Summary:

- DraftKings is a major player in the online gambling industry and is expected to become profitable next year.

- The company has made key updates, including an intent to acquire online lottery app Jackpocket and expanding its Online Sports Betting offering into newer markets.

- DraftKings has strong growth potential as the online gambling market expands, with a focus on online sports betting.

- My model implies ~16% upside from current levels.

svetikd

Investment Thesis

Gaming engagement among Americans hovers at all-time highs, while the online gambling industry is projected to grow in the mid-teens. As the gambling market continues to push into newer highs, as I will unpack in the post below, regulation and competition are the biggest headwinds in this space, but one of the largest players in the gambling space, DraftKings Inc. (NASDAQ:DKNG) still has tailwinds.

The company is demonstrating the strong balance of moving quickly into newer jurisdictions, managing regulatory pressures, and executing well within its growth operating models. Technology is one differentiator driving a robust fulfillment platform, leading to a relatively better sportsbook and customer engagement/retention metrics. DraftKings is not profitable yet, but I expect the company to become profitable next year given its trajectory of narrowing losses.

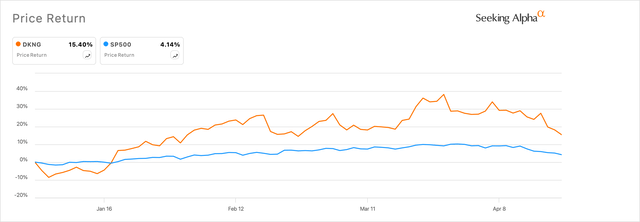

DraftKings outperforms S&P 500 Index (sa)

The company’s stock has pulled back ~18% after notching a new 52-week high last month. I believe this pullback is healthy, allowing investors an attractive entry point into DraftKings. Given my analysis of the company’s stock, I recommend a Buy on DraftKings.

Key Updates about DraftKings so far

One of the key moments from the previous earnings report was management’s announcement of intent to acquire online lottery app Jackpocket for ~$750 million in a combined cash+stock deal. The acquisition allows DraftKings to enter the online lottery market, pending approval, which management expects to close at some point in H2 FY24. Currently, Jackpocket operates in 14 U.S. states. According to the company’s projections, via Bloomberg, the acquisition is expected to add an additional $260 million in revenue and ~$80 million in adjusted EBITDA to DraftKings books.

In the Q1 FY24 quarter that went by, DraftKings launched its Online Sports Betting offering, Sportsbook in two additional U.S. jurisdictions, Vermont and North Carolina. In addition, the company is attempting to bank on the surge in women’s sports popularity by adding women’s sports shows to their weekly programming lineup on the DraftKings Network, but that is only expected in June this year.

DraftKings is seeing strong compounding growth rates as TAM expands

DraftKings has structurally positioned itself to benefit from past trends, as the online sports betting segment within its target market was expected to grow faster than the overall target market.

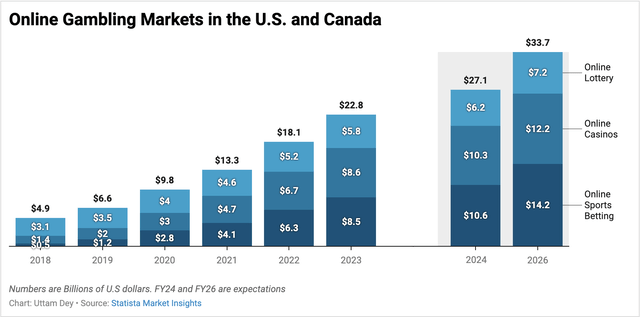

For instance, my analysis of DraftKings’ key geographical target markets, the U.S. and Canada, shows that the online gambling market grew at a very impressive 36% compounded growth rate between FY18 and FY23. The single biggest driver in those growth rates, per my analysis of the data below, was the explosive surge in revenue seen in the online sports betting segment, which grew at an astounding 78% CAGR during the same time period, now accounting for the largest share of revenues in the online gambling markets in the U.S. and Canada.

Revenues in the online gambling market in the U.S. and Canada posted impressive growth rates so far (Statista)

The market is seeing some sort of relative maturity in its TAM, as I note that the gambling market is now expected to grow ~14% CAGR between FY23 and FY26. At the same time, online sports betting is expected to grow at a respectable ~19% CAGR, while the other segments, online casinos (what DraftKings calls iGaming) and online lottery, are expected to grow at ~12.4% CAGR and 7.6% CAGR, respectively.

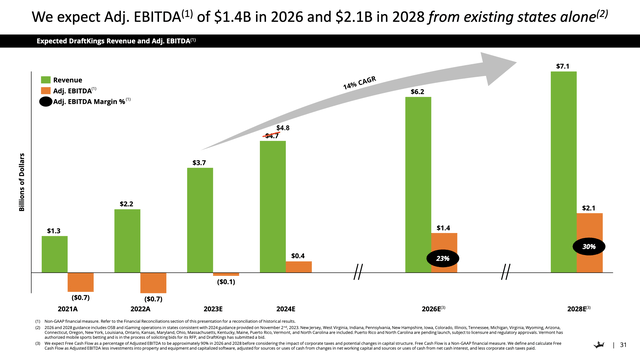

Compared to the market, DraftKings has demonstrated top-line growth rates of a robust 75% between FY18 and FY23. I have added an amended slide from their Investor Presentation deck from last year, which shows updated numbers based on the Q4 FY23 earnings call.

DraftKings is growing faster than its TAM even as TAM expands into newer jurisdictions (FY23 Investor Day Slide Deck, DraftKings)

Based on my analysis, I believe the company has a couple of differentiators to its advantage. First, the general tailwinds expand the overall market as more states in the U.S. & Canada open up their jurisdictions to DraftKings’s offerings, which I have expanded further below.

DraftKings has strong levers driving its road to growth and profitability

In the earlier section, I noted how DraftKings is seeing strong top-line growth, much faster than its target market. DraftKings now operates in 44 out of 50 U.S. states, based on its live tracker. Its Sportsbook is available in 25 U.S. states per tracker, along with Canada’s Ontario region. I believe as more jurisdictions realize the potential benefit of tax revenue from online betting and casinos, DraftKings, as well as the target market, stand to benefit from this.

One of these key areas where I believe DraftKings stands out is with its robust tech platform that works in the backend to allow DraftKings to move quickly into newer markets as and when those jurisdictions open up. At the same time, I believe DraftKings’ tech platform also has a robust platform that creates a relatively seamless fulfillment experience when it comes to gameplay in online betting. Based on my checks on various social media channels, the DraftKings tech platform has been an accretive factor in fulfilling a robust experience for its users. This is one of the other key reasons I believe DraftKings continues to experience user growth on its platform, as seen below.

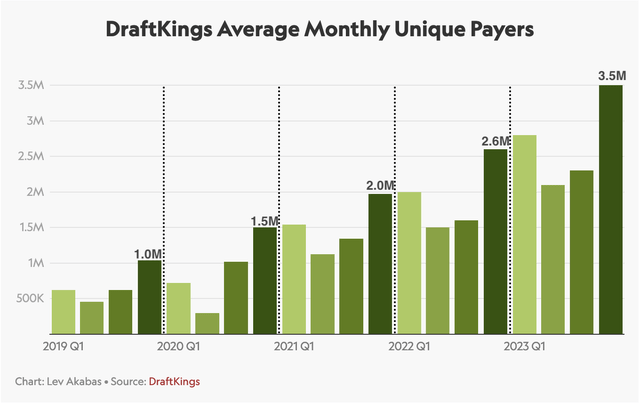

DraftKings unique paying user base grew 37% in FY23 (DraftKings via Sportico)

As can be seen above, DraftKings’ monthly unique players (MUOP), the number of unique paid users per month who had one or more real-money paid engagements across one or more of DraftKings consumer product offerings, grew 37% y/y in Q4 FY23. In addition, the company’s average revenue per MUP saw a 6% boost in the fourth quarter compared to the previous year.

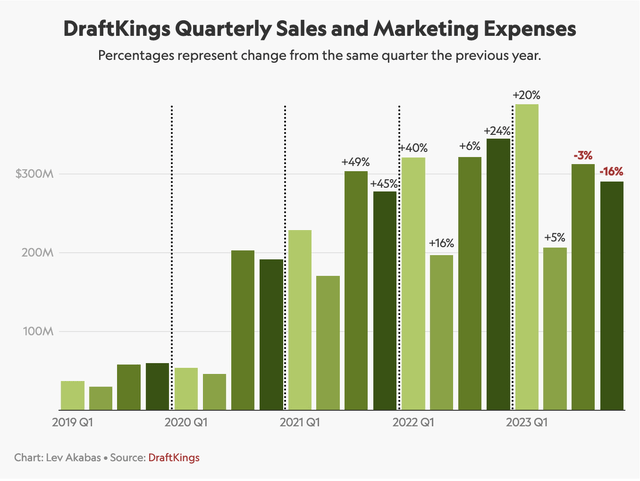

Plus, I believe the company is demonstrating it can acquire these users in a relatively profitable manner. I believe the company is using their ancillary products, such as Vegas Stats & Information Network (VSiN), DraftKings Network, as well as their existing Sportsbook and iGaming products, to cross-sell to their existing user base which is why MUP is increasing. Average revenue per MUP is going up, while the company is able to rein in their Sales and Marketing costs with lower acquisition spend, as I have noted below.

DraftKings sales and marketing spend is trending lower (DraftKings via Sportico)

This was also one of the reasons given by management when acquiring Jackpocket. Management sees the acquisition as an entry point, not only into newer markets but also expanding the opportunities to cross-sell to Jackpocket’s user base and eventually incentivize them to spend on DraftKings’ products like Sportsbook and/or iGaming. Here is an excerpt from recent management outlining an example of how they acquire users and then cross-sell products at the TMT conference a month ago:

Typically, the main way that you acquire customers is through the sports engine. That’s where you have a lot of big events that generate a lot of top-of-funnel activity. We do still acquire people directly into casino, but it’s much more precision-oriented marketing. It’s not a mass market product.

But what happens once you acquire them on to sports is we are able to cross-sell a very significant percentage onto the iGaming product. So it creates this additional monetization engine for the same player. You don’t have to pay more to acquire them. You get the same play, you just convert them into new products.

The operational leverage that management seems to have unlocked from their strategies gives me immense confidence in their goals to achieve profitability by next year.

DraftKings has 16% upside per my estimates

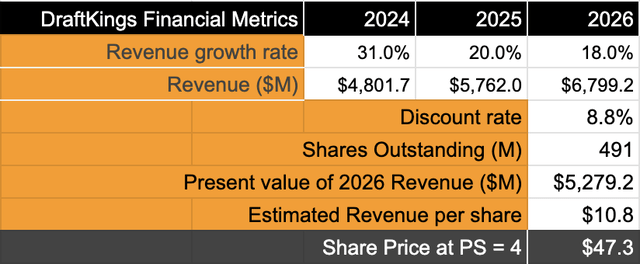

There are a few assumptions I have made to estimate my target for DraftKings:

-

I will be using revenue as my primary forecasting method. With the lack of profitability in its operating history, forecasting would be easier with revenue. I will be watching this closely and changing my forecasts in case DraftKings can achieve profitability earlier than expected.

-

My revenue estimates are in line with consensus estimates. It does not include the addition from their recent acquisition of Jackpocket, which I noted at the start of this post. The reason being, I will be more comfortable once management can provide more updates on the upcoming earnings call to discuss Q1 FY24 earnings.

-

Discount rate of 8.8%, above market estimates, to account for market fluctuations.

DraftKings has ~16% upside based on current projections (Author)

Based on the model above, DraftKings’ revenue is expected to grow to $6.8 billion between FY23 and FY26. That implies a ~23% compounded growth rate, much higher than S&P 500’s long-term revenue growth rates of about 4%.

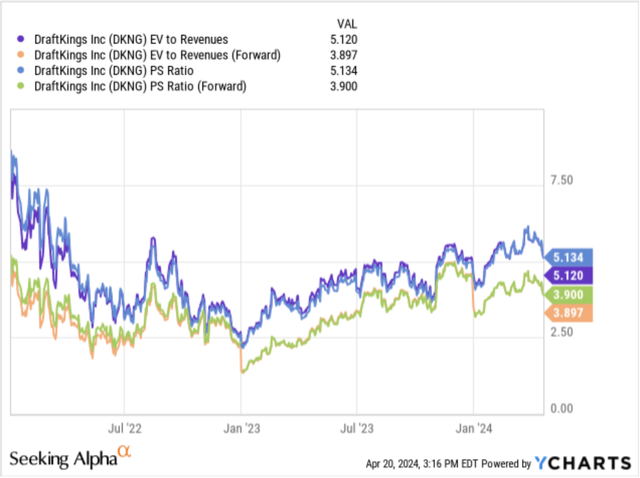

DraftKings has usually traded a forward revenue multiple of ~4, while its EV/Revenue forward also trades in the same range as seen below.

DraftKings forward revenue trends (YCharts)

The growth rates demonstrated by DraftKings could easily command a forward PS of ~8-9, in my view. Even if I assume prior trends have a revenue multiple of ~4, I see there is at least 16% upside.

Risks and other factors to look out for

The online gambling market is a highly competitive area with a few large players, such as Flutter Entertainment plc’s (FLUT) Fanduel. Together, FanDuel and DraftKings account for roughly three-fourths of the U.S. market. Smaller players compete for the remaining 20%. Newer entrants such as The Walt Disney Company (DIS) owned ESPN’s namesake betting app, ESPN BET, and MGM Resorts International’s (MGM) BetMGM are also vying for a share. I expect DraftKings to continue to grow faster than its target market based on my analysis above.

In addition to competitive risks, DraftKings also faces some regulatory risks. Last month, the possibility of federal headwinds weighed on all online gambling stocks, while comments from the NCAA President about banning proposition bets added further concern.

I think these are a few key risks and concerns to watch for as management meets with market analysts in a couple of weeks to discuss their Q1 FY24 earnings reports, slated for release on May 3rd, before the market opens.

Takeaways

In my opinion, DraftKings still has a significant runway for growth to ramp from current levels on the back of some solid FY23 performances. In addition, the company appears well-positioned to tap into newer jurisdictions as and when these markets get opened up by its regulators. At the same time, DraftKings is benefiting from a robust tech platform that continues to maintain user satisfaction, leading to higher spend on the platform while the company keeps acquisition costs in check.

I recommend a Buy rating on DraftKings and believe current pullbacks offer great entry points.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DKNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.