Summary:

- Disney’s robust Q4 report signals a return to growth, with streaming profits hitting $253 million and movie ticket sales surpassing $4 billion.

- Management remains cautious, noting that growth has just begun and setbacks are possible.

- The Direct-to-Consumer segment’s operating income significantly boosted free cash flow when compared to the historically large losses.

- Following Michael Porter’s competitive strategies, Disney’s rapid transition from losses to operating income is typical for large companies.

- The “Fox” acquisition has more upside than Mr. Market gives the company credit for.

JHVEPhoto

Disney (NYSE:DIS) surprised Wall Street with a surprisingly robust fourth quarter report. This marks the return to growth that the company was known for. The last article noted a streaming profit opportunity. While it is a bit early to tell exactly how it happened and if bundles played an important part, the fact is that streaming leapt to a record operating profit of $253 million (much to the delight of Mr. Market). All of this while Disney became the first studio to pass the $4 billion ticket sales in the current calendar year for the movies segment of the business.

Management guided to a cautious next fiscal year because the growth has really just begun and there could be some setbacks along the way. But really, all of this proves that much of what ailed the company was easy enough to fix. There will be changes and challenges in the future. But for now, the company has proved itself to be a formidable competitor and definitely a survivor.

DTC

When one reviews Mr. Market’s stance on the company, it is very easy to come away thinking that the only part of the company that matters is DTC (direct-to-consumer business). This time around, management had a report that left Mr. Market celebrating about DTC.

The last article noted the progress made by DTC. What was unexpected was the big profit jump from the previous quarter for DTC. Now, the management goal of exceeding $1 billion in profits for fiscal year 2025 is looking conservative as a result.

The long-term challenge is replacing the profitability of linear with something (and it will likely be streaming one way or another).

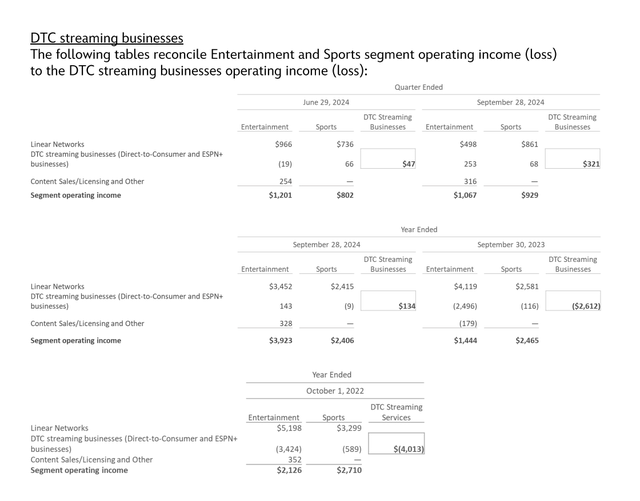

Disney Fourth Quarter Summary And Comparisons Fiscal Year 2024 (Disney Executive Commentary Fourth Quarter 2024)

The swing to a fourth quarter operating income profit (that pushed the whole year into an operating income profit) clearly had a big influence on the free cash flow leap that reported later in the same report. The division lost over $2 billion the year before.

As Michael Porter’s book “Competitive Strategies” notes, companies the size of Disney often pursue market share at any cost. After sufficient market share is obtained, then the company changes strategy to shift to a profit emphasis. Any growth after that will have a profit emphasis. Some appeared surprised at how fast the company changed from big losses to an operating income. However, this is a very typical pathway for large companies like Disney.

Probably the next logical goal is to continue to pursue profitability until it is comparable to the Linear business while seeking to grow the business. Many had given up on this because, in their minds, it should have happened from the start. But little to no research supports that supposition.

In the meantime, both Fox (FOXA) and Hulu renewed their very profitable arrangement that allows at least some Disney programs and Fox programs as well to benefit from both linear and streaming.

Free Cash Flow

Both cash flow and free cash flow tell an investor a lot about the accounting system that the company has chosen. Conservative choices often lead to rather generous cash flow for the earnings stated. Large, established companies often have conservative accounting. This is especially true when compared to pioneers of new things. Then the pioneer chooses an accounting that most likely backs the story when the company went public.

Many people believe that accounting is “black and white”. But there are a lot of management decisions that influence the accounting presentation that many investors are not aware of. The total impact of these choices often shows when comparing cash flow to the reported profits.

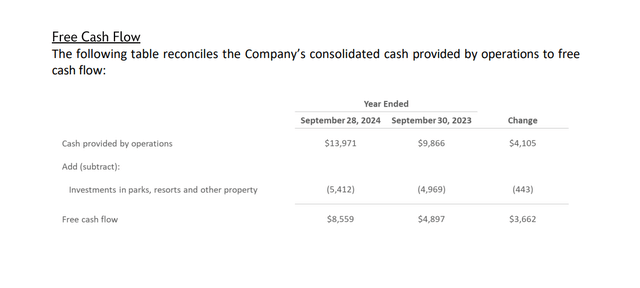

Disney Free Cash Flow Calculation And Comparison (Disney Executive Commentary Fourth Quarter 2024)

In this case, both the cash flow provided by operations and the free cash flow have clearly kept pace with the increase in earnings reported. It is not an exact science because the company had significant cash flow during the recovery phase from COVID, whereas earnings are recovering from a very low level. The existence of cash flow during a time of losses does point towards a more conservative series of accounting choices.

Now, however, the percentage increase in cash flow, while giant, is somewhat less than the percentage earnings increase. But that is due to the relatively higher level of cash flow in the previous years.

Summary

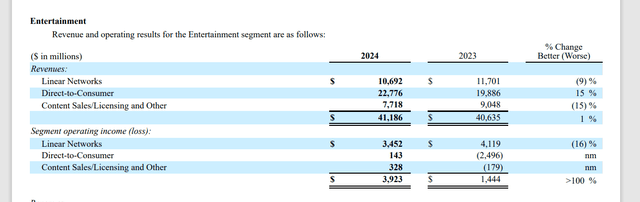

Clearly, entertainment was the area of the business that drove most of the earnings improvement reported. The earnings progress was likely related to the sizable cash flow improvement as well.

Disney Entertainment Segment Operating Income Comparison (Disney 10-K Fiscal Year 2024)

The absence of big losses in the current fiscal year (especially in this area) led to big earnings gains for the company. As shown above, most of those big losses came in the “Direct-to-Consumer” part of the business. Management is guiding to further significant profit advances in the coming year.

The second-largest improvement was in the “Content Sales/Licensing and Other”. This in some ways does not get all the attention from the market it needs to get. The acquisition (the “Fox” acquisition) that was made before COVID challenges was hardly exploited properly before the COVID situation shut most of the company down. That should change as the $71 billion “Fox” acquisition now ramps up, as it should have had the COVID challenges not happened.

This year saw some “Fox” movies that were significant profit contributors. There is no reason that this section of the business cannot be a contributor like Pixar and the main Disney studio business. It would appear that there is still substantial work to be done with this acquisition. It will be far easier going forward than it was when COVID got in the way.

The Main Focus

In summary, while the market appears to be focused on Direct-to-Consumer, it appears to be missing some of the opportunities that came with the “Fox” acquisition. But that should add upside that the market is not expecting.

Years ago, Disney acquired Marvel for what was then the scandalous price of $4 billion. Many thought that Disney had lost its collective mind (and a few other things as well). Yet, looking back on it, that deal has turned into one of the more lucrative deals the company ever made.

The “Fox” acquisition was much larger, and it got interrupted by COVID (which was beyond the control of management, plus management never saw it coming at the time). However, now Disney has the time to do the same thing with this acquisition that it did with the “Marvel” acquisition. Because it is now about 5 years ago (very roughly), Mr. Market has moved on. But the possibilities are still there. It is just that the results got delayed.

The market has been concerned about a superhero exhaustion. Yet, the characters, acquired later, give this company a potential dimension that allows it to work around such a situation if indeed it happens.

Moving Forward

Disney stock has plenty of upside potential and remains a strong buy. The DTC division is progressing towards a decent profitable level. Management has noted that they expect to make further significant profit progress in fiscal year 2025. It was not too long ago when many experts gave up on both growth and profits. Yet, the company managed both in the current quarter.

There are plenty of assets that the company has yet to profitably exploit. That should provide further upside potential that is currently outside the attention of Mr. Market until it makes a profitable appearance.

This may mitigate the concerns about what a recession could do to the company, as the $71 billion acquisition from Fox has yet to “pull its weight”. There is every chance that as the Fox assets are properly exploited, any progress here could more than offset the effects of a recession.

Earnings so far have been getting back to pre-COVID levels as the company has continued its recovery from the COVID challenges. But this management is likely to grow the company to much more than that.

Risks

Probably the biggest risk is finding someone to replace Bob Iger. The last experience was a miserable failure. But really, the group that is properly qualified to run Disney is already small. Finding another “Bob Iger equivalent” is a very tough order. That would be a very small subset of an already small group of people. Investors may have to endure a “revolving door” until the right person is found. But as long as the board remains active, this should not be a terminal situation.

Consistency in entertainment is very rare. This company has a success that is the envy of many in the industry. But that can change very fast in this industry if management does not “keep up”. Notice the quick turnaround from the previous year or two when many observers were quick to pounce on Disney’s demise. What happened this year was not supposed to happen for some time. Yet good management nearly always outperforms even though they get challenged just like everyone else. The key is to overcome those challenges as they appear in the future. There is no assurance that will continue to happen.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.