Summary:

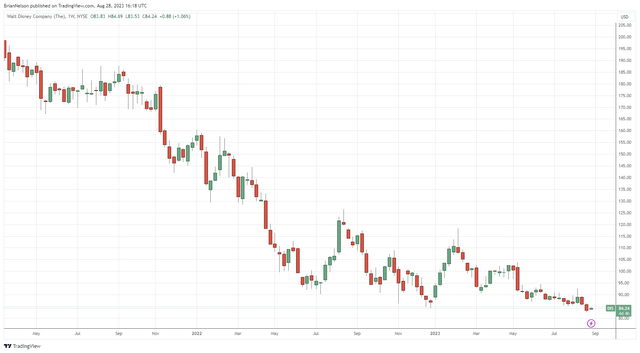

- Excitement surrounding Disney’s video streaming services drove shares higher during 2021, but the company’s equity has come back down to earth.

- The recovery of Disney’s theme parks and resorts operations post-COVID-19 and the resilience of its video streaming services offer some reassurance to long-term investors.

- However, the company’s current valuation is fair, in our view, even after building in a strong recovery in future expected free cash flows within our valuation model.

Wirestock

By Valuentum Analysts

The last time that we wrote about Disney (NYSE:DIS) on Seeking Alpha was all the way back in November 2022 in this article. The biggest changes since then have been the firm’s continued struggles in the video streaming business, further weakness in the linear television market, and the return of CEO Bob Iger. In this article, we’ll explain why we no longer think Disney’s shares are cheap–as our new fair value estimate stands about in-line with where shares are currently trading–provide an update on some recent developments, and explain why investors should expect a “market return” from shares, despite the firm’s heavily depressed share price from peak levels in 2021.

The biggest risks to our updated fair value estimate of Disney’s shares are of both the upside and downside variety. If the number of Disney’s video streaming subscribers re-accelerates and spending at its parks and resorts expand to levels greater than our expectations, the firm may warrant a higher valuation. However, from our perspective, there may be more downside risk to our fair value estimate, particularly as competition in the video streaming business intensifies and consumers remain increasingly cautious with their discretionary budgets in the midst of higher inflation. Our updated forecasts of Disney’s future free cash flows are also quite optimistic and build in a sustained turnaround for the firm, which might not come to fruition.

Disney is about as well-known of a company there is out there. The company has two main business operating segments these days: ‘Disney Media and Entertainment Distribution’ and ‘Disney Parks, Experiences and Products.’ Video streaming services are now a core part of Disney’s business model, supported by its well-known brand and its vast content library. The company had high hopes for the pace of paid subscriber growth across its Disney+ (including Disney+ Hotstar), EPSN+, and Hulu video streaming services, but more recently the firm has come up short relative to the market’s expectations. Competition in the streaming space remains fierce, too, and this in part has punished the stock the past couple years.

Disney’s shares have been under tremendous pressure the past couple years. (Trading View)

Looking ahead a few years from now, the ongoing recovery at Disney’s theme parks and resorts operations following the COVID-19 pandemic combined with paid subscriber resilience of its various video streaming services offer some reassurance to long-term investors. After all, Disney’s brand is stellar. The company should also benefit as households across the globe continue to return to the movie theaters in earnest. Movie making will always be hit or miss, however. That said, we can’t forget that Disney suspended its semi-annual dividend in May 2020 to preserve cash amid the COVID-19 pandemic, and the payout still hasn’t returned. Disney not paying a dividend really says something about the confidence of the board in its current situation, in our view.

Disney continues to work to optimize its video streaming services, but long-term profitability in this area remains difficult to forecast given the rivalry with Netflix (NFLX) and others. The firm also seems preoccupied with its feud with Florida Governor Ron DeSantis, and a weakening linear television market isn’t helping advertising revenue. All of this won’t be solved overnight either, and it might even worsen. Returning CEO Bob Iger will have his hands full as he strives to get the company back on track, which seems achievable but is not guaranteed. From where we stand, investors simply don’t need the complexity of the Disney story at this time, and the company’s recent share-price returns tell the story of a great company that is facing myriad challenges. Even with the stock price decline, however, shares of Disney only look about fairly-valued at present, and we’re building in a nice recovery in our valuation model, which we’ll discuss in depth in this article. We prefer these ideas instead.

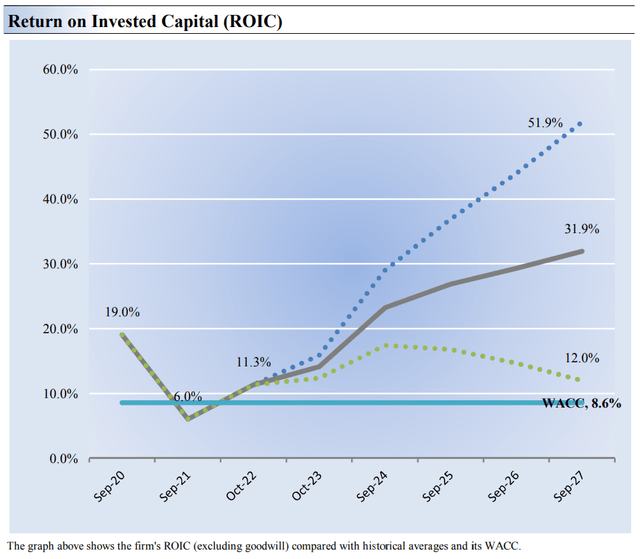

We’re expecting improvement in Disney’s return on invested capital in coming years. (Valuentum)

It is commonly accepted that the best measure of a company’s capacity to generate value for shareholders is expressed by comparing its return on invested capital [ROIC] with its weighted average cost of capital [WACC]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Based on our analysis, Disney’s 3-year historical return on invested capital (without goodwill) is 12.1%, which is above the estimate of its cost of capital of 8.6%. As such, we assign the firm a ValueCreation rating of GOOD.

In the chart above, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Disney is still a good company with a lot of valuable assets, and while we expect a strong recovery at Disney in coming years, a lot of this (if not all of it) is already priced in. It may be fair to say that Disney’s share price of a couple years ago may have built in near-dominance in video streaming (or at least tremendous growth in subscribers through the course of this decade), which now seems far fetched given the company’s recent subscriber declines.

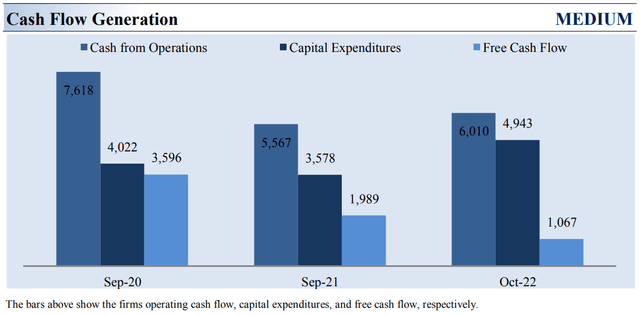

Disney’s free cash flow has faltered in recent years. (Valuentum)

Companies that put up a free cash flow margin (free cash flow divided by total revenue) above 5% are usually considered cash cows. Disney’s free cash flow margin has averaged about 3.2% during the past 3 years, which isn’t bad but could be a lot better. As such, we think the firm’s cash flow generation is relatively MEDIUM. The free cash flow measure shown above is derived by taking cash flow from operations less capital expenditures and differs from enterprise free cash flow [FCFF], which we use in deriving our fair value estimate for the company.

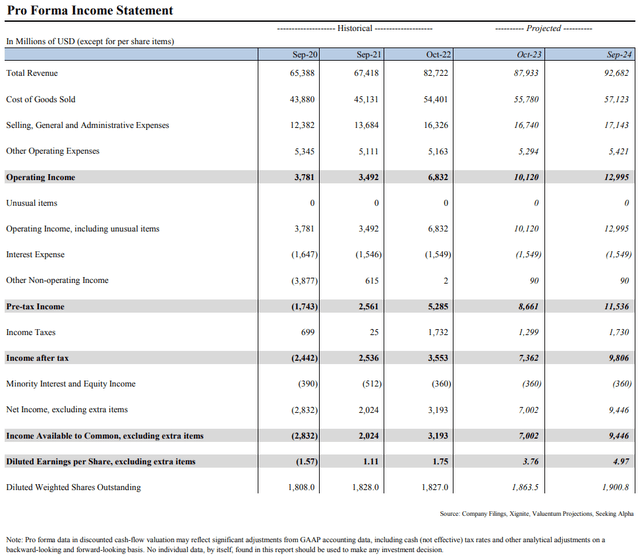

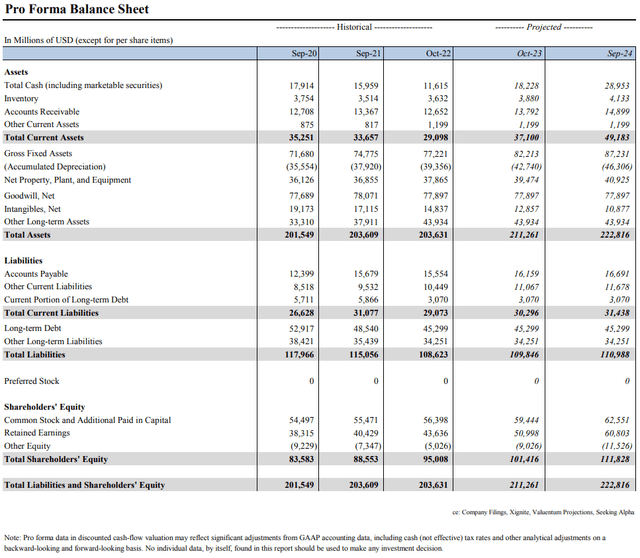

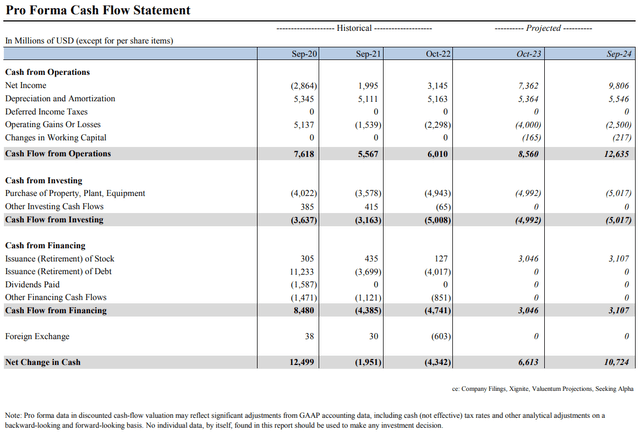

At Disney, cash flow from operations decreased from levels registered two years ago, while capital expenditures expanded over the same time period. Our forecasts over the next few years for Disney’s free cash flow are quite robust, however. For this year, we expect Disney to generate ~$3.5 billion in free cash flow, next year ~$7.6 billion, and the year after that as much as ~$9.3 billion. We’re building in quite the turnaround at Disney, but based on what these free cash flows imply with respect to our fair value estimate, a strong turnaround is largely reflected in the company’s share price. Our pro forma cash flow statement of Disney can be found at the end of this article.

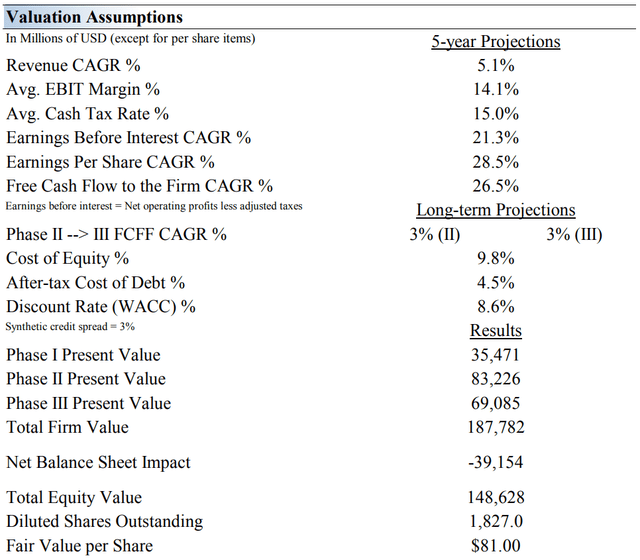

Our summary assumptions within our enterprise valuation model of Disney. (Valuentum)

Putting it all together, we think Disney is worth $81 per share. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. As one can see in the image that follows, not much of a company’s value is generated in the near term, but rather it is mid-cycle performance that matters most to valuation. What Disney will look like in five years is a difficult question to answer, but also one that influences its valuation the most. This is why we like to view valuation as a range of probable fair value outcomes, not necessarily a point estimate, which we’ll discuss later in this note.

Our valuation model reflects a compound annual revenue growth rate of 5.1% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 5.9%. Our valuation model reflects a 5-year projected average operating margin of 14.1%, which is above Disney’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3% for the next 15 years and 3% in perpetuity. For Disney, we use an 8.6% weighted average cost of capital to discount future free cash flows. The discount rate is fair for a company of Disney’s size and free cash flow resilience, in our view.

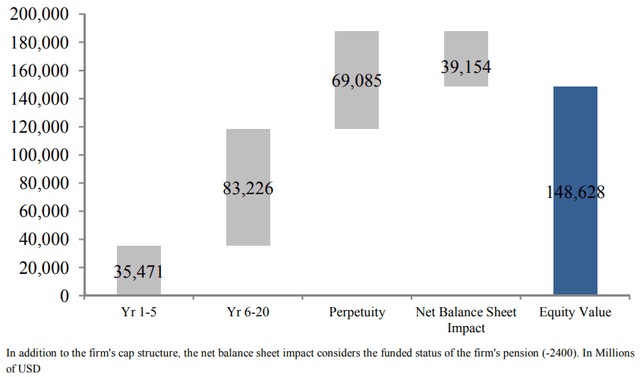

Our breakdown to Disney’s equity value. (Valuentum)

In the chart above, we show the build up to our estimate of total enterprise value for Disney and the break down to the firm’s total equity value, which we estimate to be about ~$149 billion. Disney’s market cap is about that, trading at ~$154 billion at the time of this writing. A strong recovery is already priced in, in our view. The present value of the enterprise free cash flows generated during each phase of our model and the net balance sheet impact, which considers the firm’s pension, is displayed above. We divide total equity value by diluted shares outstanding to arrive at our $81 per share fair value estimate of Disney.

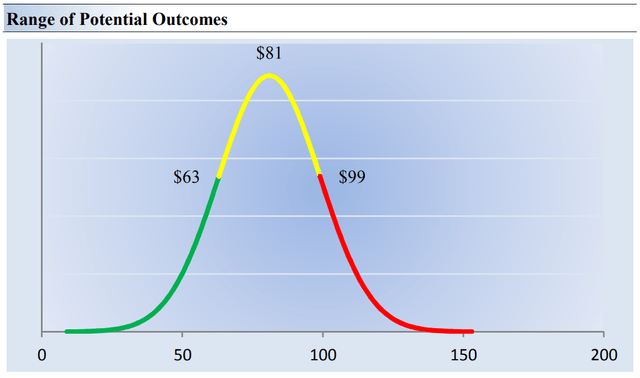

Our fair value estimate range of Disney. (Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. However, in light of the sensitivity of the discounted cash-flow model to mid-cycle expectations of revenue growth and margins, we like to view valuation as a range of probable fair value outcomes, not necessarily a point fair value estimate. Still, the central tendency of our fair value distribution is roughly in-line with Disney’s share price. This suggest that the market is getting its valuation about right, in our view.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock on the basis of the company’s sensitivity to revenue growth and margin assumptions. In the graph above, we show this probable range of fair values for Disney. We think the firm is most attractive below $63 per share (the green line), but quite expensive above $99 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

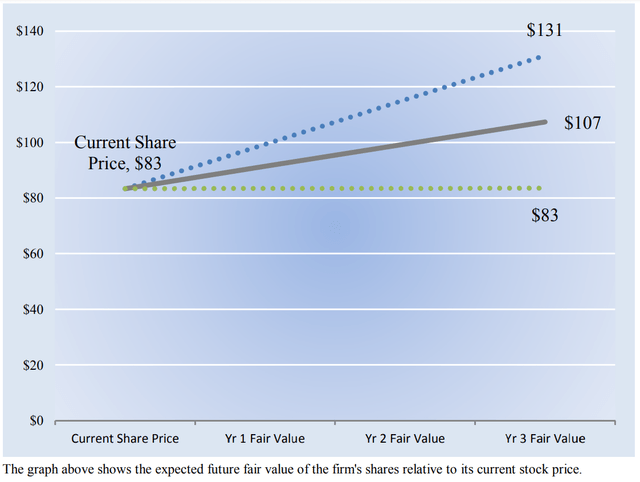

How Disney’s equity value is expected to advance in coming years. (Valuentum)

Let’s now talk about how value advances over time. Right now, we estimate Disney’s fair value to be about $81 per share. As time passes, however, companies generate cash flow and pay out cash to shareholders in the form of dividends (Disney no longer pays a dividend). The above image compares the firm’s current share price with the path of Disney’s expected equity value per share over the next three years, assuming our long-term projections prove accurate.

The range between the resulting downside fair value and upside fair value in Year 3 represents our best estimate of the value of the company’s shares three years hence. This range of potential outcomes is also subject to change over time, should our views on the firm’s future cash flow potential change. The expected fair value of $107 per share in Year 3 represents our existing fair value per share of $81 increased at an annual rate of the firm’s cost of equity. The upside and downside ranges are derived in the same way, but from the upper and lower bounds of our fair value estimate range.

All told, we think investors might expect a “market return” at Disney in the coming years (with value advancing at the firm’s cost of equity). Shares of Disney have certainly faced considerable pressure since the peak in 2021, but that doesn’t mean they are cheap. Even after factoring in a robust trajectory of future expected free cash flows within our valuation infrastructure, our fair value estimate of Disney is about in-line with where shares are trading. We think the market is a big believer in Disney’s turnaround, but even so, that may not make it the most attractive investment consideration. Importantly, if Disney fails to deliver on our robust future expected free cash flow forecasts, downward revisions to our fair value estimate may become probable. Disney’s shares are fully valued, and we reiterate that our assumptions are quite generous.

Pro Forma Income Statement (Valuentum) Pro Forma Balance Sheet (Valuentum) Pro Forma Cash Flow Statement (Valuentum)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.