Summary:

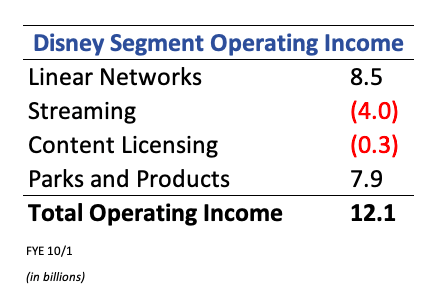

- With the focus on streaming, the market is too complacent with the risks surrounding their legacy cable channels, which comprise $8.5 billion of their $12.1 billion in total operating profits.

- Despite record cord-cutting, Disney has been able to maintain their cable networks’ profits by increasing prices to offset subscriber losses—but this isn’t a sustainable strategy.

- The industry is at inflection point. Sports content, the glue holding cable together, is set to be released as stand-alone streaming options this year, allowing fans to bypass cable.

- This could accelerate cord-cutting, causing their cable networks to experience a more precipitous decline than the market is anticipating.

Drew Angerer

Update on previous article

A few months after the launch of Disney+ (NYSE:DIS) in 2019, I wrote a piece on here challenging the economics of their streaming model. I argued that it was going to be tough for the new model to be highly profitable because of a lack of pricing power, higher content production costs, and higher churn rates. Further, I reasoned that any gains in streaming would be more than offset by losses in their highly-lucrative cable business. In this updated note, I’m going to focus on the latter point—their cable channels.

Investment thesis

Cord-cutting isn’t anything new. What’s surprising is that even though the industry has bled tens of millions of subscribers over the last few years, Disney was still able to keep their cable revenues and profits flat over the last two years. They’ve accomplished this primarily through price increases, which masked the financial effects of subscriber losses. But this isn’t a sustainable strategy.

The industry is at inflection point as sports content, the glue holding cable together, is increasingly transitioning to streaming this year. This could accelerate cord-cutting, causing their cable networks to experience a more precipitous decline than the market is anticipating.

What exactly is their cable business?

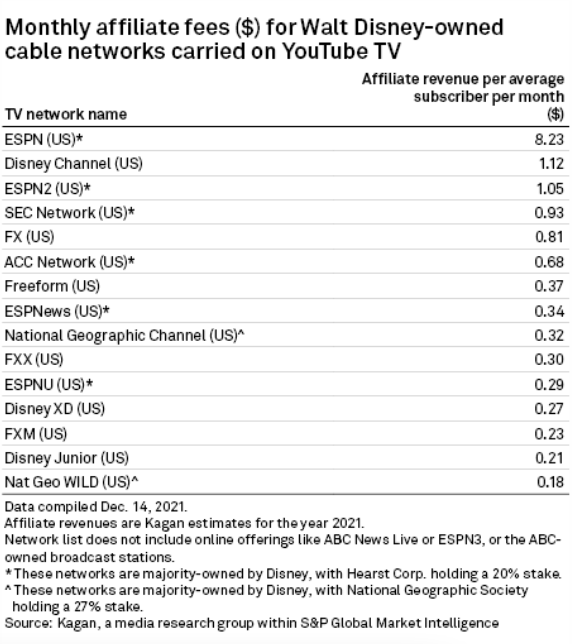

While Disney has the best-in-class content, they come with a lot of baggage. They own a collection of cable-television channels as shown in the list below. In this business model, they are paid a monthly fee on a per subscriber basis from the cable companies, and customers are forced to buy them as a package, regardless of viewership. Secondarily, they also get paid for advertising, which makes up a third of segment revenues.

S&P Global Market Intelligence Tech, Media & Telecoms

Cable downside is material

While Disney has many operating units that interconnect to create a flywheel effect, their cable networks still comprise a third of their revenues. When looking at profits, networks disproportionately make up $8.5 billion of their overall $12.1 billion in operating income, presenting material downside risk if things go wrong here. This sets a higher hurdle for streaming to not only become profitable, but to make up for declines in their traditional cable business.

SEC filings

Disney’s cable business has been resilient so far

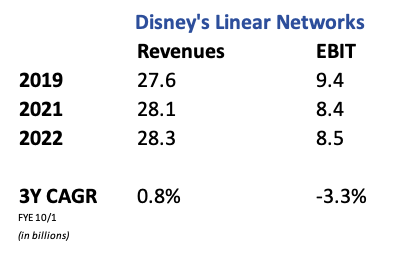

The cable industry had 100 million subscribers at its peak, but has only ~65 million today. In recent years, they’ve been losing about 5 million subs per annum. Despite this, Disney has managed the financial impact well as shown in the table below.

SEC filings

The trend has been relatively stable given the magnitude of cord-cutting. Revenues have actually increased slightly over the last three years, while profits declined at a modest 3% per year on average. They managed this through high-single digit price increases offsetting roughly a 4% per year decline in subscribers. Likewise, results benefitted from a strong advertising market. Optics were aided by lingering benefits from the Fox acquisition, as well as the addition of the ACC Network to Comcast last year.

What is the Street missing?

The market expects cable to continue this dignified decline. That has been the case so far, and to be fair, Disney has defied my initial expectations here. But with all the attention on streaming, I suspect that the Street’s complacency is causing them to extrapolate recent trends. They are overlooking how vulnerable this business is to an abrupt collapse.

Looking forward, the market is pricing in low-single digit declines in cable revenues with modest margin compression. There’s an underlying assumption that the cable industry will have a prolonged life and will ultimately settle at a floor of 30-40 million subscribers.

Management perpetuated this view on their most recent earnings call by guiding for total company revenues and operating income to both grow at a high-single digit rate in 2023. This implies resilience in their parks business, a narrowing of losses in streaming, and a continued modest deceleration in their cable unit.

The sell-side is buying into that view as Wells Fargo Analyst Steven Cahall is forecasting linear networks’ operating income to only decline by 6% in 2023.

Sports is the glue holding cable together

“The big bundle only breaks down if sports breaks down. Because that’s the muscle…Sports is the glue that holds the bundle together and I don’t see that coming apart any time soon.”

Well, that time may finally be approaching. Intuitively, it’s surprising that cable is still around as the networks prioritize their best content for streaming. The reason is sports. To watch most games, fans are forced to not only pay for the sports channels, but also for the ones they don’t watch. With more sports content going direct, devoted fans can bypass these expensive cable packages altogether.

Sports Streaming

As more games become available through streaming, fans are no longer held captive by cable to watch sports. The effect will likely hasten cord-cutting. Leagues have a strategic interest in licensing to stand-alone streaming services. This allows them to reach a wider audience, specifically appealing to the next generation of sports fans who didn’t grow up with cable.

Below are recent examples of sports leaving the cable ecosystem

- Amazon has exclusive rights to air Thursday Night Football.

- YouTube recently won the rights to NFL Sunday Ticket from DirecTV, where it had aired since 1994.

- When the NBA rights come up for renewal in 2025, the league is looking to double or triple the current $24 billion deal value that Disney’s ABC/ESPN and Warner’s TNT currently pay. These rights could be priced out of the cable ecosystem then.

- Apple has exclusive rights to stream Major League Soccer on Apple TV+.

While the national games above are important, most avid sports fans primarily care about watching their home team. We are seeing cracks here too. A plethora of regional sports networks (RSNs) are going direct-to-consumer this year. Most are priced in a range of $15 to $30 a month, significantly cheaper than cable.

-

Sinclair Broadcasting Group, the largest owner of RSNs, is launching a streaming service in the second quarter for 16 NBA teams and 12 NHL teams.

-

Steve Ballmer was ahead of the curve with his Los Angeles Clippers, having launched a DTC service for the current season.

- NESN, the RSN in the New England area, has also launched a streaming-only option for the Boston Bruins and the Red Sox.

-

The New York Yankees are on deck with their streaming service coming next season, which includes Brooklyn Nets games.

-

Crosstown, MSG Networks’ New York Knicks and Rangers, are set to go direct in the second half of the current seasons, so any day now.

These big markets have an outsized effect on cord-cutting not only because of their larger footprints, but more expensive cable bills.

Diminishing returns to scale

Profitability at Disney’s cable networks depends on scale. And as the subscriber base continues to shrink, they will increasingly lose the benefits of that scale.

First, pricing power will diminish. This is the lever they have been using to offset sub losses. Disney was able to command higher rates from cable companies because they owned the most important channels. And if a cable company wouldn’t pay, Disney would pull their channels, resulting in customer defections for that cable company. With channels starved of prime content and with ratings in decline, Disney loses that negotiation leverage.

Their recent price increases were contractual, made years ago when the ecosystem was healthier. When these contracts come up for renewal, they will likely come down to reflect the current state of the market. As for the timing, contracts with the distributors are staggered, so a percentage comes up for renewal every year.

With a smaller audience and lower viewership, advertisers are going to re-evaluate their ad allocations to cable, likely pulling back from the medium. A macro downturn could cyclically pressure CPMs in the near term. More structurally, Netflix and Disney+ are coming out with ad-supported tiers, which could cause advertisers to reallocate their ad budgets to streaming.

With mostly fixed production costs, any pressure on revenues will have an asymmetric effect on profits.

ESPN is a liability

When it comes to their cable business, ESPN is Disney’s largest potential liability.

It’s estimated that ESPN brings in about $8 billion in revenues, making up about 30% of the networks’ $28 billion in sales. When looking at operating profits, ESPN likely brings in about $3 billion of the segment’s $8.5 billion in income. While these numbers are not precise (not publicly disclosed), the point is that Disney stands to lose a lot from this channel.

ESPN is the most expensive channel in the cable bundle. For every cable subscriber lost, they stand to lose a monthly affiliate fee of $9, in addition to advertising.

Disney spends a total of $30 billion on content, a third of which go to sports rights. These payments are like debt, they are multi-year, contractual, and have to be paid regardless of how much ESPN brings in revenues.

ESPN+

Though Disney is hedging their bets with ESPN+, and they have done a tremendous job here amassing 24 million streaming subscribers, they are not the same offering. ESPN+ doesn’t air as many prime games as their sister network. On the financial front, ESPN commands almost double the monthly rate of ESPN+ at $9 vs. $5 respectively.

If management were to shift the prime games to ESPN+, they would have to charge a lot more to make up for the loss of 65 million cable subscribers. ESPN has been over-earning in the cable ecosystem as non-sports customers are subsidizing the bill. In the streaming model, only those who actually watch would pay.

ESPN Sale?

Getting rid of ESPN would alleviate a lot of pressure on Disney. Activist investor Dan Loeb had pushed Disney to sell it last year before backing off.

If they were to do so, it wouldn’t fetch much as shown by the lack of interest around Sinclair’s RSNs. Plus, the value is in the sports rights. Would-be buyers can directly bid on them from the leagues without inheriting ESPN’s distribution dilemma. The tech giants have already been doing this.

Conclusion

Last year, before returning as CEO, Bob Iger said:

“Linear TV and satellite is marching towards a great precipice and it will be pushed off.”

Cable’s inevitable demise is somewhat of a consensus now. The questions then become—are we close to the cliff? And if so, how much will their $8.5 billion in network profits fall?

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.