Summary:

- After a 50% drop in share pricing since early 2021, a brighter investment future may be close at hand for forward-thinking investors.

- Rehired CEO Bob Iger is looking into asset sales/partnerships to reduce Disney’s $45 billion debt load, including selling ESPN ownership interests to major sports leagues.

- Estimated valuation stats 12-18 months into the future are slowly moving into undervalued territory vs. Disney’s historical trading.

- I am upgrading DIS to Buy at $86, with a Strong Buy setting at $75. Total returns of +15% to +20% annually over the next 3-5 years are possible.

Drew Angerer

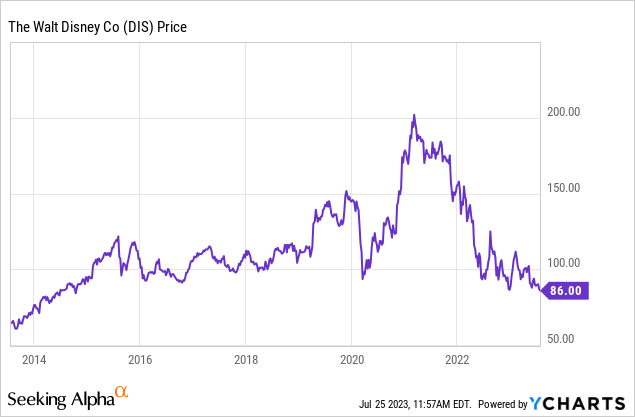

I have been correctly bearish on Walt Disney (NYSE:DIS) as an investment suggestion in my articles for several years. The pandemic drop in movie spending and vacation travel by consumers did not match well with excessive debts. Measured from my story written in January 2021 here, when I turned negative on the stock, its share price has tumbled by almost -50%. At $86 today, the share quote is basically back to early 2015 levels.

YCharts – Disney, Weekly Share Price, 10 Years

Of course, with an economy nearing recession in the middle of 2023 (hurting attendance at theme parks this summer), the streaming content wars at a fever pitch (leaving Disney+/Hulu struggling for profitability), and the Governor DeSantis political mess in Florida bringing the company rotten press almost daily for over a year, it’s no wonder both Wall Street and retail investors in general are jittery about owning this leading media brand (by sales and name recognition).

But, I am going to say – all is not lost. In fact, a brighter future may be close at hand, if you are a forward thinker and contrarian investor willing to buy when others are selling.

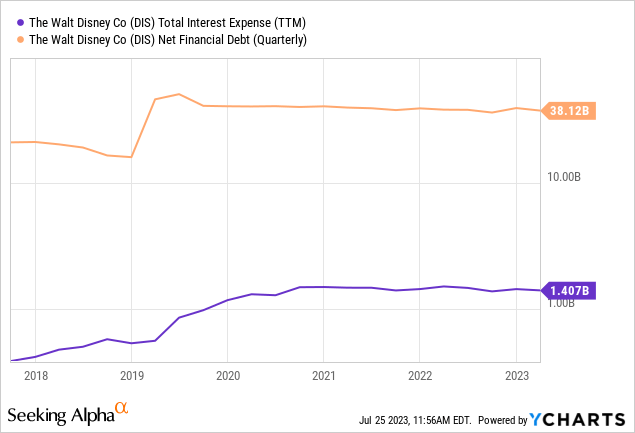

Sure, the company has a tough row ahead to reduce $45 billion in debt ($38 billion net debt) to more reasonable levels. The ill-timed Fox content deal, closed in 2019, is squarely to blame for Disney’s exaggerated woes since 2021. The company piled on a debt load at exactly the worst moment for movie and theme park attendance, going into the pandemic situation months later. Interest expense rose from almost nothing in 2017 to around $1.5 billion annually during 2020-23.

YCharts – Disney, Net Financial Debt & Trailing Annual Interest Expense, 7 Years

Plus, I am worried an eventual recession could keep a lid on operating results again next year. In addition, it may take a few years for Floridians to realize Disney’s assets, tourism draw, tax receipts, and jobs provided are far more important to the state’s long-term health than DeSantis’ immediate political ambitions.

Rehired CEO Bob Iger has been looking into asset sales to reduce debt, which I applaud. Perhaps the smartest capital-raise idea I have read the last couple of months is through selling pieces of ESPN ownership to the major sports leagues, as a way to raise cash without totally giving away inflation upside. I do like this concept best, as the sports network has not really grown in many years. If Disney can keep operational control while raising $5 to $10 billion, great.

I really would be careful dumping assets completely, as the vertical integration of the media/vacation businesses is the real-world, money-making advantage Disney has over competitors. My view is a serious dose of patience, alongside a plan of regular share purchases under $90 over the next 12 months (cost-average approach), may be the strongest risk/reward way to build a position. I personally would become more aggressive if price falls under $80.

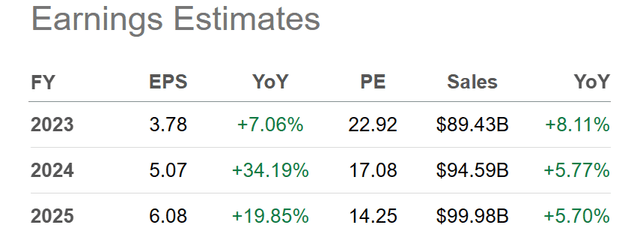

Current Wall Street estimates of nearly $4 in EPS for this year, and $6 by 2025 seem reasonable to me as inflation works its magic at the movie theater and amusement parks, while debt expense is whittled down on asset sales/partnerships and day-to-day income generation.

Seeking Alpha Table – Disney, Analysts Estimates for 2023-25, Made July 24th, 2023

The Bullish Argument

Buying Disney stock today is a conviction bet on the “future” of Mickey & Co. If you believe the company is too “woke” (I am still confused about what that means exactly, outside of a Twitter-esque, one-line zinger to degrade somebody), or a deep prolonged recession is next, please move on to other investment names. I fully understand if you do not want to support or profit from a single company or another. I can be that way also, when valuing an investment.

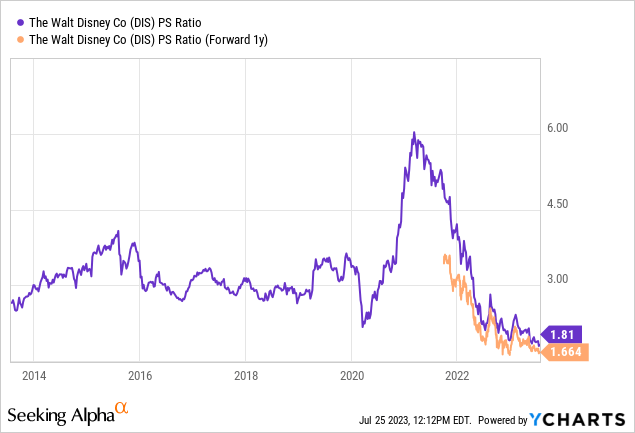

However, the facts (using Wall Street estimates) seem to support acquiring Disney under $90 a share as a trade decision approaching “fair value” in 12-18 months, using historical reference points on fundamental operations. By then, basic price to earnings and sales calculations will have normalized or even be shifting into an undervaluation zone.

Price to sales is already at 10-year lows, drawn below. Plus, ff the U.S. and global economy actually improve next year, instead of remaining weak (which is my baseline assumption), Disney sales may actually outperform today’s low expectation setting. Think about it, a forward 1-year projected valuation of 1.66x sales is quite a distance from the decade average of 3x.

YCharts – Disney, Price to Sales, 10 Years

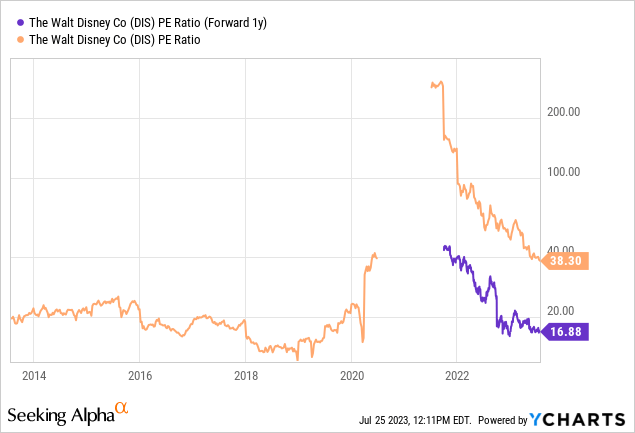

Then, over time, earnings should grow with inflation and leisure demand. Price to forward 1-year earnings estimates are getting more bullish by the day, as the share quote continues to decline. In fact, using 2024 estimates, Disney is once again trading for a P/E under 20x, at roughly 17x expected income levels. If this consensus forecast proves accurate, Disney will again be valued at a P/E multiple about the same as the equivalent projected S&P 500 ratio of 15x.

YCharts – Disney, Price to Earnings, 10 Years

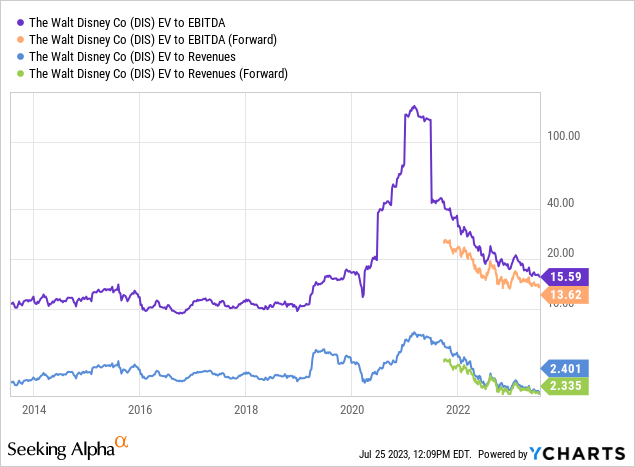

When we include debt and cash levels, the enterprise valuation on basic cash EBITDA and revenues is quickly returning to normal also. The good news is any cash raises that reduce the debt load, without affecting income generation materially, will only hasten Disney’s return to sizable/stabilized income generation. At the same time, lower debts could convince investors to price the company at its usual “premium” valuation to other blue-chip businesses.

YCharts – Disney, Enterprise Valuations on EBITDA & Sales, 10 Years

Final Thoughts

Total returns of +15% to +20% annually over the next 3-5 years are definitely possible, far better than the overvalued setup of early 2021. For example, given $6 EPS by 2025 and a P/E of 20x, a sustainable stock quote above $120 is within reach in 24-30 months. I would term Disney a work in progress over the coming year, but one that deserves to be purchased on weakness.

My view is an America that travels for fun, goes to the movie theater for entertainment, and watches TV while lounging at home, uniquely plays into Disney’s asset mix. In a year or two, the company should again be wildly profitable, with a sizable dividend payout. Plenty of Wall Street analyst optimism will return. Then, a premium valuation on much higher operating results will deliver a nice stock gain from today. That’s the stock winning formula for success.

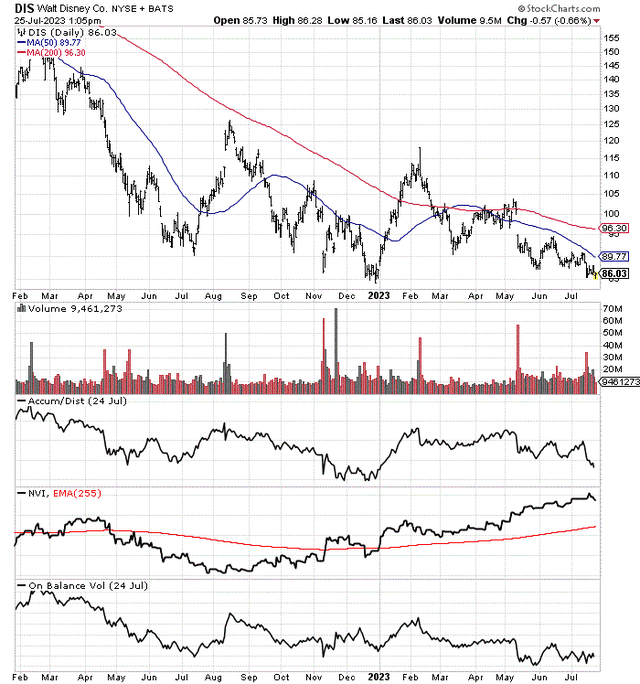

Disney’s chart pattern and technical momentum picture is not exactly bullish yet. We may get a price move to new 52-week lows under $84, before a significant rally begins. On the other hand, $84-85 may hold in the coming weeks, outlining a double-bottom formation.

StockCharts.com – Disney, 18 Months of Price & Volume Changes

At this stage, I believe CEO Iger 2.0 will do a better job at guiding operations going forward, especially if some creative ways to reduce debt are announced by the end of this year.

The biggest investment risks may be macroeconomic in nature. A stock market crash, a serious recession with a contraction in entertainment spending, and/or rising interest rates changing how every equity and real estate investment is valued, are the potential variables that concern me most.

I rate Disney a Buy at $86, with Strong Buy territory tagged at $75. My trading plan is to repurchase a starter position into August.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.