Summary:

- The Walt Disney Company’s stock price has been on a roller coaster, and the worst could be ahead of us if it continues to disappoint.

- Disney underperforming the market, justified by financial performance and concentration risk in the market.

- Bearish view on Disney due to the economy cooling down, saturated content, intense competition in the streaming space, and overvaluation.

- I like the company, but not the stock, and will be taking a short position through far OTM put options.

Imgorthand/E+ via Getty Images

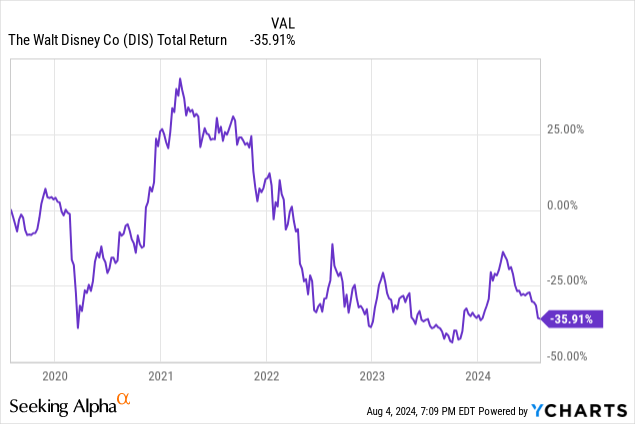

My thoughts on The Walt Disney Company (NYSE:DIS) have been more or less the same these last few years. The upside is limited and there is not much to look for. It has led me to miss the great rally that occurred in 2020-2021, but it has also prevented the grief that would have come with its steep drop of almost 50% from all-time highs that followed.

There was a time when I was bullish on Disney, which was when the Marvel universe was in its prime, I believed in its IP and its theme parks were a wonder (still is) and I felt the stock was severely undervalued. Not anymore. In fact, I feel the opposite and still feel quite bearish on the stock.

- The economy shows signs of cooling down, and theme parks are a discretionary spend which could be affected severely in a downturn.

- Marvel universe is saturated, and recent hits may not be enough to move the needle for the stock.

- Disney launched their streaming platform and there was much optimism due to the amount of IP/owned content being available on the platform. But the reality is that intense competition is being faced by the players in this space.

- Overvalued and the stock price could see a catch-up to its valuation.

Diving into my bearish view

Underperforming the market, but the bigger pain could be ahead

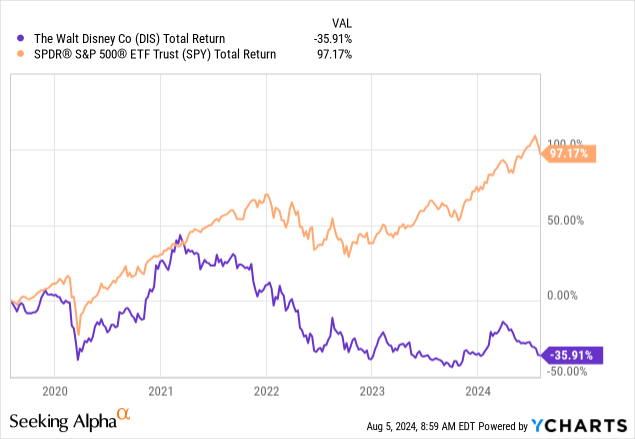

To balance my portfolio and mitigate big draw-downs, I am always in the hunt for uncorrelated assets. That doesn’t necessarily mean I ignore high beta assets. High beta assets can provide outsized returns and while Disney is high beta, (5Y Beta of 1.4) its overall performance against the index is lacking (Beta is a measure of its volatility or sensitivity to market movements. It quantifies the relationship between the stock’s returns and the returns of the overall market. A beta of 1 indicates that the stock moves in line with the market, while a beta greater than 1 suggests that the stock is more volatile than the market).

Comparison of the performance of Disney versus the index shows that Disney has heavily underperformed the index (Above chart shows 5 year performance, but its underperformance can be seen even on longer timeframes)

There are reasons for this –

- The market is increasingly driven by certain mega caps (Microsoft (MSFT), Nvidia (NVDA), etc.) whereas much of the other components of the S&P 500 have suffered.

- Concentration risk in the market is increasingly evident. The top 10 S&P500 companies now account for over 35% of the index’s market cap. I believe in many instances this could be justified.

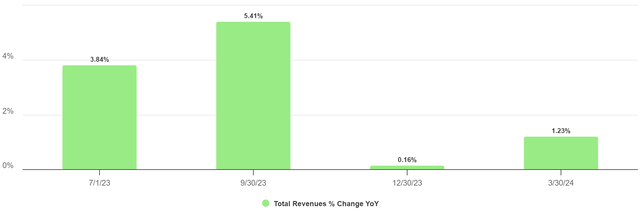

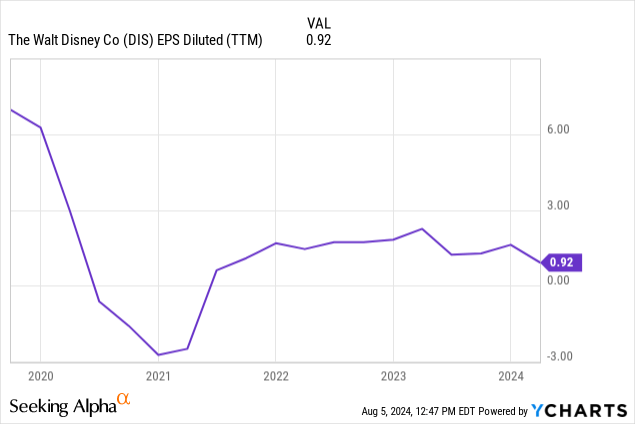

- In Disney’s instance, the underperformance is completely justified when looking at its financial performance. Revenue has stayed flat over the past two quarters, and Diluted EPS growth has been non-existent over several quarters.

Tikr

I believe this puts Disney in a delicate situation if we see more weakness in its business going forward. Its weakness against the index and my bearish view on the company means I see an opportunity to go short on Disney going forward.

An uncertain world and an uncertain future for Disney

Currently, the world is in the middle of one war, and it is increasingly looking like it will hurtle towards another one. There is also the looming threat of China finally making its advance on Taiwan, all of which can affect markets, which in turn cascades to individual names (Quantitatively we have already discussed this). But what about the economy itself?

- The Weakening labor market is considered the canary for a recession to be followed. Products that Disney offers, especially theme parks, are discretionary expenses that could be most vulnerable in an economic downturn.

- Government spending is largely supporting the GDP growth, and the United States is on an unsustainable fiscal path. Eventually, this will have to be reined in, which again will weigh on the economy.

Maybe none of these matters to the company as much as its strategy.

Disney has significantly ramped up its investment in streaming services, particularly with the launch of Disney+ in November 2019. This move was part of a broader strategy to compete with established players like Netflix, Amazon Prime Video, and newer entrants such as Apple TV+ and HBO Max. Despite the impressive subscriber numbers, Disney’s aggressive push into streaming has come with significant financial costs. The company has reported substantial losses due to high content spending and the initial low pricing strategy aimed at rapid subscriber acquisition. For instance, Disney has lost over $4B funding Disney+ since its launch. CEO Bob Iger has acknowledged that the focus on volume over quality led to financial strains, and the company is now working to balance content investment with profitability.

Now I am not saying Disney’s move into streaming was a bad call, but rather the return of investment or upside to the business is extremely limited from this segment due to competition.

Additionally, until recently, many of Disney’s movies were net money losers. It is indeed a welcome sign that its latest releases such as Deadpool and Wolverine and Inside Out 2 turned out to be winners, but again I am not sure how much it will move the needle for the company (Compared to the movies from Marvel universe at its prime I think the best times are behind us in the short term). So out of the main segments of Disney’s business (theme parks, movies, streaming, and TV) I see that the upside is limited in theme parks due to the economy, movies due to lack of consistent quality and streaming due to competition. And if recent news of job cuts in its TV segment is any indication, I would say Disney is still in the process of figuring out squeezing more returns from this segment. This again doesn’t help the stock price performance until the process is complete.

Disney’s upcoming quarter earnings do not inspire confidence

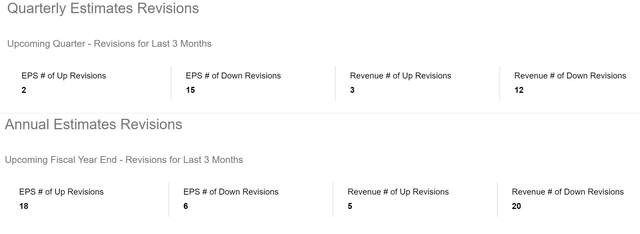

There could be some warning signs that earnings are headed down that lends credence to pessimistic scenarios. When you look at Disney’s earnings revisions for the coming quarter, the number of up revisions is only two for EPS and three for revenues, whereas the number of down revisions is 15 for EPS and 12 for revenues!

Recent issues raised by Wells Fargo regarding the current earnings season are concerning, which may well spill over to Disney.

2Q24 SPX earnings are coming in ahead of consensus, but the rate of sales beats is disappointing and consumer commentary has been mostly negative. When looking at large-caps 44% of the S&P 500 names have beat sales consensus estimates, which is well below the typical 60% rate. At the same time, small-caps, similar to large-caps are also beating less frequently on the top line.

– Wells Fargo’s Christopher Harvey.

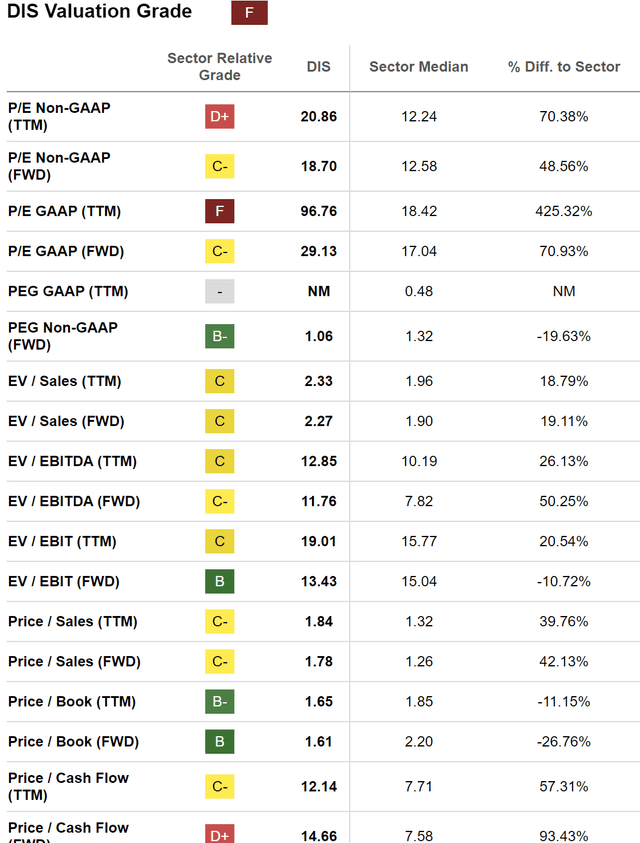

Valuation that needs to normalize

The current P/E ratio for Disney is 96x. The perceived high valuation was a byproduct of the COVID-19 period and has been taking some time to normalize. It is also related to its investments in theme parks and, most importantly, streaming, which squeezed margins and was discussed in a previous section. These could eventually pay off and forward valuations are therefore significantly compressed.

But in the event it takes a longer time than the markets expect it to pay off, we could see a further correction in its stock price. I believe this was also one of the key reasons for its ascension and eventual decline in the last few years. Disney’s foray into streaming and the initial growth in subscriber numbers caused the market to buy into its growth story with a hope that profits will follow. But when the results were not so straightforward, the skepticism started reflecting in its stock price.

Now my concern is, even if it starts delivering the results the market was looking for, it will be sometime before the valuation catches up with the stock, making the upside limited in the short to medium term.

Risks to this thesis

It has to be said that Disney is a giant in the entertainment industry, and it comes with a considerable moat. This company is not going anywhere and over the long term it will continue to exist and may be even thrive. Its parks are loved by many and, having been to one myself, I loved every minute of my time spent there. The content it owns and the way it has been able to leverage it has been impressive, all things considered. My thesis is purely on a short to medium term basis. I think Disney needs to find its ground in streaming, get back to producing great content consistently (like it has done so well before) and the current economy not favoring big dollar discretionary spends like going to one of their theme parks (I have to admit they are pricey!)

Action

I will be acting on my short term bearish view through the use of far out of the money put options. These options have the benefit of a big payoff if the stock undergoes a big correction in the upcoming months, but I will lose small if I am wrong. My previous bearish views on companies such as Nike have done extremely well, and this is a play along those lines.

While buying this, a few things of note –

- Deep OTM put options with at least 3 months to expiry have asymmetry but rely on high volatility or significant price correction to provide any real benefit (Payoff is significant in case my thesis works out and the price moves in my favor or implied volatility resets to a significantly higher value). I have exposure to contracts expiring on October 18 and Jan 17 at various strike prices ($70, $65, $60, $55). Payoffs vary depending on the premiums paid and the move of the stock. Far OTM puts can potentially generate 10x – 50x the investment.

- Sufficient Liquidity and volume to ensure the spread between bid and ask is reasonable

- 3. This strategy or modifications of this strategy (Ex: Shorter-dated puts such as September 20 expiry and closer strike price) could also work for individuals with significant long exposure to Disney or stocks exposed to the economy in general and who want to protect themselves from any short-term downside.

It has to be stressed, that the implied volatility is higher than usual as earnings are imminent (pre-market August 7) and market participants are expecting a move in the stock (up to 10% moves could be priced-in for earnings). So if the stock moves up due to a favorable reaction to earnings, does not react, or even moves down matching the expected move, the premiums paid to the options could lose their entire value.

This is a bet on the stock gapping down significantly post the earnings announcement OR the stock moving down below the strike price before expiry as a reaction to the market also moving lower OR volatility in the market cascading to individual names such as Disney.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.