Summary:

- I initially bought Caterpillar (CAT) for inflation protection and as a hedge against a weak dollar. Despite manufacturing headwinds, CAT has seen significant stock gains.

- CAT continues to deliver strong earnings and profit margins, driven by strategic positioning and efficient operations. It remains resilient despite broader economic challenges.

- With robust dividend growth, share buybacks, and promising long-term trends in key sectors, CAT is well-positioned for continued growth and solid returns in the years ahead.

Ekaterina Kiseleva

Introduction

Caterpillar (NYSE:CAT) is one of the first stocks I bought for my dividend growth portfolio. Although I started investing roughly a decade before 2020, during the pandemic, I decided to get serious about long-term investing. Since then, I’ve consistently had between 90-100% of my net worth in long-term dividend stocks.

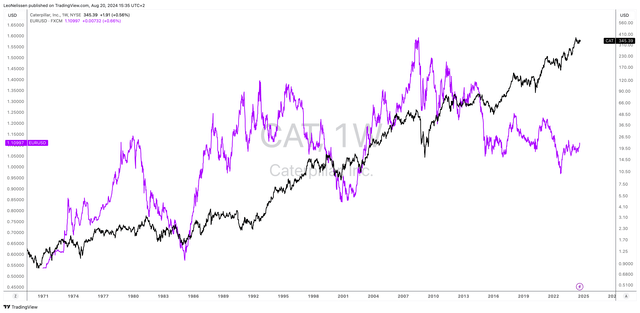

One of the first reasons I bought Caterpillar was to add inflation protection and as a hedge against a weak dollar. As a Euro-based investor, a declining USD/EUR exchange rate has a negative impact on my local net worth.

Historically speaking, a weaker dollar often leads to higher commodity prices and higher inflation, as most commodities are denominated in the mighty U.S. dollar. That’s bullish for CAT.

TradingView (CAT, EUR/USD)

Back then, I bought it for $132. Now, CAT is at $345, roughly 160% higher.

The reason I’m bringing this up is because this is somewhat unusual.

- The dollar has been rather strong since 2021.

- Manufacturing sentiment has been in a steady decline since 2021.

After peaking in 2021, the ISM Manufacturing Index and its new orders component have indicated elevated pressure on the U.S. manufacturing sector. Since last year, both have been consistently in contraction territory.

Wells Fargo

This is what Wells Fargo wrote on August 1:

It has been gloomy for two years in the manufacturing sector, but today’s ISM report shows that various measures of activity have sunk to levels not seen since the initial arrival of the pandemic. Most troubling is that this suffering comes without the merit of lower prices. – Wells Fargo

Nonetheless, Caterpillar kept making new highs, growing its dividend, and hinting at a strong economy.

This is confirmed by its recently released earnings, which caused investors to jump back into the stock, betting on a potential demand recovery with ongoing secular tailwinds.

Since my most recent article on July 21, Caterpillar has been roughly unchanged, with new upside momentum.

Hence, in this article, I’ll update my thesis, using its latest earnings and other major developments that keep me bullish on this dividend grower.

So, let’s dive into the details!

Just How Unstoppable Is Caterpillar?

Although Caterpillar is definitely impacted by weaker growth in cyclical industries, it requires more weakness to hurt the company.

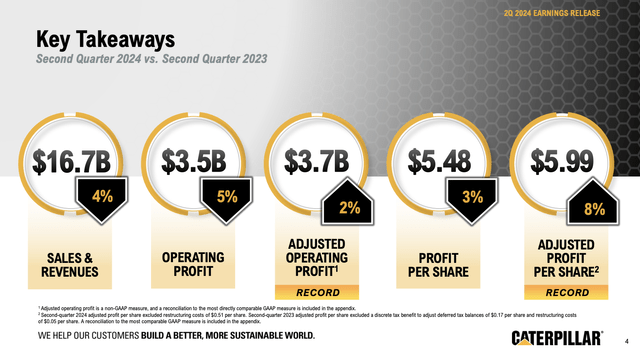

As we can see below, the company achieved a record second-quarter earnings per share result.

Caterpillar

This hardly screams “recession.”

What’s interesting is that a strong earnings result was based on rather weak sales, as the company generated revenues of $16.7 billion, a slight decline of 4% compared to the prior-year quarter.

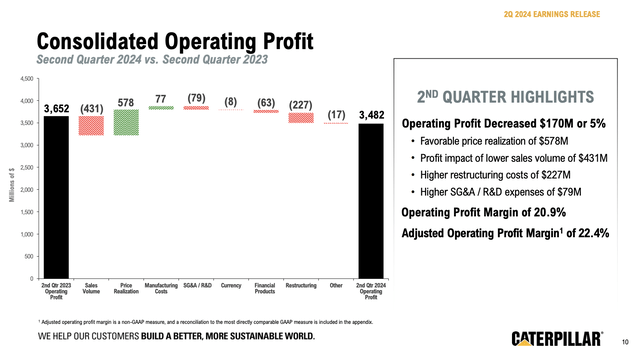

However, Caterpillar’s adjusted operating profit increased by 2% to $3.7 billion, boosted by an impressive adjusted operating profit margin of 22.4%.

This margin represents a very impressive 110-basis-point improvement over the previous year.

Caterpillar

Moreover, as we can see above and as I already briefly mentioned, Caterpillar achieved a record adjusted profit per share of $5.99, which is an 8% increase from the previous year.

Now, let’s dig a bit deeper, as there’s a lot to learn when assessing the company’s business segments.

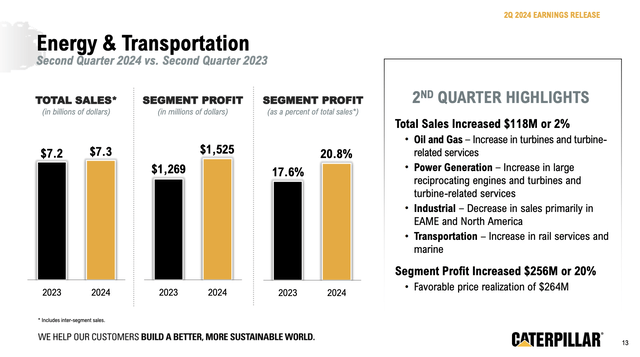

The Energy & Transportation segment, for example, reported a 2% increase in sales to $7.3 billion. This was driven by significant growth in power generation (15% growth) and transportation (up 7%).

The segment’s operating profit surged by 20% to $1.5 billion, with a margin improvement of 320 basis points to 20.8%. This allowed segment profit to come in above $1.5 billion.

Caterpillar

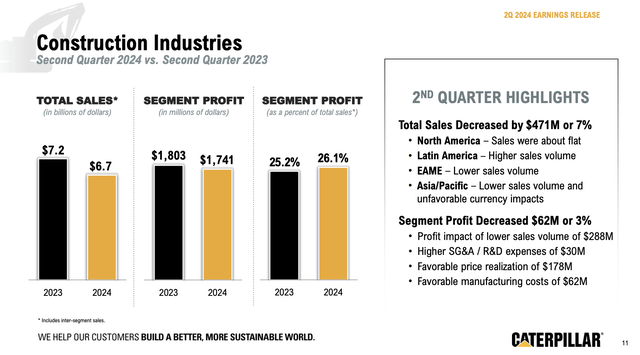

Meanwhile, the Construction Industries and Resource Industries segments saw declines in sales due to lower dealer inventories and reduced sales volumes, something typical in light of weak manufacturing sentiment.

However, both segments still managed to maintain solid margins.

The Construction Industries segment, for example, reported a profit margin of 26.1%. That’s an improvement of 90 basis points provided by a favorable product mix and lower material costs.

Caterpillar

In the Resource Industries segment, the profit margin rose by 160 basis points. This was boosted by favorable pricing and lower manufacturing costs.

Combining all segments, we clearly see in the overview below that pricing power and manufacturing cost tailwinds offset sales headwinds. This is a great achievement in a challenging environment and one of the reasons why Caterpillar’s stock has been doing so well.

Caterpillar

It also helps a lot that Caterpillar is upbeat about its future, as the company expects its adjusted operating profit margin for the full year to beat the top end of its target range, potentially supported by favorable manufacturing costs and strong operational efficiencies – the same drivers that benefitted 2Q24 earnings.

Although sales this year are expected to be slightly lower than the record levels of 2023, the company made clear that it remains focused on achieving long-term profitable growth.

As this may sound a bit vague, let’s discuss what that means.

Caterpillar’s Impressive Shareholder Value

On top of reporting elevated margins, the company generated $2.5 billion in ME&T (machinery, energy, and transportation) free cash flow.

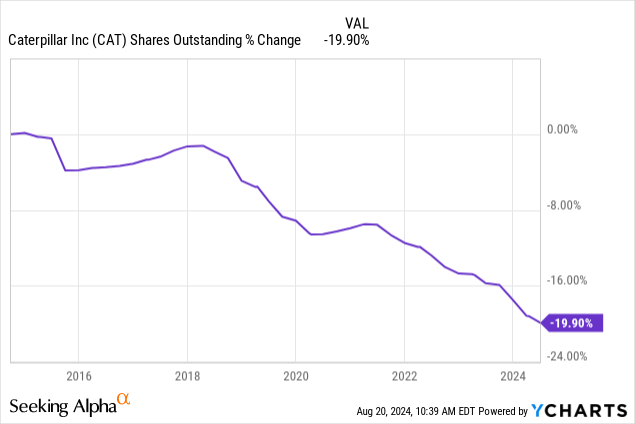

This was put to good use, as $1.8 billion of it ended up being used for share buybacks. The company, which holds more than $4 billion in cash with an A-rated credit rating, has bought back close to 20% of its shares over the past ten years.

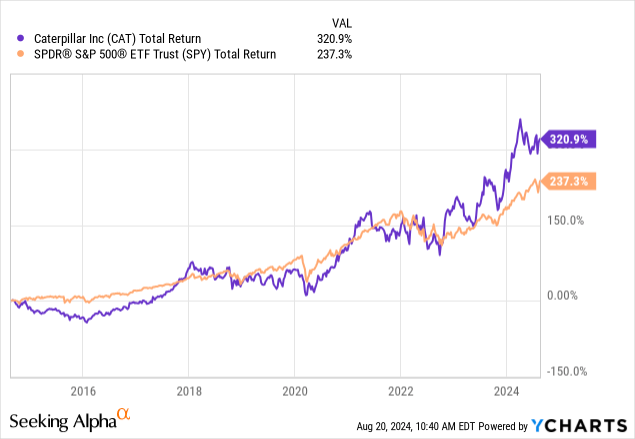

These buybacks tremendously improved the per-share value of the business and allowed the company to beat the S&P 500 by more than 80 basis points over the past ten years.

Moreover, on June 21, the company announced it added $20 billion to its current share repurchase authorization. This translates to 12% of its current market cap!

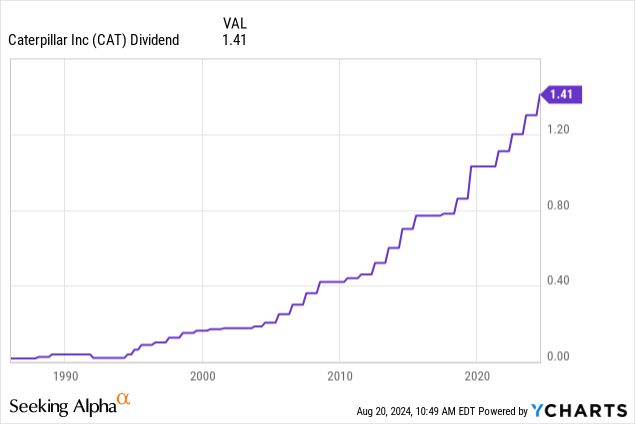

Adding to that, the company spent $600 million on dividends.

Currently yielding 1.6%, the company has a dividend payout ratio of less than 24%, a five-year CAGR of 8.0%, and 30 consecutive years of dividend growth, making it a Dividend Aristocrat.

The reason Caterpillar is so upbeat is strong secular growth in certain areas. While the ISM Index may have hinted at a manufacturing recession, we are not dealing with a “normal” manufacturing downswing, as a number of trends are very favorable for CAT.

This includes elevated demand for turbines, reciprocating engines, and power generation equipment, including demand for data centers and renewable energy solutions. Both of these areas are in a strong secular upswing, requiring construction equipment and power supply.

Reuters

In the first half of 2024, more than 500 megawatts of new data centers, or roughly equivalent to all of the existing capacity in Silicon Valley, were rolled out in the eight biggest markets in the United States and Canada, according to CBRE.

New data center inventory grew by 10% in the first six months of the year, while jumping 23% from a year earlier, the report said.

The eight main North American data center markets are Northern Virginia, Dallas and Fort Worth, Texas; Silicon Valley in central California; Chicago; Phoenix, Arizona; the New York Tri-State Area; Atlanta; and Hillsboro in Oregon. – Reuters

Moreover, while Construction Industries and Resource Industries saw some headwinds, Caterpillar is in a good position in infrastructure, mining, and energy transition sectors that profile solid long-term growth.

This includes battery-electric and hydrogen-powered equipment.

In April, Caterpillar and Vale signed an agreement to test battery electric large mining trucks as well as to conduct studies on ethanol-powered trucks. Progress has been made on both initiatives since the agreement was signed, including conducting a joint study on a dual fuel solution for haul trucks operating on ethanol and diesel fuel. We are supporting Vale’s sustainability objectives. – CAT 2Q24 Earnings Call

Caterpillar

Even its valuation isn’t bad in light of a strong stock price performance and weak sales growth.

Valuation

After 53% EPS growth in 2023, growth is expected to slow. However, using the FactSet data in the chart below, contraction is expected to be avoided.

This year, analysts expect 4% EPS growth, potentially followed by 4% growth in 2025 and an acceleration to 9% in 2026.

These are fantastic expectations in light of poor manufacturing sentiment. If we get a growth bottom in the quarters ahead, I expect CAT’s growth to be meaningfully higher, especially if the dollar keeps weakening. Such a scenario would be very beneficial for U.S. exports, emerging market growth, and overall commodity demand.

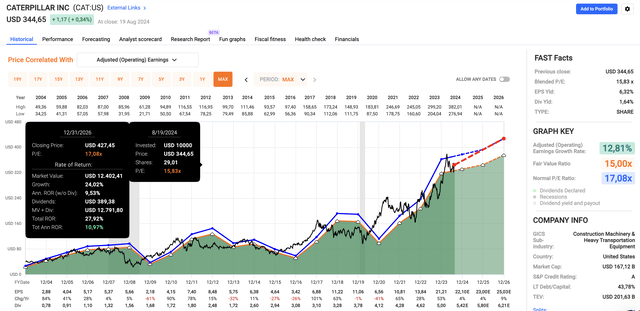

FAST Graphs

When adding that CAT trades at a blended P/E ratio of 15.8x, slightly below its long-term average of 17.1x, we get a theoretical annual return outlook of 10-12%, which is why I remain bullish on the machinery company.

Takeaway

Caterpillar continues to be a key pillar in my dividend growth portfolio, providing a lot of resilience even in the current challenging economic environment.

Moreover, despite weaker manufacturing sentiment and headwinds in certain segments, CAT has delivered record earnings, maintained strong margins, and continued to reward shareholders through dividends and (aggressive) share buybacks.

On top of that, the company’s strategic positioning in sectors like infrastructure, energy transition, and data centers offers long-term growth opportunities.

Last but not least, with a very healthy balance sheet and favorable valuation, I remain confident in the company’s ability to generate elevated returns, especially if the dollar weakens and global demand strengthens – potentially supported by lower rates as a cherry on top.

Pros & Cons

Pros:

- Strong Margins: Despite sales challenges, CAT continues to generate impressive profit margins, driven by pricing power and higher margins.

- Dividend Growth: With 30 consecutive years of dividend increases and a low payout ratio, CAT is a reliable Dividend Aristocrat.

- Long-Term Growth Potential: CAT’s positioning in infrastructure, mining, and energy transition sectors aligns with strong secular growth trends.

- Technological Integration: Advanced tech in products boosts efficiency and competitiveness.

- Robust Dealer Network: An extensive network provides great support and customer relationships.

Cons:

- Cyclical Risks: CAT’s performance is tied to cyclical industries, making it prone to economic downturns.

- Valuation Risks: Although CAT’s valuation is attractive, any significant economic slowdown could pressure earnings and limit stock performance.

- Competition: Although CAT has built a moat for itself, competition is always a factor, including from Asian and German exporters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.