Summary:

- Disney’s shares have hit a nine-year low, trading almost 60% below the all-time high.

- The company’s recent performance has been uneven, with declining profits and anemic growth in its media and entertainment segment.

- Disney may explore a potential deal with Amazon to better monetize its ESPN asset.

- However, the company’s valuation is still high considering its problems.

Wirestock

Article Thesis

Disney (NYSE:DIS) has seen its shares slump to a nine-year low, which is why it makes sense to take another look at the company. While the valuation has come down, it is not especially low, and due to the many problems and issues Disney faces, I continue to stay on the sidelines for now.

What Happened?

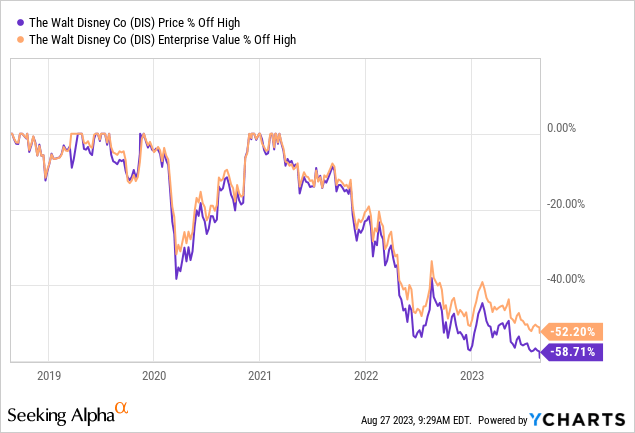

Disney’s shares have hit a new 9-year low last week, with shares trading at $83 at the time of writing. Shares have now slumped massively compared to where they traded just a couple of years ago:

Disney’s shares are now trading almost 60% below the all-time high, while the company’s enterprise value, which accounts for Disney’s market capitalization and its debt, has declined a little less. Still, even Disney’s EV is down quite a lot, suggesting it was way too high in the first place when there was a lot of hype about Disney’s streaming service during the pandemic — shares peaked in early 2021.

Since then, optimism about Disney’s streaming service has waned, financial conditions have become tighter, resulting in valuation compression for many stocks due to higher discount rates, while Disney also had some operational issues.

Disney’s Recent Performance

Disney reported its most recent quarterly earnings results earlier in August. The company missed revenue estimates and saw its sales grow by a meager 3.9%, while the company managed to beat earnings per share estimates. Still, earnings per share were down versus the previous year’s quarter, dropping from $1.09 to $1.03 after backing out one-time items. Declining profits are, of course, bad, and considering that Disney is not trading at a low valuation, the market and investors weren’t happy with the meager sales growth and declining profitability.

The performance across Disney’s different business units has been very uneven in the recent past. The company’s parks and resorts business, which is capital-intensive but where it has a huge moat, has been performing very well so far in 2023. The unit generated sales growth of 13% during the most recent quarter, relative to the previous year’s quarter. That was the best growth rate among all Disney business units. Even better, the unit is highly profitable, generating an operating income of $2.4 billion with an attractive 29% operating margin. In contrast, the remainder of Disney grew a lot less and generated an operating income margin of just 8%, which can hardly be described as attractive. The compelling revenue growth in the parks business was partially driven by substantial price increases — that works well so far, but it remains to be seen whether Disney will be able to push up prices further and further without a negative demand reaction. Especially during a potential recession, which some analysts and market watchers expect in the coming quarters, the parks business could see lower demand and might stop growing at a rate that is comparable to what we have seen in the recent past. Still, at least for now, the parks business is doing fine, and is the Disney unit investors don’t have to worry about.

The media and entertainment distribution unit, however, is indeed a unit investors have to worry about. While the unit still generated around $1 billion of operating profit during the most recent quarter, or around $4 billion annualized, growth is anemic and margins are declining. That’s a toxic combination for profits. When we consider the debt that Disney has taken on to pay for the Fox acquisition and the related interest expenses, the actual net profits of the media and entertainment distribution unit are even lower than the operating income metric suggests.

Disney’s weak performance in the media and entertainment segment has several factors, one of them being the meager growth rate of Disney+ in the recent past. A couple of years ago, when the service was rolled out, many investors expected faster growth. It is important to note that Disney+ is not the only streaming service that is not growing at an attractive pace — instead, it looks like consumers are not too eager to add new subscriptions overall. A harsher economic environment possibly plays a role, but streaming “fatigue” could be a factor for that as well. During the most recent quarter, Disney+ grew its subscriber base by 1% on a Core basis, while the performance was even worse when we also account for Hotstar. A 1% quarterly growth rate is not really what investors were expecting when Disney+ was introduced. Of course, price increases will allow Disney to grow its revenue in this unit faster compared to the subscriber growth rate, but even when we account for that, growth will likely not be especially strong in the near term.

Other media units are having problems as well: ESPN+ is losing money (like Disney+) and has experienced a decline in subscribers over the last quarter. Disney also hasn’t been too successful with movies at the box office this year, with movies such as Indiana Jones and the Dial of Destiny or Ant-Man and the Wasp: Quantumania underperforming expectations. In contrast, other studios and companies have had a lot of success with movies such as Barbie from Warner Bros. Discovery, Inc. (WBD) or Super Mario Bros. Movie from Comcast (CMCSA). While Disney has been ruling the box office for quite some time, it seems to have lost its appeal to some degree, as other companies seem to perform better when it comes to creating content that audiences love.

Potential Amazon Deal

Due to Disney struggling in some areas, management has become more open to strategic action such as asset sales, joint ventures with other companies to boost growth, and so on. One such potential deal could see Disney work together with Amazon (AMZN) in order to bring a sports-focused streaming business online that could benefit from the broad reach of Amazon. Disney’s own ESPN+ is, as noted above, struggling due to weak growth and not being profitable. But since ESPN has a strong brand and since it also has valuable content, a better sports streaming service definitely seems possible — if Disney can get there with the help of Amazon, that could work out well for both companies. An outright sale of ESPN could work out for Disney as well, as this would help the company focus on other businesses while the proceeds could be used to pay down debt. But management has stated that it will likely not sell ESPN outright, thus strategic cooperation with a company such as Amazon (and the sale of a stake in ESPN) seems more likely for now. Either way, acting here is a good thing, which is why it is positive that management seems to be willing to do something.

Disney: Too Expensive Considering Its Problems

The share price slump has made Disney less expensive, but that does not mean that it is cheap. In fact, Disney still trades at 23x forward net profits. For a company with negative profit growth and rather unconvincing sales growth (a little below 4% during the most recent quarter), that is a rather high valuation, I believe. Disney could come under pressure in a potential recession, as consumers would likely cut back on discretionary purchases such as cinema tickets and amusement park visits. Also, Disney’s debt will become more expensive over time due to rising interest rates unless the company puts significant sums of money towards debt reduction. There is still no dividend, and due to the profitability issues, it remains to be seen when and if the dividend is reinstated.

All in all, Disney has too many problems right now for me to buy it at more than 20x net profits. While the company has some very strong brands and great IP, it is not monetizing these assets in a great way right now. Until the company either turns around its business successfully or becomes significantly cheaper, I will stay on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!