Summary:

- Salesforce is well-positioned to capitalize on the AI revolution in the CRM space, thanks to its growing data treasure and large customer base.

- The high growth rate for Salesforce’s data-centric services can be considered as a strong leading indicator for loyal customers’ AI ambitions through the Salesforce platform.

- Salesforce faces a big competitive threat from a $2.5 trillion rival striving to take CRM market share in this new era of AI.

Justin Sullivan

With the AI revolution well under way, software stocks are expected to win big as generative AI transforms the way people work, and Salesforce (NYSE:CRM) is no exception. Salesforce is well-positioned to capitalize on the new opportunities arising from AI-powered advancements in Customer Relationship Management [CRM], thanks to its growing data treasure and large, established customer base. Though investors should also beware of the intensifying competition in the CRM space. Nexus assigns a ‘buy’ rating to Salesforce stock.

Salesforce has been releasing a flurry of new generative AI features this year. Earlier this year, they introduced Einstein GPT, which underpinned generative AI capabilities across its various cloud products, such as in the form of Sales GPT and Service GPT that can be used to automatically draft sales proposals or draft responses for customer service agents. At Dreamforce last month, the CRM giant advanced to offer Einstein Copilot, enabling users to interact with Salesforce’s generative AI assistant in a more conversational manner.

Majority of Salesforce’s generative AI features and services have been in pilot for the most part of this year, and Wall Street is looking towards 2024 (which for Salesforce is fiscal year 2025) for monetization of these generative AI solutions through a broader rollout to Salesforce’s extensive customer base. Now Salesforce will need to prove that its generative AI solutions can deliver higher returns on investment for its customers, which would be conducive to stronger pricing power, ultimately translating to higher revenue and profit growth. As per Seeking Alpha data, Salesforce is expected to see revenue growth of 10.94%, and EPS growth of nearly 16.84% in fiscal year 2025. Now let’s assess how well-positioned Salesforce is to experience AI-driven growth.

Data is king in the era of AI

Salesforce’s industry-leading CRM software suite offers targeted cloud solutions that serve numerous customer touch points, including via Sales Cloud, Marketing Cloud, Service Cloud, and Commerce Cloud. Serving over 150,000 customers through these various software solutions over many years, Salesforce sits on the richest dataset in the CRM industry. And it is this treasure of data that Salesforce has been leveraging to develop its own generative AI features like Einstein Copilot.

Salesforce

Given the depth and breadth of the data it holds covering various aspects of Customer Relationship Management, Salesforce is indeed strongly positioned to offer generative AI solutions that enhance customers’ ability to serve their own customers, which can manifest in the form of workflow efficiencies, cost reductions, and sales growth. If Salesforce can successfully leverage this data advantage to produce industry-leading AI models and software, it could help Salesforce retain/ attract more customers and potentially widen its lead over competitors even further.

At the core of Salesforce’s AI ambitions lies its ‘Data Cloud’ service, which CEO Marc Benioff proclaimed on the Q2 FY24 Salesforce earnings call:

“Our platform starts and ends now with our Data Cloud,…what you can see with Data Cloud is that customers must get their data together if they want to achieve success with AI. This is the critical first step for every single customer. And we’re going to see that this AI revolution is really a data revolution.”

Introduced in September 2022, Data Cloud (formerly ‘Genie’) essentially serves as a data platform that enables organizations to unify all customer data together from numerous sources, just in time for the generative AI revolution.

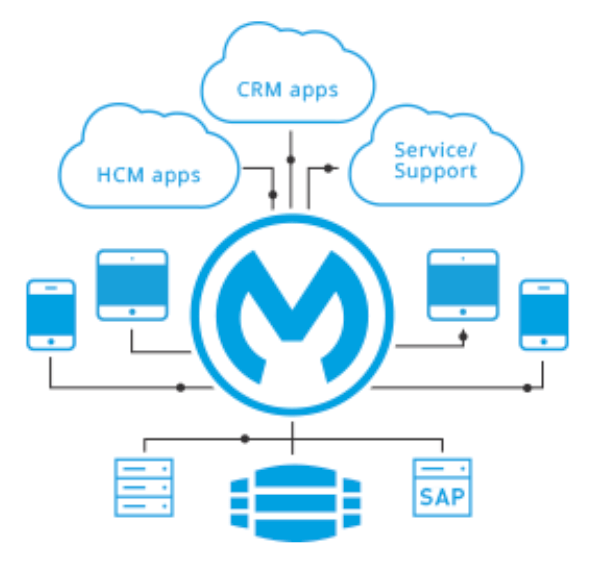

Data Cloud ingests data from various sources through built-in connectors and MuleSoft, essentially serving as a core data repository, and continuously processes this data to produce real-time outputs that help users serve customers more effectively. For instance, a sales representative looking to successfully close a deal with a prospective customer can gain access to the most relevant and up-to-date information about the customer in real-time thanks to the power of Data Cloud.

As a result, Data Cloud becomes a mission-critical element of all CRM activities, and Nexus believes that this service will play a crucial role in encouraging more customers to increasingly bring their data into Salesforce, as data is the fuel on which generative AI features and workflow automations will run on.

Salesforce is essentially striving to make Data Cloud the ultimate repository of all CRM data that feeds into its various cloud products (including sales, marketing, service, and commerce), enhancing organizations’ ability to serve their customers through Salesforce. And Salesforce is already succeeding at encouraging customers to use Data Cloud and bring all their external customer data into Salesforce, as CEO Marc Benioff proclaimed on the last earnings call that “Data Cloud continues to be our fastest-growing organic product”.

Data Cloud is included in Salesforce’s higher-end subscription plans, ‘Enterprise’ and ‘Unlimited’. Given the crucial role that unified/ optimized data plays in the era of AI, this strategy enables Salesforce to encourage more customers to upgrade to its higher-end editions as they seek to leverage the power of Data Cloud, conducive to revenue and profit growth for investors.

Furthermore, as customers increasingly use Data Cloud to aggregate all their CRM data together from various sources, it subsequently leads to increased usage of Salesforce’s data-centric solutions, particularly Tableau and MuleSoft. For context, Tableau is a data analytics and visualization platform. MuleSoft is an integration platform that enables customers to seamlessly connect external data, apps and devices into Salesforce.

MuleSoft

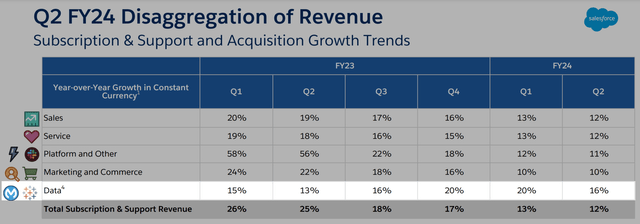

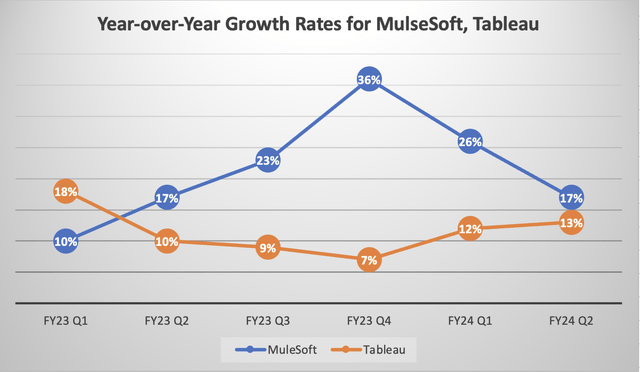

The success Salesforce is having with inducing its customers to integrate and analyze more of its CRM data in Salesforce is evident in the revenue growth of its ‘Data’ segment (which includes Tableau and MuleSoft) over the past few quarters, as it has become the fastest-growing segment.

Salesforce Q2 FY24 Earnings Presentation

MuleSoft in particular has been the key growth driver, as executives pointed out numerous times during the earnings call:

Marc Benioff

I would especially like to call out the incredible success of MuleSoft over the last several quarters because that is a product that is far exceeded our expectations

…

Amy Weaver

Now turning to remaining performance obligation, RPO, which represents all future revenue under contract ended Q2 at $46.6 billion, up 12% year-over-year. Current remaining performance obligation, or CRPO, ended at $24.1 billion, up 12% year-over-year and 11% in constant currency. This was ahead of expectations, notably due to the momentum in MuleSoft.

CPRO is a crucial indicator of expected revenue growth over the next 12 months. The fact that MuleSoft has become a key driver of future revenue growth is a strong indicator of customers’ intentions to increasingly integrate their external data into the Salesforce platform, and that Salesforce is likely to continue playing a crucial role in their CRM activities in the era of AI. Hence, the fact that more and more customers are integrating external data, apps and devices with Salesforce is a remarkably bullish development for shareholders looking for AI-related growth.

Salesforce’s data treasure is set to continue growing, further emboldening its ability to build powerful AI models and innovate AI features that enhance the value proposition of the Salesforce platform, conducive to strong pricing power that drives revenue and profit growth.

That being said, Salesforce building powerful generative AI solutions for its customers is only one part of the story.

Enabling Salesforce customers to build their own AI features

A key strategy to keep customers entangled within the Salesforce ecosystem is to enable them to deploy their own AI models for building customized applications and business processes.

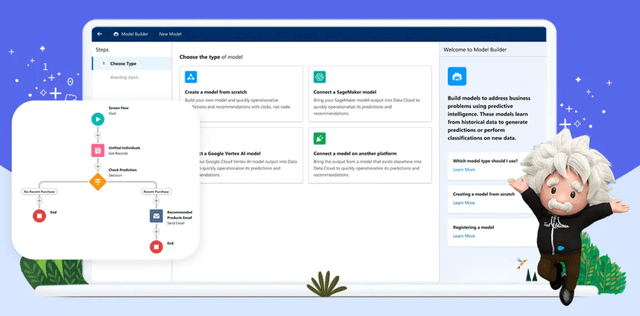

A few months ago, Salesforce introduced the ability for customers to bring their own AI models from external platforms through Einstein Studio (part of Data Cloud). Essentially, Salesforce is allowing Data Cloud customers to import the AI models they have built/trained externally with other cloud providers (e.g. Amazon’s AWS), and deploying these across the Salesforce platform for automating CRM workflows and building customized assistants.

Salesforce Einstein Studio (Salesforce)

In fact, at Dreamforce last month, Salesforce introduced Einstein 1, an AI platform advancing customers’ ability to bring together data from multiple sources and use the in-built Einstein Copilot Studio to build generative AI applications that can be tailored to the customer’s specific needs

If Salesforce can successfully induce customers to bring their own AI models and use them to build new generative AI-powered applications and workflows within the Salesforce platform, it would significantly enhance the CRM giant’s ability to retain customers and maintain dominant market share amid the AI revolution. As per a 2022 report, Salesforce held a 23% market share in the CRM market.

Salesforce’s ability to grow market share from here will depend on how valuable its AI-centric platform and solutions turn out to be in enabling customers to build generative AI applications that drive sales growth and workflow efficiencies, as that is what will drive revenue growth in the form of organic customer growth and pricing power. Although Salesforce could face some competitive challenges here as cloud providers will likely strive to encourage customers to deploy their AI models (that were trained on their own cloud infrastructure) on their own platforms. For instance, Microsoft will induce customers to train their models on Azure, and then deploy them through its own CRM suite ‘Dynamics 365’ (more on that later).

Nonetheless, the strong growth in MuleSoft revenue over the past year, as well as the future MuleSoft revenue under contract (as per the growth in CPRO discussed earlier) can be considered as a strong leading indicator for customers’ AI ambitions through the Salesforce platform.

Nexus, data compiled from company filings

Given the fact that customers are increasingly integrating their external data into Salesforce through MuleSoft signals that customers may also be increasingly willing deploy various AI models across the Salesforce platform to build their own customized generative AI applications and workflows.

Though despite Salesforce executives’ proclamations on the last earnings call that investors can expect strong MuleSoft revenue growth going forward based on CPRO trends, one can’t help but notice the slowdown in the revenue growth rate over the last two quarters. Now MuleSoft’s revenue growth is certainly likely to stay healthy going forward given the executive team’s visibility, but as investors, it is prudent to also consider competitive pressures as rival platforms also seek to attract more and more customer data to underpin AI-services growth.

Growing rivalry in CRM software market

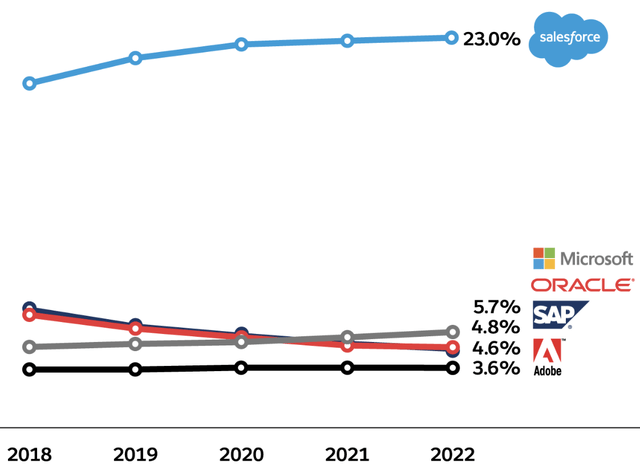

Salesforce is by far the market leader in the CRM software market, with a 23% market share in 2022.

Salesforce, IDC

There are numerous competitors striving to take market share from the CRM giant through their own AI advancements, including the likes of Oracle, SAP and Adobe. The next biggest CRM provider is Microsoft, with a market share of 5.7%.

While Microsoft is a distant second, the $2.5 trillion behemoth is not be underestimated, particularly given its perceived leadership position in the generative AI race thanks to its stake in OpenAI.

Microsoft Dynamics 365, the company’s rival to Salesforce, has lately been pushing more aggressively for market share.

Earlier this year, Microsoft introduced Copilot capabilities across its suite of Dynamics 365 solutions, including Sales, Marketing and Customer Service, rivaling Salesforce’s generative AI features.

Moreover, Dynamics 365 not only offers CRM solutions, but also Enterprise Resource Planning [ERP] solutions such as Business Central, Supply Chain Management and Finance. Hence, Microsoft Dynamics 365 offers a more extensive enterprise software solution connecting various business areas together for a more unified business management experience, which Microsoft could leverage to attract more CRM customers away from Salesforce.

Unsurprisingly, Microsoft already leverages the popularity and large installed base of its Microsoft Office 365 suite (Word, Excel, PowerPoint, Teams, etc.) to upsell business customers towards its Dynamics 365 suite through native integrations that allow for a more seamless adoption of its CRM/ ERP solutions. Now despite these deep integration capabilities over so many years, Dynamics 365 still lags Salesforce in the CRM market, which is testament to Salesforce’s superior CRM offerings.

Nonetheless, Salesforce investors should not underestimate Microsoft’s ability to take market share in this new era of generative AI. Moreover, Microsoft can indeed leverage the stickiness of Copilot across its Microsoft Office 365 suite to more powerfully upsell customers towards Dynamics 365. Once a business deploys Copilot, the underlying AI software familiarizes itself with users’ workflow processes and data usage trends, and becomes better and better at serving users over time.

If Microsoft can successfully bridge the Copilot use between Microsoft Office and Dynamics 365, then Microsoft Office Copilot users may find it more convenient to also use Dynamics 365 Copilot for their CRM/ ERP needs, given that Copilot is already familiar with users’ preferences. Microsoft could use such competitive advantages against Salesforce going forward.

Furthermore, keep in mind that Microsoft Azure is one of the leading cloud providers whose services are in high demand as businesses seek computing power for training/inferencing their own AI models and build customized business applications. Azure offers various services, such as Azure AI and Azure Data Analytics, that integrate seamlessly with Dynamics 365. This enables customers to more easily deploy their own, customized generative AI applications across the Dynamics 365 suite. Hence, Salesforce’s AI ambitions through the Einstein 1 platform faces formidable competition.

In fact, similar to how Salesforce is encouraging customers to bring their external data onto the platform through MuleSoft and helping them optimally manage and process their data through Data Cloud, Microsoft introduced ‘Microsoft Fabric’ earlier this year to encourage more data storage and processing through Azure. In a previous article, Nexus covered how Microsoft is leveraging ‘Microsoft Fabric’ to start capitalizing on the massive AI opportunity ahead, and here is an excerpt from that article:

“Launched in May 2023, Microsoft Fabric is a data and analytics platform that combines key data management and analytics workloads into one service. The service essentially strives to solve the problem of a fragmented data stack, whereby enterprises have to integrate numerous data analytics solutions together from various providers.

Microsoft Fabric has been designed with a multi-cloud approach, which means the use of the service does not lock customers into Azure, as they will also be able pull in data from Amazon S3 and Google Storage. Hence, Microsoft is indeed striving to lure in customers from its key competitors, and will indeed seek to upsell and cross-sell more Azure solutions”

Therefore, while it is encouraging to see Salesforce witness growing demand for MuleSoft and Data Cloud, investors should beware of Microsoft’s growing encroachment into the CRM industry as the software giant leverages its own strengths.

Additionally, according to Adam Mansfield from consulting firm UpperEdge:

“Microsoft is offering subsidies to prospective customers who are already committed to Salesforce, and Microsoft is more willing to help clients with the costs of consulting services to assist with implementation.

Microsoft is pretty much coming in and going, ‘We’ll make it as cheap as you want’ ”

The point is, competition for Salesforce is intensifying, which may undermine the pace of revenue and profit growth going forward.

Monetization, Financials & Valuation

As part of the Q2 FY24 earnings, Salesforce raised their guidance for fiscal 2024 revenue growth to 11%, citing strong growth in MuleSoft revenue. Note that 11% would mark the slowest top-line growth rate in several years, given that the 5-year compounded annual growth rate [CAGR] for Salesforce’s revenue is 24.5%. This slowdown is reflective of the dire macro conditions curtailing customers’ IT expenditure, leading to longer sales cycles and deal compression.

That being said, Nexus expects revenue growth to re-accelerate as macro conditions improve and customers move to upgrade their software that is fit for the AI revolution. In fact, Salesforce is already striving to re-accelerate revenue growth with the recent price hikes.

Moreover, in August 2023, Salesforce increased the prices of its core ‘Sales’ and ‘Services’ subscription services by an average of 9% across its tiers. Subscription fees are charged on a per user & per month basis.

The price of the ‘Professional Edition’ was raised by 7% to $80/month, for ‘Enterprise Edition’ it was hiked by 9% to $165/month, and for the ‘Unlimited Edition’, the price increased by 10% to $330/month.

The ultimate impact on revenue growth will be determined by the mix of subscription tiers sold, and will range from 7% to 10% (depending on the tier).

Though keep in mind that Salesforce’s contractual subscription periods range from 12 to 36 months, hence the revenue uplift from the price increases will only materialize if and when customers renew their subscriptions, as COO Brian Millham shared on the last earnings call:

“We’re going to see the impact of our price increase really hit the customer base over the next one to two to three years. So no big material change in this fiscal year.”

A key risk to keep in mind is that the AI revolution could give rise to new competitors. This could be in the form of new software start-ups that offer cheaper CRM solutions, or existing enterprise software companies expanding into also offering CRM solutions, thanks to the ease of generative AI breaking down barriers to entry. Hence, Salesforce’s recent price hikes could potentially encourage customers to explore alternatives before their contract renewal date arrives.

Furthermore, with continuous advancements in cloud computing and generative AI capabilities, there is also the risk of customers’ IT departments being able to more easily produce their own CRM software applications that run on third-party cloud providers’ infrastructure, by-passing the need for Salesforce’s platform in the future. Hence, these risks may undermine Salesforce’s pricing power going forward, limiting the company’s ability to drive revenue and profit growth.

That being said, the growing demand for Salesforce’s data-centric solutions such as Data Cloud and MuleSoft is a favorable indicator of customer loyalty to the platform. Customers aggregating their data onto the Salesforce platform signals their intent to reap as much value as possible from generative AI features across the Salesforce clouds. Hence, such customers will very likely renew their Sales Cloud and Services Cloud subscription contracts at the higher prices, conducive to revenue and profit growth for the CRM giant. Furthermore, with these customers investing more capital and resources into the Salesforce platform, they are also likely to adopt more of Salesforce’s clouds going forward to optimize their CRM activities, conducive to further revenue and profit growth.

Now in terms of monetizing its own generative AI solutions, Salesforce has not yet revealed pricing for its latest Einstein Copilot feature. However, earlier this year, Salesforce made Sales GPT and Service GPT generally available as part of the Sales Cloud Einstein and Service Cloud Einstein add-ons, respectively. The CRM giant charges $50/user/month for each of these add-ons on top of the core subscription fees listed above. This $50 fee includes both the pre-existing predictive AI capabilities of Einstein, as well as the latest generative AI capabilities.

Note that the Einstein add-ons are only available for subscribers of the higher-end Enterprise/ Unlimited tiers. Hence, now with the addition of alluring generative AI features within these add-ons, it could foster Salesforce’s ability to upsell customers towards the higher subscription plans, conducive to stronger revenue growth going forward.

However, this strategy may be undermined by the fact that Microsoft offers Sales Copilot (a rival to Salesforce’ Sales GPT) for free to subscribers of its top tier Dynamics 365 Sales Enterprise and Premium plans, and charges only $40/user/month to subscribers of its lower-end Dynamics 365 Sales Professional tier. As Microsoft makes more of its Copilot features available using a similar pricing strategy, it will challenge Salesforce’s monetization efforts.

Microsoft is indeed moving aggressively to try and take share from Salesforce in the CRM sales software market. In fact, Microsoft also allows its Sales Copilot to be integrated with Salesforce Sales Cloud, which could serve as part of a strategy to lure Salesforce customers into using more of Microsoft’s business applications over Salesforce’s suite of solutions going forward.

Furthermore, Salesforce’s $50 fee includes a limited number of Einstein GPT credits. Einstein GPT credits are consumed each time an output is generated from a user prompt. The number of credits consumed depends on the complexity of the prompt. For instance, using GPT to generate short, chat-based service replies may consume fewer credits than asking it to generate sales proposal scripts.

In case customers need more Einstein GPT credits, Salesforce strives to upsell them towards buying the ‘Enterprise Expansion’ packs (price undisclosed) for Sales and Service teams, which would grant them more Einstein GPT credits.

Processing user queries/ prompts from generative AI services can be very costly. Accordingly, Salesforce has adopted a prudent pricing strategy by issuing a limited number of Einstein GPT credits, which forces users to be more measured in the way they use these generative AI features.

So unlike OpenAI’s ChatGPT and Google’s Bard which allows users to enter unlimited prompts, this approach by Salesforce allows for better cost control as users become inclined to only enter well thought-out prompts, keeping in check the amount of processing power required to generate responses.

This approach enables investors to be more confident that generative AI-related revenue growth will likely be achieved in a cost-efficient manner, supportive of profit margins.

Although once again this strategy may be undermined by Microsoft’s intensifying encroachment into the CRM market, as the tech giant does not seem to be limiting the usage of its generative AI features through limited credits or tokens. Instead, users seem to be allowed to use an unlimited number of prompts with Copilot without having to worry about running out of credits/ tokens.

It is yet to be seen how Salesforce prices its latest Einstein Copilot, and will likely have to follow Microsoft’s approach whereby users are allowed to enter an unlimited number of prompts. Hence, Salesforce will need to prudently manage its computer processing costs to stay competitive.

Now in terms of profitability, Salesforce achieved a 31% non-GAAP operating margin last quarter thanks to its cost-disciplined approach this year. CFO Amy Weaver proclaimed on the earnings call that:

“When we did the restructuring, it was never just for the bottom line. We also made changes so that we were — we have the resources to invest in the areas that we believe are going to drive the highest growth for the company. And we’ve been very disciplined in our approach to spending this quarter, but we want to lean into these opportunities, especially around AI, around data and around their core. And as a result, you will see that our increase in guidance to 30% does imply slightly nonlinear progression this year. And in terms of the future, as we look forward, underscore everything Marc said about our commitments. And as I said last time, I really believe 30% annually is a floor, not a ceiling.”

While Salesforce strives to prioritize profitable growth, the intensifying competitive pressure could indeed undermine Salesforce’s pricing power and monetization strategies, challenging Salesforce’s ability to continue expanding profit margins going forward.

Now as mentioned earlier in the article, for fiscal year 2025 (which starts in February 2024), the street currently expects revenue growth of 10.94%. As mentioned earlier, the 5-year compounded annual growth rate [CAGR] for Salesforce’s revenue is 24.5%. This means that despite Salesforce’s AI-driven opportunities and subscription fee hikes, the street’s top-line growth expectations for next year are muted relative to historical growth trends.

In terms of EPS, the street expects growth of 16.84% in fiscal year 2025, considerably lower than the 5-year CAGR of 24.5%. Keep in mind also that Salesforce started to buy back shares in August 2022, expanding its buyback program to $20 billion in March 2023. Hence the expected growth in EPS is partly driven by the lower share count, reflecting even slower actual earnings growth expectations.

As discussed earlier, Nexus believes Salesforce’s AI-driven growth prospects are quite promising given its CRM data advantage and the growth of its data-centric products like Data Cloud and MuleSoft, as it is an indicator of customer loyalty to the Salesforce platform in the era of AI. Nonetheless, the intensifying competition in the CRM market, not least from tech titan Microsoft, does give reason for investors to tame their growth expectations. Therefore, the street’s conservative revenue/profit growth expectations are fair.

The lower expectations for earnings growth are actually more ideal than having too high growth expectations amid the AI hype. The lower bar leaves room for earnings surprises to the upside that can be supportive of stock price performance going forward.

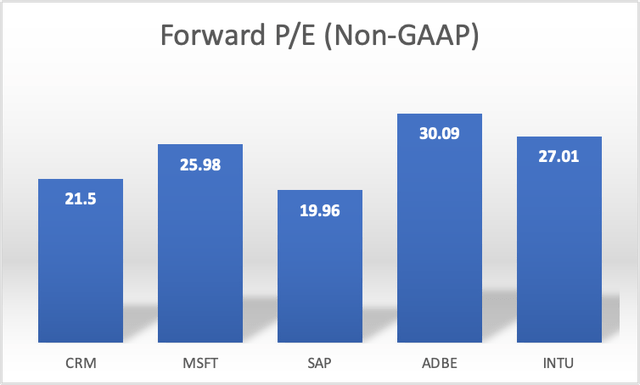

Salesforce stock is currently trading at 21.5x fiscal 2025 earnings.

Note: Salesforce’s next fiscal year ends Jan 2025, which differs slightly from competitors’ fiscal years, hence beware of some discrepancies in earnings growth/ valuation multiples. (Nexus, Seeking Alpha)

Keep in mind that the competitors listed above offer more services than CRM, which also impact their earnings growth expectations and valuation multiples. Nonetheless, relative to its CRM competitors, Salesforce’s valuation is not that rich.

Salesforce stock trades at 25.30x current fiscal 2024 earnings. As we enter fiscal 2025 in a few months, Nexus believes Salesforce’s fiscal 2025 forward earnings multiple can expand from 21.5x to 25x as the market gains a better appreciation of how Salesforce can deploy its massive treasure of CRM data, and the AI-related growth prospects given the popularity of its data-centric products like Data Cloud and MuleSoft.

Therefore, on a forward earnings (non-GAAP) basis, the stock is attractively valued for investors looking for exposure to generative AI-driven software growth. Nexus assigns a ‘buy’ rating to Salesforce stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.