Summary:

- Disney’s Q2 revenue fell short of expectations, but adjusted profits exceeded forecasts.

- The company saw strong growth in Disney+ subscribers, but a decline in ESPN+ subscribers and only modest growth at Hulu.

- Theme parks and related assets performed well, with increased attendance and revenue, while most other core parts of the business grew as well.

- Shares look attractively priced based on current guidance, especially for such a high-quality business.

Wirestock

Things could have gone better for entertainment behemoth Disney (NYSE:DIS) on May 7. Before the market opened, management announced financial results covering the second quarter of the company’s 2024 fiscal year. Results ended up being mixed with revenue falling short of expectations but adjusted profits exceeding forecasts. Although the revenue picture was somewhat disappointing, the company performed quite well by almost every other metric. The only other weak spots that I noticed involved streaming service ESPN+ and the firm’s theatrical distribution operations. On the whole, however, management posted some robust data points that show that this truly is a best of breed opportunity.

This doesn’t mean that things will turn out the way we want them to in the short term. Anybody getting into the picture should be doing so from a long-term perspective. The fact of the matter is that Disney continues to cut costs, reduce debt, and is buying back stock. Cash flows are slated to come in strong this year, while key parts of the business thrive. It’s for these reasons that, just like when I wrote about the company earlier this year in articles here and here, I’m reiterating the “strong buy” rating I assigned at the time. In fact, as difficult as it is to get more optimistic than the “strong buy” rating I already have for the business, I must say that the discount shares now seem to be trading at presently boost my optimism about the ability to do well, as a shareholder, moving forward.

Touching on headline news

Author – SEC EDGAR Data

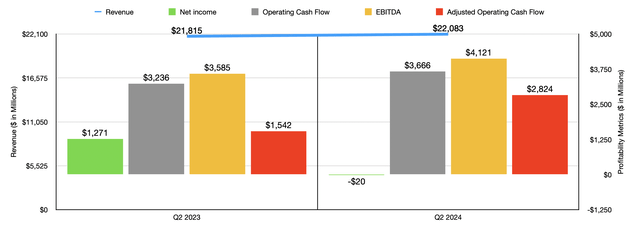

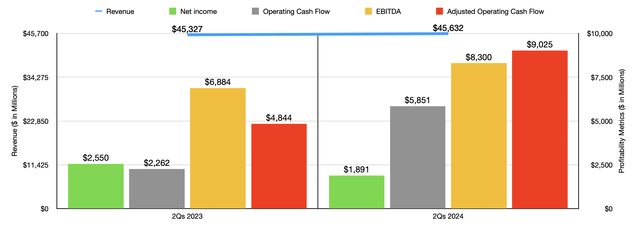

Before we get into some of the more exciting data points, we should touch on the headline news. Most notably, revenue and earnings. During the quarter, revenue totaled $22.08 billion. This was 1.2% above the $21.82 billion in revenue generated one year earlier. Despite the increase, the number reported by management actually came in $58.9 million lower than what analysts were expecting. On the bottom line, the picture was somewhat different. Earnings per share came in negative to the tune of $0.01. That compared to the $0.69 per share profit generated in the second quarter of 2023. This was, however, largely driven by $2.04 billion worth of goodwill impairments. On an adjusted basis, earnings came in at $1.21. That was actually $0.10 per share above what analysts were hoping for.

Author – SEC EDGAR Data

There are other profitability metrics that investors should be paying attention to. The most important ones, in my opinion, have to do with operating cash flow. Operating cash flow on its own rose from $3.24 billion to $3.67 billion. If we adjust for changes in working capital, however, it rose from a smaller base of $1.54 billion to $2.82 billion. Meanwhile, EBITDA for the company increased from $3.59 billion to $4.12 billion. In the chart above, you can see results covering the first half of 2023 relative to the same time of 2022. Revenue, as well as every cash flow metric I looked at, performed better on a year-over-year basis. In fact, the improvement was substantial. The only weak spot involved earnings. But, once again, that’s because of the large goodwill impairment that the company contended with.

Digging deeper

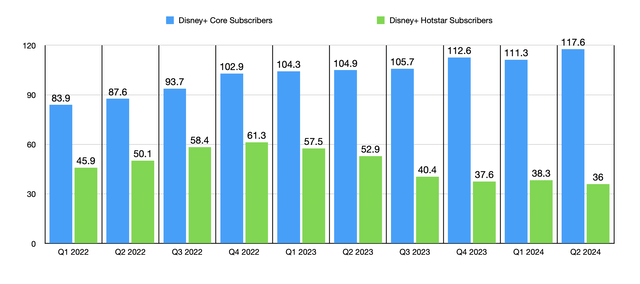

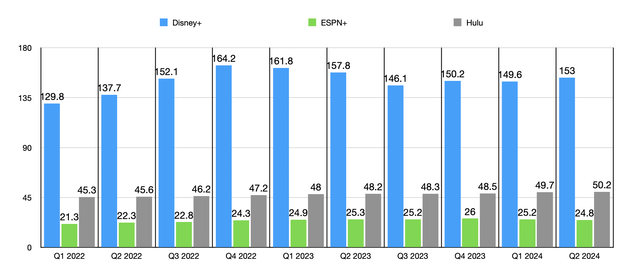

If we were to judge Disney’s quarter solely based off of these headline news items, I would say that the picture was certainly solid, though not ideal. We need to see more revenue growth moving forward. On the other hand, when you dig deeper, you see that the picture is even better than it initially appears. As always, I like to emphasize the streaming operations that the company has. The number of Disney+ subscribers grew to 153 million during the second quarter of 2024. That’s an increase of 3.4 million compared to the 149.6 million reported one quarter earlier. But it stacked up poorly against the 157.8 million reported in the second quarter of 2023.

Author – SEC EDGAR Data

While this may seem concerning, we need to remember that the company has been seeing significant declines in low value subscribers associated with its Hotstar brand in India. Year over year, the number of Disney+ subscribers dropped from 52.9 million to 36 million. I call these low value because, during the most recent quarter, they were only responsible for $0.70 per month worth of revenue apiece. In fact, the increase in pricing from $0.59 per month resulted in only about $6 million in missed revenue on a monthly basis despite the drop coming in at an astounding 31.9%. If we ignore these subscribers, the number of Disney+ subscribers jumped by 12.1% year-over-year, rising from 104.9 million to 117.6 million. The company also benefited from higher average pricing of $7.28 per month compared to the $6.47 per month reported one year earlier. Using the number of core subscribers the company had as of the end of the most recent quarter, this increase in pricing of $0.81 per month translates to an additional $1.14 billion in revenue for the company annually.

Author – SEC EDGAR Data

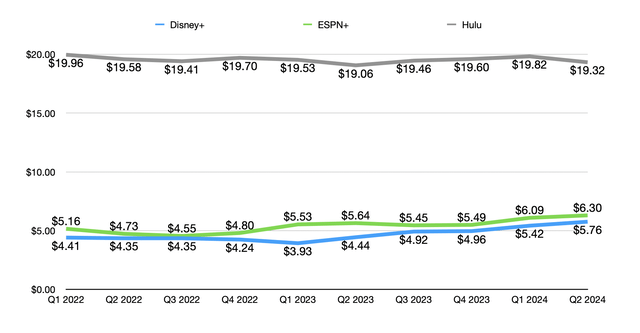

I would call this result a win. It’s also worth noting that the company continues to see modest growth from Hulu. The number of subscribers in the most recent quarter hit 50.2 million. That’s up from the 49.7 million reported just three months earlier, and it compares nicely to the 48.2 million reported the same time last year. Pricing also continues to increase, with SVOD only subscribers seeing an increase from $11.73 per month to $11.84, while Live TV + SVOD subscribers saw an increase from $92.32 per month to $95.01 per month. On a weighted-average basis, Hulu subscribers paid $19.32 per month, which was up slightly from the $19.06 per month seen one year earlier.

Author – SEC EDGAR Data

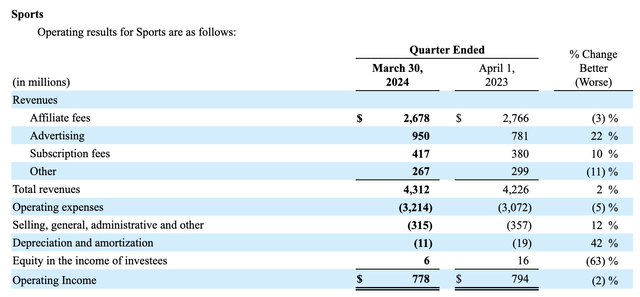

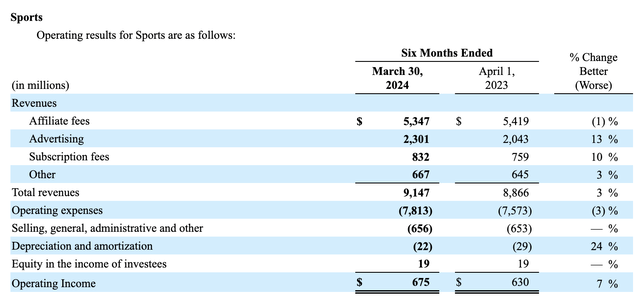

The real weakness when it came to streaming involved ESPN+. The 24.8 million subscribers that the service had was lower than the 25.2 million reported three months earlier, and it was down from the 25.3 million reported the same time last year. This is likely in response to increased competition, combined with the effects of higher pricing. Average monthly revenue per paid subscriber grew from $5.64 last year to $6.30 this year. Despite the weakness from these subscriber figures, the overall Sports business is showing modest growth, with revenue climbing from $4.23 billion last year to $4.31 billion this year. While affiliate fees and other miscellaneous revenue has fallen, subscription fees associated with ESPN+ and other offerings, as well as advertising revenue, managed to grow year over year.

Disney

Disney

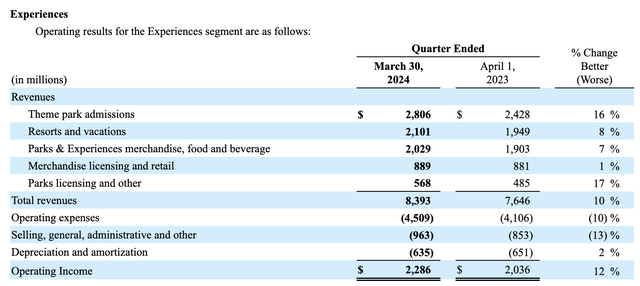

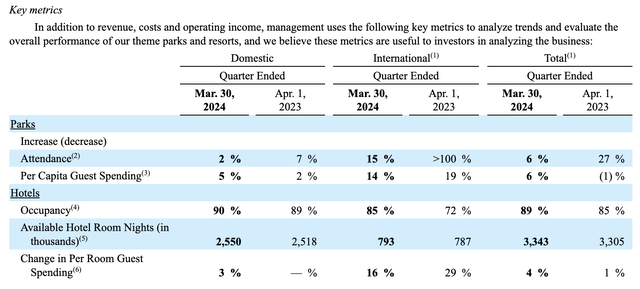

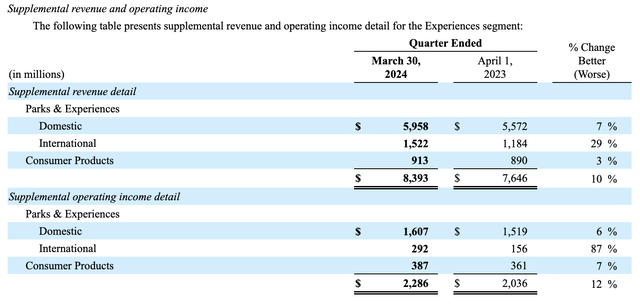

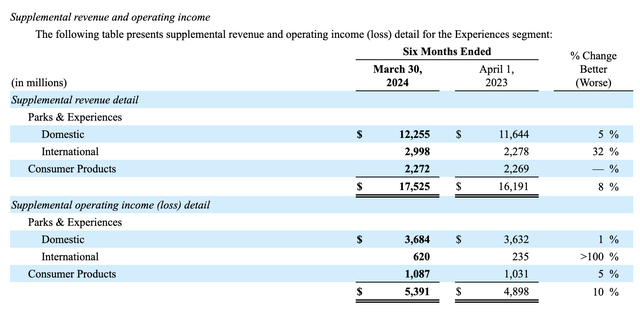

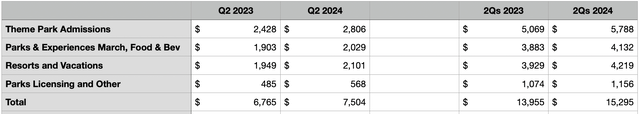

Moving beyond streaming, there were other parts of the business that deserve attention. One of my favorite parts to focus on involves the theme parks and other related assets that the company has. Revenue for the most recent quarter involving theme park admissions jumped to $2.81 billion. That’s an increase of 15.6% compared to the $2.43 billion reported one year earlier. Despite having a 12% rise in average per capita ticket revenue, the company still benefited from a 4% increase in attendance. Most of the growth here came from international parks. However, on the domestic front, the Disneyland Resort saw a rise as well.

Disney

Disney

Disney

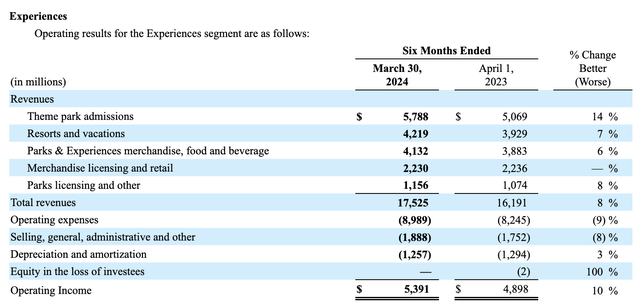

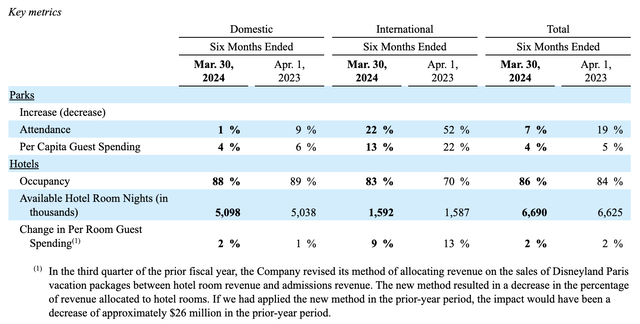

There are other parts of the company that involve these types of assets that deserve attention. Resorts and vacations revenue, for instance, rose from $1.95 billion to $2.10 billion. A 2% rise in hotel occupancy, and a 2% increase in the average daily hotel room rates, not to mention a 5% rise in ticket prices for cruise line sailings, proved to be valuable in pushing these sales up. Parks and experiences merchandise, food, and beverages, saw a 6.6% increase in revenue from $1.90 billion to $2.03 billion. And parks licensing and other related revenue shot up 17.1% from $485 million to $568 million. Thanks to these increases, and in spite of higher costs, operating income involving these operations rose from $2.04 billion to $2.29 billion. You can also see in the data how this continues a trend, with results for the first half of 2024 coming in stronger than the first half of last year.

Disney

Disney

Disney

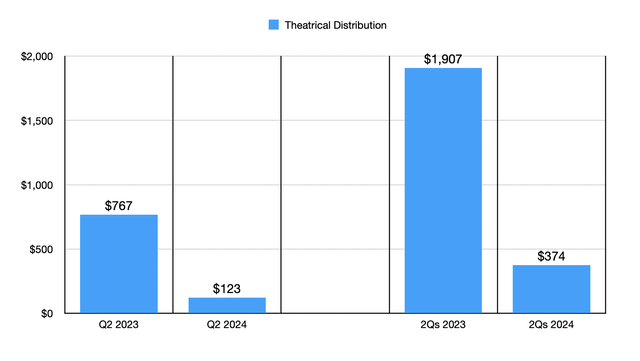

There definitely were some weak spots when it came to various operations of the company. For instance, TV/VOD distribution revenue plunged from $790 million to $470 million. This was due to a reduction in the sale of episodic content. But the only thing that really worried me was on the theatrical distribution side. Revenue of $123 million paled in comparison to the $767 million reported one year earlier. Management attributed this weakness to the fact that, in their own words, “there were no significant titles released” during that quarter. By comparison, the year prior, the company had benefited from the launch of Ant-Man And The Wasp: Quantumania, as well as the continued benefit from Avatar: The Way of Water. In the short term, I expect this kind of trend to continue. But as I wrote about in another article, this year will probably be the last in which movie theater revenue, generally speaking, will be weak.

Author – SEC EDGAR Data

Despite these problems, the good definitely overshadowed the bad. For instance, management forecasted that earnings per share this year will rise by 25% compared to the year prior. In addition to this, they’re anticipating operating cash flow of around $14 billion or more. This would be a massive improvement over the $9.87 billion reported for 2023. It would also likely translate to EBITDA of around $20.86 billion. With the firm’s spending plan, free cash flow should be around $8 billion. And management is making sure to put the capital generated already to good use.

Author – SEC EDGAR Data

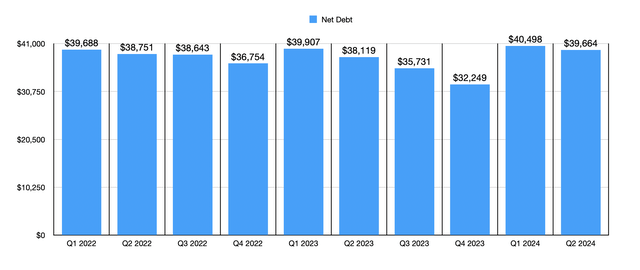

During the second quarter alone, the company repurchased $1 billion worth of shares. In addition to this, they reduced net debt from $40.50 billion to $39.66 billion. That’s a decrease of $834 million in just a three-month window. If management does come through on guidance, shares also look attractively priced, with the company trading at a forward price to adjusted operating cash flow multiple of 13.8 and at a forward EV to EBITDA multiple of 11.4. For such a high-quality company, this is bargain territory.

Author – SEC EDGAR Data

Takeaway

Was this a perfect quarter for Disney? Most certainly not. However, the data provided by management is very promising. Cash flows are particularly strong and the company continues to put that capital to good use. Shares look attractively priced at current levels, and I suspect the long-term outlook for the company will only continue to improve. Given these factors, I see this as a great buying opportunity for those who are as bullish on the company as I am. I would personally be adding more if it weren’t for the fact that I am currently all tapped out. But with 11% of my investment portfolio already tied up in the stock, at an average price that’s comfortably below where we are today, I’m not complaining. I am, however, reiterating the “strong buy” rating I assigned the firm previously.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!