Summary:

- DraftKings is a high-growth company with positive trends, making it a good long-term investment opportunity.

- The US online sports betting market is expected to grow at a 14% CAGR, creating an attractive industry for DraftKings and FanDuel.

- DraftKings is in a competitive position with FanDuel, showing potential for profitability and growth in the future.

- The stock is undervalued, presenting an attractive 42% upside potential.

SeventyFour/iStock via Getty Images

Overview

DraftKings (NASDAQ:DKNG) is a high-growth company with negative margins in the past. The company reported 1Q2024, its first-ever positive Adjusted EBITDA, and a positive trend. It is time to analyze it deeply to see if it is a good time for a long-term investor to buy.

My conclusion is affirmative because the company operates in an industry I estimate will be attractive, an oligopoly of two. Secondly, margins and profitability will improve according to my analysis, which, along with a high growth revenue, will make it a good investment. Lastly, the current price is undervalued, with an upside potential of 42%.

High TAM and attractive market dynamics

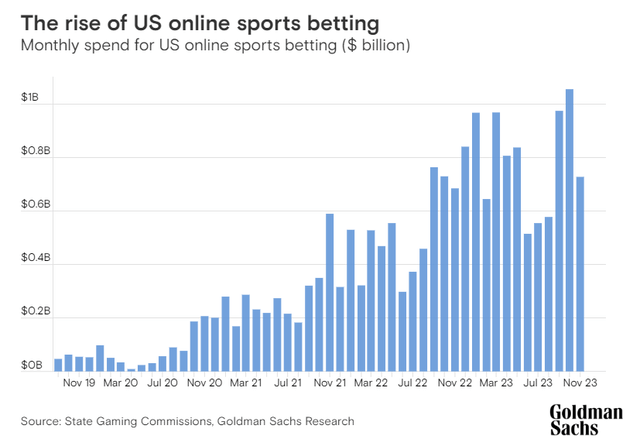

I estimate the total addressable market in the US to be $13.5 billion in 2023. It is expected to reach $45 billion in 2033, the time I consider the market mature. This 14% CAGR increase (Figure 1) is due to legalizations in new states, increasing adoptions, and the spread of new betting methods (iGaming).

The market is very competitive nowadays, but I estimate it will be attractive in the future. Customers have a lot of power because they can change easily from one provider to another, even have several accounts simultaneously, and are very price-sensitive. However, the market has two big players that dominate the industry, with a market share between 65% and 70%. We are in a very intensive customer acquisition phase, with high marketing costs. But I don’t foresee this trend forever. Being a “two-player” game, a lot of coordination can exist. This coordination can moderate customer acquisition costs and improve profitability. Meanwhile, this marketing battle enhances barriers to entry, making it harder for competitors to fight for clients when there are tough competitors like BetMGM, Caesars Sportsbook, and PointsBet. There are about 30 online sports betting companies, but most of them won’t be relevant in the future.

Competitive position

The two main competitors are DraftKings and FanDuel. FanDuel could have 32-37% and DraftKings 28-32%. DraftKings is characterized by innovation and a high-scope portfolio, and FanDuel takes advantage of its extended customer base, backed up by Flutter Entertainment’s (FLUT) financials. Both companies compete intensively to acquire customers and face similar risks, with more effort on the side of DraftKings because they have a lower customer base. I consider both companies to be a future oligopoly.

Both competitors are similar in size. They have about $1.2 billion in revenue per quarter, about 3 million unique monthly paying users, a similar average revenue per user, and the same growth profit ratio. FanDuel market share is slightly better but in the same range. It is hard to foresee a clear winner in this market. This data reinforces my estimate of an oligopoly dominated by both companies.

DraftKings has a drawback with respect to FanDuel. FanDuel is backed by Flutter Entertainment, and DraftKings is not. For the exceptional growth that those companies are immersed in, it is critical to finance this growth. FanDuel can use Flutter’s finance, but this is not true for DraftKings. So DraftKings, from time to time, has to get funds from equity finance with the corresponding dilution for the investor. In mid-2020, DraftKings raised $1 billion through a secondary Class A common stock offering. It is a possibility unless margins improve. Let’s see if this is going to happen.

Path to profitability

DraftKings has declared positive Adjusted EBITDA in the latest quarterly report 1Q2024 of $22 million. I think this is the main issue for the company, and the news is promising. The company has been unprofitable due to the expensive customer acquisition costs, regulatory compliance, and increasing taxes. I foresee that the industry’s structure will temper those efforts, as I mentioned in the former section, and empirically, that is what I am seeing.

Profitability is encouraged by product innovation and cross-selling. Average Revenue Per Monthly Unique Payer (ARPMUP) increased 47% in 1Q2023, indicating increasing engagement due to product innovation. Cross-selling is improving; for instance, iGaming (online casino) accounts for 21% of total revenue. This cross-selling is encouraged by a unified app experience and retarget promotions.

The company also works with cost control and operating leverage. The percentage of Sales and Marketing expenses as a % of revenue has decreased from 58% in 1Q2023 to 45% in 1Q2024, and this reduction is more valuable if you consider that monthly unique payers have increased 31% to 2.9 million in the same period. Gross profit has increased from 44% in 1Q2023 to 54% in 1Q2024, proof of being able to scale operations in this high-growth environment. General and Administrative expenses as a % of revenue have remained flat despite the increase in revenue.

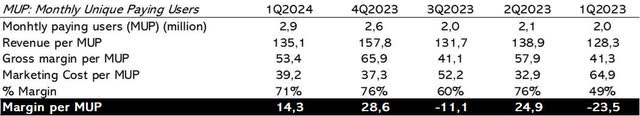

As shown in Figure 2, we can see how the sales and marketing efforts are paying off concerning the revenue the company gets. Without a clear trend, revenue per user is mainly flat between $130-160 per paying user, but users grew from 2 million to 2.9 million in 1Q2024. If you skip 2Q2023 because there is a clear stationary behavior due to the final NFL season and marketing costs are lower, there is a clear tendency toward profitability. Gross margin grows from $41 per user to $53 per user, and marketing costs decrease from $65 per user to $40 per user. So, go from unprofitable customer acquisition to profitability in 1Q2024 and 4Q2023.

Valuation

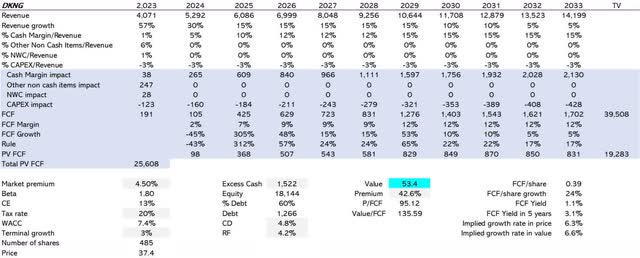

I typically base my projections on an annual basis, but I take into account the last four quarters to gather information on the most recent quarterly performance. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

In Figure 3, I show the value drivers that compose free cash flow. As you can see, it is unstable and has two trends: certain revenue growth deceleration, but not strongly, and margin improvement. So, I project those value drivers based on the analysis described in the article’s previous sections.

I estimate that revenue growth will lower over the years as the revenue base rises. As I have stated, the US market will be $45 billion in 2033, and I said there won’t be any clear winner. So, I established that its market share will remain at 30%. So revenue in 2033 will be $13.5 billion, as shown in Figure 4.

For the Cash Margin projection, I use the same as Flutter Entertainment, which is around 15%, as a reference. I suppose that DraftKings will increase the margin until it reaches this level in ten years.

I don’t see any structural evolution in Other Non-Cash Items, and I averaged it to zero. The same is true with net working capital change when it is conservative because the company gets paid instantaneously, can negotiate payment terms with providers, and doesn’t manage inventories. I assume a constant level of capex investment of 3% of revenue.

Cash flows will be discounted at a 7.4% WACC because the beta is 1.80 and risk-free at 4.2%. Given the company’s high leverage, at 60% with a cost of debt of 4.8%, the terminal growth rate is set at 3%.

As shown in Figure 4, my value estimate is $53 per share, a 42% premium over its current stock price.

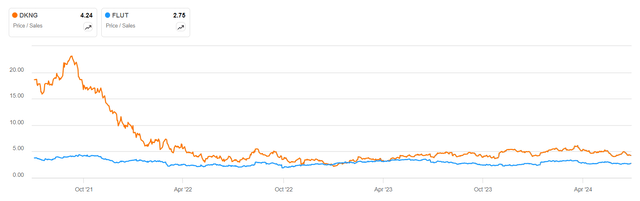

In context, I show historic valuations based on price-to-sales multiples because of negative margins. I compare it with Flutter as the best reference. You can see that historically, it is not overvalued and has a higher premium than Flutter due to better growth prospects because Flutter has a more stable segment (Europe).

Risk

One of the risks facing DraftKings is raising taxes. I assign a 60%-70% chance that taxes will be raised in the next two or three years. Those are the reasons that make me believe in that. Several states have raised this in the past, and some others are considering increasing it. Budget deficits are a real constraint in public economic agendas, and raising fiscal collection is an option. There is a perspective that considers online betting to be unethical, and many people view taxes as a way to regulate it.

There is also a moderate risk (30-50%) for regulation restricting advertising and promotional material. These restrictions can raise acquisition costs, as gaining an additional customer would be more costly. Regulators could impose additional gambling measures. I assign a high probability (70%-90%). It could impose mandatory deposit limits, stricter age verification, and increased gambling addiction, which could raise its costs.

Even if these risks are possible, the 42% premium stated in the valuation section provides a margin of safety for me.

Conclusion

In my analysis, I support a good recommendation for the stock. This is primarily due to its operation within an industry that I anticipate will be highly attractive. It is an oligopoly dominated by only two major players who hold about 65%—70% of the market.

Furthermore, my assessment indicates that the company’s margins and profitability will improve until it reaches a cash margin of 15% in ten years, particularly given its high growth revenue potential, which makes it a good investment opportunity.

Finally, I believe that the current market price undervalues the company. It has an upside potential of 42%, reaching a value of $53 per share. So, I recommend buying the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DKNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.