Summary:

- I have high conviction that the return of Bob Iger will benefit the company’s value, given his track record of smart strategic moves during his first term as a CEO.

- The company’s high brand recognition and loyal fan base should drive demand for its products and services, making it very well-positioned to capture post-pandemic rebound.

- My valuation analysis suggests the stock is undervalued.

Robert Way

Investment thesis

The Walt Disney Company’s (NYSE:DIS) cash flow has been hit hard by the pandemic in recent years. The company stopped paying dividends in the midst of the crisis. However, I strongly believe that the company’s business will recover strongly after the pandemic. I believe Disney’s recovery is very likely and will be driven by the return of visionary Bob Iger. My analysis of the company’s financials during Bob Iger’s first term shows that he has an impressive track record in running Disney. The release of last quarter’s results reinforces my thesis. And last but not least, the valuation suggests that the stock is massively undervalued.

Company information

DIS is a global entertainment company owning such well-known franchises as Star Wars, Marvel Cinematic Universe, Pixar, Disney Channel, National Geographic, ESPN etc. The company owns rights to most globally recognized characters, from Mickey Mouse to Luke Skywalker.

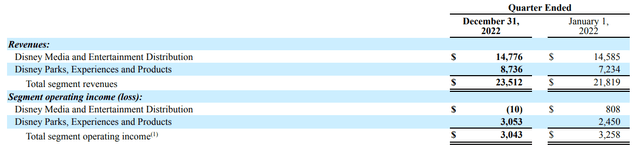

The company’s operations are conducted in the Disney Media and Entertainment Distribution [DMED] and Disney Parks, Experiences and Products [DPEP] segments. Based on the latest quarter results, almost 63% of the company’s revenues represented DMED segment with the rest generated by DPEP. However, DMED segment’s operating profit was close to zero with DPEP segment being the only contributor to the company’s operating profit.

Financials

Disney’s fiscal year ends each year on the last Saturday in September. Bob Iger returned to the company as CEO on November 20, 2022. So he has not had much time to make a difference, and last quarter’s results show little evidence of Bob Iger’s impact. Therefore, when reviewing last quarter’s results, I would look more at management’s forward-looking plans which were highlighted during the earnings call.

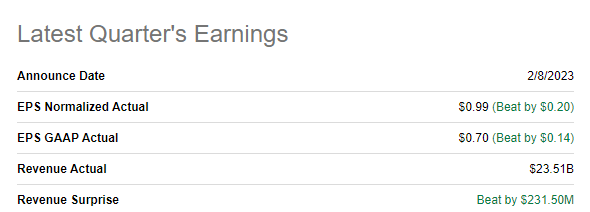

Regarding the performance, in Q1 FY2023 Disney delivered both revenue and EPS higher than consensus. The top-line demonstrated about 8% growth YoY.

Seeking Alpha

Narrowing down to segments, DPEP reported a 21% increase in revenue to $8.7 billion and a 25% increase in operating income to $3.1 billion for the quarter. The growth was driven by higher results at domestic parks and experiences and, to a lesser extent, international parks and resorts. Growth in domestic parks was due to higher volume and guest spending, while growth in international parks was due to Disneyland Paris and higher royalties at Tokyo Disney Resort. Shanghai Disney Resort recorded a decline due to lower visitor numbers as a result of the closure of COVID -19.

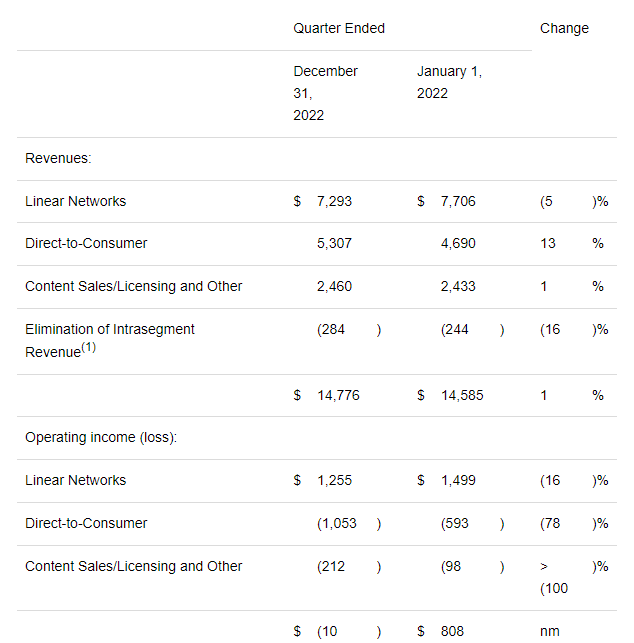

DMEM segment comprises of three subsegments with total segment revenue being almost flat and operating income deteriorating.

Disney

The Linear Networks subsegment recorded a decrease in operating profit due to lower advertising revenues, an unfavorable foreign exchange impact, and a decrease in affiliate program revenues, partially offset by a decrease in program and production costs.

Direct-to-Consumer subsegment revenue for the quarter increased 13% to $5.3 billion. However, operating loss increased $0.5 billion to $1.1 billion. Disney+ posted a higher loss despite higher subscription revenue and lower marketing costs due to higher programming, production and technology expenses. Hulu saw a decline in earnings due to higher programming and production costs and lower advertising revenue, but this was offset by growth in subscription revenue. ESPN+ improved due to subscription revenue growth from more subscribers and retail prices.

Content Sales/Licensing and Other revenues increased 1% to $2.5 billion in the quarter, but operating loss increased $114 million to a loss of $212 million. The decline in TV /SVOD distribution results was due to lower sales volumes of movies and episodic television content. Home entertainment results decreased due to lower sales of new releases. However, the increase in theatrical distribution results reflected the performance of titles released in the current quarter, led by Black Panther: Wakanda Forever.

Now I want to move on to the part that interested me the most, which was the forward-looking plans of Bob Iger’s team to streamline the business and the cost optimization initiatives. And Mr. Iger lived up to my expectations in that regard. He started with a very inspiring speech about the team’s plans:

Now it’s time for another transformation, one that rationalizes our enviable streaming business and puts it on a path to sustained growth and profitability while also reducing expenses to improve margins and returns and better positioning us to weather future disruption, increased competition, and global economic challenges. We must also return creativity to the center of the company, increase accountability, improve results and ensure the quality of our content and experiences.

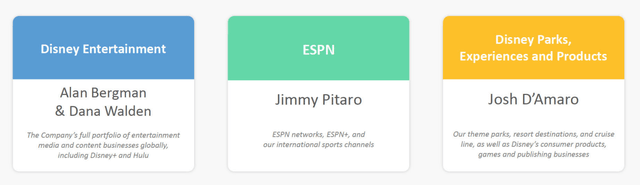

The company’s strategic reorganization will empower creative leaders to determine the content, distribution, monetization, and marketing of Disney’s core brands and franchises. There will now be three core business units headed by experienced leaders and the company will begin financial reporting under the new business structure by the end of FY 2023.

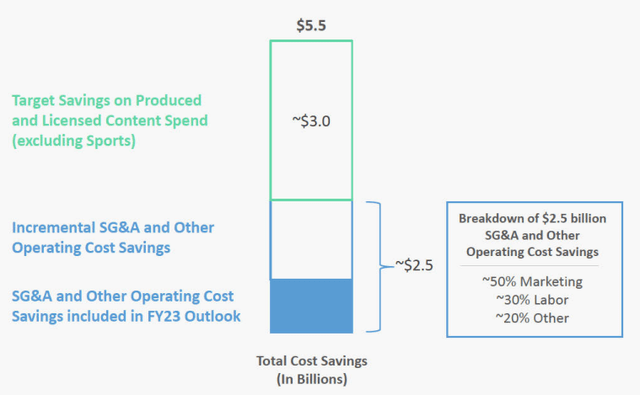

The restructuring will also result in a more cost-effective, coordinated and streamlined approach to operations, with a goal of $5.5 billion in cost savings across the company. The company will focus more on its core brands and franchises and curate general entertainment content, while re-evaluating all markets in which it has launched to determine the right balance between global and local content.

What would make value investors very happy, according to Christine McCarthy, the CFO, she believes that the company will return on track of paying dividends and declare a modest dividend by the end of 2023 calendar year.

The company will also focus on improving the economics of its streaming business by restoring the direct link between content decisions and financial performance. In addition, Disney+ will focus on achieving profitability and growth by 2024, aligning pricing strategies and marketing initiatives to balance platform and program marketing while leveraging existing distribution platforms.

Overall, I believe that Bob Iger has very strong record of delivering exceptional operating and financial performance, so I have high conviction that management team will demonstrate top level execution of outlined strategic initiatives.

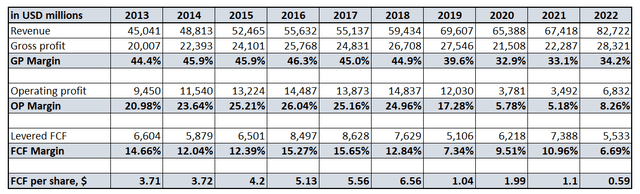

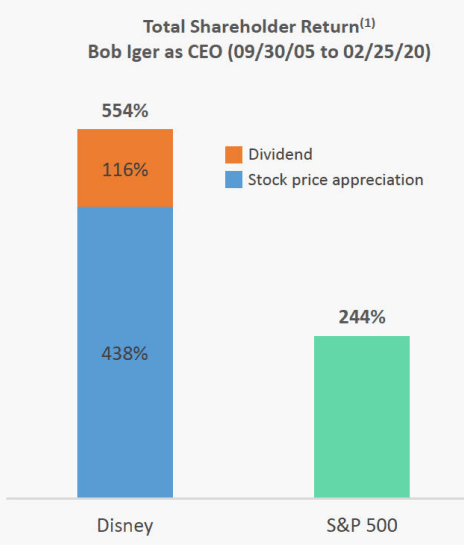

I have high conviction here because I have analyzed the company’s key financial metrics over the past decade and it is obvious that DIS demonstrated stellar financial performance when Bob Iger was in charge during his first term as a CEO from 2005 until early 2020.

Moreover, if we compare DIS stock performance versus the S&P500 during Bob Iger’s first tenure, we see that it by far outperformed the benchmark. So I am very optimistic looking forward to Mr. Iger’s second tenure as a CEO.

Disney

Valuation

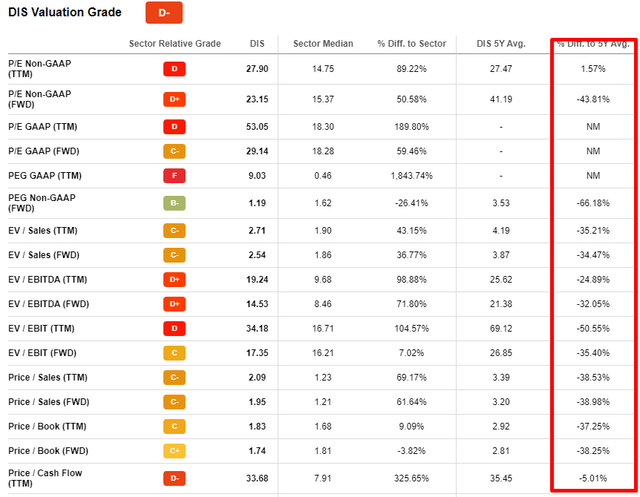

My valuation methodology here is a mix of multiples analysis together with Discounted Cash Flow [DCF] modeling. Before we start with valuation ratios analysis, let me emphasize that DIS profitability metrics are much better compared to sector median metrics. DIS has a Seeking Alpha Quant profitability grade of “A” which is very solid. That is why I am not surprised that DIS stock is traded at a substantial premium versus sector median.

Thus, to understand from a multiples viewpoint, whether DIS is over or undervalued, we should compare Disney versus Disney 5-year average ratios. From the screenshot above we can see, that current multiples are much lower than recent years averages. This suggests the stock could be undervalued.

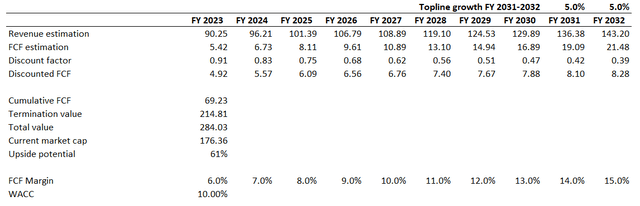

To challenge multiple historical analysis I also conduct DCF modeling for DIS. As usual, I prefer to be on the safe side and choose conservative assumptions. For WACC I use Gurufocus estimate and round it up to 10%. For revenue till FY 2030 I use consensus estimates, and for two years beyond I implement modest a 5% topline CAGR. For free cash flow [FCF] margin I go even further in being conservative; I take FCF margin of a very tough year for the company which FY 2022 was, and round it down to 6% with an assumption that the company will widen FCF margin by 100 basis points each year and reach 15% FCF margin by the year 2032. I don’t believe I am being too optimistic here because historical analysis of DIS financials show that they were able to deliver this FCF margin under Bob Iger’s leadership previously.

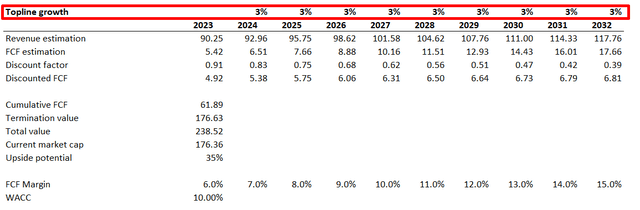

Even with these very cautious assumptions DCF outcomes indicate that the stock is significantly undervalued with an upside potential of 61%. I feel a little bit uncomfortable when I get such a massive upside potential, so I prefer to run a sensitivity test with even more conservative revenue growth prospects. While in the first scenario there is a topline CAGR of 5%, for the sensitivity check I implement a 3% revenue annual growth pace.

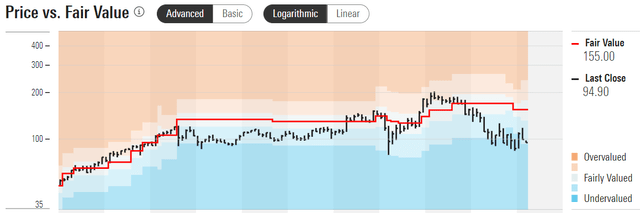

Even with this very modest topline growth assumptions the DCF demonstrates 35% undervaluation of Disney stock. My followers know that I also usually cross-check my valuation analysis outcomes to other well-known analysts. Morningstar Premium suggests that DIS fair value is at $155 per share indicating approximately a 40% discount, while Argus Research set DIS 12-months target price at $130 per share which is also by far higher than current market price. Below you can see the chart how DIS’s actual stock price historically correlated with Morningstar’s fair value estimates.

Risks to consider

While I believe DIS has solid upside potential and strong management under Bob Iger, as any business it faces numerous risks.

First, in case of an economic downturn or recession, consumers may be more cautious in their spending, which could result in lower demand for Disney’s products and services. This could impact the Company’s financial performance and profitability. However, a possible recession in 2023 is expected to be mild and short-term, therefore the impact on Disney’s business could be relatively minor compared to a severe recession. The company’s diversified business model, with a range of offerings including media networks, theme parks and consumer products, may help mitigate the impact of an economic downturn.

The second major risk for me is the tough competition the company faces in various segments of its business. In the streaming business, for example, DIS is competing with entertainment giants such as Amazon (AMZN) and Netflix (NFLX), which have enormous resources. Competitors may be able to outperform Disney in content development and marketing, threatening subscriber churn from Disney’s streaming offerings.

The third big risk I see is our rapidly changing world, especially when we talk about changing consumer preferences and behaviors in terms of entertainment. If Disney fails to keep up with these rapid changes, it’ll have difficulty defending its market share before it’s eaten up by the competition.

Investors should carefully consider these risks and conduct thorough due diligence before investing in Walt Disney stock.

Bottom line

Overall, DIS is a compelling investment opportunity for long-term investors. With a strong brand and character portfolio, successful franchises, and under the leadership of Bob Iger, I believe Disney is well positioned to capitalize on the recovery in the entertainment industry and drive shareholder value. Given the DCF model results, which suggest that the stock is undervalued, it is a strong buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.