Summary:

- XPeng Inc.’s eye-watering rally since August was dampened after the company reported a tempered sales outlook for Q4 this week.

- Despite optimism for accelerating volume growth, the comparatively softer strength in XPeng’s revenue prospects highlights imminent ASP pressures.

- Looking ahead, the introduction of four new models next year, alongside the implementation of an EREV strategy, is likely to reduce visibility on its longer-term fundamental trajectory.

- The related execution risks remain underappreciated at current levels, and will likely diminish the durability of XPEV’s valuation premium over its comparable Chinese EV peers in the near-term.

hapabapa/iStock Editorial via Getty Images

XPeng Inc. (NYSE:XPEV) has been one of the best-performing EV stocks recently. The stock has largely recovered from its early year selloff, more than doubling in value since August lows, before it recently pared some gains.

Based on XPeng’s latest earnings results, its consistent delivery of margin expansion underscores accelerating progress in ramping up its recently launched products. This has effectively improved visibility into management’s target of achieving profitability by 2025. The company’s emphasis on its line-up of AI-defined next-generation vehicles, as well as its impending introduction of EREVs later next year, have also underpinned investors’ optimism over XPeng’s growth trajectory.

However, we are becoming incrementally cautious about XPeng’s impending foray in EREVs. Management currently views XPeng’s emerging line-up of EREVs based on its proprietary “Kunpeng Super Electric System” powertrain as a strategy for better penetrating opportunities across local and overseas regions that lack an expansive charging network. But whether the strategy will drive TAM expansion for XPeng, as management aspires, remains to be seen given cannibalization risks between the EREV and BEV segments.

Coupled with near-term pressures on XPeng’s average vehicle selling price, we believe the underlying business faces incremental execution risks ahead. This could inadvertently reduce the durability of the stock’s latest upsurge and diminish its premium to comparable Chinese EV peers at current levels.

XPeng’s EREV Strategy

In addition to management’s recent emphasis on the integration of AI technologies across XPeng’s next-generation line-up, the company’s impending introduction of EREVs has been a focal point of its growth strategy. Earlier this month, XPeng introduced the “Kunpeng Super Electric System,” its newest extended-range platform that leverages both a battery and an engine. The Kunpeng powertrain can enable a range of up to 870 miles on a single charge, besting XPeng’s longest-range BEV – the P7i and P7+ Max – by 430+ miles.

Management currently believes EREVs will help expand XPeng’s addressable market and underpin additive growth opportunities ahead.

In the coming future, XPeng will adopt a dual energy approach, offering a batch of new vehicle models with pure electric and super electric powertrain options to cater to the diverse needs of global customers. I believe that this will significantly expand our total addressable market, bringing multiple opportunities for sales growth and accelerating the mass adoption of AI-defined vehicles worldwide.

Source: XPeng 3Q24 Earnings Call Transcript.

This is because the strategy is aimed at better addressing underpenetrated opportunities across local and overseas regions where “charging infrastructure is lacking.” This includes emerging markets like Latin America, Central Asia, and the Middle East, according to management.

While details on models and pricing remain limited, management expects the first Kunpeng-based vehicle to start shipping in late 2025. This will also mark at least one of the four new vehicle models that XPeng has earmarked for the coming year.

We also expect the impending EREV model to be competitively priced. Specifically, EREVs are less expensive to produce than pure battery electric vehicles (“BEVs”) due to the lower composition of battery materials – the most expensive component. Given it is XPeng’s intention to penetrate less affluent and EV-supportive markets with the EREV strategy, we believe it is likely that the company will pass on the technology’s inherent cost savings to consumers through competitive pricing.

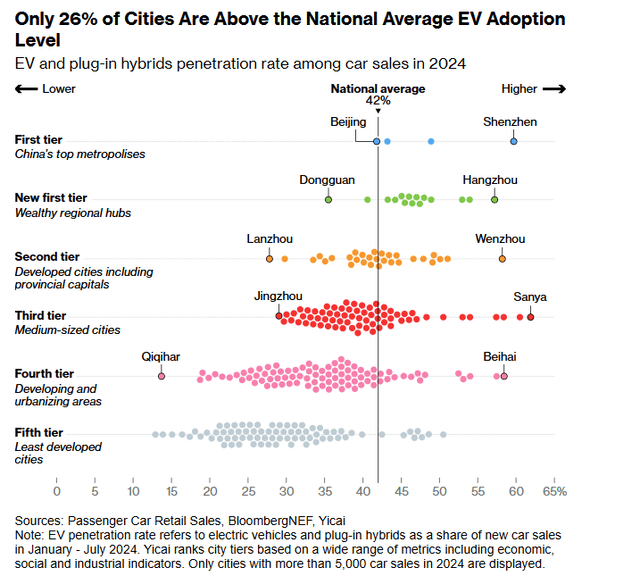

This drives us to believe that the impending Kunpeng-based EREV line-up will also help XPeng better penetrate concentrated opportunities across lower-tier, rural regions in China. Specifically, in XPeng’s core Chinese market, the majority of untapped NEV opportunities remain concentrated in lower-tier cities, where consumers are relatively more price-sensitive and public charging infrastructure availability is lacking. While China’s latest passenger vehicle registration data shows an EV penetration rate of more than 50%, the national average currently hovers near the 40% range, with the majority of Chinese cities exhibiting adoption levels below the threshold.

Bloomberg News

Kunpeng’s Share Cannibalization Risks

While XPeng’s EREV strategy could help it better address underpenetrated opportunities both in China and overseas, we believe it also creates significant cannibalization risks to the company’s existing BEV line-up. This is corroborated by plateauing BEV market share in China, given the increasing availability of EREV alternatives recently to assuage range anxiety among consumers. Specifically, BEVs and EREVs have been exhibiting “diverging growth trends” lately. In China, EREV adoption has rapidly outpaced BEVs, marking the “fastest growing NEV category” in the region this year with a triple-digit percentage increase in sales:

EREV cannibalization of existing BEV opportunities could potentially diminish XPeng’s recently observed growth momentum over the longer term. This would effectively counter management’s aspirations for the strategy to drive TAM expansion as well.

In addition to the risks of a slower-than-expected growth outlook, the change in sales mix could also unfavorably impact XPeng’s margin prospects. It is likely that XPeng’s BEV line-up will yield higher margins due to long-time scale benefits, as well as the potentially competitive pricing strategy that the company will implement for Kunpeng-based models, as discussed earlier. This is consistent with the company’s recent expectations for the newly launched P7+ and other next-generation models on the same BEV platform to drive greater margin accretion at scale:

New platform-based technologies we have implemented in the P7+ will also be applied to new models and major facelifts over the next few years of 2025 and 2026. We anticipate that the gross margin of our next-generation models will reach double-digits, significantly increasing our sales volume to a new level during our strong product cycles and helping us move steadily toward achieving scale profitability.

Source: XPeng 3Q24 Earnings Call Transcript.

Our expectation for superior margins in XPeng’s BEV line-up is further corroborated by management’s expectations for the company to turn profitable next year. Most of the contribution likely comes from the continued scale of its BEV line-up, given that XPeng’s first Kunpeng-based model will not ship until late 2025.

Fundamental Considerations

In the near term, management’s Q4 delivery guidance of 87,000 to 91,000 vehicles implies a robust uptake of recently introduced models, including the P7+ and Mona M03. This is further corroborated by XPeng’s latest earnings commentary on the order backlog of “tens of thousands” of M03 and P7+ vehicles entering 2025.

However, the anticipated volume growth will be offset by near-term ASP pressures given the competitive pricing strategy implemented for the P7+ and Mona M03. For instance, the newest P7+, which starts shipping later in Q4, boasts a starting price of RMB 186,800 for the standard range trim and RMB 198,800 for the extended range trim. Despite having a slightly higher range of 710 km than its P7i counterpart on the premium trim, the P7+ is 20% cheaper. Meanwhile, the Mona M03 marks XPeng’s lowest product to date, with a starting price of RMB 119,800. The company’s ASP has dropped -16% sequentially in Q3 following the start of delivery on the Mona M03, highlighting the robust demand and price impact of the mass market model.

As a result of its recent pricing and adoption dynamics on newly launched vehicles, we expect XPeng to grow revenue by 34% y/y to RMB 41.1 billion ($5.7 billion) for the full year 2024.

In 2025, XPeng will add four new models, including at least one EREV in the back half of the year. While we anticipate XPeng’s first EREV model to be additive to growth at initial launch, the segment will likely represent a greater share of the sales mix over time, and potentially erode and/or overlap BEV growth prospects. This could result in substantial deceleration going into 2026, in our opinion, which should not be overlooked.

Meanwhile, vehicle margins are expected to reach double-digits next year with scale on expanded capacity – particularly with XPeng’s recent implementation of a double shift in productions, which is capable of an annual capacity of up to 300,000 vehicles. However, the pace of margin expansion will likely slow following the introduction of Kunpeng-based EREVs. This is consistent with the risks of margin dilution, given the EREV strategy’s intention of penetrating mass market opportunities.

Valuation Considerations

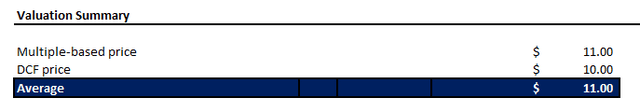

We are setting a base case price target of $11 apiece for the XPeng stock, which approximates its currently traded levels.

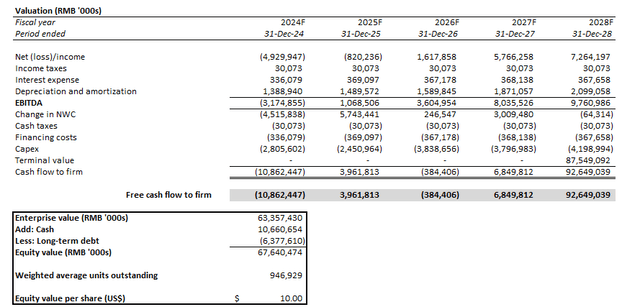

The price target is computed by the weighted average of results from the multiple-based and discounted cash flow (“DCF”) approach.

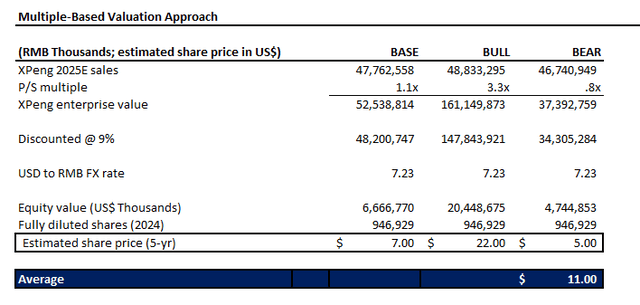

Under the multiple-based approach, we explore the base case and upper and downside growth scenarios of XPeng’s. Specifically, the projections consider the range of anticipated EREV cannibalization and TAM expansion scenarios. The valuation multiples applied are reflective of XPeng’s currently traded premium over its comparable Chinese EV peers (1.1x ’25 sales), the BEV OEM average (3.3x ’25 sales), and the comparable Chinese EV peer average (0.8x ’25 sales).

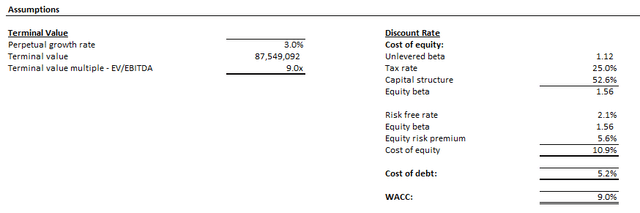

For the DCF approach, we considered cash flow projections taken in line with the fundamental analysis discussed in the earlier section. The analysis considers a 9% WACC, which is in line with XPeng’s capital structure and risk profile. An implied perpetual growth rate of 3% is also used in determining XPeng’s terminal value. The assumption applied is consistent with China’s projected long-term pace of economic expansion and is adequately reflective of XPeng’s normalized growth prospects, in our opinion.

Conclusion

While XPeng Inc.’s near-term volume growth prospects are likely to benefit from its widened product portfolio spanning various powertrains and price segments, its topline remains prone to ASP pressure. This is consistent with XPeng’s increasingly competitive pricing for newly launched models, and the growing mix shift towards them.

And over the longer term, the extent of additive growth and margin accretion currently priced in may not be as durable as expected. This is consistent with the risks of BEV market share cannibalization from XPeng’s emerging introduction of EREVs. Taken together, we remain incrementally cautious about the stock’s outlook, particularly given the reduced visibility of growth and earnings prospects with the introduction of the Kunpeng powertrain segment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.