Summary:

- Disney beat Wall Street’s expectations for Q3 on both the top and the bottom line.

- Disney saw solid subscriber gains in Disney+ domestically and reported its first positive operating income in the DTC business.

- Concerns about Disney’s profitability trajectory have impacted its valuation, but the company’s progress in the streaming business is promising.

- Shares trade at an attractive P/E ratio and have a favorable risk profile.

Henrik Sorensen

Entertainment company Disney (NYSE:DIS) reported better than expected results for its fiscal third quarter on August 7, 2024 and the earnings scorecard showed continual progress in terms of an improving profitability profile in the direct-to-consumer business… which finally reached an inflection point in the June quarter and posted positive operating income for the first time. Further, Disney added a significant amount of new subscribers to its Disney+ domestic subscriber base. With Disney continuing to return more cash to shareholders and shares being cheap based off of earnings, I believe the risk profile here for long-term investors looks a lot better than at the beginning of the year!

Previous rating

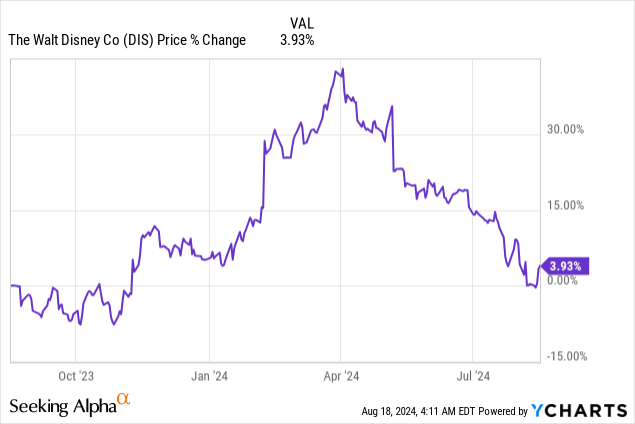

I rated shares of Disney a strong buy in June after the company announced that it was accelerating its capital returns and buying back more shares and raising its dividend. Disney also revealed a significant cost reduction program in the amount of $7.5B which would go a long way, in my opinion, to support an improvement in the profitability picture: 3 Reasons To Buy The Drop. Unfortunately, since my last work in June, shares of declined 12%, but Disney finally reported its first DTC operating profit in DTC in third fiscal quarter. I believe the company is making solid progress in its streaming business and shares remain a strong buy after Q3’24 earnings.

Disney beat estimates, solid subscriber gains in Disney+, inflection point in DTC

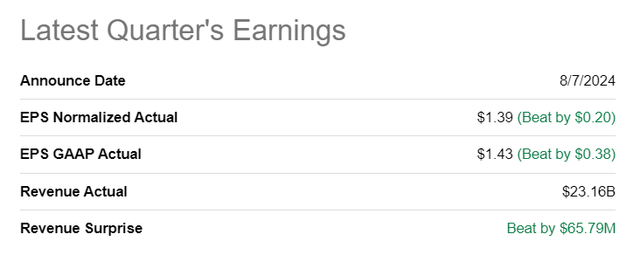

Disney beat Wall Street’s expectations for the third fiscal quarter and reported adjusted earnings of $1.39 per share, which surpassed the consensus estimate by $0.20 per-share. The top line also came in ahead of expectations, at $23.2B, topping the consensus estimate by $66M.

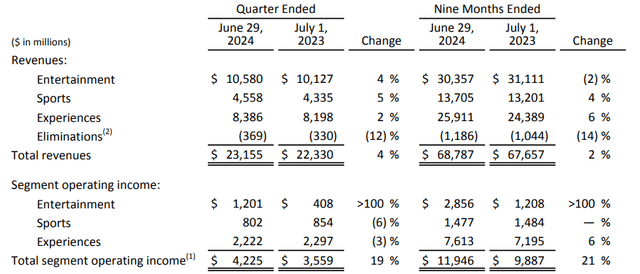

Disney delivered solid results for its third fiscal quarter earlier this month, with the entertainment company posting 4% year-over-year top line growth and revenue of $23.2B. The biggest segment once again was Entertainment, which saw a 4% increase in revenues Y/Y and benefited from a significant boost to its profitability amid a successful turnaround in the streaming business. In Q3’24, Disney reported a 194% increase in Entertainment segment operating income to $1.2B, which was led by Disney’s direct-to-consumer business. All other segments, including Sports and Experiences (which includes the company’s theme parks) reported negative year-over-year operating income growth.

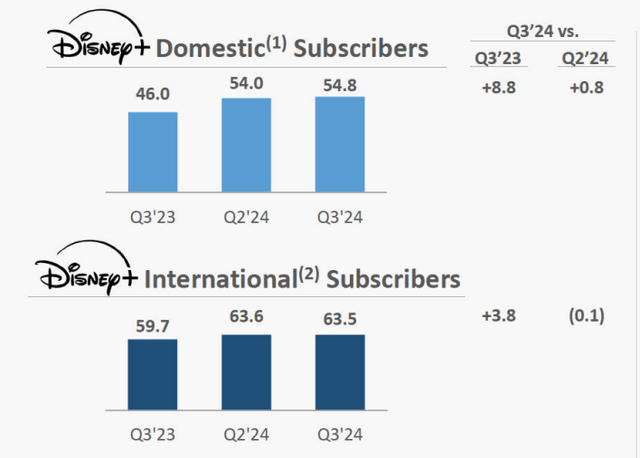

There were two major takeaways from Disney’s third-quarter earnings report earlier this month: 1) Disney continued to grow its domestic subscriber base in the core Disney+ plan, which is where the amount of paying subscribers increased by 800,000 quarter-over-quarter to 54.8M. This positive growth in the domestic market, however, was slightly offset by a decline of 100,000 subscribers in the international Disney+ business.

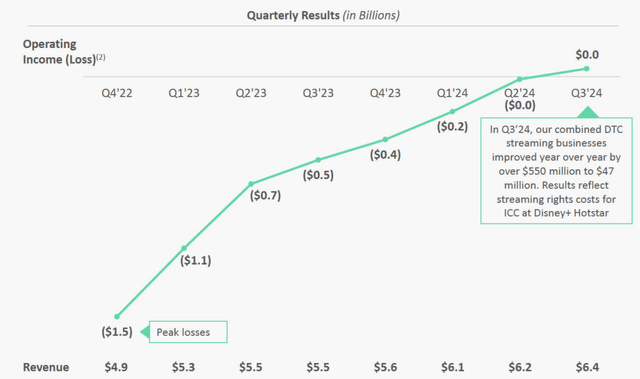

Disney has been able in the last year to significantly narrow its losses in the streaming business, in part due to growth in (Disney+) subscribers, increases in subscription prices as well as a stricter focus on cost reductions. As a result, Disney finally achieved positive operating income in the amount of $47M. With this inflection point reached, investors can look forward to the direct-to-consumer business reporting positive operating income going forward and making more significant earnings contributions in FY 2025.

Disney’s valuation

Disney’s valuation has suffered greatly in the last couple of months, in part due to concerns about the streaming company’s profitability trajectory as well as fears over a recession which would negatively impact the company’s theme park business.

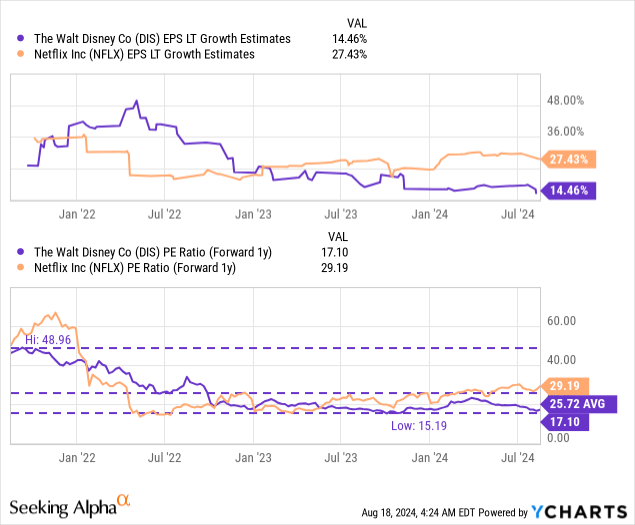

Disney’s shares are currently priced at a P/E ratio of 17.1X, which is 34% below the company’s longer-term average P/E ratio of 25.7X. Netflix’s (NFLX) shares are trading at a 29.2X price-to-earnings ratio and are therefore significantly more expensive. However, Netflix is also expected to grow its EPS about twice as fast as Disney in the future and Netflix has been widely successful in cracking down on password-sharing practices that led to a boost in revenue lately.

In my last work on Disney, I stated that I saw a fair value P/E ratio of 30X (or higher) for the entertainment company in case it managed to grow to profitability in the streaming segment… which is something that I continue to consider a reasonable assumption. A 30X P/E ratio implies a fair value of $157 per-share (based off of a consensus estimate of $5.22 per-share). I believe this fair value could be reached under the conditions that the streaming company achieves significant operating income growth in DTC going forward, realizes estimated cost reductions of $7.5B by year-end (as per guidance) and continues to add profitable subscribers in its Disney+ core subscription offer.

Risks with Disney

The biggest risk for Disney would be a potential contraction in the Disney+ domestic subscriber base, as well as a recession that would surely lower the company’s earnings prospects in the theme park segment. A decline in theme park visitors is highly likely in the event of a recession, which is when consumers are likely to cut back on discretionary spending items. What would change my mind about Disney is if the company were to see a contracting Disney+ subscriber base or failed to build on recent DTC momentum and again reported operating losses in its streaming business in the coming quarters.

Final thoughts

Disney reported a better than expected third fiscal quarter on August 7, 2024, and I don’t believe that the sell-off here is really justified. The streaming company has made fundamental progress in the profitability of its direct-to- consumer business, whose losses weighed on Disney’s shares before. Now that the operating income picture has drastically improved and Disney has a lever to grow its operating income due to subscription price increases and Disney+ domestic subscriber momentum, I believe the risk profile is fundamentally skewed to the upside. In my opinion, the value proposition for Disney has considerably improved after the company’s third-quarter earnings scorecard, and I am confirming my strong buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.