Summary:

- The DOJ is considering breaking up Google, targeting key business segments like Android, Chrome, and Google Ads, according to Bloomberg.

- A historical look at antitrust battles reveals the potential for a significant impact on Google’s future.

- The breakup could disrupt Google’s ad revenue growth and its ecosystem, opening doors for competitors.

- On the flip side, there is the possibility of a business breakup unlocking hidden value in some business segments.

Natallia Pershaj/iStock Editorial via Getty Images

I mostly invest in small-cap stocks, as my regular followers know. That said, I have invested in several mega-cap stocks such as Meta Platforms (META) and Microsoft Corporation (MSFT) given the long growth runway enjoyed by these companies. Although I never pulled the trigger to invest in Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), I have been following the company closely for well over seven years given the massive impact Google has on our everyday life. Yesterday, Bloomberg reported that the Department of Justice is considering breaking up Google on the basis that the tech giant used illegal monopolistic business practices.

If the DOJ pursues this option, it would mark the first time the government has attempted to break up a business since its failed attempts to break up Microsoft back in 2001. In this analysis, I aim to provide some historical context to assess the likelihood of a successful DOJ campaign, discuss potential outcomes and how they would impact investors, and evaluate the impact of a business breakup on Google’s competitive position in key end markets.

The Threat

According to yesterday’s Bloomberg report, a few business segments will be targeted by the Justice Department. In summary:

- The Android operating system and Chrome browser will be the main targets of the DOJ.

- The Justice Department will also push for a spin-off of AdWords (now called Google Ads), Google’s ad sales platform.

- The DOJ will also prohibit Google from entering into exclusive search engine contracts with leading smartphone manufacturers to prevent the company from enjoying the default browser status in popular smartphone brands.

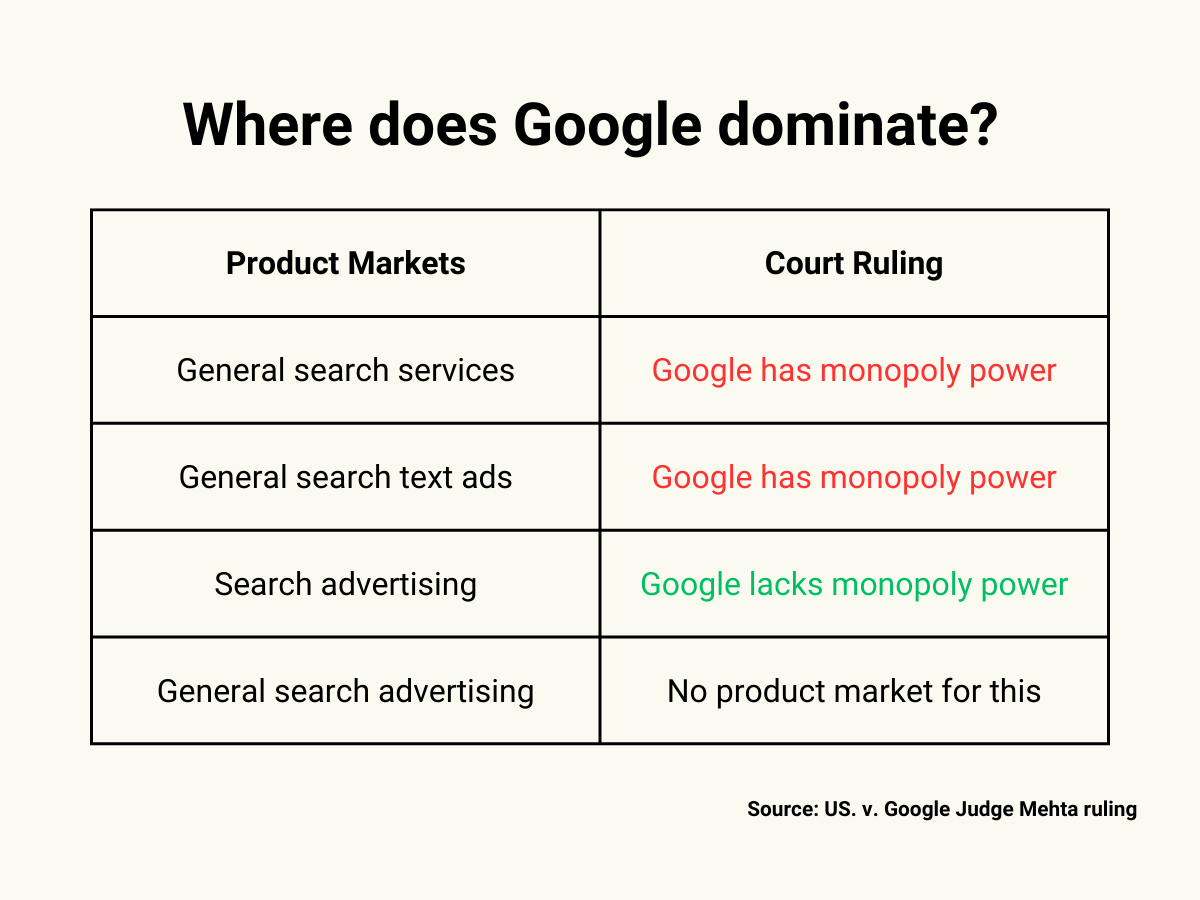

The DOJ is fresh off a recent win over Google, where a Federal judge ruled that Google’s search engine distribution contracts with smartphone manufacturers are in violation of Section 2 of the Sherman Act. When MarketWatch reached out to the Justice Department yesterday to confirm Bloomberg’s revelations, a DOJ representative said:

The Justice Department is evaluating the court’s decision and will assess the appropriate next steps consistent with the court’s direction and the applicable legal framework for antitrust remedies.

Exhibit 1: Court ruling summary

The Hindu

Before evaluating the potential outcomes of a DOJ decision to pursue a Google breakup, I will present my findings on historical antitrust battles to give some color to DOJ’s track record.

Insights From Historical Antitrust Battles

When I surfed through several online investing platforms last night, I was surprised to see that forums are full of comments that claim the DOJ does not have what it takes to separate Google or any other business for that matter. This is simply not true and exhibits naivety, given that there is strong empirical evidence to suggest otherwise. I am not even remotely suggesting that the Justice Department will be successful in separating Google’s businesses if it decides to pursue that goal, but as investors, it pays to be objective.

Below are some of the most notable victories scored by the Justice Department against corporate behemoths.

| Company | Background | Year of business breakup | Outcome |

| Standard Oil | The company controlled more than 90% of the U.S. oil refining industry in the early 1900s. | 1911 | Standard Oil was separated into 34 independent companies, including Exxon Mobil, Chevron Corporation, and ConocoPhillips. |

| American Tobacco Company | The company controlled more than 90% of the U.S. tobacco market before the business breakup. | 1911 | American Tobacco Company was separated into several business units, including R.J. Reynolds and Liggett & Myers. |

| AT&T | The company controlled the telecommunication industry value chain in its entirety leading up to the court ruling. | 1982 | The company agreed to divest the local telephone operations business by creating seven regional entities. |

The DOJ has scored major wins against corporate giants in the past, which is a good enough reason for investors to evaluate all possibilities if the DOJ decides to go after Google, which is a very likely scenario given its recent success.

The Justice Department has not always been successful. The DOJ tried to break up Microsoft’s Windows software and other software into two separate business units by suing the company for monopolistic practices in 1997. These efforts were initially successful, with District Court Judge Thomas Penfield Jackson ruling Microsoft was in violation of antitrust laws in April 2000, soon after which the DOJ appointed a group of state attorneys to split Microsoft into two business units. Microsoft, not surprisingly, appealed this decision, and eventually, in June 2001, a DC court reversed the decision to separate Microsoft as new evidence suggested Judge Jackson may not have been impartial during the trial process. In November 2001, Microsoft reached a settlement with the DOJ which prohibited the company from entering into exclusive licensing agreements with PC manufacturers that prevented them from using other software applications such as browsers that competed with Internet Explorer owned by Microsoft. In addition, Microsoft also agreed to share API codes with other software developers, enabling them to develop software applications that seamlessly function on Windows computers.

The Potential Fallout For Google

In the worst-case scenario, Google will be forced to separate the Android operating system, Chrome browser, and the AdWords platform, which was rebranded as Google Ads in 2018. Although there is no immediate risk of this happening (we are not even sure whether the DOJ will go down this path), it makes sense to understand the impact of such a development.

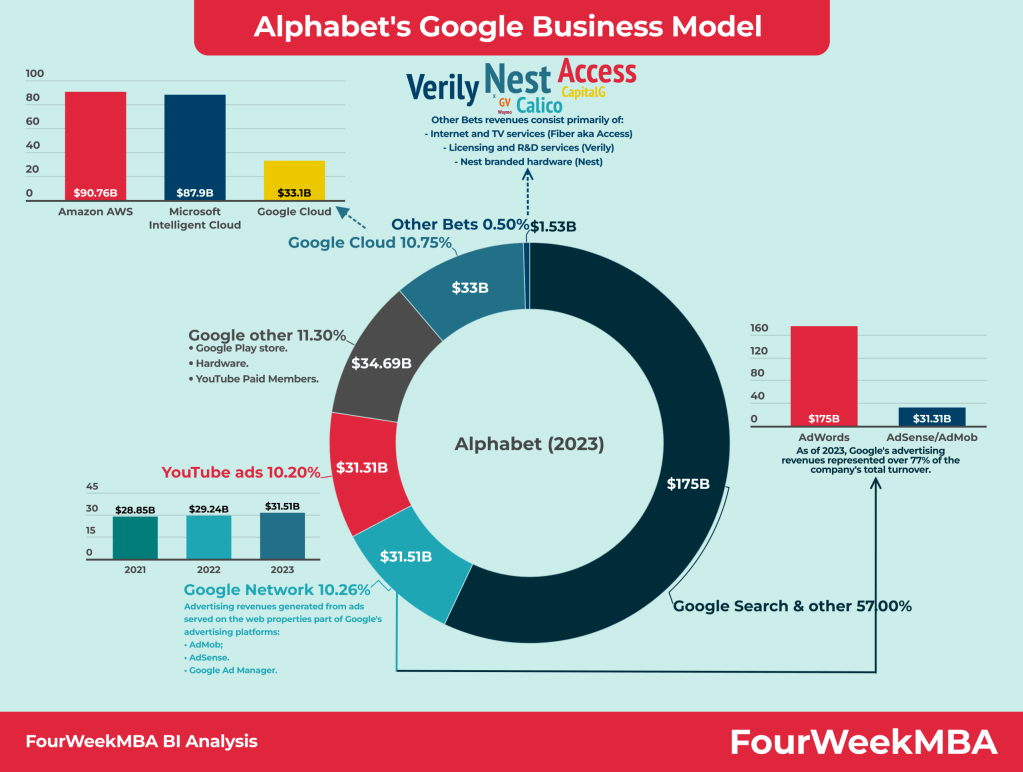

The biggest direct hit to Google will result from a potential spin-off of the Google Ads platform. In 2023, Google reported $237.8 billion in ad revenue, consisting of $175 billion in Search ad revenue, $31.3 billion in YouTube ad revenue, and $31.5 billion in Google Network ad revenue.

Exhibit 2: Alphabet 2023 revenue breakdown

FourWeekMBA

The Google Ads platform plays a key role in the company’s ad business as it is used by advertisers to reach their target audience. A spin-off of Ads will directly impact the way Google integrates its Ads with the search engine, potentially leading to a loss of market share.

A spin-off of the Android platform, on the other hand, will hinder the company’s ability to place Google apps such as Gmail, Google Search, and even the search bar on Android home screens. According to Business of Apps, there are more than 3.9 billion active Android devices globally today, which is a massive market that Google monetizes by placing its apps to enable higher ad visibility. If the DOJ orders a business separation, Google may have less control over placing these apps on Android devices in the future, and a notable deterioration of the Android ecosystem growth will be difficult to avoid due to integration difficulties.

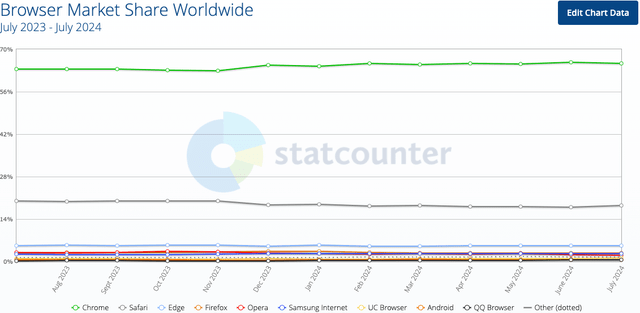

Chrome, which is the world’s most popular web browser, also plays a crucial role in Google’s ad revenue growth as it collects invaluable user data that helps marketers run personalized ad campaigns using Google’s ad products. On the other hand, Chrome uses Google as the default search engine, which helps drive search traffic for Google. DOJ’s decision may impact traffic growth in the future if Chrome were to be separated from Google.

Exhibit 3: Browser market share as of July 2024

Statcounter

Overall, Google’s ad revenue growth will face several challenges in case of a business break up involving Android, Google Ads, and the Chrome browser. In addition, the Google ecosystem will face challenges, potentially creating an opportunity for rivals such as Apple, Inc. (AAPL) and Microsoft to eat into Google’s market share across several business verticals. More than the direct financial impact of the separation of business units, I am worried about the disruption to Google’s ecosystem, which may hinder the long-term growth potential of all these individual businesses.

Shareholders may want to explore how a business breakup may end up adding value in the short term, too, especially if the market believes these business units will prove to be stronger as independent businesses. That said, in my opinion, a business separation will create room for competitors to take market share from Google.

Takeaway

The Justice Department may launch a campaign to break up Google’s key businesses, potentially leading to the biggest antitrust lawsuit in recent history. Going by empirical evidence, it seems naive not to consider the possibility of a DOJ victory, in which case Google shareholders will have to bear the consequences. I am keeping a close eye on new developments to assess whether this risk will materialize or whether the DOJ’s business separation move will end up creating more value for shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long MSFT.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.