Summary:

- Snapchat reported 3Q24 earnings and the stock shot up over 16% as a result.

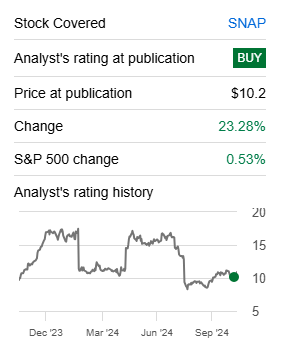

- The stock is up over 23% since my last call ahead of earnings, and I think the growth catalysts have been priced in, meaning there’s limited upside ahead.

- I expect the company’s investments in its augmented reality platform or AR, its strides in AI, and the recent partnership with Google’s Gemini to show up in the long term.

- I hereon share my sentiment on Snapchat and why I see minimal upside ahead for the near term.

J Studios/DigitalVision via Getty Images

Investment thesis:

Snapchat (NYSE:SNAP) reported 3Q24 earnings on Tuesday after the bell and the stock to shoot up over 15% the following day after the company beat on top and bottom lines, plus guided much better than street estimates expected for their last quarter of the year. I had initiated Snapchat with a buy around a week before earnings, expecting the stock to outperform after its crash last quarter and as it gains more traction in DR (direct response) ads.

Indeed, my expectation played out basically, meaning if you bought the stock on my last call when the stock was $10.2 per share, you’re up over 23%, as seen below, with the stock price now around $12.48 per share. This also means that a lot of the investor confidence that came with the better results got priced in. So, in the aftermath of the earnings call and given Snap’s trend of jumping and crashing on quarterly results, I think it’s best for investors to step out of the stock. I still like Snap in the long run, especially their My AI feature, but I think there’s limited upside in the near term. I think if the volatility of the stock price performance over the past year tells us anything, it’s that Snap will deflate again, and investors should see more favorable entry points down the road.

Seeking Alpha

Snapchat increased its daily active users by 37 million, up 9% year over year at 443 million. This backed revenue to come in at $1.37 billion, up 15% year over year and ahead of consensus estimates at $1.36 billion. Non-GAAP EPS of $0.08 beat expectations by $0.03. I initiated Snapchat with a buy ahead of earnings, expecting short-term tailwinds from Direct Response and longer-term tailwinds from the company integration of AI with My AI and down-the-line AR investments.

Let’s unpack the short-term tailwinds. Heading into the earnings call, I was particularly optimistic about “management’s investments in the Direct response ad platform, which, I think, will show up on top-line in the short term, despite competition from Meta (META) and TikTok.” This quarter, advertising revenue is up 10% year over year to $1.25 billion and up sequentially from $1.13 billion in Q2, backed by DR advertising revenue increasing 16% year over year, driven by strong demand for 7-0 pixel purchase optimization, up 160% year over year. According to the company’s CEO Evan Spiegel, the momentum in direct response products in SMB businesses was reflected in total active advertisers, which was more than double year over year for the quarter. I remain optimistic about management’s efforts in DR and expect them to expand in the longer term.

My previous longer-term optimism about the company still stands. I expect the company’s investments in its augmented reality platform or AR, its strides in AI since launching My AI last year, and the recent partnership with Google’s Gemini on Vertex AI, to heighten engagement. The momentum is definitely there, and Q3 numbers confirm my thesis as the number of Snaps sent to My AI in the U.S. was more than triple from last quarter (yes, tripled). However, I think it will take longer to boost the stock price, considering that investor confidence is running pretty high after Tuesday’s report.

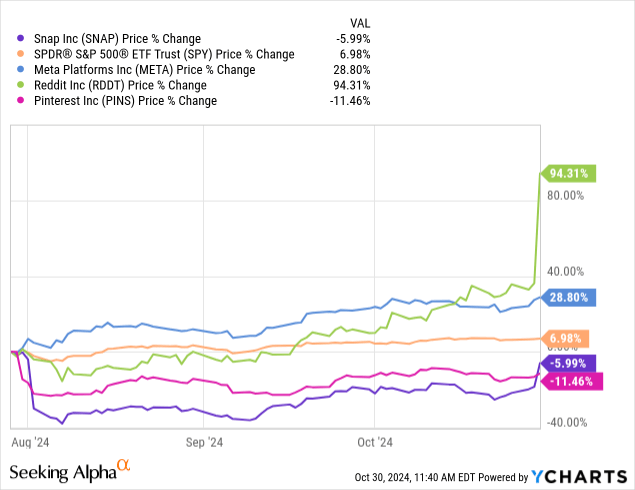

YChart

In my last article, Snapchat was down 28.2% on the three-month chart but is now only down 5.9%, reflecting the positives from the 3Q24 earnings beat. The stock is now outperforming Pinterest (PINS), down ~11%, but underperforming the S&P500 and its peer group. The S&P500 is up 6.9% % in the same period, Meta (META) is up 28.8%, and Reddit (RDDT) is up over 94%. Unlike my last article, where I was right to think that there’s “limited downside from here and growth catalysts that haven’t been priced in yet,” I now think said growth catalysts have been priced in, meaning there’s limited upside ahead.

Earnings rundown:

In 3Q24, total revenue was up 15% year over year and 11% sequentially, mainly reflecting the company’s diversification strategy as they get revenue from the ads business but also from other sources such as the Snapchat+ subscription that witnessed subscribers more than double this quarter to exceed 12 million. North America’s revenue was up 9% year-over-year but still had a lower growth rate due to weaker brand-oriented demand. Europe revenue was up 24% year over year, backed by the DR ad platform, and the rest of the world’s revenue was up 32% year over year, also driven by progress in the DR ad platform.

Global impression volume was up around 19% year-over-year, mainly backed by expanded advertising delivery. Adjusted gross margin was up sequentially from 3% last quarter to 54% in Q3 but was in line year over year. Adjusted operating expenses were $64 million this quarter, up 1% year-over-year. Adjusted EBITDA was $132 million for the quarter, up from $40 million in a year ago quarter, driven by higher revenue and operating expense discipline. Net loss was $153 million this quarter, down from $468 in a year ago quarter, with a 58% improvement year over year. Free cash flow came in at $72 million, and operating cash flow was $116 million; the company currently has $3.2 billion in cash and marketable securities with no debt for the current year, reflecting a well-balanced balance sheet.

For the next quarter, management expects a DAU of around 451 million, above estimates of 448.6 million. Q4 revenue is forecasted to be $1.51 billion—$1.56 billion, implying a year-over-year growth of 11%—15% over consensus estimates at $1.56 billion. Adjusted EBITDA is expected to be $210 million—$260 million, ahead of estimates at $233 million. I think the positives from this are priced in, and I see minimal upside ahead.

Valuation:

Snapchat has a market cap of $20.6 billion and an enterprise value of $19.2 billion, up from $17.4 billion and $18.3 billion since my last article, respectively. The market sentiment on the stock is reflected in the +16% surge it had today after the bell. 4.5% of Street analysts give the stock a strong buy, and over 18% give it a buy, with around 70.5% of street analysts giving it a hold, and 6.8% giving it a sell. According to data from Refinitiv, the PT mean and median remain unchanged from my last article, where they both:

notice a downward trend, reflecting investor caution and a dash of pessimism about the stock. The PT median was at $16 in late July and went down to $13 in August. The downward trajectory continued into September at $12 and is currently maintaining that. The mean PT was around $15 in July and was also down to $12.9 in August. It continued downwards to $12.6 in September, currently at $12.4.

Snap’s P/E ratio for C2024 is 49.4, higher than the peer group average of 32 and significantly higher than its biggest competitor, Meta, of 27.8. Snapchat’s EV/Sales ratio for C2024 is 3.5, higher than the peer group average of 5.1 but lower than its biggest competitor Meta’s of 9. I don’t think it’s going anywhere in the near term, and I don’t see an incentive to buy the stock after the fact (aka better-than-expected 3Q24 results).

What’s next:

While I’m still watching the stock for entry points at a cheaper price, I think it’s presenting a very sexy sell opportunity. I said it once with my buy rating, and I’ll say it again with my sell: Snap isn’t a stock for the faint-hearted. With a stock so volatile, I think the chances of finding a more attractive entry point aren’t slim. I suggest investors get out with what they made on the surge and find another buying opportunity over the next few months. I’m now watching the stock closely and will make sure to change my rating accordingly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.