Summary:

- Disney’s live-action remake of The Little Mermaid generated $185.8 million globally in its opening weekend, despite claims that the company is suffering from consumer backlash due to its stance on social issues.

- Disney’s box office market share remains above its historical average, indicating that consumers are still flocking to the content it produces.

- The company’s recent struggles are likely due to the lingering effects of the COVID-19 pandemic at the box office, rather than a lack of popularity.

Lisa Maree Williams/Getty Images Entertainment

Over this past weekend, another film by The Walt Disney Company (NYSE:DIS) was released in theaters. That happened to be the live action version of The Little Mermaid. Ever since the company voiced its opposition to some controversial policies enacted down in Florida, it has been under attack for allegedly being ‘woke’. The belief among those making the attack is that the company is suffering because of consumer backlash, with consumers angry at Disney’s stance on certain social issues. Often, those who champion this backlash against the company will cite how poorly the stock has performed as of late. From its 52-week high point, the stock is down 30.6%. And it’s down by more than half compared to its all-time high. As a shareholder of the company and somebody who has followed it for some time now, my own belief is that fundamental data is what matters. The true problem lies in the fact that costs frankly got out of control. And when you factor that with the fact that revenue is at an all-time high, the company is actually more popular than ever.

In my opinion, the tremendous success that the live action version of The Little Mermaid is turning out to be is yet one more example of how those who are bearish about the company are missing the forest for the trees. Those who disagree with me might very well point out this could be just a one-off event of success at the box office. But when you dig deeper and look at the company’s box office history, including history covering the current fiscal year, you actually see that the company is holding its own remarkably well. While the business is not as popular at the box office as it was immediately prior to the pandemic, this can really be chalked up to the extraordinary circumstances facing the firm back then. But compared to how the company has operated historically, there’s no evidence that consumers are turning away from the content that it provides.

Another success

Heading into the release of the live action remake of The Little Mermaid, the expectation was that the film would see a domestic box office weekend of between $90 million and $100 million. While the film did bring in $95.5 million in the domestic market during the three-day weekend, it brought in an impressive $118.8 million over the four days that included Memorial Day. In fact, the film ultimately became the fifth-highest Memorial Day weekend opening movie of all time in the domestic market. Globally, box office receipts came in at $185.8 million. That was in spite of the fact that the company struggled in China, generating only $2.5 million over the weekend there. In its first full day at the box office, the film generated $38.1 million domestically, beating out this year’s top-grossing movie so far, The Super Mario Bros. Movie, which generated $31.7 million. And through May 30, the film generated $198.6 million globally.

Based on the data provided, audiences enjoyed the film, with it receiving a 95% score on Rotten Tomatoes. In the domestic market, the film was even more successful than Return of the Jedi, which brought in $92.8 million. Another live action remake, Aladdin, brought in $91.5 million during the weekend, and $116.8 million during its holiday weekend that it debuted in. This is monumental in and of itself because Aladdin alternately went on to generate $1.05 billion in the global box office. The live action remake of Beauty and the Beast fared even better, generating $1.27 billion, while The Lion King raked in $1.65 billion. What this suggests is that The Little Mermaid is well on its way to generating $1 billion or more in the box office. Considering that it had a budget of $250 million, it should ultimately prove to be a win for the company.

Those who are critical about Disney may very well point out that this could be a one-time event. However, I would argue that it’s an example that Disney is still incredibly popular with consumers. To prove my point, there are any number of data points that I could look at. Examples would include attendance at its theme parks and associated revenues. I could look at the occupancy rates at its hotels. I could point to the tremendous success that has been Disney+. The list goes on. But these are all items that I have touched on previously. Instead, I would like to focus solely on box office data.

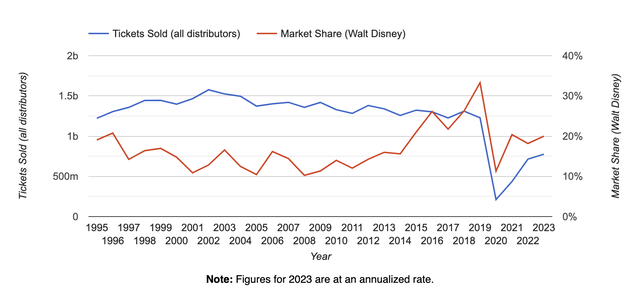

In the chart above, you can see both the number of tickets sold and the market share that Disney has experienced at the box office. This covers from 1995 through the present moment in 2023. Naturally, the number of tickets actually sold in the box office plummeted in recent years. But this was because of the COVID-19 pandemic. We saw an initial spike in overall market share reported by the company from 2016 through 2019. But this spike was caused largely by the tremendous success of the final installments of the Avengers series. Even with overall ticket sales currently down in 2023 compared to what we saw in those three years leading up to the pandemic, the market share for the company remains above its historical average.

It’s important to note that this data does not include movies that the company produced because of its acquisition of 21st Century Fox in what was ultimately a $71.3 billion transaction. Through its 20th Century Studios, Disney only saw one release in 2022 and 2023. That was the tremendously successful Avatar: The Way of Water that went on to sell 24.7 million tickets in 2023 alone and generated overall box office receipts of $2.32 billion. But even this data is not included in the chart that I posted. Without Avatar in the mix, Disney has been responsible for two of the five most successful box office releases so far this year and for three of the top ten.

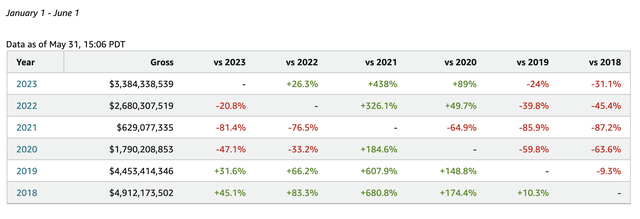

What this data shows so far is that, when it comes to the box office, Disney is still one of the two big fish in the pond (the other being Universal). The fact that the company has a box office market share that’s comfortably above its historical average is proof enough to me that consumers are still flocking to the content it produces. The problem is not a lack of popularity then, but instead stems from the fact that the box office is still suffering because of a hangover effect associated with COVID-19. This shows up in the data in multiple forms. Consider, for instance, year to date box office receipts. From January 1 of this year through May 31, overall box office receipts totaled $3.36 billion. While this is higher than anytime from 2020 through 2022, it is still 24.2% lower than what we saw in 2019 and 31.3% below what we saw in 2018.

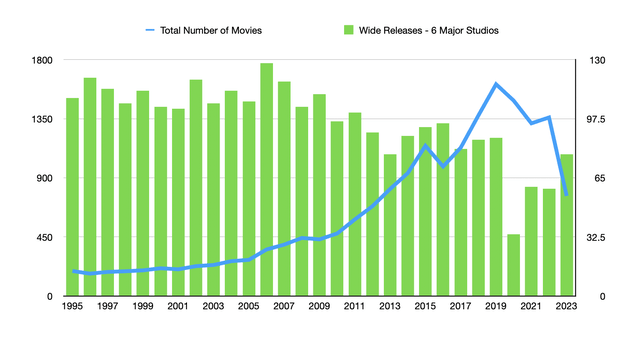

This, I believe, has nothing to do with some sort of backlash against ‘woke’ Hollywood. Rather, it is a supply side issue, not a demand side one. Back in 2018, in the domestic market, the total number of theatrical releases was 993. That’s the highest it had ever been. In 2019, this number dipped to 910. But you should expect to see fluctuations from year to year. When COVID-19 hit, the number of releases fell through the floor. By 2021, the domestic market saw only 440 films released. And in 2022, this number recovered only slightly to 496.

It is true that the majority of box office revenue falls to the six major studios. And those studios overwhelmingly produce roughly the same number of wide release films from year to year as a group. But when you look at the data through the lens of the group, you miss Disney specifically. In 2019, for instance, the company had 10 films that were widely released. Last year, that number was only five.

Takeaway

Based on the data that’s available, it seems to me as though Disney continues to do incredibly well from a purely business and fundamental perspective. The latest example of this can be seen by looking at the tremendous success that its latest film, The Little Mermaid, has seen so far. Obviously, this picture could change moving forward. But when you look at past data, the problem for the company in recent years has been not a lack of appetite for its films, but instead the COVID-19 pandemic and the lingering effects from it. With that now long gone, and the box office finally showing signs of a nice recovery, I suspect that box office success will look very much like it had in many prior years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!