Summary:

- Parks/Cruises contribute more than half of earnings.

- A slowing economy can significantly impair earnings growth and share valuation.

- It will likely be a very long time until the shares reach new highs.

- The stock is a sell for short and medium term investors.

A Walt Disney World arch gate on the street in Orlando, Florida, USA. JHVEPhoto/iStock Editorial via Getty Images

Overview:

Disney (NYSE:DIS) has for a long time been a favorite stock that avid fans hold through thick and thin and plan to pass onto the next generation. It’s a “forever” stock. See my previous Disney article:

Since that comment, CEO Iger has significantly streamlined the company via layoffs and cost cuts, fought off private equity board challenges, delayed stepping down until 2026, finally stemmed the losses in streaming, captured the Hulu shares it didn’t control, and reduced presence in India. All good, but also already reflected in the recent share price run to $120. Succession plans, however, remain murky.

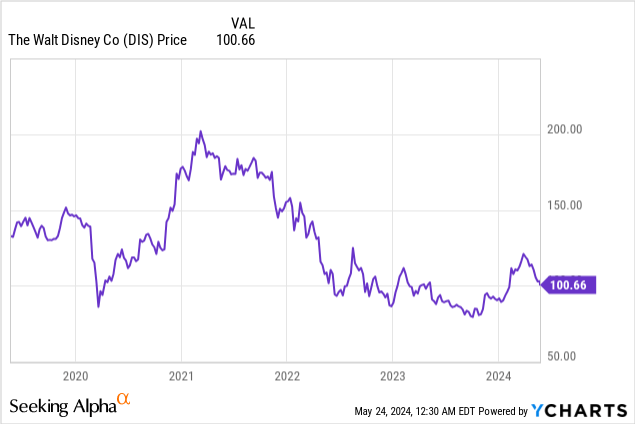

There’s no way to convince any multi-generational holders/enthusiasts to sell. The problem is though that it might indeed be a generation for the shares to exceed the most peak price of $202 that registered in April 2021. Even with all the recent positives, today’s share price is no higher today than it was in September 2015!

There are many reasons behind this pessimistic point of view.

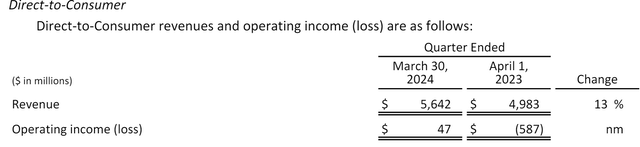

The streaming business is now fairly saturated in the U.S. and competition is formidable. After an estimated $10 billion of losses since 2018, the latest Q2 2024 report suggests that there’s a probable turn toward sustainable (but not great) streaming profitability.

Q2 2024 earnings report data (SEC Filings)

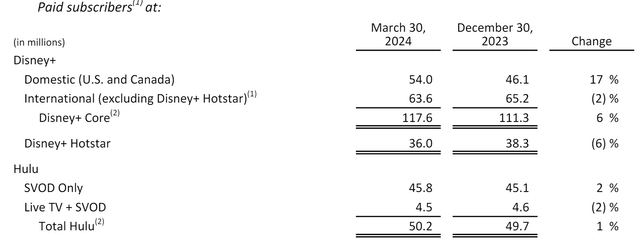

Disney 10-Q earnings (SEC filings)

Yet any such positive turn seems unlikely to offset the reduced profitability of cord-cutting-affected cable networks and the fading advertising-dependent linear ABC television network and station assets.

After the 2024 election cycle advertising boost, the stations and the network too will likely to experience notably reduced profits. There’s also been considerable analysts’ speculation that, as a result, the ABC network might eventually be put up for sale. But the question is to whom?

Warner Bros. Discovery (WBD) might have a need and interest but is saddled with $40+billion in debt and doesn’t have high-priced shares with which to do a stock deal. As noted in my recent SA article on Paramount (PARA) — “Paramount’s Sale Still A ‘Twilight Zone’ Mess” May 6, 2024 — there aren’t in the age of streaming many buyers for such slowly fading ad-dependent linear networks.

Comcast (CMCSA), owner of rival NBC, might think about buying but would face high antitrust barriers. And foreign buyers would be legally barred from taking control. Paramount faces the same situation if it decides or needs to sell CBS around the time when ABC might also be up for sale.

The fate of ESPN is also uncertain as it moves into a crowded streaming market in which companies like Amazon are strong and fierce competitors for very expensive sporting event rights. Also, the increasing ties to gambling enterprises create new risks along with the apparent opportunities so afforded.

The succession plan for CEO Bob Iger also appears to be in gestation and the film and TV business will, like all major studios, encounter an extremely crowded release schedule in 2025-26 as the pandemic shutdowns and WGA and SAG strikes of 2023 has forced major Hollywood releases to be bunched starting in late 2024.

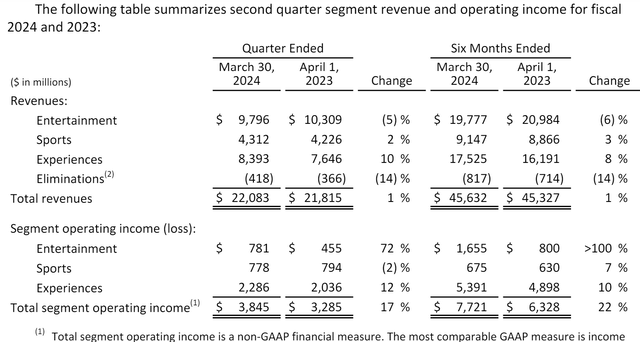

All of these items are important in terms of long term growth strategies and profitability. But these are relative side shows given that Disney generates more than half of income from parks/cruises, known as the “Experiences” sector.

Q2 2024 earnings data (SEC filings)

If the common macroeconomic portfolio manager/strategist narrative of “no hard landing” or no “soft landing” is assumed, then it would seem that “Experiences” profits ought to at worst be flat and perhaps even rise over the next two years. If the common macroeconomic portfolio manager/strategist narrative of “no hard landing” or no “soft landing” is assumed, then it would seem that “Experiences” profits ought to at worst be flat and perhaps even rise over the next two years. (The company has planned major capital investments for new Experiences attractions over the next ten years.)

But note that in previous recessionary periods U.S. park attendance has either declined or growth has been notably slowed whenever broad problems in the U.S. economy have appeared.

To most prognosticators, the current popular current view is that Fed will not further raise interest rates and will probably cut short-term rates at least once or twice this year. We’re just “buzzing the control tower,” they might conclude. So no problem!

But what if the economy begins to falter under the pressure of high-for-longer rates, up-ticking inflation caused by persistently high energy and food prices, and a rising unemployment rate? Target (TGT), for example, just reported a 4.8% decline in comp-store sales for Q1 2024. This is perhaps an idiosyncratic blip only affecting Target (as competitor Walmart, WMT, did well), but it might also be an important early signal that a recession of either the soft or hard kind is nigh.

If so the outlook for Disney shares then changes dramatically for the worse as it becomes increasingly evident that, in terms of earnings growth prospects. Disney might come to increasingly be seen by investors as a relatively lower multiple deserving theme park/tourist/lodgings company with good media assets attached.

Current average analyst EPS estimates float around $4.75 for fiscal year 2024 and $5.45 for fy 2025. But even a “soft” landing scenario would thus probably jeopardize the fy 2025 estimate and reduce the p/e multiple.

Macro Sensitivity:

The standard analyst approach is to model divisional earnings growth prospects for the next two or three years and then also do a sum-of-the-parts type of estimation. This method is OK in many if not most situations, especially those in which there’s a relatively stable trend.

Yet given Disney’s great dependence on “Experiences” division earnings, it is useful to test for the sensitivity of this division’s earnings prospects to changes in the macroeconomic environment. In my texts (Entertainment Industry Economics, 10th ed. or Travel Industry Economics, 4th ed.) I’ve shown that park attendance is sensitive to unemployment rates and also often interest rates and consumer credit conditions as well.

Econometric methods don’t prove anything, and my approach is to keep things simple. Even so, the approach provides interesting insight into how bad or good things might be.

An econometric application to Disney’s total U.S. park attendance over the last 35 years shows that there is considerable macro sensitivity to changes in disposable income and the actual unemployment rate. Rising disposable income would have a positive effect on park attendance (and vice versa) and a rising unemployment rate a negative effect.

This can be seen from the following regression that suggests a high probability (p-values nearly zero) that these two variables are significant. Here, a 1% rise in the unemployment rate will result in more than a 3% drop in U.S. park attendance (~2.7/77).

|

Sample: 1985 2023 |

||||

|

Included observations: 39 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

LOG(DPI) |

7462.233 |

339.4529 |

21.98311 |

0.0000 |

|

UNEMPLRATE |

-2682.818 |

766.0563 |

-3.502116 |

0.0012 |

|

R-squared |

0.450477 |

Mean dependent var |

58799.86 |

|

|

Adjusted R-squared |

0.435625 |

S.D. dependent var |

16755.34 |

|

|

S.E. of regression |

12587.44 |

Akaike info criterion |

21.76871 |

|

|

Sum squared resid |

5.86E+09 |

Schwarz criterion |

21.85402 |

|

|

Log likelihood |

-422.4898 |

Hannan-Quinn criter. |

21.79932 |

|

Buy/Sell Considerations:

If Disney investors are of the opinion that the macro situation will be expansionary over the next two or three years, i.e., only “buzzing the control tower,” a hold or even a buy rating for Disney would seem appropriate. Raider Nelson Peltz was defeated in a nasty recent proxy fight but has vowed to return if Disney strategies falter and this might be a source of future demand for the shares.

In the meantime, however, my view is that an economic recession will appear sooner than later.

One sign of this is that the treasury funding yield curve is still inverted. For how long and to what effect no one really knows but in the past a persistently inverted curve has led to economic downturns. Other signs are that credit card debts of consumers now range to over $1 trillion, credit as a percent of disposable income is rising, and that real disposable income is being crimped by inflation.

All of this suggests that any prospective Fed interest rate cuts will likely be the result of a recession that causes real disposable incomes to fall, unemployment to rise, and theme park attendance and earnings to decline.

On balance I’d therefore tend to be a seller rather than a buyer of Disney shares and I doubt that the stock can reach a new record high (above $200 as of 2021) or even exceed the more recent peak of around $120 any time soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.