Summary:

- DraftKings revenue grew 26% year-over-year in Q2 2024, driven by organic growth factors and new market entries.

- Despite a positive net income, DKNG is still operationally unprofitable due to high sales and marketing expenses.

- The Company acquired Jackpocket to enter the online lottery market, aiming to attract higher-value customers at a lower cost.

Matthias Tunger

DraftKings (NASDAQ:DKNG) just released its most recent quarterly results and the reception on Wall Street has been negative. Post announcement has DKNG stock down roughly 4% on decent results. This article examines whether DKNG stock is a worthwhile investment.

DraftKings Growth in Q2 2024 Remains Intact

The company’s revenue increased by 26% year-over-year during the quarter, from $875 million to $1.1 billion. According to the company’s press release, the revenue jump was driven by a combination of organic growth factors as well as entry into new jurisdictions and the impact of the Jackpocket acquisition. Despite the positive year-over-year growth, DraftKings did slightly miss Wall Street revenue expectations by $20 million.

Apart from revenue, DraftKings other key performance indicators are performing well. The company’s Monthly Unique Payers (“MUPs”) increased to 3.1 million in Q2 2024, a growth of 34% excluding the impact of the Jackpocket acquisition (more on this below). Average revenue per MUP saw a 15% decrease in the same period, driven by the lower revenue Jackpocket customers, a higher customer win rate, and increased investments. This will be a number to watch in the coming quarters; however, I am not too concerned in the near term as the company has the potential to expand the per revenue earned for Jackpocket customers as mentioned above. The other two factors are temporary and will tend to smooth over in the long term.

DraftKings is Not yet Profitable

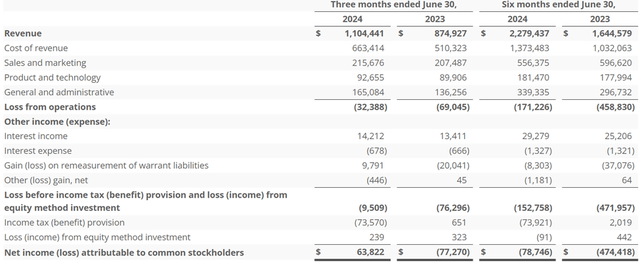

DraftKings reported Q2 2024 “adjusted” EPS of $0.22 and GAAP EPS of $0.13. This translated to Net Income of $68.8 million, compared to the $77.3 million loss reported at the same time last year. As a headline, this seems like fantastic news for the company, as it has seemed to achieve profitability. However, digging deeper, we can see that the company is still operationally unprofitable. The bulk of Net Income comes from a one-time income tax benefit provision.

In Q2 2024, the company’s loss from operations was $32.4 million. This was a drastic improvement from the $69 million loss reported at the same time last year. Over the last six months shows even greater improvement, as losses shrank from $458.8 in the first half of 2023 to $171.2 in the first half of 2024.

Income Statement (DraftKings Press Release)

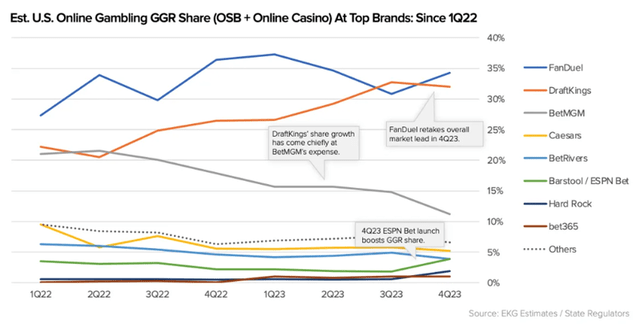

However, despite these improvements, it is still concerning to see a company lose money on an EBIT level. Examining DraftKings’ cost structure, what sticks out to me is the incredibly high “Sales and Marketing” expense. This is no surprise, as the company has been aggressive with its promotions in order to win over customers. In a new industry like online US sports betting, it is key to get as much market share as possible in order to establish dominance. This has been the playbook with most technology firms in the past.

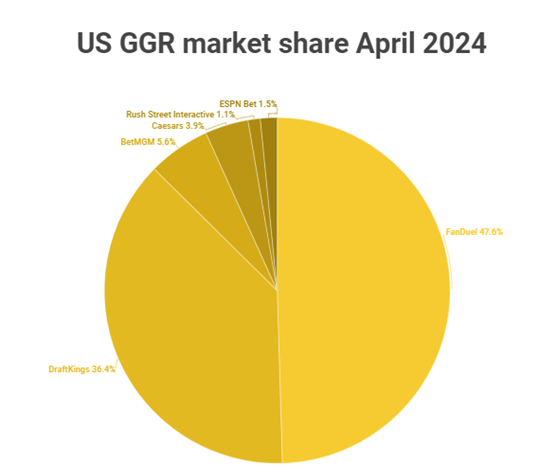

This heavy spending has paid off as, currently, DraftKings holds a dominant position in the industry. The company’s market share is second only to Flutter (FLUT) owned FanDuel. In fact, DraftKings saw its market share dramatically increase in 2023. According to the website Next.io which compiles the information, in early 2022 DraftKings only had a roughly 22% market share for US online gambling (sports-betting and casino). Based on the latest data for April 2024, DraftKings has a 36.4% market share of the US online gambling market.

US GGR (Next.io) US GGR (Next.io)

As the industry starts to mature, I expect that DraftKings Sales and Marketing expenses will start to rationalize as the company makes the move toward profitability. In the first half of 2024, Sales and Marketing costs were $556.4 million. This translates to 24.4% of revenue and 22.7% of operating costs. This was an improvement over the first half of 2023 which had a Sales and Marketing cost of $596.6 million or 36.3% of revenue and 28.4% of operating costs. Getting these costs down will be the key to long-term profitability, something that DraftKings’ management is well aware of.

The industry continues to grow and expand, and thus is a very target-rich environment when it comes to new customer acquisitions. I don’t expect Sales and Marketing expenses as an absolute number to go down. But management is signaling declining spend on a per-customer basis, i.e. customer acquisition costs (“CAC”). Therefore, as DraftKings continues to grow its customer base, Sales and Marketing as a percentage of revenue should hopefully start to decline in the coming quarters. From the company’s latest earnings call;

So as we noted, we had an over 80% increase — an almost — excuse me, 80% increase in new players in Q2 year-over-year and an over 40% CAC decline. I mean, those are just massive numbers, right? So when you or me looking at those numbers, your marketing team is coming to you and saying we can deliver more productive spend with the same type of results, it’s hard to say no to that, right? And we’ve been monitoring cohort quality.

Lottery as a means of bringing in new customers

In the context of increasing its player base and reducing customer acquisition costs, DraftKings’ purchase of Jackpocket starts to make strategic sense. The company acquired the online lottery app for $412.5 million in cash and $337.5 million in DKNG stock. This acquisition will allow DraftKings to expand into a brand-new vertical, namely the massive U.S. lottery industry, as well as make its gaming “platform” more sticky by offering a new type of game to its customers.

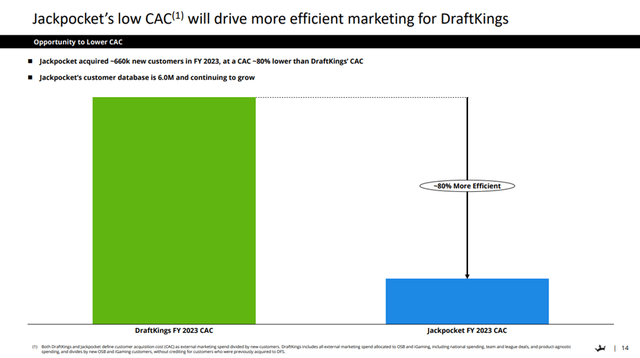

Analysts estimate that the total addressable market for online lottery in the U.S. is as high as $100 billion, with 53% of Americans having purchased at least one lottery ticket. This could possibly make Jackpocket’s online lottery a sort of “gateway” to other, more expensive online gambling games and sportsbooks. According to the company, there is a roughly 33% overlap between Jackpocket and DraftKings customers. Furthermore, these customers tend to be heavier spenders and are worth 53% more over a lifetime of gaming than DraftKings customers other customers. In other words, management believes that Jackpocket can attract higher-value customers at a lower cost of acquisition. Jackpocket’s customer acquisition is as much as 80% lower than DraftKings, which could lead the company down a path of long-term profitability.

Jackpocket CAC (Investor Relations)

From the company’s press release, Jason Robins, Co-founder and CEO of DraftKings:

We are very excited to enter the rapidly growing U.S. digital lottery vertical with our acquisition of Jackpocket. This transaction will create significant value for DraftKings not only by giving our customers another differentiated product to enjoy but also by improving our overall marketing efficiency similar to how our daily fantasy sports database created an advantage for DraftKings in OSB and iGaming.”

Valuation and Conclusion

Management is guiding for revenue in the range of $5.050 billion to $5.250 billion for 2024. This translates to year-over-year growth of around 43%. As mentioned earlier, I believe that the industry is in a “high growth” stage and that DraftKings has a good chance to achieve this ambitious growth target. Furthermore, the overall US gaming market is expected to grow at a CAGR of roughly 9.8% for the next 5 years. Using the median of the guidance range and applying the growth rate to 2029 gives me a 5-year revenue target of roughly $8.3 billion.

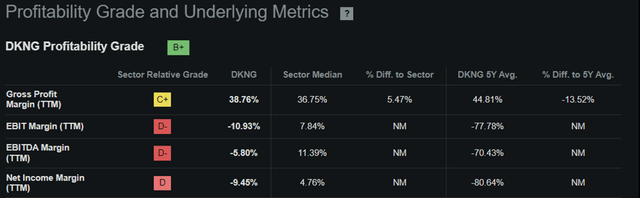

Assuming this is the steady state of the business, I believe that DraftKings could achieve a Net Income margin in line with the overall industry of 4.76%. This translates to a Net Income of $394.8 million or, using its current 484.6 million shares outstanding, an EPS of $0.81. At the current price, DraftKings would have a P/E ratio of 39.3x using these back-of-the-envelope calculations.

Of course, there could be a bullish argument that the company grows faster than the industry as the smaller players get pushed out. Another bullish argument is that Net Income margins in the future would be better than industry due to DraftKings being primarily software-based. However, using this base case of assumptions, it is in my view DraftKings is fairly valued. I give the stock a Neutral rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.