Summary:

- Disney shares have plummeted and are now at their pandemic lows, prompting a trader to bet on a rebound above $90.

- Analysts predict strong earnings growth in 2024 and 2025, which could contribute to the stock’s recovery.

- Recent news of a potential sale of Disney’s ABC TV unit has given the stock a boost, further supporting the bet on a rise.

Wirestock

Disney (NYSE:DIS) shares have been smashed since peaking in 2021 and have even returned to their pandemic lows. The stock’s poor performance and sharp declines have led a trader to bet that the stock will rebound in the coming weeks and rise above $90. This stock trades at just 16.6 times next year’s forward earnings estimates, the lower end of its historical range.

Bloomberg

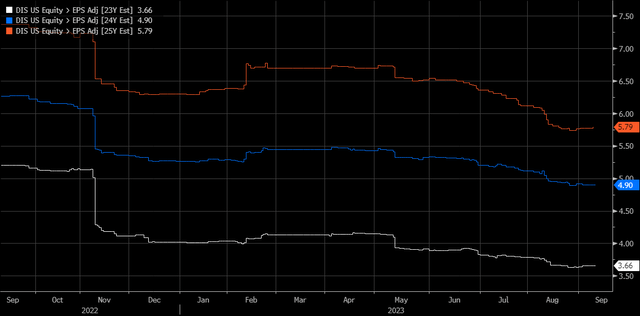

If analysts’ estimates are correct, earnings growth in 2024 will rebound sharply and rise by almost 34% to $4.90 per share, while revenue will grow by 5.4% to $93.1 billion. Even more surprising is that earnings growth is expected to remain strong in 2025, rising by 18.2%, while revenue grows by 5.3%, healthy growth rates.

Bloomberg

One reason for the stock’s weakness is likely because those actual earnings estimates have been trending lower. This will be a weight on the shares in the short term as questions swirl around Disney’s direct to consumer product offering, the potential impacts of an economic slowdown on theme parks, and the struggles the company has had with linear TV and ESPN units.

It’s worth noting that the stock has recently gotten a pop following news that the company may be looking to sell its ABC TV unit. On Sept. 14, reports surfaced that Byron Allen made an offer for $10 billion on Disney’s ABC TV Network, FX, and National Geographic channels.

Betting On A Rise In The Stock

Before the news of these potential sales, a trader was betting that Disney’s shares would rebound to around $90 by the middle of October, based on changes to open interest levels. Data from Trade Alert showed that open interest levels for Disney’s October 20 $90 calls rose by 11,216 contracts on Sept. 12. The data also shows that the 10,000 contracts were traded on the ASK in a block for $0.64, indicating they were bought and a bet that the shares would rise.

Technically Oversold

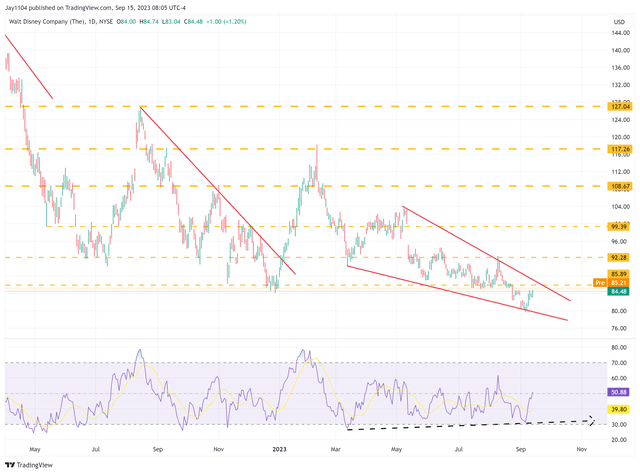

Meanwhile, the stock price has fallen back to pandemic lows and may be showing signs of forming a bottom. The relative strength index fell below 30 in March when the stock was around $92. More recently, the stock made a new low of around $80, while the RSI fell to only 31.2, a higher low. This is a bullish divergence, as noted by the lower low on the price and a higher low on the RSI, and could suggest a longer-term change in trend is coming.

The stock also appears to be forming a falling wedge, a bullish reversal pattern. If the stock can get past resistance at $85, where the trend intersects with horizontal resistance, there’s room for it to run to around $92.

TradingView

Disney’s stock has been beaten down, and at the very least, it could be overdue for a rebound, especially if the news of a reshuffling at Disney is on the way.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

TRY READING THE MARKETS AND GET THE FIRST 2-WEEK FREE

Reading the Markets helps readers cut through all the noise, delivering stock ideas and market updates while looking for opportunities. We also educate our members on what drives trading to help them make better decisions.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.