Summary:

- I must admit that I have been disappointed with Disney stock’s recovery. While I bought near its lows, DIS has continued to struggle for momentum.

- Despite making solid progress in its streaming business toward breakeven, investors are focusing on the execution risks in its declining Linear TV business.

- The recent post-earnings surge has also been reversed, indicating investors weren’t confident holding their positions for long.

- I assessed that while the market is justified to be concerned, they have been overly pessimistic, given Disney’s high-quality asset base.

- I make the case for why DIS remains close to its peak pessimism, providing investors another opportunity to buy more before the coast is clear. Comment and let me know whether you agree with me.

Bastiaan Slabbers

I must admit that the performance of The Walt Disney Company (NYSE:DIS) stock has been nothing short of underwhelming and disappointing. Despite the battering DIS received at the hands of sellers as DIS hovers just above its March 2020 COVID lows, buyers weren’t keen to return.

As such, the recent post-earnings surge in DIS has all but dissipated as investors reassessed their initial optimism on the company’s transformation. DIS has fallen below its previous week’s lows, suggesting investors weren’t confident about holding DIS, using momentum spikes to take profits. CEO Bob Iger attempted to lift investors’ confidence as the company initiated streaming price increases and committed to cracking down on password sharing by FY24.

Management stressed that Disney remains focused on profitable growth, predicated on the underlying growth drivers in streaming, studios, and parks. As such, it’s looking to monetize its declining legacy Linear TV assets while assessing partnership opportunities for ESPN.

I believe investors are likely unsure how best to value Disney’s diversified asset base, leading to the depressed valuation that we gleaned. Disney is nowhere close to Netflix’s (NFLX) scale regarding streaming profitability, despite narrowing its losses remarkably. Despite that, Disney is likely on track for breakeven in its streaming segment by the end of FY24. I assessed that the ongoing recovery in the advertising market should further boost its push for more subscribers toward the ad-supported version, helping to lift ARPU metrics.

Moreover, the ongoing recovery in travel and hospitality has taken off, as seen in the stocks of peers in that segment. Booking Holdings (BKNG) stock remains at an all-time high, while Royal Caribbean Cruises (RCL) stock has surged to levels not seen since the start of 2021. Carnival Corporation (CCL) stock remains well below its pre-COVID highs but has recovered toward levels last reached in April 2022. As such, it makes sense that Disney sees tremendous opportunities for its parks business to grow further.

Therefore, it does seem like investors are focusing on Disney’s strategies to untether its legacy assets which are still a critical profitability driver in the near term. Accordingly, Linear TV delivered revenue of $6.69B recently while posting an operating income of $1.89B (margin: 28.3%). Given that Disney reported a corporate operating margin of 15.9% in its fiscal third quarter or FQ3, investors’ concerns about execution risks in its key profit driver aren’t unfounded.

As such, I believe that unless we get more clarity over Disney’s plans for its Linear TV networks moving ahead, buyers aren’t likely to return in a hurry. Notwithstanding the near-term volatility, I believe high-conviction investors of Disney’s subsequent recovery should still find the current levels attractive to add more exposure.

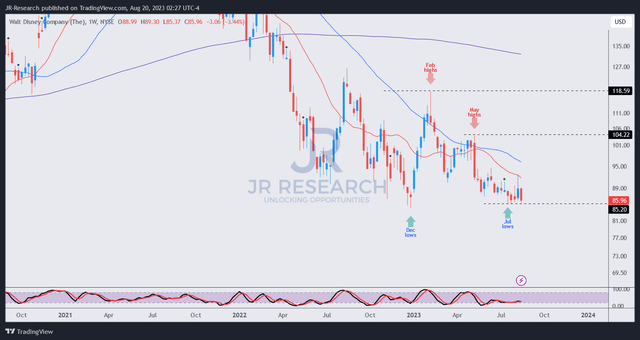

DIS price chart (weekly) (TradingView)

As seen above, DIS has continued consolidating at levels suggesting it bottomed out in December 2022. However, sellers met the initial bullish reversal with a sharp rejection at its February 2023 highs.

Unfortunately, DIS buyers haven’t been able to muster sufficient recovery momentum anywhere close to those levels, as buyers are likely concerned with its Linear TV transformation plans.

However, I believe the market pessimism has likely peaked, although patience is necessary for multiples expansion to follow with more clarity subsequently. While investors can wait until then to add exposure, I believe the most favorable risk/reward upside is likely when the market is highly pessimistic due to immense uncertainties over its crucial profit drivers, such as the current levels.

As such, DIS remains a Buy for me. Investors anticipating a pullback from the post-earnings surge have been given another fantastic opportunity to buy more shares.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!