Summary:

- I normally do not pay attention to Wall Street Ratings, and neither should you.

- However, I think Wall Street gets it right this time on Disney stock.

- I see its current troubles to be temporary and its assets (both physical and intellectual) to be underearning.

- In terms of valuation, it offers a reasonably priced option to tap into the digital content future.

BobHemphill

Thesis

Wall Street ratings are notorious for their various limitations and biases such as near-term focus and herd thinking. And above all, I feel their ratings tend to be more biased toward the bullish end. Wall Street analysts are incentivized to be bullish. After all, their employers make money by selling stocks to investors and it is hard to sell stocks if their own ratings are negative.

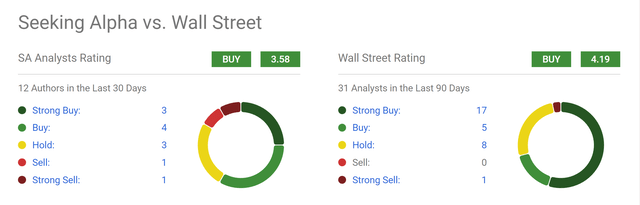

However, in the case of the Walt Disney Company (NYSE:DIS), I will argue that their strong-buy rating is well justified. Main Street’s opinion (approximated by Seeking Alpha authors) is already pretty strong on the stock as you can see from the survey below. Among the 12 authors who wrote on the stock in the past 30 days, 7 of them rated the stock as a “buy” or “strong buy”. And Wall Street opinion is even more bullish. To wit, a total of 31 Wall Street analysts rated the stock in the past 3 months. And 17 of them (i.e., more than half of them) rated the stock as a “strong buy” and only 1 rated it as a strong sell.

in the remainder of this article, I will detail my reasons for siding with Wall Street. And my main arguments will consist of the following considerations:

- I see its current troubles to be temporary and its assets (both physical and intellectual) to be underearning. Its poor profitability in the past 2~3 years was due to a combination of the pandemic and the ramping up of its streaming business and impacts from both are fading.

- I see profitability recovering in the near future with its new leadership and also ongoing restructuring efforts.

Wall Street profitability projection is justified

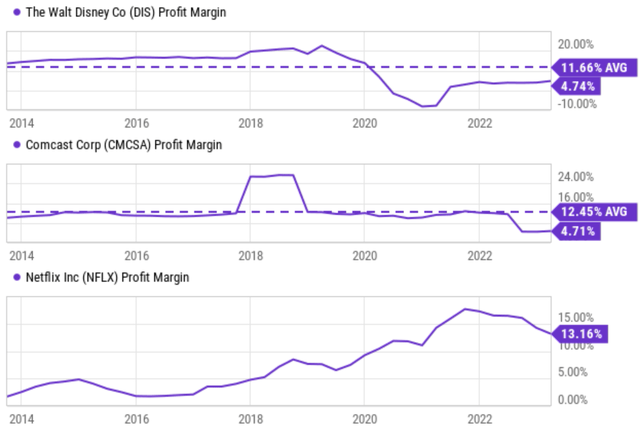

DIS used to enjoy superb profitability. Its average profit margin before the pandemic hovers around 20%, which compares favorably to both similar peers such as the Comcast Corporation (CMCSA, which also runs theme parks in addition to its media segment) and also pure streaming companies like Netflix (NFLX). However, the pandemic had a significant impact on DIS (and peers who rely on physical theaters and parks like CMCSA). In 2020, Disney’s profit margin fell to negative and currently is 4.74%, a far cry from its pre-pandemic level.

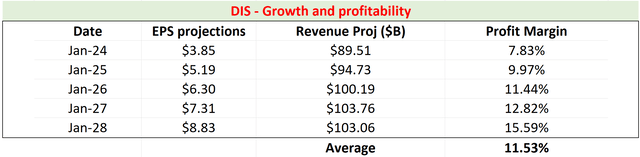

Looking ahead, I see DIS’ profitability as well-poised to recover. The following table shows my projection of its profitability made based on consensus estimates of DIS’s projected EPS and revenues for the next 5 years. The only additional assumption I made here (i.e., besides the consensus estimates) was that its outstanding shares remain fixed at the current number of 1.82 billion shares. This assumption was needed to convert its EPS to total profit. As shown by this projection, I expect a steady recovery in its net margin. To wit, its margin would improve to 7.8%, almost double its current level in 2024. Its margin then gradually improves to about 15.6% in the next 5 years, resulting in an average of 11.5% from 2024 to 2028.

I view this projection as a very plausible scenario for several reasons. First, I see its assets (both physical and intellectual) to be underearning due to the interruptions of the pandemic as aforementioned. And such impacts, even though tremendous, are ultimately temporary. Second, the past few years also coincided with the ramping-up phase of its streaming segment. Now I view the launch of its Disney+ service as very successful and well-poised for rapid growth in the next few years. Third, I view the following projection to be on the conservative side. An average net margin of 11.5% is still about ½ of its pre-pandemic level. It is below the average net margin of both CMCSA and also NFLX as seen in the chart above. And finally, besides the recovery and growth catalysts just mentioned, I also see its current reorganization plan to cut costs and boost profitability, as elaborated on next.

Source: author based on Seeking Alpha data.

Other catalysts and valuation

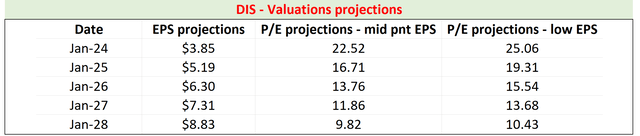

Besides the reopening of theaters and theme parks, I see the return of former CEO Bob Iger and his strategic restructuring program as key additional catalysts for EPS growth. As you can see from the following table below, the consensus estimates project its EPS to resume growth at a healthy pace going forward. More specifically, its EPS is projected to grow from $3.85 in FY 2024 to $8.83 in 2028, translating into an annual growth rate of 18%+. The projection seems quite aggressive at first glance. However, I think it is achievable given the combination of margins as discussed above and also the cost cut in Iger’s ongoing restructuring efforts. The company will consolidate its various operations under three segments: Disney Entertainment, ESPN, and the others (the parks, experiences, and products). At the same time, the company is pruning business costs and plans to lay off 7,000 employees, translating into about 3% of its current workforce. All told, these reorganization efforts would lead to about $5.5 billion dollar of cost savings according to Bob Iger.

With these efforts and the EPS growth projection, the stock is trading at a very reasonable valuation as shown below. Its implied P/E is about 22.5x for 2024 based on the price of this writing and would drop to about 16.7x in 2025 and further decrease to a single-digit 9.8x in 2028. Actually, even assuming the lower end of the EPS projection (shown in the last column in the chart below), its implied P/E in 2028 would only be 10.4x.

Source: author based on Seeking Alpha data.

Risks and Final Thoughts

Finally, risks. DIS faces competitive pressure in the streaming segment from both streaming providers like NFLX and also – more importantly and interruptedly in my view – other social media platforms. Ultimately, I view social media platforms such as TikTok and YouTube as the ultimate risk to streaming. There is a hard limit to our “attention capacity”. If we spend more time on TikTok and YouTube (which seems to be the trend now), we will have less time for Disney+ and NFLX. I don’t imagine there is a way to provide us with more “attention capacity”. In the near term, its stock may see some volatility ahead given the change (quite unexpected to me) of its CEO with Bob Chapek’s tenure lasting under only three years. Also, Nelson Peltz (of Trian Fund Management) has recently accumulated a sizable chunk of DIS shares. Peltz was vying for a seat on the board earlier and abandoned the fight in Feb 2023. His activist investing approach could cause near-term stock price volatility too.

All told, my conclusion is that Wall Street’s strong-buy rating on DIS is well justified. My main consideration is twofold. First, its assets, both physical assets such as theme parks and intellectual assets such as its contents, are underearning due to temporary troubles. Second, I also view its valuation as attractive amid an otherwise expensive market. Its forward P/Es are at very reasonable levels even under conservative assumptions about its margin recovery.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.