Summary:

- DraftKings reported Q2 earnings in line with expectations, growing well and expanding profitability through scaling operations.

- The 2024 outlook was revised into more aggressive revenue growth but lower adjusted EBITDA with multiple underlying factors under the change.

- The company continues improving its underlying financials from the incredibly high CAC in prior years, and is well on track to achieve its longer-term targets.

- With the continued momentum, DraftKings’ stock remains attractively priced.

John Lamb

DraftKings Inc. (NASDAQ:DKNG), the online gambling giant in North America, reported its Q2 report on the 1st of August. The quarter was roughly in line with Wall Street analysts’ estimates, and came with a revised guidance, including multiple underlying changing factors, as well as the announcement of a share buyback program.

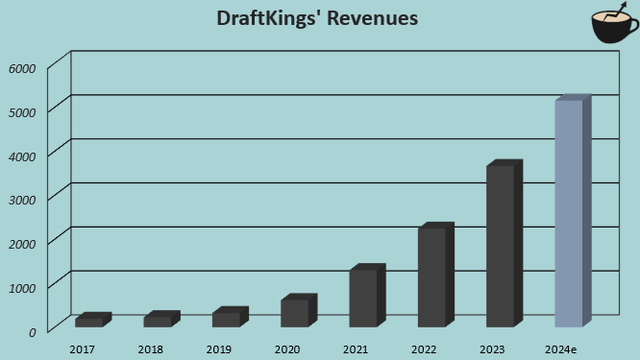

After a merger into a SPAC, the stock has now returned an impressive 275% with revenues constantly scaling and as earnings are finally becoming healthier after wide losses in past years. The company’s future outlook remains incredibly good as the customer base is increasing across existing and newer states, and as competition in customer acquisition is easing, making it easier for DraftKings to achieve good profitability.

Q2 Financials: As Good As Expected

DraftKings reported the company’s Q2 earnings on Thursday. The reported revenues of $1104 million at a 26.2% year-on-year growth came in $20 million below Wall Street expectations, and the adjusted EPS of $0.22 beat estimates by $0.03 – the financials came in roughly as expected in Q2, continuing the momentum in new acquired customers and well-increasing margins as the EPS increased by $0.08 year-on-year.

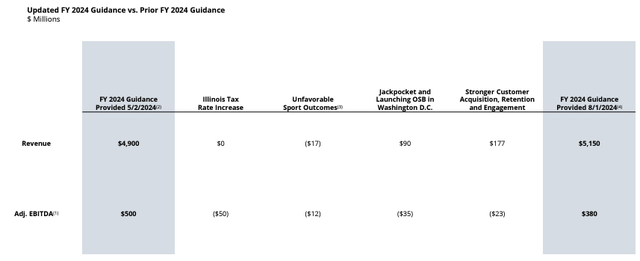

More notably in the report, DraftKings revised the 2024 financial guidance – the revenue guidance range was raised from $4.8-5.0 billion into $5.05-5.25 billion now implying a better mid-point growth of 40.5%, but the adjusted EBITDA guidance range was lowered considerably from $460-540 million into a thinner $340-420 million range, now including the completed $750 million acquisition of Jackpocket that seems to only be accretive to earnings in the midterm.

The changes to the guidance are mostly related to one-off effects with the lower adjusted EBITDA, also including more aggressive expected customer acquisition that should aid longer-term earnings but worsen the bottom row in the short term. A recent tax rate change in Illinois also pushed the earnings range down, being a more persistent negative factor.

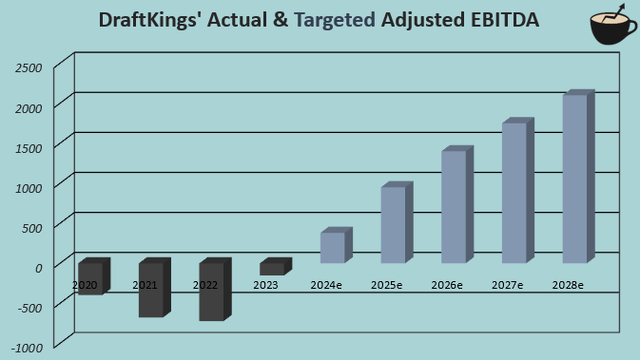

The new adjusted EBITDA guidance still estimates very great operating leverage from the prior year’s -4.1% margin at a new mid-point margin of 7.4% for 2024. The 2025 adjusted EBITDA guidance of $900-1000, a million was also reaffirmed.

To summarize, the Q2 report was a solid continuation of recent trends. Revenues and adjusted EBITDA came in as expected at good year-on-year increases, and the guidance change was in my opinion a neutral to slightly positive factor as the growth remains incredibly strong with more aggressive customer acquisition. The longer-term outlook stayed the same as DraftKings continues scaling into a profitable, giant entity in the space.

Long-Term Financials: The Customer Acquisition Competition is Easing

As online gaming has become legalized in states across the US, DraftKings has entered new markets, driving greater revenues. Unique customers on the platform has risen from 0.8 million in Q1/2017 into an over ten-fold 8.4 million after Q2 as told in the Q2 Investor Presentation. The company now operates the mobile sportsbook in 25 states as well as Washington D.C. after Q2, and iGaming in 5 states as well as offering the sportsbook solution in Ontario, Canada, still leaving potential for potential new state launches in the mid- to long-term as legalization allows – DraftKings should still have great growth ahead.

*2024e Represents New Guidance Mid-Point (Author’s Calculation Using TIKR Data)

In previous years, the legalizing market has come with incredibly high competition to acquire customers – competitors such as Flutter Entertainment’s (FLUT) leading brand FanDuel that I have previously written an article on, and multiple other competitors such as BetMGM, PrizePicks, and better-established European operators’ US brands, have competed for a share of the rapidly growing market. The competition for acquiring customers has especially pushed the industry’s earnings down in previous years with extremely high customer acquisition costs [CAC] as DraftKings still reported a -52.2% adjusted EBITDA margin in 2021 with the company spending an enormous 52.9% of revenues on marketing alone with FanDuel having similar trends.

The market has slowly started easing up, especially with DraftKings achieving a great position in the industry at the great market share. The company maintained its market share with the Q2 GGR market share increasing 20 basis points into 29.8%, but has been able to deleverage CAC already by -21% in 2022 as told in the 2023 Investor Day, by around -20% in 2023, and with continued decreases in 2024 as marketing expenses stayed near stable in Q2 despite great continued new customer momentum.

Currently, marketing only accounts for 27.0% of revenues, nearly half of the 2021 level, with further declines being likely with retained customers and a dramatically cheaper new CAC.

*Estimated Data Represents DKNG’s Guidance/Targets, 2027e Represents a Linear Increase Between 2026-2028 Targets (Author’s Calculation Using DKNG’s Press Release & 2023 Investor Day Information)

The underlying trends should aid improve earnings dramatically as DraftKings’ 2028 financial target of $7.12 billion revenues and $2.1 billion adjusted EBITDA with currently operating states alone suggests, making the target well achievable.

Announced Share Buyback Program

DraftKings initiated a share buyback program of up to $1.0 billion of Class A shares with the Q2 report, representative of around 5.4% of current diluted outstanding shares. The company has $815.9 million in unrestricted cash after Q2, making the buyback program a good use for the excess capital in my opinion.

The company’s cash flow profile has been slowly improving with already positive trailing operating cash flows, enabling the buyback program.

DKNG’s Valuation Is Still Quite Attractive

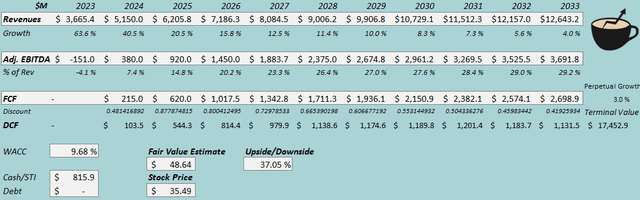

I constructed a discounted cash flow [DCF] model to estimate a fair value for the stock. In the model, I estimate a revenue CAGR of 13.2% from 2023 to 2033 and 3% perpetual growth afterwards representing DraftKings’ own current-state targets in coming years along with a good amount of new state launches aiding revenues.

For the adjusted EBITDA margin, I estimate great leverage within DraftKings’ target. The eventual perpetual margin of 29.2% represents competitor Flutter’s highly mature U.K. & Ireland operations’ adjusted EBITDA margin in 2023 which I believe that DraftKings could well achieve eventually, and near DraftKings’ suggested 29.5% margin target in 2028 in currently operating states.

The cash flow conversion from adjusted EBITDA has been surprisingly good with quite modest capital expenditures and capitalized development costs, and great working capital management. I estimate the conversion to remain good, as I believe that development costs shouldn’t elevate too much from prior years.

I estimate a 10% dilution into diluted outstanding shares due to the relatively high SBC level.

DCF Model (Author’s Calculation)

With the estimates, DraftKings’ fair value estimate stands at $48.64, 37% above the stock price at the time of writing – while the stock has already rallied massively from 2022 forward from improving earnings, the stock remains undervalued by a good margin in my opinion unless the current trends abruptly change. As the stock remains undervalued, share repurchases could potentially raise the fair value estimate further.

CAPM

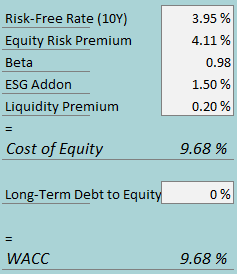

A weighted average cost of capital of 9.68% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

For the time being, DraftKings doesn’t leverage notable interest-bearing debt, and I estimate the financing to stay the same.

To estimate the cost of equity, I use the 10-year bond yield of 3.95% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I use Aswath Damodaran’s Hotel/Gaming sector unlevered beta estimate of 0.98, and while DraftKings may be worth a higher beta currently with a thinner margin profile, I believe that the company should have a low market risk after earnings mature more. With an ESG add-on of 1.5% and a liquidity premium of 0.2%, the cost of equity and WACC both stand at 9.68%.

Risks

With the quickly growing market, DraftKings could still be posed with increasing competitive risks. The prior years’ financials already represent competition’s ability to push CAC up incredibly high, pressuring earnings. My DCF model accounts for DraftKings to remain with a very good market share along with good maturing margins. Also, higher competition could push the hold percentage in the sportsbook product lower, although DraftKings has been able to manage the very KPI well into 9.5% in 2023.

The online gaming industry is also still posed with regulatory risks, especially regarding taxes related to the industry, as the recent Illinois tax rate increase represents that partly caused the 2024 adjusted EBITDA guidance shift. Also, the timing of new market entries along legalization could be a risk if multiple states’ regulatory outlook changes.

Takeaway

DraftKings’ Q2 follows the recent solid financial trends – with the company still aggressively acquiring customers and looking to expand into new states, along with the completed acquisition of Jackpocket, the top line and earnings improved as rapidly as expected. The 2024 outlook was changed due to tax changes, the acquisition, and more aggressive customer acquisition in the rest of 2024, being a neutral to slightly positive change in my opinion with higher revenue growth but worse adjusted EBITDA.

As CAC continues to decrease, and with increasing scale, DraftKings looks to achieve its ambitious longer-term revenue growth and adjusted EBITDA targets amid lowering marketing competition in the previously incredibly high-marketing sector. With the announced share buybacks and a remaining attractive valuation, I initiate DraftKings at a Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.