Summary:

- Trian Partners’ 130-page “White Paper” challenges The Walt Disney Company’s management and calls for more than just two board seats.

- The document accuses Disney of making fiscal blunders and losing its “magic,” resulting in a 60% drop in shares.

- Trian’s case prompts questions about Disney’s future and the need for change, but the outcome of the proxy vote is uncertain.

HAYKIRDI

Disney Proxy Vote Day: April 3rd

Trian Partners’ 130 page “White Paper” is a remonstrance against The Walt Disney Company (NYSE:DIS) management that spares no detail–much more than a demand for two board seats.

Stipulation: It is clearly something of a huge stretch to compare the 130-page screed from Disney proxy challenger, Nelson Peltz with the day in October 1517 when Martin Luther presumably nailed his remonstrance to the church door. We think the challenge and defense analogy brings context to the battle for board seats and much more.

We believe it frames the Peltz challenge as a direct attack on the fundamental beliefs of the current Disney management and true-believing shareholders as to what makes for entertainment /media IP success today.

For that reason, DIS holders and would-be investors are best guided to take the time to slog through the massive presentation on the Trian website. It is a bit of heavy lifting in this age of human attention spans, a Bill Gates study once characterized as shorter than that of goldfish.

The facts do echo the context of events of over 500 years ago in that they represent the following:

It’s a kind of an attack on the mother church for media. Disney is in fact, or has been, that for decades due to its reach, performance and scale as the dominant entertainment provider globally. Its organization penetrates the business deeper into the public consciousness than any peer.

The contention of Trian is that the DIS mother church, as it were, has lost its way. And in the process, shareholders have been the victims of its entrenched policy failures. His goal really goes beyond two board seats and positions him, Radulo, and partner Issac Perlmutter (former head of Marvel and Disney exec) as the accusers against “church” policies, i.e., the Martin Luther role players in this drama.

Above: The modest price recovery from the lows in the 80s could work in favor of the DIS incumbents, but is still far off from the beating from the highs.

The Trian 130-page Remonstrance: We Now Have The Details

According to the Trian Partners document, Disney has squandered its “magic,” its resources, and its future with fiscal blunders that have decimated its financial health and by extension, pummeled its shares down 60% from its highs.

The screed digs deep into every possible metric and what it characterizes as bad decisions on Iger’s and his board’s watch. For those with neither the time nor inclination to plow through the presentation, we’ve digested the key top line assertions by the challengers here.

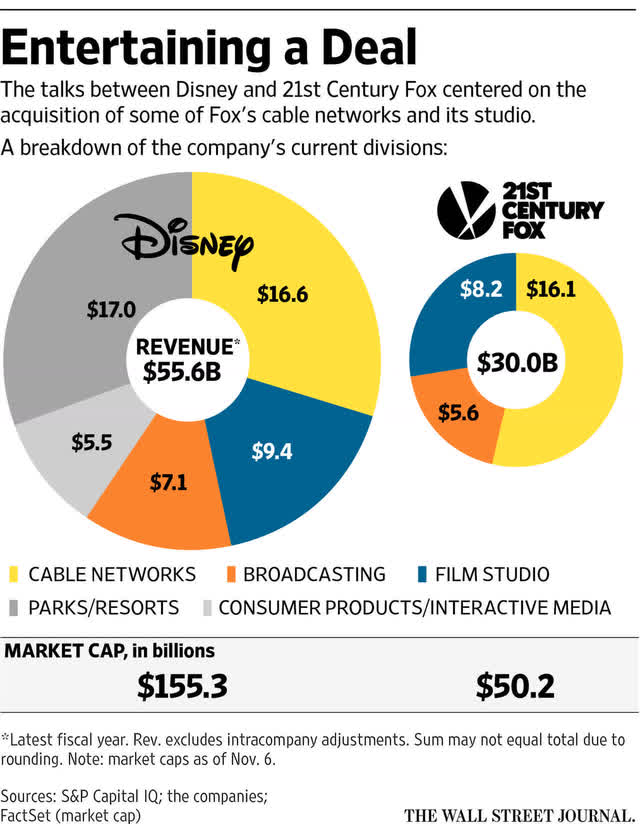

Since 2018, DIS has invested $200b in various bad deals and policies with terrible results. Starting with the gifts of scale no other competitor had, the company has underperformed peers. The poster child for a disastrous investment was the company’s acquisition of 21st Century Fox for $71b in a questionable effort to build scale, adding in the process $21b in debt to the already tilted balance sheet.

In addition, Disney has lost and continues to lose a disproportionate amount in streaming vs. Netflix (NFLX). Given the richness of its IP, it should be a sector leader in subscribers. The round trip to the CEO chair for Bob Chapek (2020-2022) underlies the failure of process in a succession plan. The Trian paper calls for a specific time line and succession plan post Iger immediately, not vague promises. It asserts that the creative juices that for so many years have fueled DIS leadership have dried up. A deep dive into that management team is warranted asap.

Performance decline: FY18 EPS: $7.08 FY23: $3.76 FCF18: $19b FCF23: $4.8b Dividends: FY18: $1.68 FY23: $0.30 ROIC vs. peers: NFLX: 15%; Warner Bros. Discovery (WBD): 6% DIS: 4%. Market cap since 2021: $200b vs. $80b. As of now, no clear goal to get DTC into profit.

Trian cites a series of theatrical movie flops: Haunted Mansions, The Marvels, Light Year, Indiana Jones 5, Wish, and uncited but in our view similar to those, The Little Mermaid—probably at breakeven at best). The paper argues that the current board is not composed of directors with any real expertise in entertainment.

Above: Shows the 21st Century Fox relative positions before the deal closed. Trian cited the $71b price tag as a major blunder for DIS management.

Nowhere in the Trian document was there any direct or even guarded reference to the toll DIS revenue has taken due to woke content and casting. This is a tricky potential rabbit hole, that Trian understandably has avoided. But it’s an implied critique of the failures Trian has asserted in creative output.

Missing in the Trian paper is any reference to the tsunami that has engulfed the entire media/entertainment space

Clearly, in the 130-page document, there was no direct or even guarded reference to the massive macro destruction inflicted on all peers in the sector. Linear cord-cutting and ad revenue declines, the scramble for DTC subscriptions, and the costs of holding down churn. Add the move to ad-supported content with no sure outcome long term, and the Covid-ignited drop in attendance for theatrical films to the mix. The performance of DIS parks has held up despite growing rumblings about prices. The cruises continue to attain 90+ occupancies.

The Trian document is a detailed, well-argued rationale for the changes Trian has nailed to the DIS door, as it were. It is an advocacy document faithful to partisan political rhetoric that conveniently omits any mitigation against its foe. Similarly, the Disney dismissal document on the proxy vote issues is mostly happy talk about happy prospects, improving performance and much hugs and kisses for the present board.

While DIS can’t entirely hide behind the tsunami that has the entire sector treading water, investors need to give management something of a pass on what if anything more it could do. Getting a sure path back it optimal earnings to date seems elusive to many holders.

At the same time, Trian’s case is undeniably powerful, leaning on hard facts and analysis of the results those facts have produced. But its solutions prompt as many questions as it does answers to the great dilemma.

Making book on the results: We think it’s close, but DIS wins

DIS has the edge of an incumbent in that long-time holders have withstood the beating the stock has taken because they are true believers that the “magic” will return. The recent inching up of the stock will contribute to that decision to support management. Mr. Market seems to lean on the premise that, in time, Iger’s moves to date will right the ship.

Last October, DIS was trading ~$80. At writing, it has moved up to $112. The 2021 high watermark was over $200, with some analysts out with price targets (“PTs”) looking for $234 to $250. Big holders as usual tend to get rattled in threats to status quo unless it presages the kind of disruption they think they can exploit with hedged plays or smell a company in play.

On the other side, we discern a real restiveness among many DIS holders, who have clearly lost confidence in the board and management. The Trian remonstrance gives them a strong set of reasons to vote with Peltz without question. It is not so much that Peltz and his group getting two board seats will be a cure-all. But their success as possible gadflies (or flies in the ointment, take your pick) who can hold feet to the fire on so many issues can set the tone for real change in corporate direction. Be clear, if Trian prevails, Iger’s days are numbered, his check cut but as yet unsigned.

Yes, this is a referendum on Iger’s watch as much as anything. Going through both cases, we come out that (my take is way above my pay grade) neither Trian nor DIS has made a truly compelling case for status quo or revolutionary change.

As I have noted in prior Seeking Alpha posts, the best outcome I see given the treacherous waters in which the sector now tosses, is to whittle DIS down to a cost-efficient, manageable size. A smaller DIS with a shorter span of management control, exponentially carved down debt, makes far more sense for investors than anything management or Peltz can realistically deliver.

First, investors and management alike need to recognize that the business model of today’s DIS was built off a world that valued mere size and scale by its addiction to endless sequels and acquisitions. That world was one in which linear TV was still a powerhouse, cable TV was growing rapidly, theatrical movie attendance and ticket prices were strong and headed up. That world is now a dead planet. The oxygen no longer exists.

For DIS, as I have noted, there is a strong case to sell ESPN, go REIT on its park business, dump or spin off ABC, package the cable business for sale, forget retail. What investors could wind up with is a DIS that focuses on parks and the buildout of DTC, and the studio for IP generation. And the kicker will be a carve-down of at least half of DIS debt or less that diverts tons of cash from feeding the banks their interest. Instead, those saved funds will nurture ever greater IP that does, indeed, bring back the magic assuming a restoration of creative chops.

Like Luther 500 years ago, if Peltz wins, it won’t just mean two board seats, but a veritable roiling of the company as it pivots to a new world and, for investors, a forward stronger valuation. If he loses, the fight will have been a valuable teaching moment for Iger and company that compels them to a better outcomes for shareholders going forward.

Bottom line for the stock here: If The Walt Disney Company management prevails, we could see a four to five dollar spike short term. If Peltz wins, we likewise could see Mr. Market’s DIS skeptics assert the same upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.