Summary:

- Disney stock has rallied almost 20% in the past three months, outperforming the broader market.

- The stock is undervalued from a multiples perspective and has significant upside potential according to my discounted cash flow simulation.

- There are several positive catalysts related both to Disney’s fundamentals and improving market sentiment around the stock.

Neilson Barnard

Investment thesis

My previous bullish thesis about Disney (NYSE:DIS) aged well since the stock rallied by almost 27% over the last three months, while the broader market increased in high single digits. A lot of developments happened since mid-December 2023 and today I want to share my opinion regarding them. I am also updating the valuation analysis, which suggests the stock is still very attractively valued. The management continues executing the turnaround plan initiated by Bob Iger in February 2023 and the transformation results in rapidly improving financial metrics. The company’s biggest bet of recent years, streaming services like Disney+ and Hulu under the DTC segment, is likely to turn profitable within the next couple of quarters. The streaming business operating loss has narrowed rapidly after Mr. Iger returned as a CEO. The company’s legacy businesses like experiences and content licensing businesses are also likely to enjoy tailwinds. All in all, improving fundamentals together with the upside potential outweigh potential risks and this means that I am reiterating my “Strong Buy” rating for Disney.

Recent developments

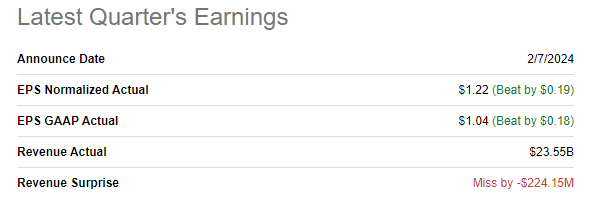

Latest quarterly earnings were released on February 7, far away from now, and I will just briefly highlight key figures and trends. DIS slightly missed revenue consensus estimates but delivered a solid beat in terms of the bottom line. Revenue was almost flat YoY, but the adjusted EPS improved by around 20%.

Seeking Alpha

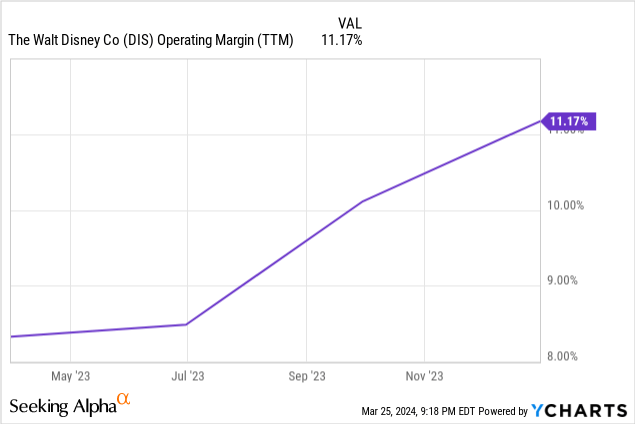

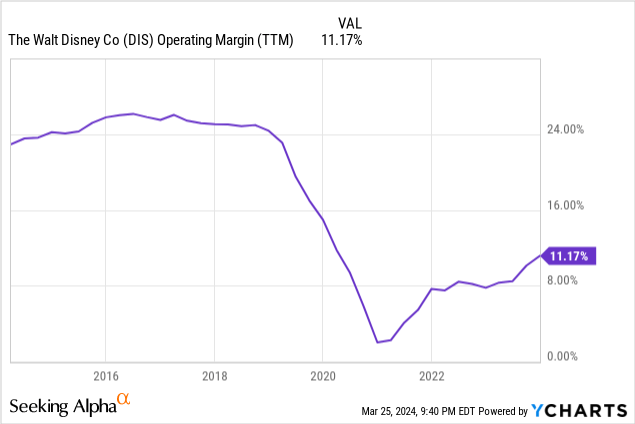

I am a long-term investor and I prefer to rely on secular trends or some crucial strategic shifts when I formulate my investment thesis. Last year I was [and still I am] bullish about DIS due to the Bob Iger’s turnaround plan introduced last year, in February 2023. The key metric to measure success of this turnaround plan is the operating margin. As demonstrated below, the operating margin has improved significantly on a TTM basis.

The above chart is the clear indication that the turnaround is successfully executed and Bob Iger’s strategic visionary talent is undisputed. The notable operating margin improvement over just few quarters for such a big company like Disney with numerous completely different business units is apparently not an easy task. But to understand where we are now, I want to zoom out the above chart.

As we can see, Disney typically maintained an operating margin of around 24% before the pandemic. There was a sharp decline in operating profitability due to the pandemic when the company’s theme parks were closed for almost 1.5 years due to the global lockdown and massive losses in Disney’s streaming business. Given the current 11% TTM operating margin, which is significantly lower compared to historical 24% levels I do not believe that Bob Iger is even close to being satisfied or believes that the turnaround is complete. Moreover, we all know that he will remain in charge until the end of 2026, which means almost three more years to continue improving the situation.

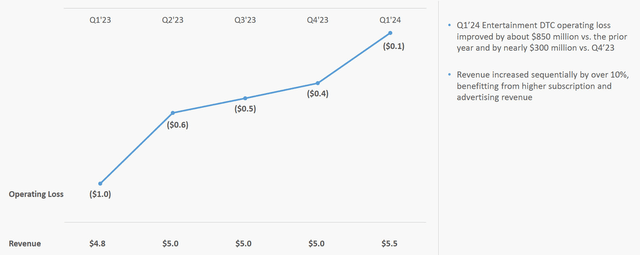

Apart from historical levels, I see few other solid reasons why Disney is likely to continue improving operating leverage. The crucial moment is that during the latest earnings call, the management reiterated the target to achieve profitability in streaming by the end of this year. Achieving profitability by the indicated timeline will mean that adjustments made to the business model [pursuing responsible growth instead of growth at all costs] after Bob Iger returned are sound. Once the economic viability of the business model is established, achieving operating leverage for a vibrant brand like Disney will become merely a matter of time. Therefore, the ultimate goal of achieving double-digit operating margins in next few years looks doable. According to the below chart, the DTC [streaming] business is already very close to zero operating margin.

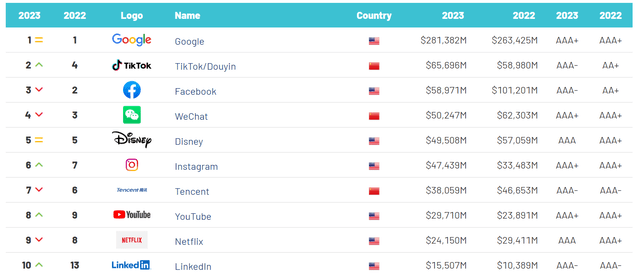

Disney bears might argue that Disney’s streaming offerings face fierce competition and there is an apparent formidable competitor that generates buzzworthy content, Netflix (NFLX). I have a couple positive moments to mention here to argue that competition risk for DTC is likely to be overestimated by pessimists. First, Disney is able to generate buzzworthy content as well. The recent Oscars, where Disney got five awards and received a dozen of nominations, serves as a solid evidence of the quality of their content. Second, Disney has the most valuable brand among companies offering video streaming and is by far surpassing Netflix. Third, I believe that Disney has a more well-rounded video streaming offering, which also includes sports streaming via ESPN and vast content base of Hulu. Having three different streaming offerings also makes Disney’s offering more flexible with various bundle configurations which can help potential subscribers to select the optimal offering.

The company’s legacy businesses like theme parks and licensing content for theaters are also poised to benefit from the pandemic disruptions. According to UN World Tourism Organization, international tourism is expected to fully recover to pre-pandemic levels in 2024. This will highly likely result in increased traffic for Disney’s theme parks and resorts, which is a good macro tailwind. With Disney World remaining the most popular U.S. travel destination, the company has a solid pricing power behind the back. Therefore, I am not surprised that a rebound in travel together with magic aura around Disney’s theme parks allows the company to raise ticket prices for 2025 without damaging the reputation.

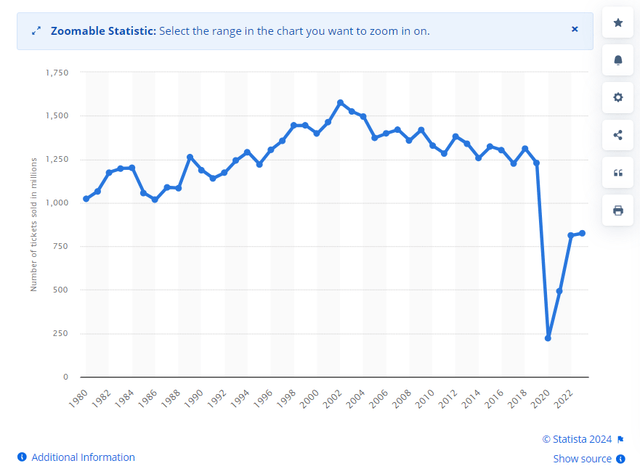

The movie theaters industry in North America still did not recover from the pandemic, which means there is still room to grow. Number of tickets sold in 2023 is far below 2019 levels. I believe that the resurgence of famous movie franchises in movie theaters will play a crucial role in attracting audiences back to cinemas. From this perspective, I believe that Disney is well-equipped to contribute to the industry recovery in the next couple of years with several successful franchises set to return to theaters in 2024-2025.

The management demonstrates firm confidence in the ultimate turnaround success, which I see from the $3 billion share repurchase target in fiscal 2024 alongside the dividend which was brought back in 2023 after the pandemic-related crisis. Since I expect the operating margin to continue expanding closer to pre-pandemic levels, it is reasonable to expect that dividends and substantial buybacks will likely once again become typical for Disney.

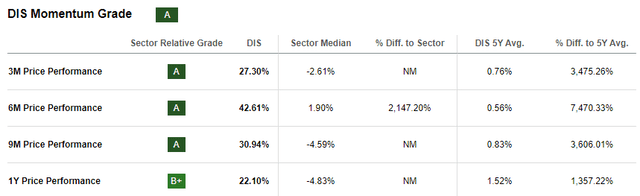

As investors we all know that even in times when the business performance is improving, the stock price might deteriorate due to the weak sentiment around the stock. And it actually was the case around 12 months ago when Bob Iger already unveiled his turnaround plan but the share price stagnated over several more months. The current situation is not the same. It looks that the sentiment around Disney is strong as the stock demonstrates robust strength and has a high “A” momentum grade from Seeking Alpha Quant.

To me, a combination of positive market sentiment together with rapidly improving fundamentals is a formidable blend of catalysts which substantially increases chances for the rally to last longer. Overall, I am reiterating my firmly bullish stance regarding Disney’s prospects and now want to analyze at how the valuation looks after the notable rally of recent months.

Valuation update

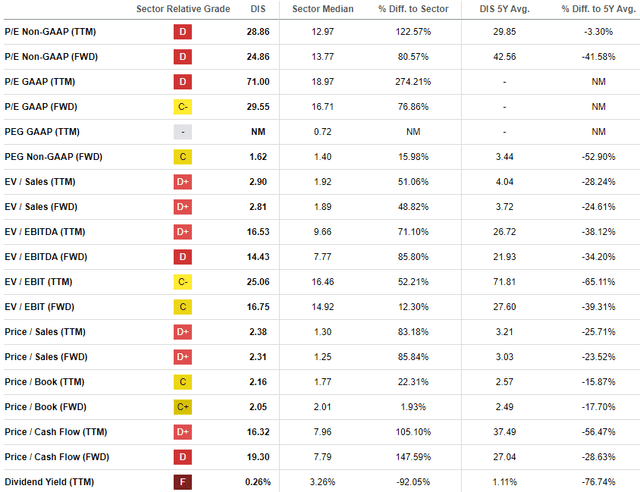

DIS had a solid start in 2024 with a 32% YTD rally. At the same time, DIS is far below its 2021 highs of around $200 per share. Currently valuation ratios are significantly lower than the last five years’ averages, which means that the stock is undervalued from the multiples perspective.

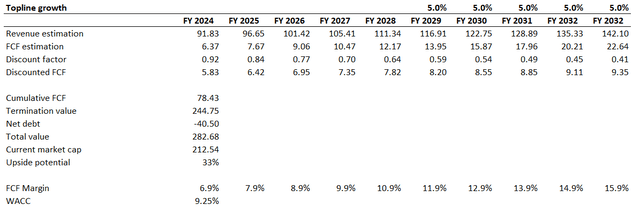

However, the discounted cash flow [DCF] simulation usually gives me much more confidence in the valuation attractiveness. I am using a 9.25% WACC this time which is the previous 10% discount rate adjusted for the potential three rate cuts in 2024. The TTM FCF margin ex-stock-based compensation [ex-SBC] has improved notably since my last valuation, from 5.2% to 6.9%, and I am incorporating this improvement for FY 2024 FCF projections. For the years beyond I expect yearly one percentage point FCF margin expansion. Despite all the favorable recent developments, I reiterate my 5% revenue CAGR for the next decade to remain conservative.

The business’s fair value suggested by my DCF model is $283 billion, which is 33% higher than the current market cap. The upside potential is extremely attractive, especially given very cautious revenue growth assumptions.

Risks update

As the company’s turnaround continues, it is crucial that the atmosphere in the top-management team and the board is productive and constructive. Recent developments suggest that there is an ongoing battle with activist investors, which might harm the company. Internal battles distract the management from focusing on the company’s strategic goals and may lead to flawed decision making driven by short-term interests. Tensions within the Board also do not add positive sentiment around the stock.

My thesis bets on the company’s ability to successfully complete turnaround initiated and executed by the legendary Bob Iger. At the same time, his tenure is not infinite and the CEO’s contract terminates in December 2026. Given recent news that Disney is seeking for a successor, it is unlikely that Mr. Iger remains in charge after 2026 when he will be 75 years old. Therefore, there is a great extent of uncertainty of how the business will [if will] succeed under the new leadership.

Since spending on entertainment is usually discretionary, Disney might not unlock full potential after the turnaround before the Fed cuts rates closer to less restrictive levels. The risk of a potential recession in 2024 also should not be ignored, which will also highly likely adversely affect the demand for entertainment activities and services provided by Disney.

Bottom line

To conclude, Disney is still a “Strong Buy” to me. There is still vast potential to improve profitability and I see several positive catalysts which will likely help the company to continue successfully executing Bob Iger’s turnaround plan. Moreover, the valuation is still extremely attractive with a 33% upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.