Summary:

- Amazon is reportedly in talks with wireless carriers about offering low-cost or free nationwide mobile phone service to its Prime members, causing share prices of major telecom companies to fluctuate.

- The most likely partner for Amazon would be Verizon.

- This would be due to its overall size and the fact that its weaker position would make it more likely to push for low-margin wholesale revenue over no revenue.

- However, both Amazon and T-Mobile have stated that no such deal is imminent, and the probability of a deal materializing is considered low.

HJBC

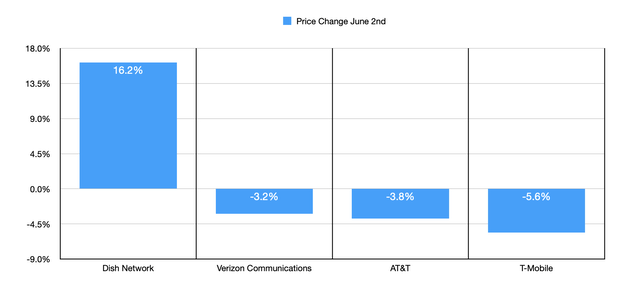

June 2nd was a wild day for telecommunications companies like AT&T (T), Verizon Communications (VZ), T-Mobile (TMUS), and DISH Network (DISH). After a report surfaced that indicated that Amazon (NASDAQ:AMZN) was in discussions with wireless carriers about the potential offering of a low cost or free nationwide mobile phone service to members of its widely popular Prime subscription, a flurry of speculation sent shares of these telecommunications companies all over the map. The larger players, AT&T, Verizon, and T-Mobile, saw their share prices drop for the day, though the decline was not as bad as it looked set to be earlier in trading. Meanwhile, shares of DISH Network shot up because of the potentially positive impact that such a deal could have on it.

At this time, it is unlikely that such a deal will materialize. But in the event that it does, I would imagine the company that would offer the best terms that Amazon might gravitate toward would actually be Verizon. Having said that, I believe that a more likely outcome is that no such move is ultimately made by Amazon. And if I am correct, this will end up being a great opportunity for investors to buy some of these companies on the cheap.

A look at the rumors

As I mentioned already, shares of the major telecommunications companies moved all over the map on June 2nd. Verizon, for instance, saw its share price drop by 3.2%. Slightly worse than that was my own personal favorite firm, AT&T, which declined by 3.8% despite being down as much as 5% earlier in the day. But the worst mover of the group happened to be T-Mobile, which saw its share price plunge 5.6%. The only winner of the four companies mentioned ended up being DISH Network, which saw its shares close up 16.2% for the day.

These movements were driven by a report that stated that Amazon was in discussions with these firms about the possibility of offering either a low cost or a free version of nationwide mobile phone service to its Prime members. If such a deal were to come through, it is unclear exactly what impact it would have on the market. The fear from investors seems to be that it could cause all the other companies besides the one that partners up with Amazon to suffer significant churn as customers transition from them to the winner, which would naturally cause a decrease in revenue. This pain would be only the beginning, since it would also likely result in all the players in this market having to cut prices in order to remain as competitive as possible.

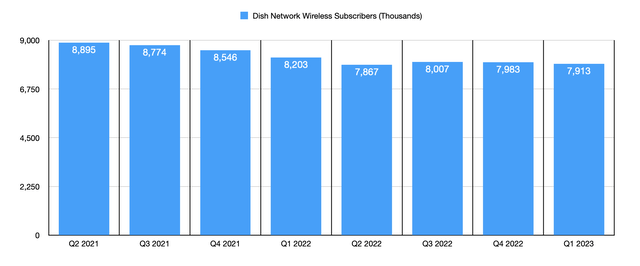

Even though the perception is that the major players that would not partner up with Amazon would suffer, I would also make the case that the winner would probably also suffer. Yes, it would see an inflow of customers if things go according to plan. But the price point of these customers would be significantly lower than existing contracts. When you add on to this the fact that customers who would already have contracts with the winner might be able to take advantage of this offering, overall revenue per user could fall rather substantially. Probably the only winner if the deal would go through, on the telecommunications front at least, would be DISH Network. At this time, DISH Network is substantially smaller than the other players in the space, with only 7.91 million wireless subscribers utilizing its services. This includes all subscribers and actually illustrates that the company has seen a decline in its user base in recent years. The ability of the company to rapidly expand its customer base may very well prove to be a boon for it in the long run.

Obviously, the biggest winner from this would be Amazon. Recently, the company has seen its Prime service experience slower growth. But this should not come as any surprise. According to the most recent estimates available, the company has over 200 million Prime members across the globe, with 148.6 million of them located in the US alone. The addition of an incredibly valuable service to its already wide array of services could spur more individuals to subscribe to Prime, especially if the new service is free or close to it.

At this time, judging by the share price action we have seen in response to this development, the market is clearly assuming that DISH Network is the most favored company at this point. Part of the reason for this likely involves the fact that, on May 25th, shares of DISH spiked because of revelations that it was in talks with Amazon to sell phone plans through the company’s website. There’s also the fact that, in some respects, DISH Network has the least to lose and the most to gain from some major deal with Amazon. The company has been under pressure for years to continue building out its 5G network. According to management, the company has spent roughly $30 billion on spectrum alone in recent years, and it is facing a deadline of this month to get its network size up to the point of reaching 70% of the population in the US. Failure to achieve the threshold that regulators set could lead to financial pain for the company.

In the event that a deal does transpire, I don’t believe that DISH Network will be the company that likely comes out on top. As I mentioned already, it has a small user base and, as it is building out its 5G network, it has to rely on the infrastructure provided by rivals AT&T and T-Mobile. Amazon is more likely, in my opinion, to favor a company that is already well established in the market and that can provide more significant scale rapidly. To some, this would mean that T-Mobile would be the key candidate. After all, it is currently leading in the 5G race. At present, its nationwide 5G network reaches 325 million people, with its faster version reaching approximately 265 million. By comparison, AT&T’s nationwide 5G service reaches about 290 million people, while its mid-band 5G spectrum reaches over 160 million. For context, Verizon reaches 230 million for its nationwide network, while its mid-band network reaches 200 million.

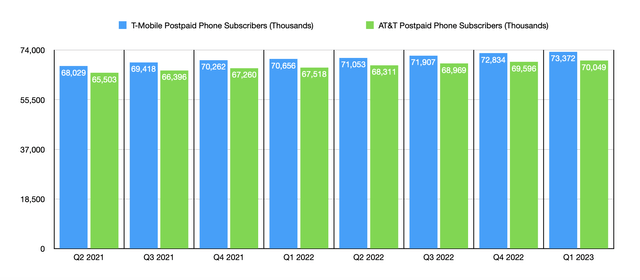

Even though T-Mobile wins when it comes to scale, neither it nor AT&T have much incentive to make a deal happen. If anything, they may prefer that the deal goes to a smaller company with less scale and more work needed in order to capture that scale. The goal here, in my mind, might be to stifle this competitive pressure right out of the gate. The reason why I say that these two don’t have much incentive is because they both are doing quite fine in the grand scheme of things. As you can see in the chart above, both continue to grow their wireless post-paid phone subscriber bases. From the second quarter of 2021 through the first quarter of 2023, AT&T grew its wireless post-paid phone subscriber base from 65.50 million to 70.05 million, while T-Mobile grew its from 68.03 million to 73.37 million. They both also have very small churn. For AT&T, churn was 0.81% during the first quarter of 2023. When it came to T-Mobile, churn was only slightly higher at 0.89%.

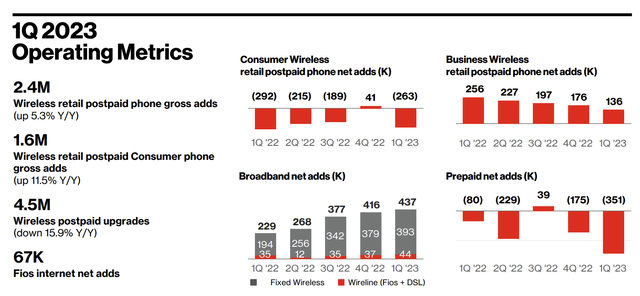

Verizon does provide data when it comes to wireless subscribers, but from what I can tell, it does not break up this data quarterly for us to look at. You can work backwards to get some of the data, however. In its investor presentation for the first quarter of the 2023 fiscal year, for instance, the company said that it had experienced 2.4 million wireless retail post-paid phone gross additions over the past year. This includes both its consumer wireless retail operations and its business wireless ones combined. On the business side, Verizon had been doing quite well. But on the consumer side, the company saw net losses in four of the past five quarters. The weakness on the consumer side at a time when its rivals are seeing growth may very well prompt it to strike a deal with Amazon.

Truthfully, I think a deal is very unlikely to materialize, at least for the foreseeable future. This is not pure speculation either. Though I do think that, with Amazon working to cut costs, this is not the ideal time to consider taking on such a large endeavor that would certainly cause it to use some of its cash flow from its Prime subscriptions to pay for this relationship, my thoughts on the matter are well informed based on what the parties involved are saying. Amazon itself, for instance, through spokesperson Maggie Sivon, said that the company doesn’t ‘have plans to add wireless at this time’. And T-Mobile, in response to these rumors, stated of that, while the company has a history of working with Amazon on certain projects in the past, it is, ‘not in discussions about inclusion of [its] wireless in Prime service, and Amazon has not told [it that it] plans to add wireless service’. That seems pretty concrete to me.

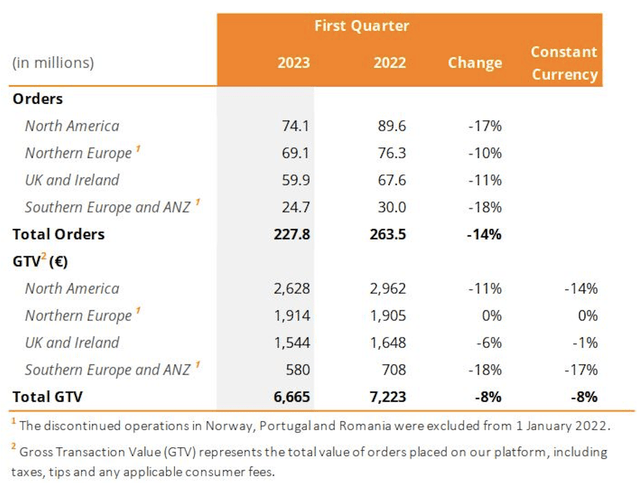

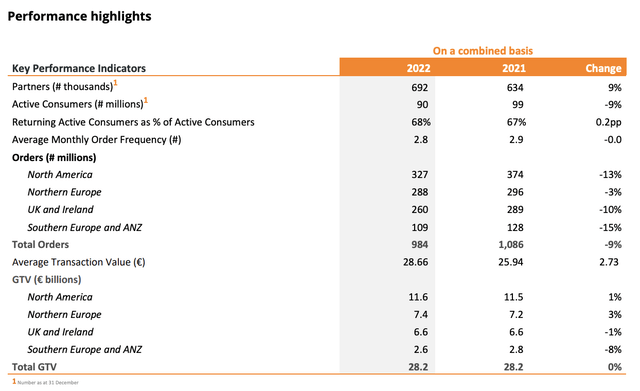

Even if a deal does materialize, there’s no guarantee that it will have a significant impact on the industry. Consider, for instance, the company’s decision last year to strike up a partnership with Just Eat Takeaway.com (OTCPK:JTKWY), the parent of Grubhub. According to their arrangement, it would grant Prime members one free year of Grubhub+. The idea at the time was that this could prove to be a huge boon for Just Eat Takeaway. However, there’s no evidence that it had a material impact at all. In fact, throughout North America, the number of orders placed in North America for the company it came out to 74.1 million in the first quarter of 2023. That’s actually down 17% compared to the 89.6 million experienced the same time last year. For 2022 as a whole, orders were about 327 million in North America, down from the 374 million reported one year earlier. Meanwhile, the number of MAUs (Monthly Active Users) utilizing larger rival DoorDash (DASH) expanded from 25 million in 2021 to 32 million in 2022.

Takeaway

I understand why some investors may be concerned about the development that has been rumored to be in the works. But I think any significant reaction to all of this should be considered an overreaction. Frankly, we don’t know what will transpire. But we do know that both Amazon and T-Mobile have said no such deal is imminent. If there is a beneficiary of a transaction, that beneficiary would probably be DISH Network, but I think the probability of such a development occurring is quite low. The more likely candidate, in my opinion, would be Verizon. But even that scenario playing out seems improbable to me. Should something actually happen on this front, the example with GrubHub shows that there is no guarantee that a major shakeup in the industry were actually occur. So with all of these data points added together, I would argue that it might make more sense for investors to focus on the firms that are most attractively priced in this space. My own personal favorite, as I have written about before, is none other than AT&T. But I would be wrong if I said that the other two major players in the market are bad prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!