Summary:

- PayPal’s stock has dropped significantly and investors are skeptical about its future, but the company still operates in a favorable environment with healthy main metrics.

- I view PayPal is the king of digital payments, while Venmo should be the main growth driver in the coming years.

- PayPal is implementing a massive cost-cutting program. This should help to reach $5 billion in FCF by the end of the year, which will go to stock repurchases.

- PYPL is dirt cheap.

Spencer Platt

Main thesis

It looks like the market is done playing with PayPal (NASDAQ:PYPL). The stock is down 20% YTD and 80% from all-time highs. The company disappointed investors by publishing a few disappointing quarterly results. Last year proved to be a turning point for its business in many ways as it faced a strong drop in profits and margins under the influence of global factors. However, investors act as if the company has lost all credibility points, and they don’t see a brighter future for the Fintech giant. Well, I don’t think that’s true. PayPal is still working in a favorable environment, the main metrics and balance sheet look healthy and the valuations look cheaper than ever.

Tailwinds & Headwinds

In the long term, the digital payments’ industry has good growth prospects. Statista estimates the global digital payment transaction volume in 2023 at $9 trillion and expects it to rise to $15 trillion by 2027 (CAGR of 11.8%). The growth of the e-commerce industry, the popularity of BNPL services, and the automation of payment solutions for businesses should be the main growth drivers.

At the same time, I don’t expect the macro environment to be good for PayPal’s business in 2023. I believe waning demand in times of high rates, declining household disposable incomes, and an overall slowdown in international e-commerce should put additional pressure on transaction volume when the recession kicks in.

The slowdown in the Chinese economy is also a powerful headwind, as China is a key player in the global e-commerce market and a major hub. While the global e-commerce industry itself continues to expand, growth was below 10% YoY in 2022, according to PayPal management estimates. Before the pandemic, the industry was growing at an average of 15% per year, and then increased dramatically by 30% in 2020, ahead of the trend by several years. Thus, the market is “cooling down”, and by the end of 2023 or by the beginning of 2024 it may return to the growth trajectory.

PayPal is the king of digital payments

A long time ago, PayPal made its debut in the promising market of digital payments due to the convenience of the application and thoughtful technology (especially compared to traditional bank transfers). PayPal has a set of advantages that are simply unattainable by most competitors due to the lack of scale effect or branding like a high level of security, availability, and low cost. PayPal Wallet is one of the closest of all platforms to a personal finance super app.

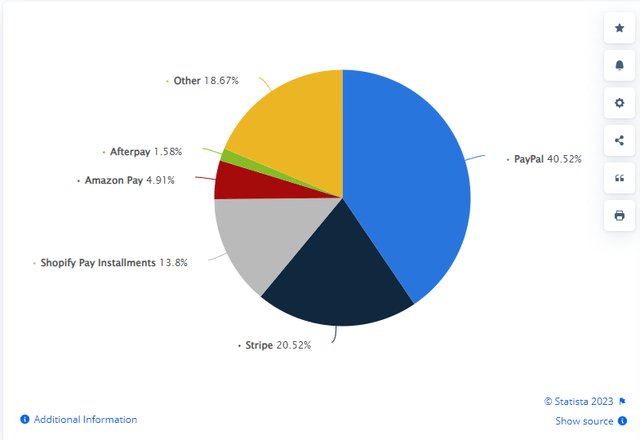

According to surveys, 37% of US consumers prefer to use a PayPal wallet when making purchases online to any other kind of technology. Moreover, 82.8% of the top 1,000 retailers in North America and Europe accept PayPal payments. The closest competitor is the Apple Pay wallet, which is accepted by only 40% of retailers. All in all, the company enjoys a 40.5% share of the online payment processing technologies market.

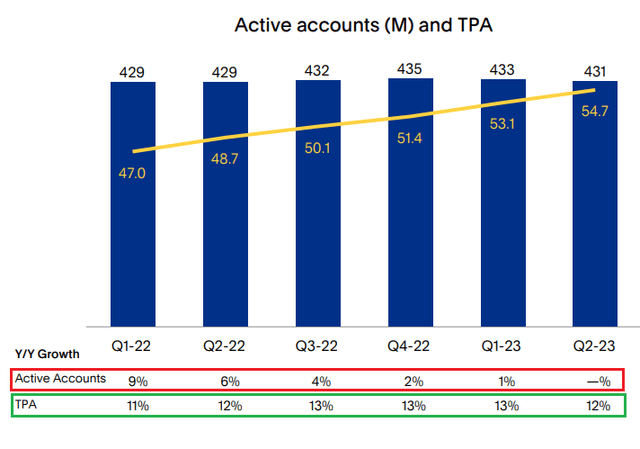

In the last couple of quarters, the company stopped attracting new active accounts. However, this has been offset by Transactions per active account (TPA), which rose to 54.7. Thus, total payment volume wasn’t affected by this and grew 5% YoY.

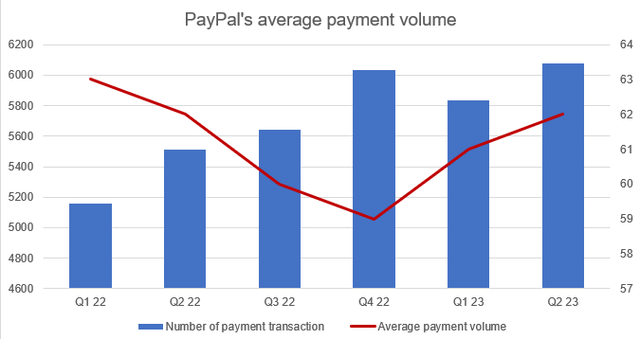

PayPal has reached a massive scale, and it is becoming more difficult to expand at the same pace, so the company should be interested in deeper monetization of existing customers. Average spending per transaction (or average payment volume) reached $62, the same as in Q2 last year but the number of transactions increased by 10%. Keep in mind that this happened with almost no change in active account numbers, so existing customers made 10% more transactions YoY.

Last year, PayPal dumped its partnership with eBay (EBAY). This has had a short-term negative impact, but the company will be able to show higher growth rates in the future. The management has long said that eBay doesn’t account for a significant part of the transactions and is more like a burden for PayPal. This segment had low growth rates and grew very slowly compared to the rest of the business, holding back aggregate growth. At the end of 2022, eBay accounted for only 2% of the total payment volume.

Venmo

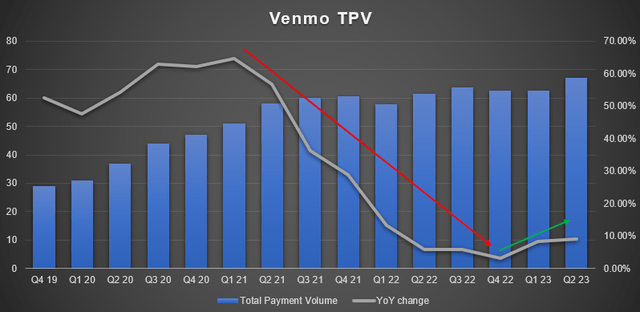

At the same time, Venmo is still rapidly gaining popularity. The revenue has quadrupled over the past few years and the app has 60 million active users and 90 million active accounts. In 2023, the total volume rebounded. In Q2’23, Venmo app transaction volume was $67 billion, up 9.1% YoY compared to 5.9% YoY growth in Q2’22. Since Amazon (AMZN) began accepting payment for purchases with Venmo in 2022, Venmo’s share of total US e-commerce payment transactions has grown from a few percent to more than 35%. The new Tap to Pay feature in the latest iPhones, which allows users to use their smartphone as a POS terminal, will help increase the adoption of a digital wallet and Venmo-branded credit and debit cards.

I believe that Venmo has massive monetizing opportunities. Take a look at the table below:

| Venmo | Cash App | |

| Revenue (2022, transaction-based) | $935 million | $466 million |

| Payment volume | $244 billion | $17.07 billion |

| Take rate | 0.38% | 2.7% |

| Source: Business of Apps |

In 2022, its revenue totaled $935 million and payment volume reached $244 billion. So the annual take-rate was 0.38%. While Block’s (SQ) Cash app was 2.7% (7x higher). Thus, Venmo is deeply under-monetized, and it can be changed as the platform has more than 2 million merchants, and they continue to flow. Given its scale and branding awareness, I believe that it would be the key growth driver for the next couple of years. Dan Schulman, the ex-CEO said the same thing in the Q2 earnings call.

We’ll keep plugging away at Venmo. As I always say, Venmo has more potential than a lot of parts of our portfolio. We still have to prove that we can monetize it even beyond what we are doing. But I feel like the team is making a lot of good efforts and progress in this area right now.

Cost-cutting & Shareholders’ gains

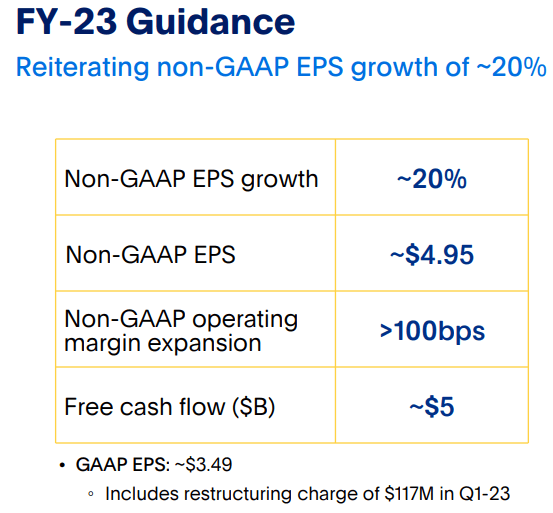

PayPal is implementing a huge cost-cutting program. These operating moves led to $900 million in savings last year. In early 2023 the management projects $1.3 billion in savings and >100 bps margin expansion. In early February, the company announced the reduction of about 2 thousand employees (7% of the staff).

PayPal

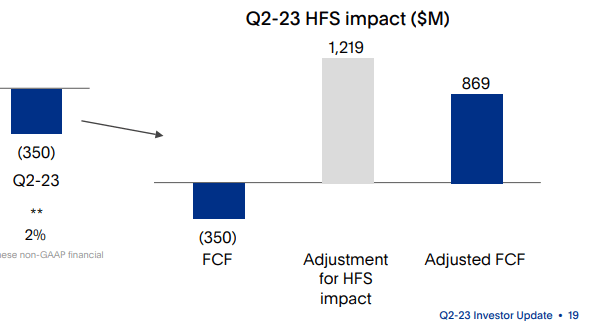

Cash flows turned negative in Q2 as the company plans to resell receivables on BNPL loans in Europe to the KKR consortium, and expects to receive about $1.8 billion from the deal. Later this year, when the sale of the European BNPL portfolio (buy now, pay later) closes, the proceeds will be recognized in operating cash flows and offset this decline. Moreover, PayPal raised its FCF forecast from $4 billion to $5 billion. Based on this, the company also raised the buyback bar, similarly from $4 billion to $5 billion, so 100% of free cash flow should go to stock buybacks, which is 7.4% of the market cap now.

PayPal

Dirt cheap

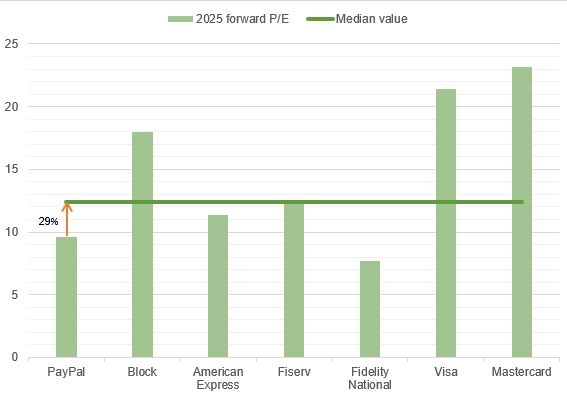

Throughout 2022 and 2023, PayPal stock has underperformed the S&P 500 and NASDAQ Composite. However, after a strong decline in capitalization, the stock is now trading at an average discount of 30% relative to its peers at 2025 P/E.

Author, Seeking Alpha

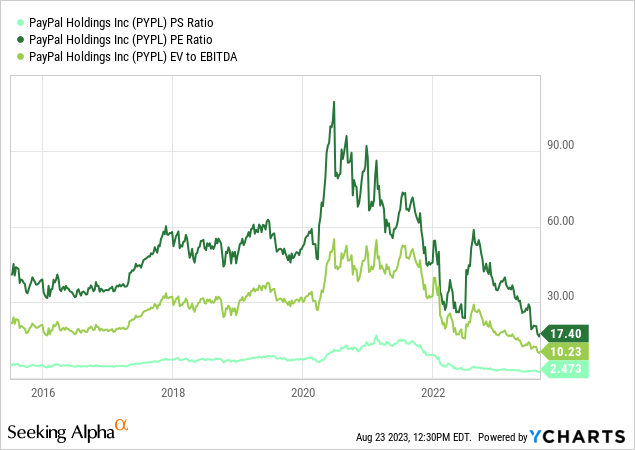

The company also trades at its absolute historic lows even if takes into account non-forward multiples.

Final thoughts: Meta-like environment

There is a reasonable belief that at some point PayPal is in a Meta-like environment where the company initially squeezed costs and maintained profitability even with weak advertising demand, and then the advertising market revived, which led to an explosive increase in profitability and EPS and a tripling in stock prices. A similar trend can occur in the case of PayPal. There is a noticeable pressure on most companies in the fintech, despite decent financial results, and PayPal is no exception. Moreover, it looks like it stumbled even more than its peers given the massive discount.

PYPL is a strong buy at these levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.