Summary:

- Walt Disney Company stock has outperformed the S&P 500 since my previous update, as the Magic Kingdom has rediscovered its winning touch.

- Disney’s ability to rationalize costs and focus on achieving streaming profitability has boosted investor confidence.

- The recent joint venture with Fox and Warner in sports streaming showcases Disney’s ability to unlock growth opportunities from its existing world-class assets.

- Disney’s DTC transformation is tracking well, as it rationalizes content spending to improve profitability.

- I explain why the market hasn’t been optimistic enough about Disney’s ability to recover. DIS’s FY26 earnings multiple remains valued at a relative discount to its long-term average.

Razvan

Investors in the House of Mickey Mouse have done remarkably well, as The Walt Disney Company (NYSE:DIS) stock has outperformed the S&P 500 (SPX) (SPY) since my last article in early December 2023. While I lowered my rating to a Hold/Neutral, I also highlighted that investors should capitalize on potential dips to add more exposure.

Accordingly, DIS pulled back through its January 2024 lows and hasn’t looked back. As a result, DIS has surged nearly 30% through last week’s highs at the $115 level. Disney investors who suffered the post-pandemic meltdown but held on to their conviction likely felt vindicated. In addition, dip buyers who ignored DIS’s peak pessimism in late 2023 and bought aggressively have been rewarded for their contrarian conviction.

Disney is a world-class company with global assets spanning Linear TV, streaming, consumer products, and theme parks. While it still needs to manage the secular decline attributed to its Linear TV assets, Disney has demonstrated its ability to rationalize costs while remaining on track for streaming segment profitability.

In addition, Disney management remains confident in its theme parks business, flexing its muscles to monetize its IP on its highly profitable parks and experiences assets. As a result, the company’s solid performance for Disney’s first fiscal quarter likely corroborated the market’s confidence in its ongoing recovery.

At a recent conference, Disney CEO Bob Iger elucidated why Disney intends to close the gap on streaming leader Netflix’s (NFLX) technological lead. As Disney moves closer to reaching sustainable profitability in its direct-to-consumer segment by the fourth fiscal quarter, it should bolster Disney’s ability to invest. In addition, Disney has committed to meeting or exceeding its targeted $7.5B in annualized cost savings by the end of FY24, lifting its margins.

The recent joint venture with Fox (FOX) and Warner Bros. Discovery (WBD) to create a leading sports streaming platform showcases Disney’s ability to expand its growth vectors and monetize its assets. While there are valid concerns about whether it could hurt Disney’s existing portfolio given the pricing uncertainties, the market doesn’t seem unduly concerned. In contrast, the market appears confident that the platform could extend the competitive edge of Disney and its peers. The negative response from fuboTV (FUBO) underscored the potentially imminent threat that could shake up the sports streaming market if regulators cleared it.

Analysts’ estimates are highly favorable for Disney’s capability to continue recovering its highly prized profitability. Seeking Alpha Quant rates DIS with an “A+” profitability grade, underscoring Disney’s fundamentally strong moat.

Wall Street expects Disney to deliver a 4Y adjusted EPS CAGR of 14.3% from its FY22 base. DIS is valued at an FY26 adjusted EPS multiple of 18.3x, well below its 10Y average of 32.4x. Therefore, I assessed that the market remains relatively pessimistic over Disney’s long-term prospects, possibly baking in execution risks relating to its DTC transformation amid a secular decline in Disney’s Linear TV business. In other words, investors confident of a further recovery in Disney’s ability to leverage the growth vectors enunciated earlier should consider capitalizing.

Is DIS Stock A Buy, Sell, Or Hold?

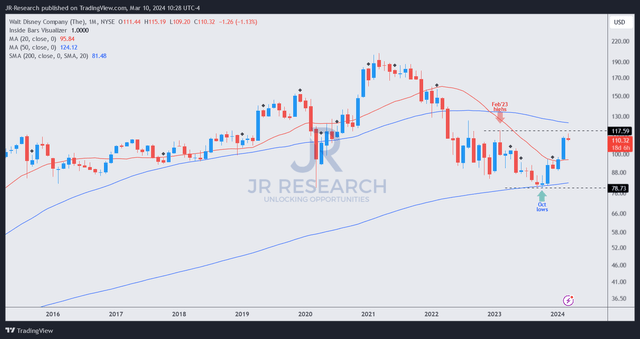

DIS price chart (monthly, long-term, adjusted for dividends) (TradingView)

As seen above, DIS’s price action suggests its long-term bottom in October 2023 at the $80 level has remained robust. I gleaned selling pressure this month as DIS buyers attempted to clear the $115 level.

I’m not surprised that we could see downside volatility, as some dip buyers could have leveraged the recent outperformance to take profits and reallocate. However, DIS remains well below its pandemic highs, and its valuation has not been assessed as aggressive.

With Disney tracking confidently toward DTC profitability by CY2025, it should further improve DIS’s buying sentiments. Long-term investments in its theme parks should also enhance Disney’s ability to mitigate the structurally weaker Linear TV assets, as it likely affected the market’s perception of their valuation. However, investors must remember that Disney possesses a range of world-class assets at its disposal, allowing it to creatively unlock near- and long-term opportunities to mitigate the secular decline.

As I expect DIS to retake the $115 level after the anticipated consolidation decisively, I’m ready to upgrade my rating to reflect my bullish sentiments.

Rating: Upgrade to Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!