Summary:

- Disney reported strong Q2 results with underlying profitability improvements overshadowed by a $2.1 billion goodwill impairment.

- Multiple successes such as profitable DTC business along with great performance by the experiences division suggest Disney’s core products continue to resonate with consumers.

- Shares appear 22% undervalued after the recent market sell-off suggesting a real GARP opportunity could exist in the company’s stock.

- Closure of the proxy battle and legal dispute with Ron DeSantis have reduced Disney’s ESG risk profile in my opinion.

- Buy rating reiterated.

RinoCdZ

Investment Thesis

The Walt Disney Company (NYSE:DIS) produced a pretty solid set of Q2 results where underlying profitability improvements were obscured from view by a massive $2.1 billion one-off impairment.

Without the impacts of these charges, Disney would have generated what I believe is a wonderful set of earnings data with multiple operational efficiency improvements along with their DTC business finally becoming profitable helping to bolster net income.

The current share price suggests a 22% undervaluation given my base-case intrinsic value calculation. This is up from just a 14% undervaluation in February 2024 (my last update on DIS) which has come primarily as a result of a pullback in the stock’s price.

I maintain my intrinsic value target for Disney of around $129 and continued to rate the firm a Buy at present time.

Company Background

Disney is an undisputed entertainment juggernaut with the American company sporting one of the most iconic portfolios of media franchises currently in existence.

Through multiple acquisitions of smaller yet hugely popular studios such as Lucasfilm’s Star Wars and Marvel, Disney has expanded the breadth of their target demographic massively.

Simultaneously, The Walt Disney Company has continued to excel at further commercialising their massive portfolio of content through various media formats such as linear TV, movies, TV shows, music and even computer games.

Disney also has a massive physical entertainment business consisting of their famous theme parks, holiday resorts and even a cruise line.

The massive diversification pursued by Disney over the past three decades has allowed the firm to become an almost unavoidable element of the daily lives of millions of people across the globe.

I wrote a holistic in-depth analysis of Disney’s economic moat and business dynamics back in late-2023 in an article titled: “Disney: The Deep-Value Play of 2023”.

I still believe that the majority of analysis in that article rings true today, which is why I whole heartedly implore you to read that piece so as to gain a better understanding into how the company makes their money.

Earnings Analysis – Q4 & Full Year 2023

Since my last update on Disney back in late-February, 2024, a few material changes have occurred at the firm from a fiscal perspective as evidenced by the company’s most recent Q2 earnings report.

Disney FY24 Q2 Earnings Release

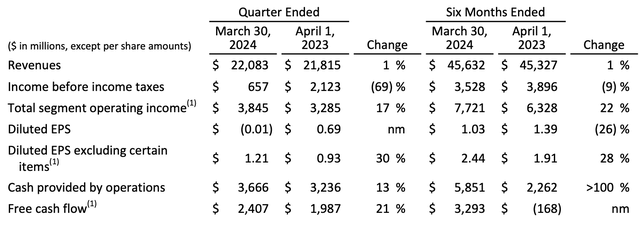

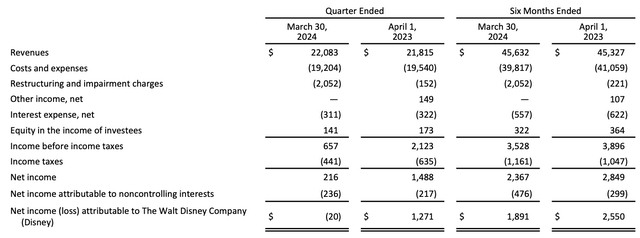

Top-line revenues for the entire Walt Disney Company increased 1% YoY to $22.1 billion while total income before taxes fell 69% YoY.

While these figures may initially sound very concerning, the reality is that Disney made multiple tangible operational improvements in the past quarter with a few one-off items perhaps distorting their overall income figures.

Disney FY24 Q2 Earnings Release

The major item impacting the firm’s operating income came from $2.1 billion in goodwill impairments absorbed as a result of the Star India divesture.

Worth noting is the inability for companies to deduct tax from goodwill impairments which increased Disney’s effective tax rate significantly from 29.9% to 67.1%.

Without these goodwill impairments, Disney’s bottom-line net income would have been closer to around $2 billion rather than the $20 million loss made in Q2.

This would have left net income up around 40% YoY (after accounting for taxes at a hypothetical yet realistic 25% rate) which in my opinion is much more representative of the superb profitability improvements made at the company during the last quarter.

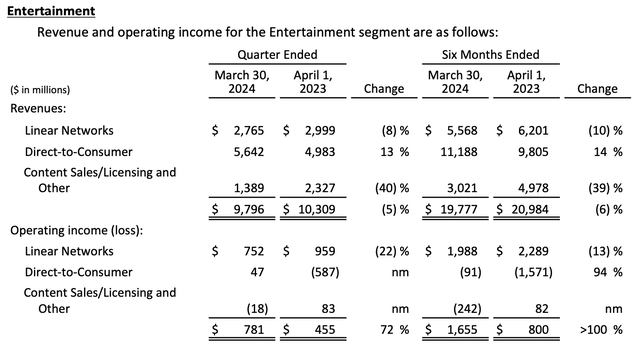

Disney FY24 Q2 Earnings Release

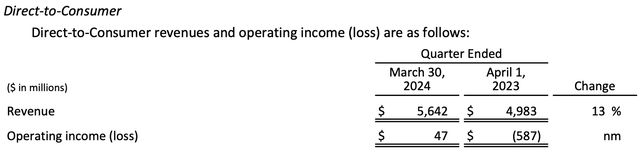

Most notably, Disney’s DTC streaming business finally becoming cashflow positive generating $5.64 billion in revenues and even more importantly, an operating income of $47 million compared to the $587 million loss in the same quarter one year prior.

Disney’s ability to generate profits from this segment came thanks to lower distribution costs, increased subscriber revenues and increased advertising revenues.

While Disney+ may still tail Netflix in overall subscriber count, the platform undeniably has a market-leading portfolio of content for viewers to enjoy with the recent bundle tie-up with Warner Brother’s Discovery’s (WBD) MAX service only further bolstering this competitive advantage for the firm.

Disney FY24 Q2 Earnings Release

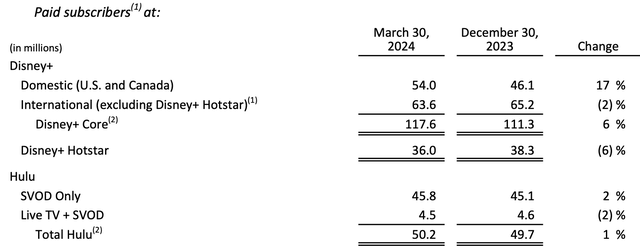

On the topic of paid subscribers, Disney+ saw a 17% YoY increase to 54 million total paid subscribers at the end of Q2. This increase cam party as a result of price increases in certain regions along with a crackdown on account sharing.

Disney+ is now offered in certain “wholesale” packages which has slightly decreased the firm’s U.S. domestic revenue per subscriber from $8.15 in FY23 Q2 to $8.00 in the most recent one.

Nevertheless, I really like the trajectory Disney+ is on and see the media giant successfully replacing linear TV revenues in the long run. While a prediction on how long this process may take is difficult to provide due to the multitude of variables and competitors in the space, Disney has historically been very good at extracting profitability from new business ventures.

Disney FY24 Q2 Earnings Release

Total entertainment segment revenues fell 5% YoY due to a decrease in linear networks revenues being slightly greater than the gains made in the DTC category.

However, operating income increased 72% as a result of the massive turnaround achieved in the streaming business.

Disney FY24 Q2 Earnings Release

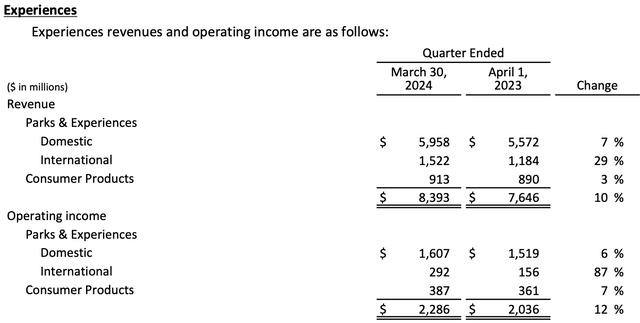

Disney’s experiences business continued their earlier Q1 earnings romp by producing a wonderful 10% top-line revenue growth along with a 12% expansion of operating income to $2.3 billion.

These superb results came as a result of strong demand by consumers for the firm’s Walt Disney World Resort and Cruise Line products. Both higher ticket prices along with successfully implemented cost saving initiatives helped bolster the bottom line.

However, it is worth nothing that while international experiences revenues increased 29% YoY, operating income only expanded 7%. This was due to ongoing inflationary pressures on Disney’s supply-side operations along with a weaker consumer demand environment in Europe and Asia.

Overall, Q2 produced what I deem to be a pretty wonderful set of results for the entertainment giant. While the goodwill impairment absorbed with the Star India divestiture was regrettable, I believe the firm is in a better position than ever to continue generating great returns in quarters to come.

April 2024 also saw the end of the proxy battle between Nelson Peltz’s Trian Partners and Disney’s CEO Iger with Bob maintaining control of the company after the shareholder vote.

I personally believe Iger is well suited to lead Disney for the coming year although I also appreciated the pressure for operational improvement brought to the discussion by Peltz.

Valuation – Q4 & Full Year 2023

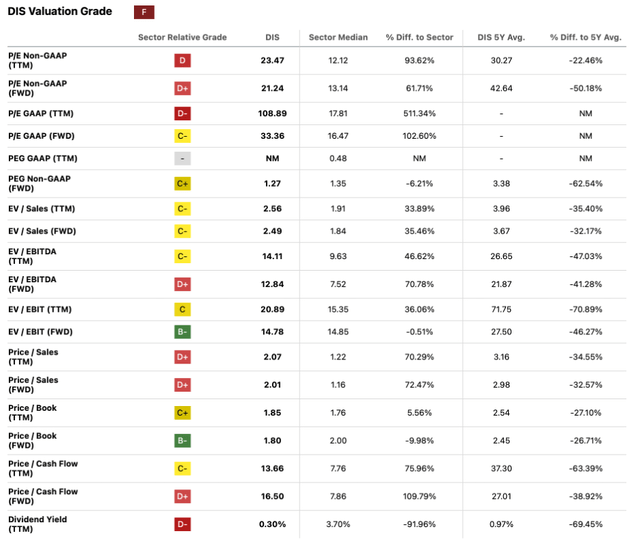

Seeking Alpha | DIS | Valuation

Seeking Alpha’s Quant continues to assign Walt Disney with an “F” Valuation rating. I still think this is an excessively pessimistic letter grade considering both the underlying improvements being made at the firm along with the heavy discount of DIS stock relative to historic averages.

The current P/E GAAP FWD ratio of 33.36x is quite reasonable in my opinion given the solid growth prospects at Disney. The current P/S TTM of 2.01x is at what I would consider a reasonable long-term level and certainly not indicative of a massive overvaluation in shares.

I also just want to quickly highlight that the current FWD P/B ratio of 1.80x is quite low indeed. Given Disney’s massive breadth and presence in multiple different business areas, it appears that the current valuation does not fully price-in the true scale of the firm’s operations.

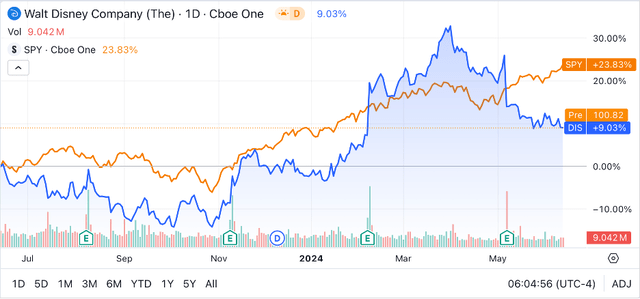

Seeking Alpha | DIS | 1Y Advanced Chart

A quick comparison of DIS stock against the ever-popular S&P 500 tracking exchange traded fund SPY (SPY) using Seeking Alpha’s 1Y Advanced Chart function provides an interesting view into the performance of shares over the past annum.

Solid profitability improvements have buoyed Disney’s stock with the most recent earnings report triggering a small selloff in shares. I can only speculate that this drop-off in investor sentiment has occurred as a result of the perhaps initially misleading headline earnings figures.

Fundamentally, I continue to rate the most recent Q2 results highly and believe a solid improvement in profitability is being achieved at the media giant.

The Value Corner

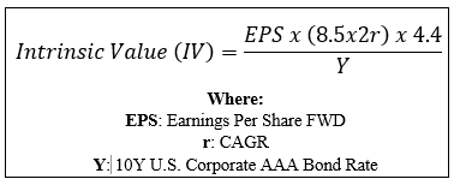

In order to develop a more objective and quantitatively-based perspective on Disney’s valuation, I like to use The Value Corner’s Intrinsic Value Calculation.

By inputting Disney’s current share price of $100.80 into the formula along with a 2024 EPS consensus estimate of $4.75, a relatively realistic “r” value of 0.12 (12%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.25x, I derive a base-case IV for DIS stock of $129.40.

This base-case model suggests share are currently undervalued by around 22%.

I also modelled a bear-case scenario where the U.S. economy would fall into a slight recession due to delayed quantitative easing by the FED by implying Disney’s growth rate would fall to around 6% (0.06). In such an event, Disney’s shares appear overvalued by 23.5%.

The massive difference between my base- and bear-case IVs is to be expected given the growth prospects currently being priced-in to Disney’s stock. It is also this very fundamental quality of most GARP opportunities that makes forecasting short-term performance (1-12 months) essentially impossible.

Quite simply, there are too many variables that could cause excessive volatility in shares when examining such a short-time frame.

In the long-run (1-5 years), I believe that the current fiscal data and qualitative performances at Disney present sufficient evidence to argue that the firm is effectively positioning themselves to generate outsized returns from their invested capital in the future.

While unfortunately nothing is for certain, I really like the trajectory Disney is currently on and continue to believe that a renewed focus on telling great stories is the key to generating wonderful earnings from all their businesses in the future.

Disney’s Risk Profile

The entertainment industry as a whole continues to present multiple competitive challenges to Disney.

Significant levels of competition within the streaming marketplace could continue to impact the underlying profitability of the Disney+ platform. Notably strong performances by the likes of Netflix (NFLX) and Apple’s (AAPL) Apple TV+ streaming offerings does raise the question how much longer the entire industry can go before significant consolidation beings occurring.

Failed execution on behalf of Disney with regards to new cinematic and TV releases also presents a real threat to the overall profitability of the firm.

While the more accountable tone coming from the management team with regards to some failed releases of blockbuster titles is refreshing, it would be nice to see some more information on how Disney is planning to improve the quality of the content they are producing.

Without great content which appeals to a wide variety of customers, Disney’s entire business model fails to function as it is the underlying IP and the connection consumers have with these franchises that provides the customer base for all of Disney’s parks, merchandise, resorts, cruises and games.

Finally, I would also like to mention a material change to their ESG profile which has come as the legal disputes between Disney and Florida Gov. Ron DeSantis have finally come to an end.

The closure of governance concern which at one point appeared to present a material threat to Disney’s ability to continue expanding their operations in their tax-effective Reidy Creek Improvement District (RCID) is positive in my opinion.

Considering these risks, I rate Disney as having a moderate risk exposure as a few material challenges continue to impact the business.

Of course, I implore everyone to conduct their own research into risk and ESG matters before making an investment decision as these topics are by their very nature highly subjective.

Summary

Carefully analysis was certainly required of Disney’s Q2 earnings so as to ensure a reasonably holistic understanding into the current situation could be developed.

I believe it was exactly this fiscal opaqueness which has placed a damper on their stock’s performance as many investors failed to look past the headline figures when the Q2 earnings were released.

Nevertheless, I continue to appreciate the profitability improvements being made at The Walt Disney Company and believe the firm is positioning themselves well for the future.

While Disney’s valuation is highly reliant on the firm generating topline YoY growth of around 10%, I believe the media giant’s stock still makes for an attractive GARP opportunity given the 22% base-case undervaluation currently present in shares.

Therefore, I rate DIS a buy at present time and continue to hold a significant position in the entertainment giant myself.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. The opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.