Summary:

- The role Disney plays in our culture cannot be overestimated – but that is exactly what happened to the company’s stock at some point, leading to its long-term fiasco.

- I discuss why the strong market rally of H1 FY2023 didn’t help DIS recover, and when this long-term decline should be over. Read on.

- Despite the dramatic sell-off, DIS share is fairly valued today, based on my comps and DCF valuation.

- I’m hoping for a strong catalyst – from management or the market – that will most likely drive the DIS stock price higher.

- And until that happens, I’m in no hurry to recommend DIS as a “Buy”. In this case, it seems to me that buying after the fact is better than buying in advance.

Erika Goldring/Getty Images Entertainment

Introduction

The Walt Disney Company (NYSE:DIS) is a $158-billion market cap global entertainment company operating in content production, streaming services, theme parks, and licensing. I’m more than sure you know about this company and what it does without my help.

The role this company plays in our culture cannot be overestimated – but that is exactly what happened to the company’s stock at some point, leading to its long-term fiasco that still cannot be stopped.

Seeking Alpha, DIS

All existing and potential investors of DIS are now interested in the main question – why the strong market rally of H1 FY2023 didn’t help DIS recover, and when this long-term decline will be over. These are the points I want to explore today.

The Recent Developments

The company operates and reports in 2 segments, according to the most recent 10-Q filing:

- Disney Media and Entertainment Distribution (DMED) – 64.4% of total sales;

- Disney Parks, Experiences, and Products (DPEP) – 35.6% of total sales.

Disney reported its fiscal 2Q23 results in May, with revenue rising 13% YoY due to rebounding from pandemic restrictions. The DPEP division contributed significantly to revenue growth [+16.9% YoY] despite its fewer share of total revenue. The DMED went up by just 3.1% YoY, and its EBIT fall of 42.4% YoY dragged the overall bottom line of the company in Q2 lower than Wall Street expected. As a result, DIS’s EPS missed consensus by a penny [by <1%], and the management said it expected a $1.5-$1.8 billion impairment charge for underperforming direct-to-consumer content. Disney+ lost 4 million net subscribers in 2Q23 QoQ [likely because of the December 2022 price increase].

The investors didn’t like what they saw and heard, so the DIS stock dropped by almost 9% on its report release date:

TrendSpider Software, author’s notes

Since then the stock lost another 7% of its value, and now we have Q3 quarterly results around the corner waiting to be released on August 9, 2023.

Despite losing some subscribers on the overall basis [QoQ], DIS still has a substantial subscriber base of 157.8 million, up 15% YoY, and 231.3 million total subscribers to all streaming services, rivaling Netflix’s (NFLX) 232.5 million. The DTC segment [Disney+, Hulu, ESPN+] saw progress with improved operating losses compared to the previous quarter. Disney+ core subscribers grew modestly, with over 600,000 net additions, and Hulu and ESPN+ subscribers increased slightly. The direct-to-customers is a key focus of the firm, according to the management’s words during the latest earnings call, as DIS plans to offer a one-app experience domestically that incorporates Hulu content via Disney+, streamlining content offerings for subscribers and increasing advertising opportunities. They see significant potential in addressable and programmatic advertising, with over 40% of domestic advertising being addressable [a market size of ~$300 billion, according to Publift].

Another pillar for future top-line growth is the international parks, especially Shanghai Disney Resort and Hong Kong Disneyland, which have room for expansion and are expected to see further growth shortly. New attractions and lands, like Zootopia at Shanghai Disney Resort and Frozen-themed areas in Hong Kong Disneyland, are planned. Domestic parks are also enhancing the guest experience with pricing changes and new attractions like Reimagined Mickey’s Toontown at Disneyland and TRON Lightcycle Run at Walt Disney World.

Argus Research [proprietary source] analyst noted in its report that DIS implemented a major restructuring to cut expenses and resume dividend payments by the end of FY2023. The firm plans to cut $5.5 billion in expenses, including $2.5 billion in noncontent-related expenses. Content spending will remain around $30 billion in 2023, with a likely decline in 2024 due to spending cuts.

DIS is returning to the organizational and management structure that existed during Bob Iger’s earlier time as CEO. The new management structure includes two divisions: Disney Entertainment, responsible for the company’s global entertainment, media, and content businesses (including streaming and ESPN), and the Parks, Experiences, and Products division, which will remain unchanged. This restructuring gives more authority and financial responsibility to the creative content executives. Additionally, a new board committee dedicated to succession planning has been established, headed by incoming chairman Mark Parker, as the company plans for a smooth CEO transition after Bob Iger’s two-year term.

In general, I’m positive about the company’s future – recent events suggest that the company is unlikely to fare worse. The consensus on Wall Street agrees with me and expects the company’s financials to recover relatively quickly over the next few years:

![Seeking Alpha, DIS, Earnings Estimates [author's notes]](https://static.seekingalpha.com/uploads/2023/7/26/49513514-16903642252611673.png)

Seeking Alpha, DIS, Earnings Estimates [author’s notes]

Disney’s Valuation Analysis

First off, I propose to conduct a small comparative analysis of DIS with its main peers, among which I see the following companies:

-

Comcast Corporation (CMCSA): a global media and technology company that owns NBCUniversal that operates television networks, movie studios, theme parks, and cable networks;

-

Netflix Inc.: a leading streaming service that offers a vast library of TV shows, movies, and original content;

-

AT&T Inc. (T): owns WarnerMedia, which includes Warner Bros. Studios, HBO, and various television networks;

-

Sony Group Corporation (OTCPK:SNEJF): owns Sony Pictures Entertainment, a major movie studio, and also operates television networks and other entertainment businesses;

-

Amazon.com Inc. (AMZN): a global technology and e-commerce company that owns Amazon Prime Video, a popular streaming service;

- Warner Bros Discovery Inc. (WBD): ab entertainment company operating multiple different media brands.

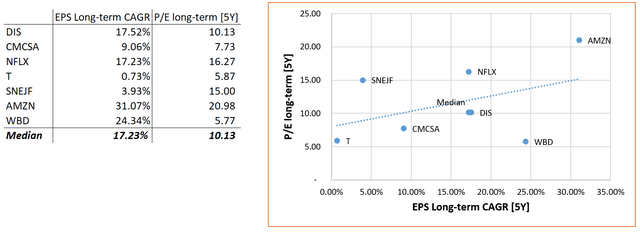

I suggest looking not at TTM multiples, as they’re skewed based on past results that no longer matter to Mr. Market, but at forward earnings and their growth rates. And let’s not look just at the next year, but 5 years ahead for more clarity:

Author’s work, based on SA and NASDAQ data

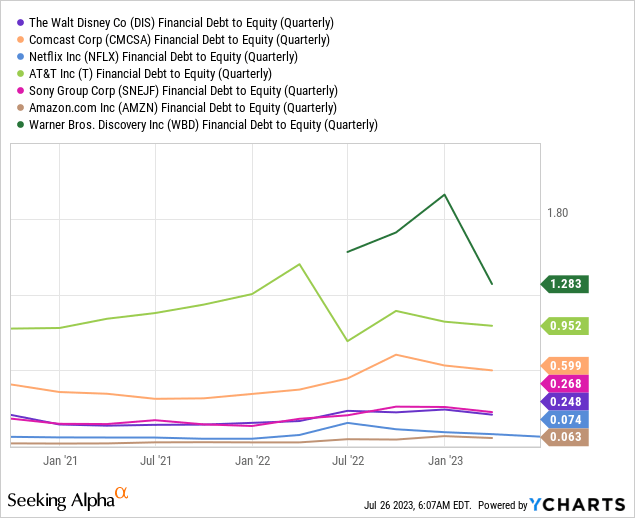

WBD proved to be the most undervalued company of the group under review – with a five-year price-to-earnings ratio of 5.77x, investors should receive >24% annualized EPS growth if the consensus numbers hold true. Why does this underestimation exist? I suspect it’s because the debt burden of WBD is the highest compared to others:

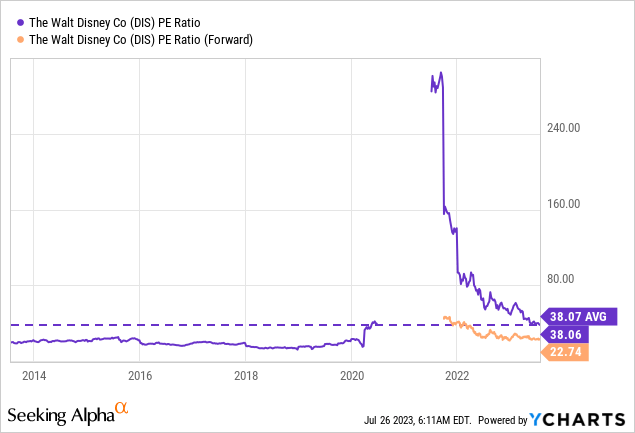

However, DIS doesn’t have a high debt level and therefore the company’s financial prospects are much clearer and deserve a premium to WBD. At the moment, the value of DIS is in the middle range, considering the long-term ratios mentioned above. At the same time, DIS’s P/E ratio for the next year is now in the pre-pandemic range in a historical context, which also points to the potential fairness of the company’s valuation today:

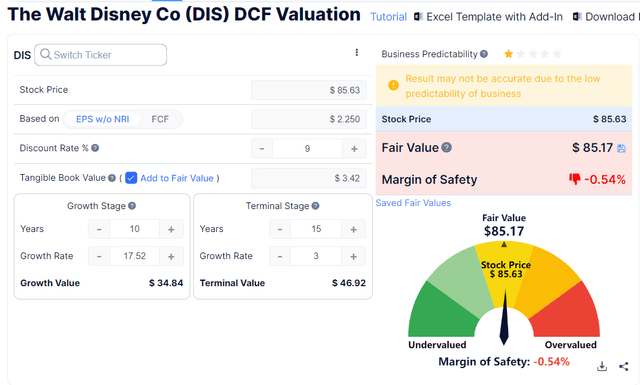

To test my hypothesis that DIS is now trading close to its fair value, I decided to perform DCF napkin calculations using the template from GuruFocus. Let’s assume that the TTM EPS will grow at a current implied growth rate of +17.23% [discussed above] for 10 years rather than 5, and the terminal value will see a 3% YoY growth in the post-forecast period for a 15-year period. Then with a WACC of 9%, the DIS share is fairly valued today – my hypothesis is confirmed under the given assumptions.

GuruFocus, author’s inputs

The prospects opening up for the company as a result of the cost-cutting measures and further DCT expansion must prove themselves in practice – it’s the first unexpectedly strong operating and financial results that DIS needs as a catalyst for its stock to rise from the ashes.

The Verdict

I titled my article with the word “catalyst” for a reason (I don’t think I need to explain why the word “mouse” is also in it). Even though the DIS stock has lost 3.75% of its value YTD while the S&P 500 Index (SPX) has risen ~19% over the same period, the company hasn’t become undervalued. Disney has only approached its fair value with a set of fairly optimistic assumptions, which I think is embarrassing – another earnings miss could send DIS noticeably lower. Still, I’m optimistic because I expect that the investments of the past few years will eventually help the company not only prove to Wall Street that the most interesting thing in this business is still ahead but also make it unexpectedly strong. In other words: I’m hoping for a strong catalyst – from management or the market – that will most likely drive the DIS stock price higher. And until that happens, I’m in no hurry to recommend DIS for purchase. In this case, it seems to me that buying after the fact is better than buying in advance.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!