Summary:

- The $60 billion capex promised by Disney has yet to be specified by management.

- The proxy vote on April 4th will be a crucial catalyst for the stock’s movement.

- The theatrical film business and streaming continue to pose challenges for Disney’s profitability.

Joe Raedle

Above: The parks are bearing the load. The $60b capex promised has yet to be followed up by management specifics as to what and when it will be done.

History provides us with compressed, but workable insights for both sides in the Walt Disney (NYSE:DIS) proxy fight. Each characterizes the respective combatants bottom line:

For bears – Oliver Cromwell’s admonition to parliament in 1653:

You have sat too long for any good you have been doing lately… in the name of god, go!

Clearly the essence of the Peltz message.

For bulls – the clarion call of CEO Iger from the 1933 inaugural address of Franklin Delano Roosevelt fits:

The only thing we have to fear, is fear itself…

Iger could not have put a more concise rationale for a vote of confidence in his and his team’s management.

The results of the proxy vote on April 4th will, in theory, be the single most crucial catalyst to move the shares higher or lower depending on whether holders listen to the Cromwell’s or Roosevelt’s call to action.

Until then, investors are presented with many strategies here.

- Sit tight and hold believing in a DIS win.

- Or, as a really true blooded believer, add to your position.

- You can price average against consensus PTs of the moment that $160 is not that far off. That confirms you believe that nothing will interfere with strong price recovery ahead.

- Or, sell, convinced that the business model for DIS, and the sector as a whole. is so broken that none of the nostrums for cure undertaken by DIS to date can work.

The $1.5b EPIC video gaming deal has been an upside catalyst. But some investors may remember that DIS failed at this business in its initial try with Disney Interactive back in 2016. Iger became CEO in 2000.

The state of play: The ten weeks before the vote

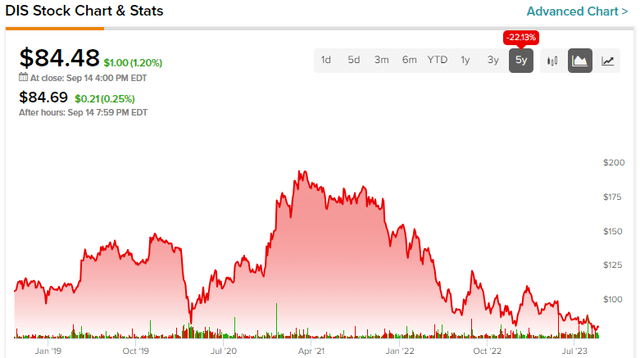

Above: Just before the recent run up DIS had been dead pooled in the low 80s. Now just before the vote it sits at $113 and could have run room if management prevails over Peltz. Source: Google, depicted: graph

In my honest opinion, it would appear that the recent 40% run up of DIS evoke a growing belief by investors that the FY23 results presage even better returns ahead because the ship is well along to being righted. Yet scratch below the surface of the ignition fired by the FY performance and you still see a boat leaking here and there. They may or may not figure in the forward PTs.

Looking at the guidance universe from the hedgies and the bulge analysts we find a tracery of mostly bullish conviction that the stock could run after the expected earnings release on May 5th shows surging progress continuing on all fronts. Add a winning proxy vote on April 4th as a prelude and you have near a mortal lock on a round trip upside. We’re not joining in on forward earnings estimates for FY24 at $4.60 a share at this point. It is a reasonable call – depending on many what ifs. Nor do we suggest a big miss lies ahead. But in examining major unsolved strategic issues that continue to rattle other investors, we think the interregnum before the proxy vote could present opportunities.

We note that balancing against the positive moves to date we still have no further news on the progress if any, on the promised $60b capex plan for the parks. Nor have Iger’s comments on succession planning gone much beyond vague promises like “we’re working on it”. One can’t blame skeptics for believing that Iger has no intention of going anywhere. He is, after all, a shareholder as well. (He holds ~1.1m shares worth around $121m. In better days in June of 2021 he unloaded 500,000 shares at $90m at $179 average a share).

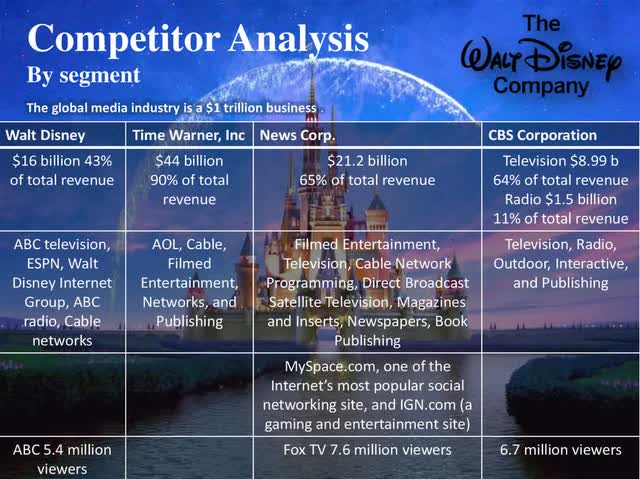

Above: The crowding of the sector (not shown Para and others) is an issue.

Jamie Dimon, formidable CEO of JP Morgan Chase, weighed in on the proxy fight with a vigorous endorsement of Iger and his management last week.( Note: His bank has on occasion done work with DIS). Whether this has any impact on the vote or not is just guesswork. It’s one of those moves that clearly can’t hurt the Iger cause, yet still invokes a shrug as to be a big plus.

Some hedgies we spoke to ultimately see the Trian move as a pure vengeance play by former DIS executive and Peltz ally Ike Perlmutter against Iger personally.

Said our source: “The hostility was born during Ike’s tenure running Marvel at Disney. He deeply disagreed with the direction of the company and Iger fired him a year ago for what he said were management failures at the Marvel unit. It was part of the 7,000 person bloodbath,” (Our source sold out his DIS position in late 2020). “It’s not just Disney. The whole sector, sad to say, is a holy mess..”

Some holders may be inclined to sell covered call options in expectation that the premium implied is worth the move. It could limit risk during the period before the vote.

Others could easily see a straight round trip strategy here. Sell at least 50% or all of a DIS position if your entry point was during the time the stock was dead pooled around $80ish or less for so long. You are then looking at a 40% gain. A covered call now seems to me to be a sensible approach in this interim pre-vote period.

As of the end of FY23, beyond DIS surface numbers we see:

Gross margin: 34%

Operating margin: 11%

Net margin: 3%

ROE: 3%

ROA: 1%

ROIC: 4%

ROICE: 6%

Current ratio (Dec. 2023): 0.80 – This edges near 1+, which is acceptable, yet reflects the debt of ~$47.6b as a continuing millstone around the DIS balance sheet. It is $11.9 lower than its peak of $68b after its $72b acquisition of 21st Century Fox.

DIS paid out ~$2b to service its debt in ’23, so while the debt remains too high in the light of its historic ranges, it is manageable. (Average solvency score 49).

Streaming and box office woes remain unsolved

No amount of happy talk at earnings time can overcome the historic down cycle of profit potential for DIS, and of course its sector peers, with theatrical film attendance up against streaming. Simply put: Why spend $90 for a family of four on a theater visit when you can buy it on streaming for maybe $4.99?

One of the core problems of theatrical film business is that it has not attracted enough scrutiny from investors or financial media. It was called to our attention by one of our regular associates with long experience in movies. The reason it has escaped the Larry David squint is the wide belief that the cure is nothing more complicated than improving the ratio of dog movies to blockbusters. Barbie and Oppenheimer are cited.

That sounds pretty, pretty, pretty good to investors who still have faith in the DIS creative people to produce big winners.

Our source asserts that a biggie movie or two will not solve the theatrical segment’s problems.

The real problem she says is this: Too many studios producing too much aggregate content that wobbles through theatrical audiences and makes its way to streamers. There are six major studios and at least 7 more minors all sending masses of productions into theaters seen by diminishing audiences. There were 1,286 movies released in 2018 and 400+ in 2023 (strike effect) This does not include foreign onslaughts of English language movies as well as subtitled European and Asian production.

These films, one way or another, will wind up streaming after their theatrical release, or on linear TV. It’s a “bombardment of content that runs out of eyeballs” said our source.” And blockbusters remain as rare as they ever were.”

Ticket prices, snack chomping, even fast foods served at seat side, all militate for thinning audiences as visit price totals soar.

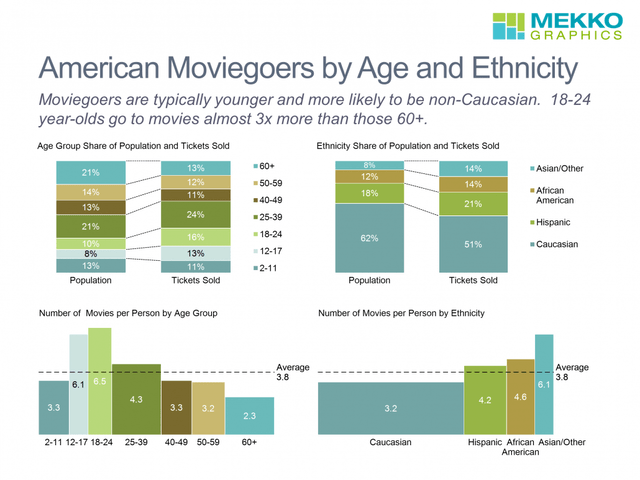

Then came Covid that literally destroyed what habit patterns for attendance had been sunk into the public psyche. It became a teaching moment. Young people in particular had turned to YouTube, TikTok, X, Instagram, and Facebook for quicker, cheaper and engaging entertainment that was mostly free.

“Today’s movie theatre is the smart phone” added our source..

None of this of course is any surprise, but seen from a slightly different perspective that asks the question based on glut rather than audience habits, it is telling.

There are too many studios. And what’s needed is consolidation. It’s a free for all business now with newbies popping up all the time.

Above: The shift in audience demos shuts out more segments than it attracts. Younger demos are also addicted to smartphone free entertainment posts.

Streaming shares the same business model challenges as does the online sports betting business. Rapid sales growth? Great, both qualify. Low margins? You said it. Too many platforms? How about 14 now operating. Low barrier to entry? They’re almost twins in that. Sports betting businesses can commission a complete tech design stack and ongoing system. It can spend what is affordable (nor not) to poach market share. That’s a fool’s errand. No matter what happens to streaming, the Darwinian result will see the big 6 either buying or merging with marginal guys, or watching them go down the tubes.

And also edging fast from the sidelines, Mr. AI, who can deliver a 90 minute genre movie as good as most of what sits on streaming now for perhaps $200,000 vs. the $100m it may now take to create, shoot, and release a genre movie. Watch out, your neighbor’s 19 year old college sophomore armed with no more than an Apple smart phone can gather a handful of pals and do a romantic comedy as good as anything out there now. Is it possible? I’ve already seen two. Scary.

Conclusion

Making money with old media stocks presents challenges to conventional wisdom. The current situation in DIS creates opportunities to be either long or short before the votes are counted. In brief, we believe DIS has become a stock to trade over short time spans, rather than sit on or just sell it and forget the sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.