture looked anything but. Operating income for the Linear Networks division fell from $9.41 billion in 2020 to $8.52 billion in 2022. In the first nine months of 2023, profits of $4.97 billion were substantially lower than the $6.78 billion reported the same time last year. In addition to certain revenue categories hitting profits, the company also dealt with higher programming and production costs during this window of time. For the first nine months of this year, for instance, the firm had to dole out an extra $310 million under its cable division alone, largely because of contractual rate increases that it has to pay to the NBA, as well as to College Football Playoffs and to the NFL.

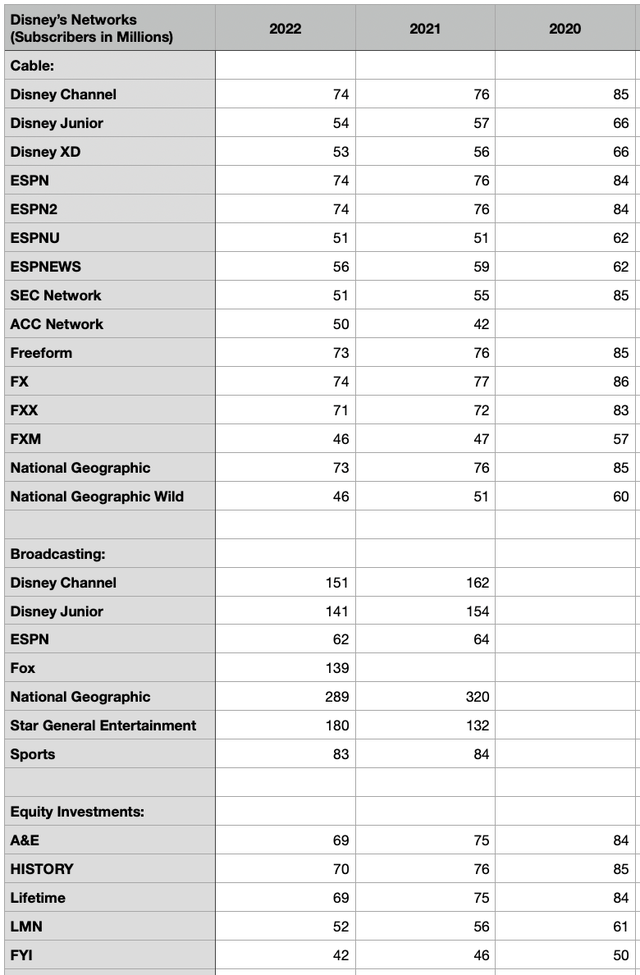

This aggregation of data shows us that, at least up until this year, the company could offset a good part of its pain, from a revenue perspective, simply by increasing prices. But this is not a good long-term strategy in a world where the subscriber base of these networks is destined to continue declining if nothing else changes. As you can see in the table above, Disney has seen substantial declines in his viewership for most of its major properties under the Linear Networks division. For instance, from 2020 through 2022, Disney Channel viewership has dropped from 85 million to 74 million. I would like to know what that picture is so far this year. However, management has not disclosed data from quarter to quarter. Disney Junior viewership declined from 66 million to 54 million. ESPN has dropped from 84 million to 74 million. No data was made available for 2020 for National Geographic. But from 2021 to 2022, viewership there plunged from 320 million to 289 million when it comes to the international operations, while declining from 85 million to 73 million domestically.

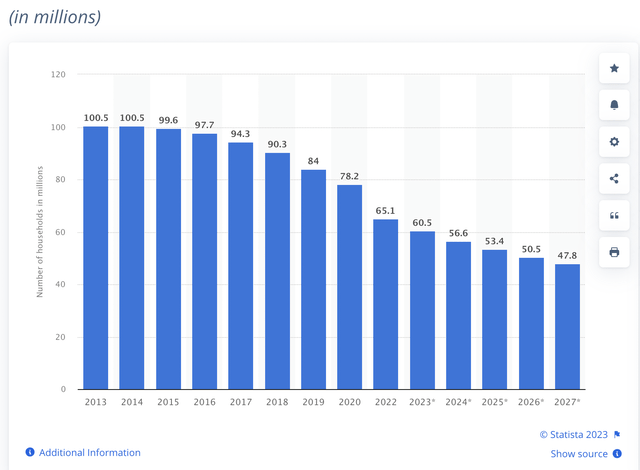

As tempting as it may be for some to allege that these declines are because Disney has ‘gone woke’, the real answer centers around two different points. For starters, more and more people are ‘cutting the cord’. Streaming has provided a great alternative for those who want to save some money, especially for those who happened to be limited in the range of interests that they have. Back in 2013, 100.5 million households had cable packages. That number dropped to 78.2 million in 2020. The explosion of streaming alternatives that began somewhere around 2020 brought this number down to 65.1 million in 2022. And this year, that number is expected to be 60.5 million. As the aforementioned image shows, we should see this drop continue. And that brings us to the second thing, which is that the streaming platforms that Disney has, such as Disney+, ESPN+, and Hulu, have eaten a good part of the more traditional networks that the company has. All three have grown in recent years, making the company the largest streaming operator on the planet and making Disney+ the second largest streaming service in the world.

Outside of these bigger structural issues, there are other problems facing these operations at the moment. One of these is the dispute Disney is having with Charter (CHTR) over its channels. The long story made short is that, on the past Thursday, 26 different Disney-owned channels, including ESPN and ABC, went dark because Charter was unwilling to pay what Disney wants it to pay in order to continue hosting its content. This circles back to the earlier argument that pricing increases alone, especially during the decline of a legacy business, do not make for a good long-term strategy. And secondly, there’s the ongoing writer’s strike and actor’s strike that is affecting the entire entertainment industry. So far, there has been only a limited impact to many of the firms in this space, but with the writer’s strike already well past the 100 day mark, it’s only a matter of time before everybody in this space starts to get hurt in a big way.

However, management is not content to let Linear Networks drag the rest of the company down. There are other major conglomerates that have what you might call legacy businesses that are in a state of consistent decline. The market does not like these and often heavily discounts companies with these operations, even as other parts of those firms flourish. My favorite example is another company that I hold stock in, and actually my largest holding, AT&T (T).

It has been because of this desire to maximize shareholder value that management has been very open about their interest in seeking strategic alternatives for these assets. Management has even said that they could consider different options for different parts of these assets. ESPN, for instance, which Disney owns 80% of, has shown impressive strength relative to the other assets under the Linear Networks division. And management has said that they are looking for separate strategic options for it, as well as for the Linear Networks division. There have been rumors circulating that both Apple (AAPL), Amazon (AMZN), and Verizon (VZ) are in discussions with Disney regarding ESPN and also regarding Linear Networks as a whole. One analyst even suggested that it would be a ‘no-brainer’ for Apple to acquire ESPN for $50 billion.

Personally, I view a sale of ESPN in its entirety as unlikely. But one of these players stepping in and taking a minority stake in the company and/or partnering with Disney to transition its Linear Networks into a more streaming oriented business is highly probable. One potential avenue would involve a partnership that would make ESPN available to customers on other platforms at a price of between $20 and $35 per month. This should not be conflated with ESPN+, which would probably remain its own separate unit and would, with a lower price, focus on niche sports content.

Takeaway

At the end of the day, we will have to wait and see what ultimately transpires. What we do know for now is that Linear Networks is struggling and that management is actively looking for ways to improve matters. Outside of this part of the company, which is admittedly a very large part that is vital to the company’s success, the rest of the firm looks healthy. Even though I am bullish enough on Disney to rate the company a ‘strong buy’, I could see some sort of big deal coming through serving as a catalyst to propel shares higher. So for those who are already bullish about the company, I see this opportunity as a great thing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!