Summary:

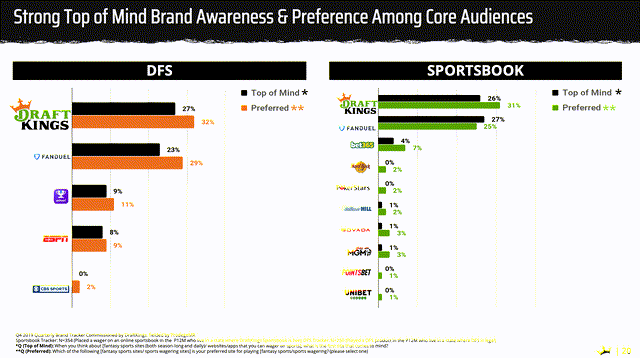

- DraftKings Inc. aims to maintain its 40%+ market share amidst new competitors entering the market.

- DraftKings is projected to become profitable in 2023, with revenue expected to reach $4.77 billion in 2024.

- The success of new entrants, such as BetESPN and Fanatics, will depend on their acceptance by the market and their ability to retain customers.

RgStudio

DraftKings: Maintaining market share as new deep pocketed competitors arrive will to be a key to sustaining a 40%+ share of market

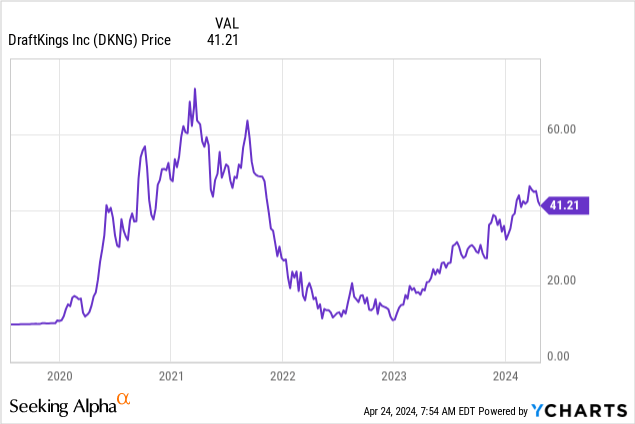

It is clear that the rocket ride that has characterizes the trading pattern of DraftKings Inc. (NASDAQ:DKNG) almost since its IPO in 2020 at $40. Ironically, the stock traded furiously higher, reaching $70 by 2021 then falling off to below single digits as its earnings reports (next one for Q1 expected post-market May 2nd) showed massive marketing costs, draining any prospect of profitability.

The hemorrhaging of cash has continued through 2023 with a loss of ($800m) though this was a vast improvement over 2022. In that year, the company booked a loss of ($1.5b). Our analysis indicates that DKNG is close to turning profitable sometime this year (if not already there in 2Q).

This year, we expect total revenue in the U.S. sports gambling sector to reach above $19b. DKNG is projecting 2024 revenue of $4.77b, a 27% increase YOY. Top market leadership with FanDuel of Flutter Entertainment (FLUT) puts that platform single-digits ahead of DKNG but very close in some states. As the sector moves toward our forecast of a $30b market by 2023, we are looking at a range of CAGR of 10% to 12% for the period. This would bring the DKNG business to a range of over $7b.

Two key issues could challenge my call for 2030: How effective will the two new entrants be in poaching share from the leaders? And second, what can we expect from the next nearest platform competitors like MGM Resorts (MGM)?

google

The heft of ESPN BET and Fanatics is yet to be felt

The possible success or failure of the two new challengers turns on how they will be ultimately accepted or spurned by the total addressable market of players. DKNG has a strong record of retaining customers, as does FanDuel. The entry of both companies are impressive in numbers. Fanatics claims to have a 65m database of authenticated customers for their sports gear and team wear.

The crossover value into sports betting could be huge. ESPN’s core audience is 71m, but it has been declining over the last ten years from a peak of 100m. And the viewer majority lies in the all-important 18-49 demo.

On the surface, it would seem a potential slam dunk when you add the financial heft of PENN Entertainment’s (PENN) role in running the ESPN betting site with its annual $150m ten year marketing deal to the massive content presence of ESPN. Likewise, Fanatics is valued at $31b.

Just a minute now, as we take a closer look at recent history,

The predecessor of ESPNbet was the Barstool Sportsbook, originally acquired in total by PENN Entertainment in 2023 for $551m. At the time, the platform held at best a 4% share of the market after over 3 years of intensive promotion aimed primarily at the 52,000 “stoolies.” Over the three years under its management, the site barely began to near profitability due to the demands of cash burn to promote the site.

So, the lesson here was clear: the database, regardless of its huge, diamond-pure sports betting demo, could not convert enough customers to bring the site into the top-performing double-digit market share operators. So what barriers erupted to a faster uptake on Barstool?

It was our old friend, Pareto’s Law, that was the culprit. It’s a theory proved accurate by the 19th century Italian economist Wilfredo Pareto, which states that in any outcomes measuring the productivity, 80% of results will always come from 20% of the participants. Over time, this has been proven to be a foundational insight into the results of any sales effort. So, applying it to Barstool’s effort, we can project that at best, that potential bettors out of the population of stoolies, about 10m were possible migrators to PENN sports betting.

Applying the “law” to the vast pool of ESPN and Fanatics viewers and customers brings us to an addressable audience of 135 million – we have 27 million between the two. But we then have to chop it down further to 20% of the 20%, to 2.7m addressable. Our only point here is that the impressive audiences that appeared in the two new entries all use the gross audiences in the financial materials published at the announcement of the PENN deal.

Original sign-ups to ESPNBet according to the network broke a two-day record over 1m people primarily because of a generous opening bonus of $150. This is no predicate of what may come since the key is not sign-ups but retention. In searching the social media universe, among early adapters is a mix of positive and negative reviews of the site.

More importantly, we will need to see the numbers on average bets, frequency of action and demographic and geographic breakdowns in the 17 states where the two new sites are live.

We think the two new entrants could be looking at mid-single digit market shares over the next three to five years. The barriers would be for ESPNbet – for all its heft a clear too little too later entry, as legalization was in 2018, over six years ago. ESPN fiddled, beset by corporate paralysis at Disney (DIS). For Fanatics, we have a demo, probably somewhat too heavy on underage customers. It’s difficult to make the case of large-scale migration of its gear buyers to serious bettors.

DKNG’s head start and retention levels make its DCF calculation viable on a forward ramp through 2030

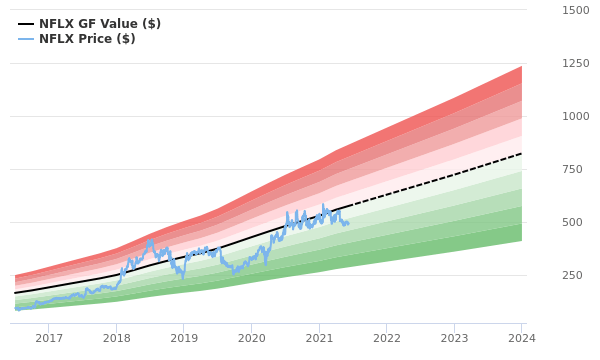

According to two discounted cash flow, or DCF, calculations, DKNG shares have a fair value of $64, or with a five-year terminal value of $117. For that reason and the prospect of the company going profitable in view and its retention rate, we agree with that calculation.

We disagree, though, with some analyst sentiment that suggests the stock may be overvalued, having moved too fast before a solid profitable range of earning has been reached.

Our PT for early Q3 ranges between $57 and $58. In essence, we see no major disruption to DKNG maintaining co-sector leadership in the out years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.