Summary:

- I am downgrading Disney to Sell due to the heightened recession risk from Trump’s second term and potentially disruptive economic policies.

- Historically, the stock experiences significant price declines during a recession, making it a poor investment if consumer spending drops.

- Disney’s current overvaluation exacerbates the risk, with rising odds of a greater-than-normal loss given a recession in 2025.

- I suggest using the recent earnings boost as an opportunity to liquidate shares or hedge your position with covered calls for extra income.

Adam Gault

I have been bullish on The Walt Disney Company (NYSE:DIS) since my article from July 2023 here, when the price was around $85 a share. And, the company has proven a worthwhile investment since then.

Seeking Alpha – Paul Franke, Bullish Disney Article, July 26th, 2023

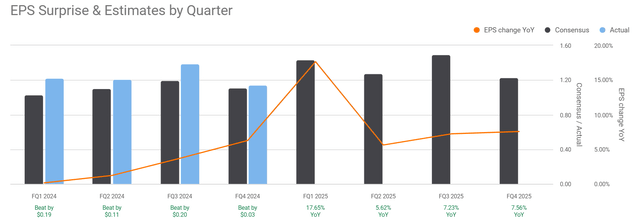

In fact, management reported an earnings beat last week (the 6th quarterly earnings beat in a row), with a small guidance increase, to vault the share price to an 8-month-high.

Seeking Alpha Table – Disney, Quarterly Earnings Results vs. Forecasts, 2024-25

However, the good news may end there. My concern is the election of Donald Trump to a second Presidential term, matched with a total Republican takeover of voting control in the Congressional House and Senate, may bring a period of disruptive economic consequences for the U.S. starting in just a few weeks.

If a recession is now our immediate future, you will want to avoid consumer spending-heavy names like autos, homebuilders, many retailers, and even travel/vacation related names like Disney.

Because of the added recession risk appearing over the past several weeks, I suggest Disney investors avoid and/or sell shares into the end of the year. So, I am downgrading my view of Disney to Sell, from a previous Buy rating. Let me explain my rationale.

Trump Recession Risks

The newest issue for owning Disney that did not exist a few weeks ago was the election of Donald Trump as president on November 5th, with another term set to begin on January 20th, 2025.

While most pundits are looking forward to a repeat of 2017’s decent economic growth, tax cuts for big business, and hopefully a strong stock market run in 2025, I am saying not so fast with the optimism. Trump’s first term included more targeted changes, with numerous advisers/experts arguing the pros and cons. A second term from a much older, clearly aggrieved individual (rightly or wrongly doesn’t matter), surrounded by “yes men” (some with questionable intentions for the nation), could bring enormous missteps in policy for the average American.

We have never experienced the kind of shake up in how our economy works, as promised by Trump’s campaigning for votes. Removing millions of workers (and their spending dollars) through the deportation of people out of the country with U.S. military help has never been a thing for an experiment over 248 years in our nation’s history. We did forcibly intern Japanese immigrants and citizens during World War II, but today’s contemplated illegal immigration “fix” is a grander scale idea, with still unknown macroeconomic consequences. The most likely end result (if such an effort plays out) is a direct reduction in spending in the economy from lost workers, with much higher wage inflation overall, given the ultra-low 4% unemployment rate at the start. The base conclusion is this policy will be a net loser for the U.S. economy, at least upfront.

Then, if Trump and Republicans follow through on the tariff threats on all imported goods, a trade war like witnessed during the 1930s Great Depression will not be good news for the economy (either consumer spending or business profits). It would likely prove incredibly stagflationary, as foreign nations (Germany and Mexico specifically) have already promised immediate retaliation on U.S. goods exported around the world. Just this week, both Walmart (WMT) and Lowe’s (LOW) have come out against any increase in tariffs on imported goods.

Then, we have the “efficiency” push in government spending to try and cut the deficit (which is nearly unsolvable at this point, if you look long and hard at the math). Sounds great in campaign soundbites and press releases (social media posts), but slashing fiscal spending will undoubtedly lead to far lower economic growth overall (taking away the major stimulus of increased federal spending since the pandemic began). Really, this was another mistake made during the Great Depression. A reduction in government spending was undertaken simultaneously as the 1930 Smoot-Hawley Tariff Act was passed, a double whammy of sorts for the economy.

So, the risks to consumer spending next year are amazingly high now, and in a far worse situation than October 2024. My thinking is the Republicans need to be talked off the ledge by business leaders in coming weeks, else Trump and his clan could go down in the history books with Herbert Hoover as the gang that crashed the U.S. economy.

I will say I am very sympathetic to reducing the federal government’s reach and size. I absolutely would prefer a balanced budget in theory. However, changes have to be made slowly, over four years would the smartest, not all at once. The difference between pruning a tree and cutting it down, is one lives until the next growth season, while the other dies forever. In terms of the economy, if Trump changes drag the economy down, we will not get a redux, redo or mulligan (in golfing vernacular).

An additional worry I have, that every investor needs to contemplate, is our national debt of $35 trillion cannot be serviced properly in a recession. An expansion in deficits may be the result of a recession, no matter what minor spending cuts are achieved in 2025. At that point, foreign investors could entertain a mass exodus from U.S. assets and crash the dollar’s value. We won’t have any say in the matter, especially if a trade war turns world leaders against the U.S. That’s why “isolationism” and America First policies could actually bankrupt the country (or create hyperinflation), when you start moving the 3-D chess pieces.

Disney Sucks to Own in Recessions

Well, Disney has a history of being a horrible investment during economic downturns. That’s not a hard concept to understand. When consumers cut spending (either by choice or because of lost income), they cancel trips to Disney World, or decide not to book a trip/cruise to save money. In the modern age, they may cut back on streaming services and/or skip the movie theater entertainment experience when unemployed.

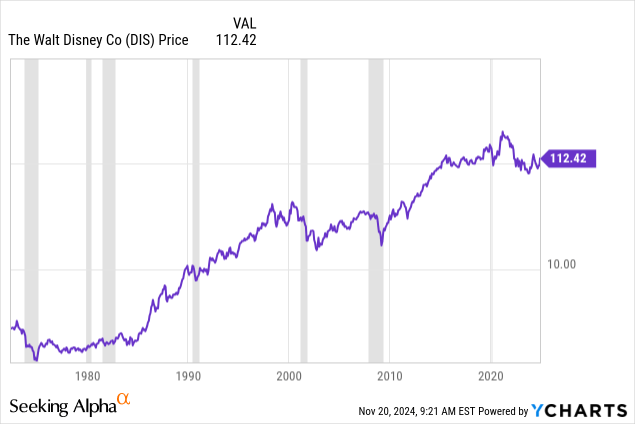

Below is a chart of Disney’s share price movement since 1970, with recessions shaded in grey. If you measure performance from just before recessions hit, large sell-offs occurred in 6 of 7 instances. Only the minor technical GDP contraction of 1980 did not pummel Disney shareholders. Price declines of -30% to -60% were the norm during recessionary periods.

YCharts – Disney, Monthly Price Changes Since 1970, Recessions Shaded, Log Scale

Valuation Getting Stretched

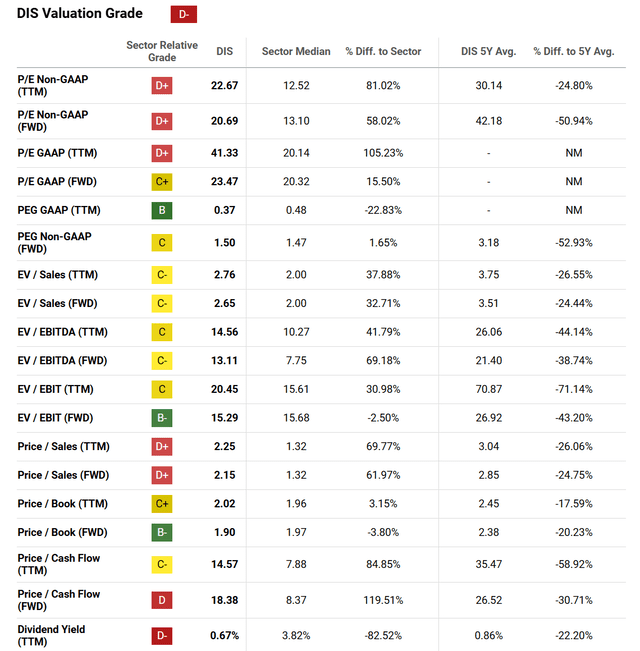

Now, if Disney retained a better than usual historical valuation, I might be willing to hold shares through 2025. It would still be something of a gamble that reasonable government policy decisions will be made.

Yet, that is not the case today. While Disney often has enjoyed a sound valuation setup going into recession, late 2024’s experience remains on the overvalued end of the pricing spectrum. To me, this is really bad news if we do get a recession, as the downside price loss potential could be “greater” than normal.

Below is a fair roundup of the valuation setup for Disney, as expressed by Seeking Alpha’s Quant Ranking system. The final grade of “D-” does not inspire a lot of confidence in share price direction, assuming a recession is approaching during the first half of 2025.

Seeking Alpha Table – Disney, Quant Valuation Grade, November 19th, 2024

Final Thoughts

I would use the latest upside earnings/guidance surprise stock boost as a gift to sell your shares (at least a portion of them). I would not buy shares above $110 for the time being. And, if you decide to keep your shares, maybe sell some covered calls for extra income.

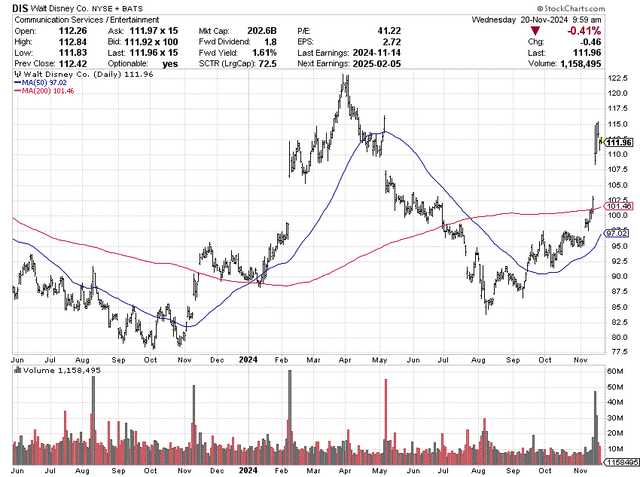

StockCharts.com – Disney, 18 Months of Daily Price & Volume Changes

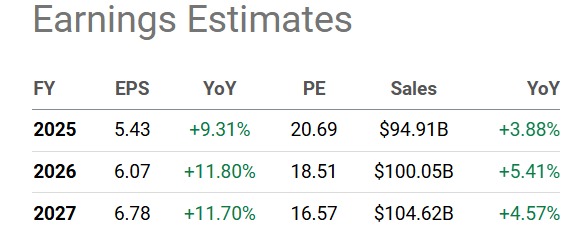

I will say the operating business and financials seems to be moving in the right direction, recovering from the COVID shutdown of 2020, while slowly paying down debt from the 21st Century Fox asset combination in 2019. The current consensus analyst forecast (largely on estimates made before the election) is calling for stable/modest growth in Disney sales and EPS for fiscal years 2025-27. The open question is how will Trump’s policy reversals and experimental changes affect the economy.

Seeking Alpha Table – Disney, Analyst Estimates for FY 2025-27, Made November 19th, 2024

My bearish Disney call is purely one based on my personal forecast of a worsening macroeconomic picture for 2025. I am praying Trump proves me wrong, with a more restrained agenda of change following the inauguration. The ball really is in his court, regarding the future direction of the economy and Wall Street.

For now, I am stepping aside, waiting for more clarity on economic policy and the repercussions of Republican changes to how our society functions. If major disruptions are the direction, I fully expect quite a bit of volatility in the U.S. stock market, with the potential for major losses in a severe economic fallout scenario during 2025.

I may have to grit my teeth and accept the “opportunity cost” of missing further gains in Disney’s quote, assuming only minor changes to taxes, spending, and immigration status become reality. I guess we will see what materializes. We are definitely living in interesting times.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.