Summary:

- The Walt Disney Company CEO Bob Iger is back for a second term, promising stability and profitability, but the company’s stock has fallen 10% since his return.

- Disney’s market capitalization has dropped from $350 billion to around $150 billion today.

- Iger has suggested selling “non-core” assets such as ABC and FX networks, which could add to Disney’s $10 billion cash pile and create a tailwind for future profits.

JHVEPhoto/iStock Editorial via Getty Images

Is The Mouse Back…?

The Walt Disney Company (NYSE:DIS) has never been a company to fly under the radar–the struggles of the company’s leadership have been documented for decades through various leadership regimes (Exhibit A: James B Stewart’s excellent book, “Disney War“). But the company has seemingly never faced a crisis quite like the one it does today.

We won’t rehash the whole saga here, as it is surely known to most readers, but current CEO Bob Iger has returned for his second term at the helm after replacing Bob Chapek, who was Iger’s own replacement after departing the company for the first time.

The company was embroiled in many issues then, and remains so. Iger, however, promised a return to the olden days: to stability, profitability, and (investors hoped) a dividend.

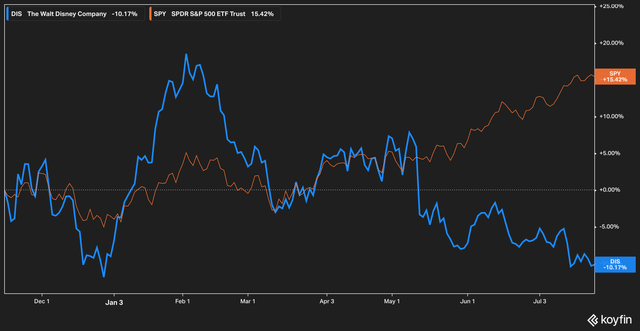

The market has not reacted so well, however, since Iger’s return.

In the time since Iger has returned to the big seat, the stock has fallen 10%, while the broader S&P 500 Index (SP500) has returned 15% to investors.

Big ships, however, don’t turn on a dime, and while some may liken Iger to the arsonist who returns to put out a fire, we believe that the market has likely overreacted to the downside. We intend to spell out why we think so in this article.

Let’s dive in.

What Is Disney Worth?

Let’s start with a value question. Disney is obviously a complex media company with a sprawling, worldwide operation. But let’s start with some basics.

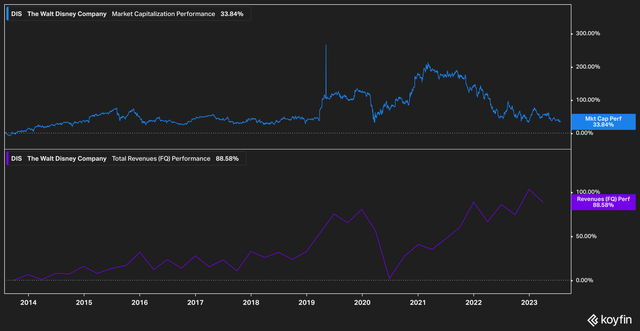

Disney has seen its market capitalization shaved over the last few years, from a high of around $350 billion to just around $150 billion today. Today, Disney’s market capitalization is only 33% higher than it was ten years ago (see chart above, blue line). Compare this with Disney’s top line revenues, which have grown 88% over the same period (see chart above, purple line).

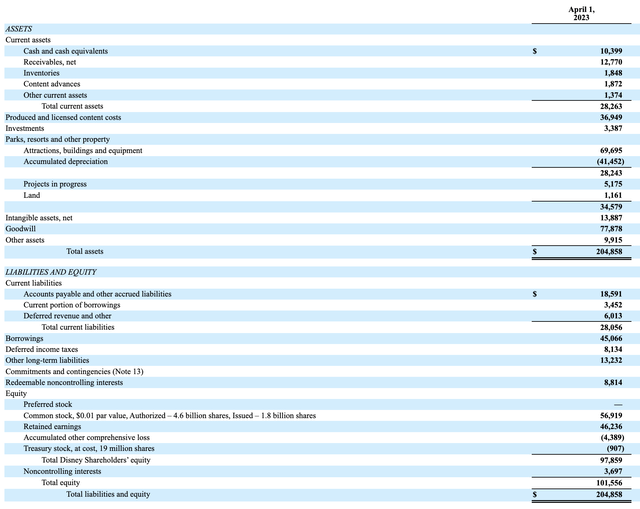

Next, let’s assess Disney’s balance sheet (image below from latest quarterly filing, excluding the prior years balance sheet data).

Disney posted total assets of $204 billion for the quarter ending April 1, 2023 and $101 billion in total equity.

We note that while Disney has depreciated its ‘Parks, resorts and other property’ line item by $41 billion, it almost defies imagination in our mind that a sale of the venerable Disney properties (including Disneyland, Disney World, the partnerships in Disney Hong Kong, Disney Cruises, etc.) would result in proceeds of only $28 billion. Thus, it makes sense in our mind to back out a bit of depreciation, which is essentially being recorded for tax purposes rather than for use in a market value estimate. Indeed, companies are highly incentivized to minimize the estimated values of its assets when not seeking a sale.

Adding back this depreciation from parks alone would boost shareholder equity to north of $130 billion, or the vast majority of Disney’s current market capitalization. Of course, this is theoretical–Disney isn’t pursuing a sale of its business. But it seems clear to us that Disney’s current market capitalization seems low based on even a rough estimate of the company’s sale value.

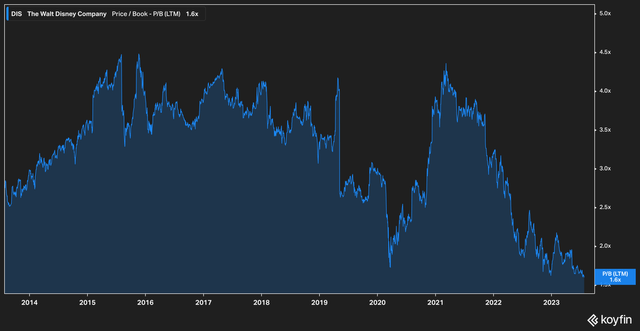

To this end, we note that while book value has generally fallen out of favor with investors as a way to value non-banking companies, Disney’s price to book is currently plumbing ten-year lows.

Valuation & Possible Divestitures

To counter this, Disney bears may point out that Disney is not cheap on a forward valuation basis.

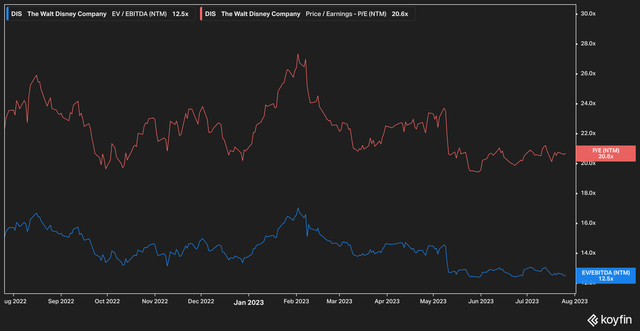

Indeed, we submit, it does not seem particularly cheap (the above chart depicts a one-year time frame–moving out much further than that reveals a somewhat useless chart where Disney traded at a P/E multiple in the hundreds owning to the pandemic). Today, Disney trades at 20x forward earnings, and 12x EV/EBITDA.

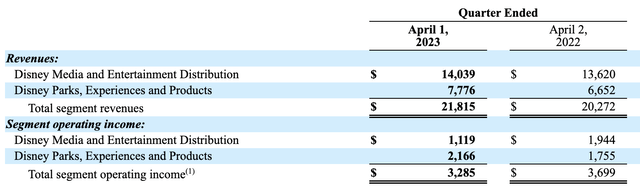

The reason for this seeming expensiveness is that Disney has struggled with its streaming and television operations. Consider the company’s revenue by segment and operating income by segment for the second quarter.

The Disney Media and Entertainment Distribution [DMED] segment–which operates everything outside of parks, such as movie distribution, streaming, etc.–generated $14 billion in the second quarter, yet produced only $1.1 billion in operating income, representing an operating margin of only 8%, while the parks segment posted an operating margin of 27%.

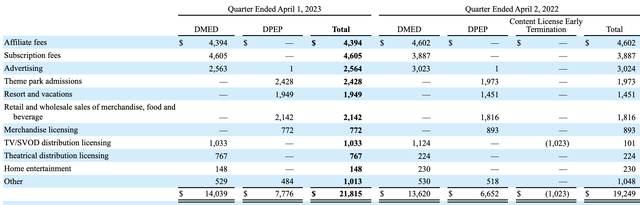

Digging in under the hood of DMED reveals that while the segment posted growth, key business units posted losses.

While subscription fees and theatrical distribution licensing grew year over year, every other unit with DMED posted declines in revenue. Advertising fell by roughly $500 million, while TV/SVOD revenue declined almost $100 million.

Investors rightly reacted with excitement, then, when Iger floated the possibility of divesting assets deemed “non-core” to Disney’s business, such as the ABC and FX networks, while also potentially seeking a partnership for ESPN as the company looks to capitalize on a subscription service model.

Selling these assets–which, again, are going downhill quickly and creating a drag on Disney’s bottom line–would add to Disney’s already ample cash pile of $10 billion and immediately create a tailwind for future profits. Such a move would also generate a downward re-rating of the company’s forward earnings ratio.

The Bottom Line

Iger’s contract was recently extended until 2026 by the board. While some may view this as a negative–an extension of business-as-usual at Disney–we view it as a commitment to a turnaround effort and thoughtful consideration of succession planning, especially in the wake of the disastrous Chapek regime.

The seeming willingness of The Walt Disney Company to explore the sale of underperforming assets is also a positive sign, as executives of multi-billion dollar corporations don’t typically float such questions in public unless things are quite serious. Further, we note that Disney’s market capitalization has fallen to the point where the company trades at ten-year lows on a price to book basis. For these reasons, we think Disney today presents a compelling opportunity for investors to evaluate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.